PropNotes

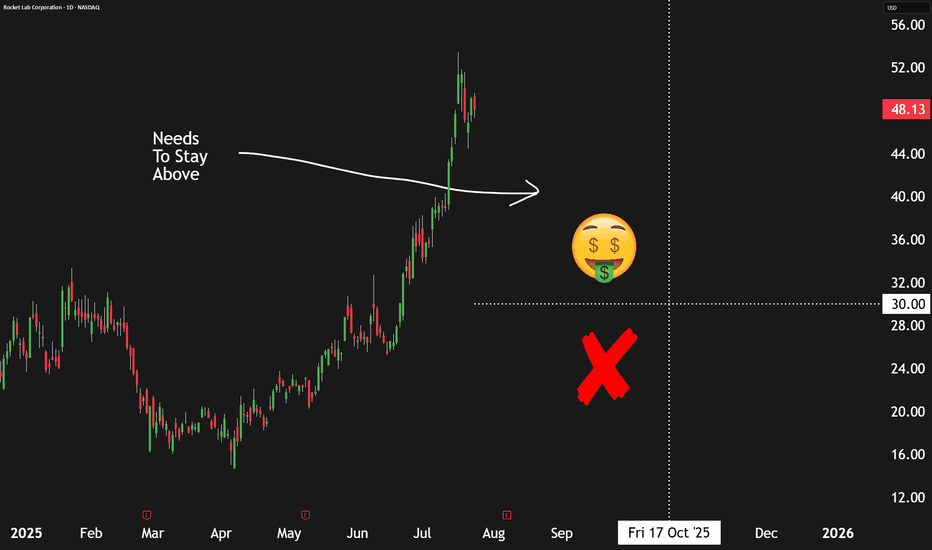

PlusThe commercial space sector is booming, and Rocket Lab NASDAQ:RKLB stands out as one of the most promising players—not just another speculative startup or space tourism hype. But while the company is making strong operational strides, its stock valuation appears stretched, prompting a more strategic approach to investing. 📈 Strong Execution, Growing...

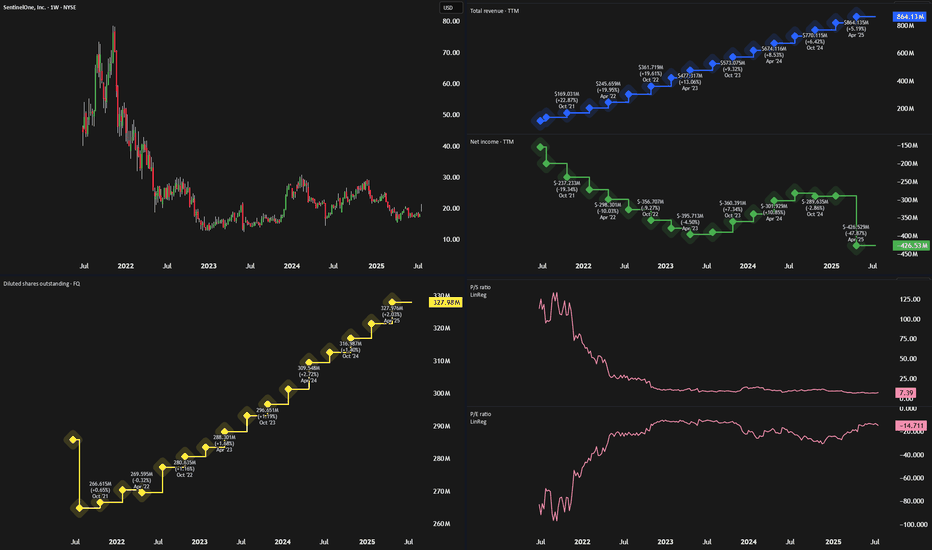

In every market cycle, some high-growth companies are misunderstood—until they aren’t. Palantir (PLTR) was one such stock, dismissed early for its lack of profitability and complex model, only to soar when its AI tools gained traction. Now, SentinelOne (NYSE: S) may be next in line. 🧠 What SentinelOne Does SentinelOne is a top-tier cybersecurity firm offering an...

