stakkd

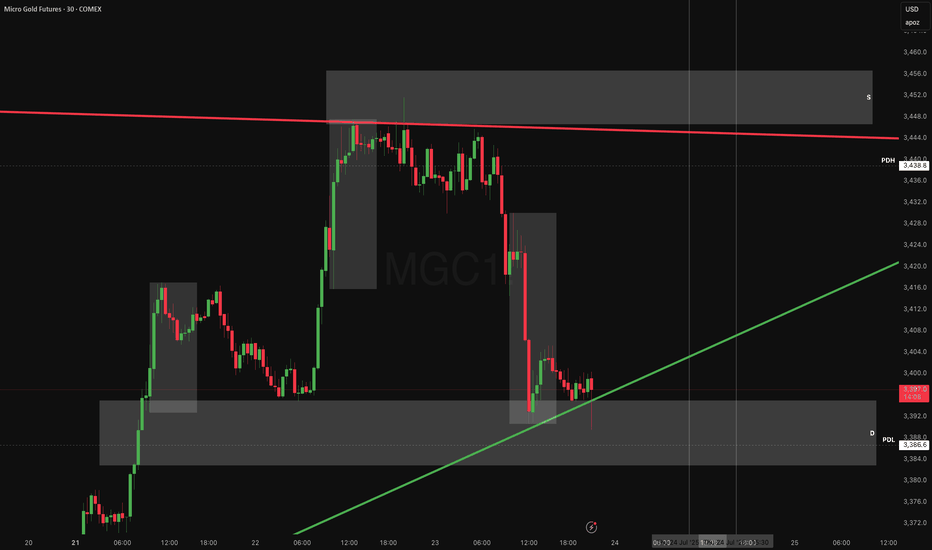

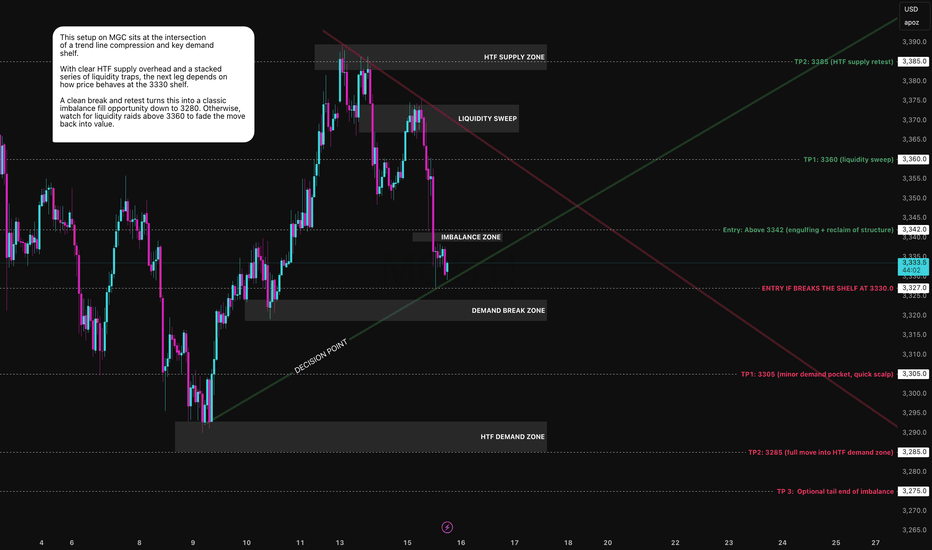

PlusThis one was a request from someone asking for a breakdown of MGC heading into the Tokyo session so here’s the full quant review. After Friday’s clean liquidation, gold found temporary footing around 3330. But the bounce is stalling under VWAP (3344) and Friday’s POC both stacking resistance like a ceiling of bricks. EMAs are fanned and directional, suggesting...

I’ve been experimenting with a wide range of strategies from full quant models to pure price action, from EAs to structure-based setups. Recently, I came across Tori Trades’ trend line method, and I was intrigued. It’s clean, visual, and grounded in logic: draw structure, follow the reaction, keep it simple. So I decided to test it. Not on metals or indices, but...