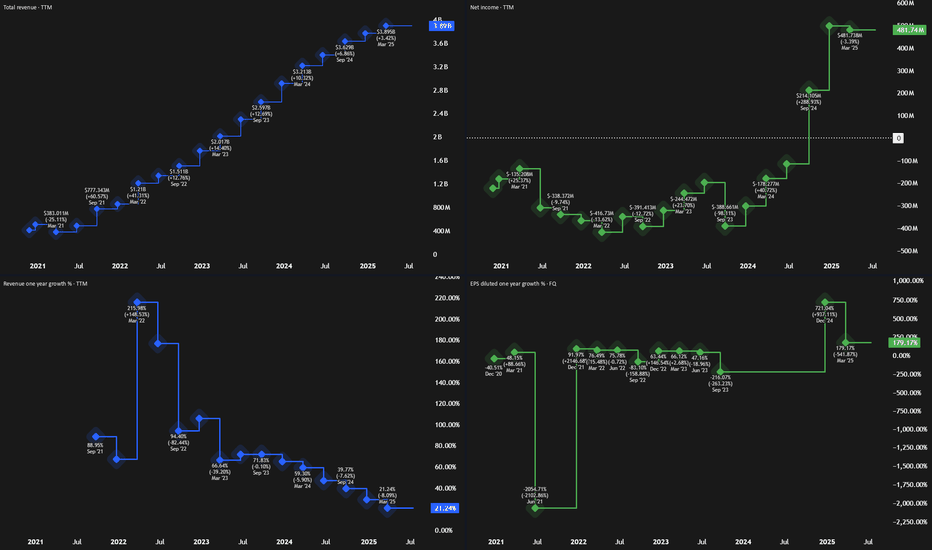

After soaring to nearly $28 per share during the SPAC-fueled fintech boom in 2021, SoFi Technologies (SOFI) crashed back to earth, trading under $5 as rising interest rates, regulatory headwinds, and lack of profitability dimmed investor optimism. But the tide has turned. Over the past year, SoFi has reshaped its business and posted significant growth. Shares are...

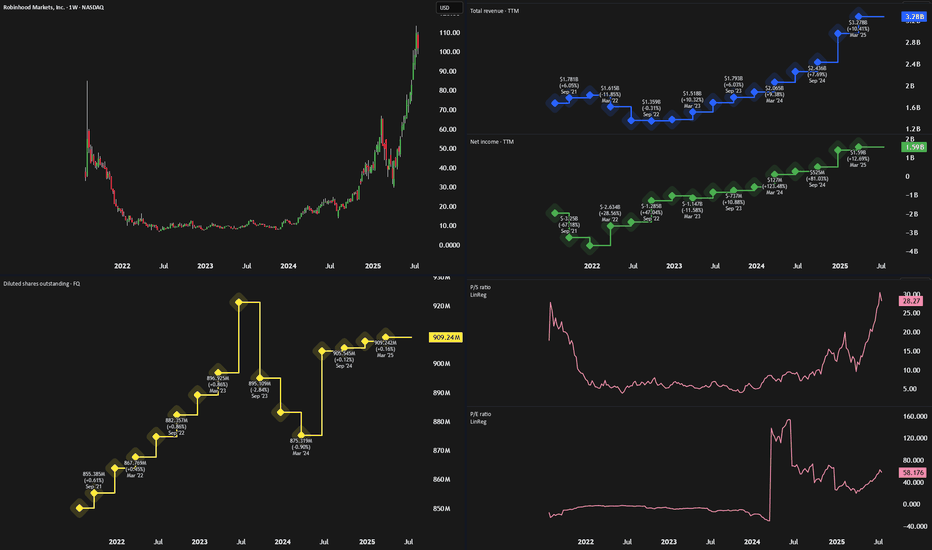

Robinhood NASDAQ:HOOD has seen an incredible rally over the past year, rising more than 500% since August 2023. Much of this surge has been driven by renewed crypto enthusiasm—sparked by Circle’s IPO—and Robinhood’s aggressive push into new products across fintech and crypto. But despite strong financial performance, we now believe the stock has run too far,...

Casual dining has been in limbo post-pandemic—too pricey for impulse meals, not fancy enough to feel special. But Brinker International (EAT), parent of Chili’s and Maggiano’s, is proving there's still a winning formula if you get the execution right. 🛠️ Operational Overhaul at Chili’s Chili’s has quietly transformed itself. A deep operational review led to...

📈 Spotify's Remarkable Comeback Spotify NYSE:SPOT has transformed itself from a money-losing audio platform into a disciplined, profit-generating tech firm. Through smarter podcast investments, layoffs, and better monetization strategies, the company recently swung from red ink to positive free cash flow and strong earnings — a major shift for long-frustrated...

A few months back, we highlighted key investment trends for the next decade—among them, cross-border finance and fintech disruption. Now, Wise plc OTC:WIZEY , a British fintech leader, is showing strong alignment with both themes, and it may soon benefit from even more investor attention as it plans to move its listing from the UK to the U.S. 🌍 What Wise...

In a tech world often driven by hype and speculation, ServiceNow NYSE:NOW stands out as a reliable growth engine—a true compounder. Unlike flashier tech names, ServiceNow delivers steady revenue growth and expanding margins, all while offering mission-critical software to businesses. 📈 What’s a Compounder, Anyway? Compounders are companies that grow steadily...

We’ve long been eager to invest in Circle Internet Group (CRCL), the issuer of USDC, due to its vital role in the crypto ecosystem and straightforward revenue model. After years as a private company, CRCL recently went public, and its stock has rocketed—from an IPO range of $27–28 to over $240—yielding a ~780 % return for early investors in just weeks. 🏦 Why...

In 2023, we covered Arista Networks NYSE:ANET , calling it part of the internet’s "bedrock" but rating it a Hold due to valuation concerns. Since then, ANET has outperformed the S&P 500, proving our call wrong. Recently, ANET’s stock has dipped alongside broader market declines. However, we believe the selloff presents a buying opportunity, given ANET’s strong...

After recommending Hims & Hers NYSE:HIMS as a 'Strong Buy' from $6, we recently downgraded it due to its stretched valuation. Since then, the stock has dropped over 40%, but we don't yet see it as a clear value proposition at current levels. HIMS combines two critical elements: - High lifetime customer value with low churn - High gross margins (customers...

What Makes a Compounder? "Compounder" has become a buzzword in investment circles, but we define it simply: a company that delivers higher-than-average returns for longer-than-average periods. The formula is basic economics - a compounder excels at both sides of the supply-demand equation: Demand side: Growing revenue and profits drives investor...

In a recent post on key investment trends for the next decade, we highlighted the addictiveness and pervasiveness of social media as a critical long-term shift. Today, we're buying Meta Platforms NASDAQ:META which we believe represents an exceptional investment opportunity. The Financials META's recent financial performance has been stellar. The company has...

As generalist investors, we go where the opportunities are. While we've typically avoided fashion and beauty stocks due to constantly changing consumer trends, e.l.f. Beauty NYSE:ELF has recently captured our attention and investment dollars. Three Key Reasons We're Buying: 1. Impressive Growth We've been impressed by ELF's revenue expansion from $266...

Happy market selloff everyone! It's about time we got some action. It's been interesting to see which sectors are selling off, and surprising perhaps nobody, it's mostly high-priced SaaS, consumer finance / gambling names, and meme stocks. Of note - private equity investment managers, which have presumably seen much higher-than-average financial stress as a...

Hey guys! In this video, we're talking about a 'dip-buy' trade idea in gold. The macros and micros favor it - good luck to all. Want more high-quality trade ideas? Follow us below. ⬇️⬇️

It is often said that “a gambling license is a license to print money." If that's true, then Flutter Entertainment is a massive cash machine. 🌎 As a leader in the global gaming industry, Flutter is capitalizing on the massive growth of sports betting and gambling, especially through FanDuel in the U.S. Here’s why we're bullish on FLUT and think it’s worth...

Hey all! Welcome back - today we're talking about Vistra, the energy utility company that has been on a huge run in 2024. Will shares continue their march, or is now a good time to cash in on gains? Let's dive in and find out. Want more high-quality trade ideas? Follow us below. ⬇️⬇️