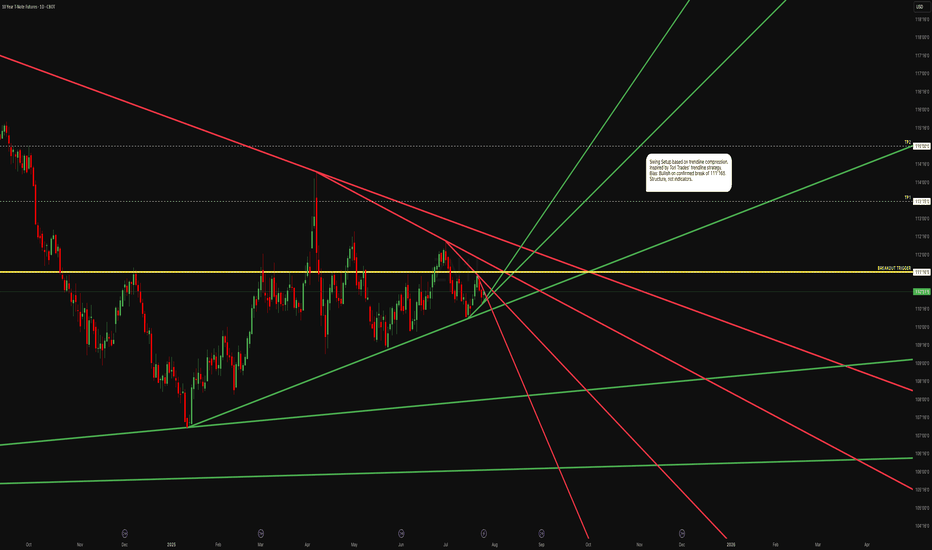

Been watching this 2Y Note coil under pressure all week, and it’s starting to look like a loaded trap door. Price is compressing inside a descending triangle, pinned under VWAP and a full EMA stack (9/21/50 bearish alignment). We've now had multiple failed rotations into 103'18⁶–103'19² the value zone top and each one got slapped. With the POC sitting right at...

The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations. We got five separate stabs into that zone, all failing to close with strength above 3444, a key breakdown level from earlier...

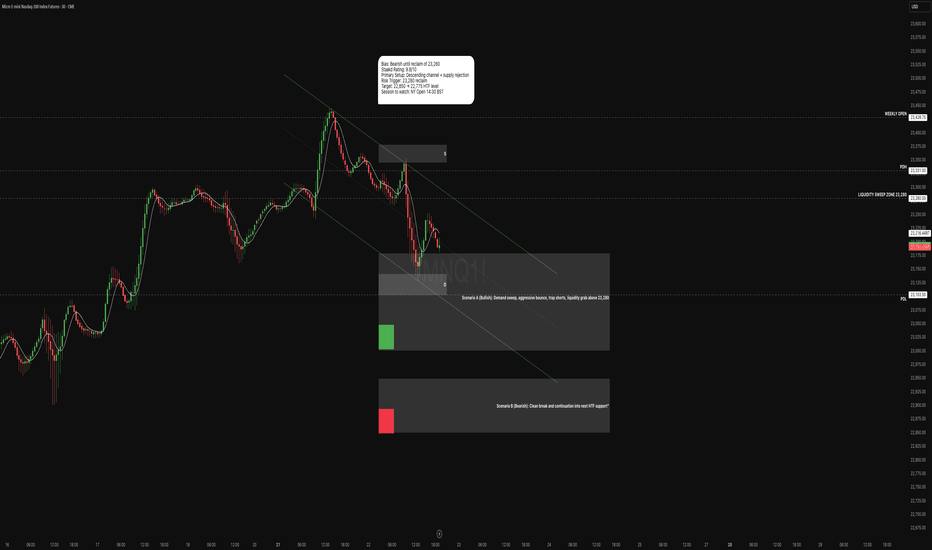

After last week’s strong rejection from the 23,300 supply zone, MNQ has shifted from a bullish channel into a clean descending structure. This break in character, combined with consistent lower highs and compression into a high-interest demand zone, sets the stage for a decisive move either a clean continuation lower or a fake out reversal to sweep short...

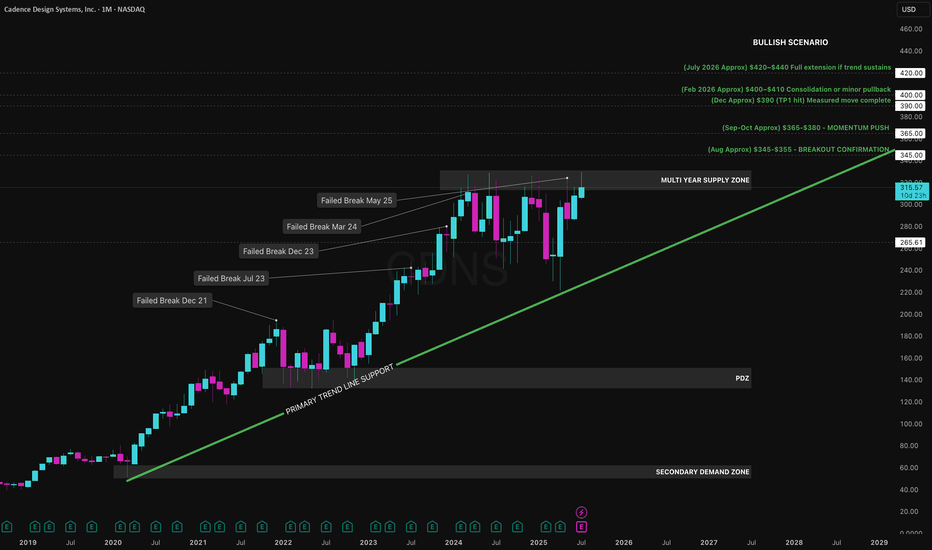

CDNS has been building a multi-year base just under all-time highs, pressing into a supply zone that’s rejected price five times since 2021. While the market has rotated through AI hype names like NVDA and SMCI, CDNS has quietly been holding trend, consolidating, and building pressure. Now, it’s compressing with zero structural damage and sits on the verge of a...

As we head into the new trading week, GC presents a clean, disciplined short setup developing right below Friday’s key high. Price tapped the Previous Day High ($3,368) and supply zone before rejecting, failing to hold bullish momentum into the weekend close. The market structure is currently defined by: - A strong upward trend line (supporting the latest...

This is a mechanical short setup mapped out ahead of the Sunday futures open. It’s based on clean structure, distribution signals, and a confirmed internal shift in trend via iBOS but it’s not a blind breakdown short. The setup respects demand proximity, prior lows, and the risk of early-week traps. Read on. Structure Breakdown Over the last two weeks, price...

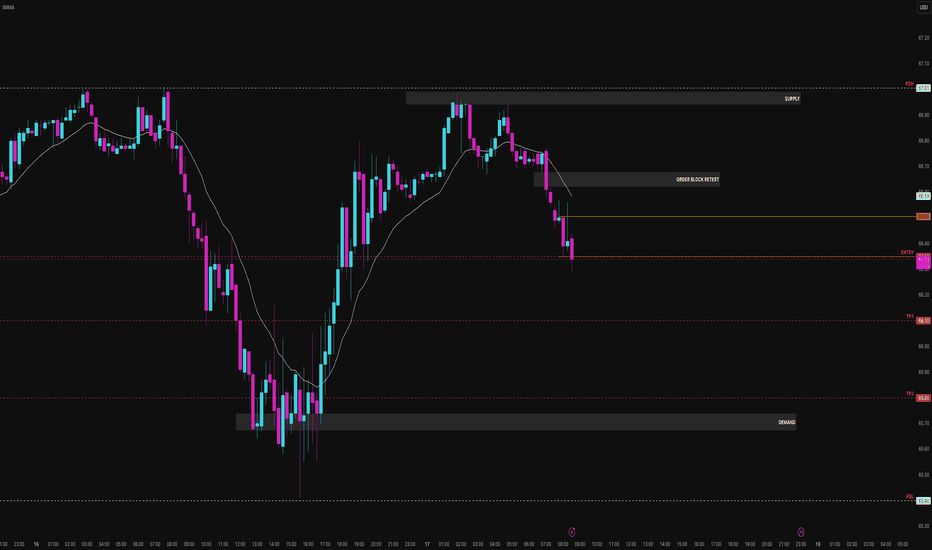

You ever watch price grind into a supply zone like it’s got no clue what's coming, then slap the trend line like it owes it money? That’s what MCL did this morning. It ran the previous day high, tapped into a juicy supply zone, gave us a textbook order block rejection and I said, “bet.” I’m not here for 300 IQ Fibonacci spirals or Jupiter retrograde entries I...

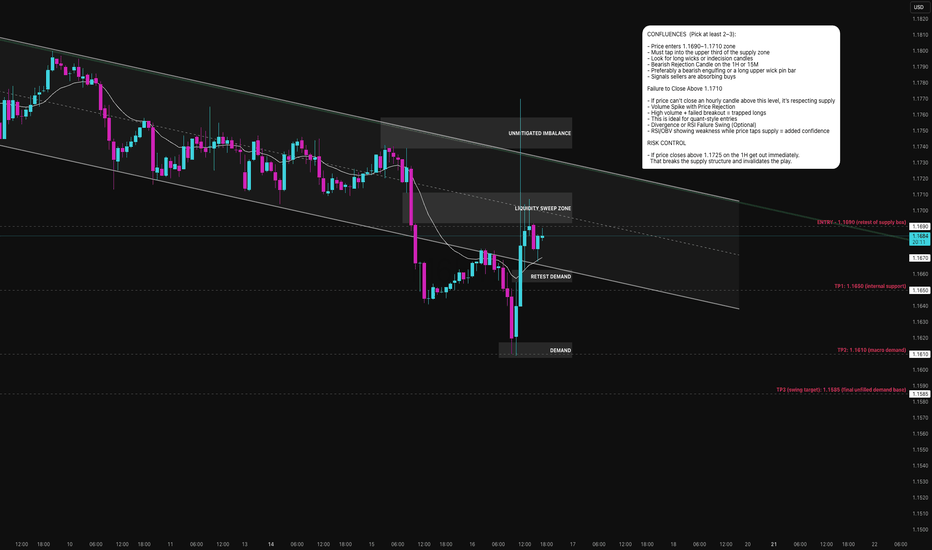

The Euro thought it could sneak one past the quant crowd. It creeped up into 1.1690–1.1710, broke some weak highs, and even teased a breakout. Then boom! rejected harder than a dodgy NFT pitch in 2024. We're inside a bearish channel, mid-supply zone, and price just faked out everyone chasing the highs. This is trap territory, and the sellers are circling like...

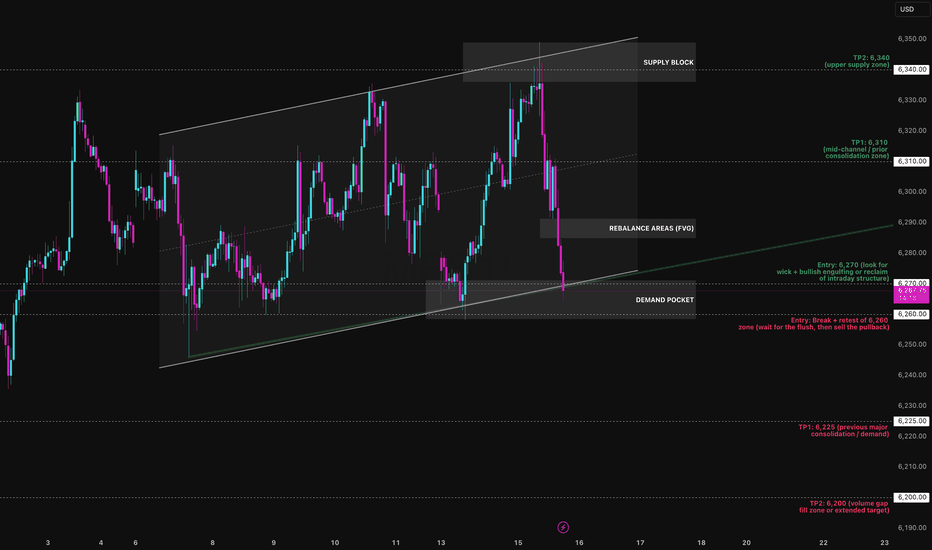

The Micro E-mini S&P is walking a tightrope. After weeks of controlled movement within a rising parallel channel, price has now slammed into the lower boundary and the next move will define the week's direction. I've mapped the channel from the July 2 low, with multiple precise touches on both upper and lower boundaries. Currently, MES is printing a heavy...

This setup on MGC is a textbook example of what happens when structure, compression, and liquidity converge at a critical price shelf. We’re currently sitting on top of a demand break zone near 3330, right at the intersection of a long-term ascending trend line and a descending supply-side compression line. This convergence zone is what I’m calling the Decision...

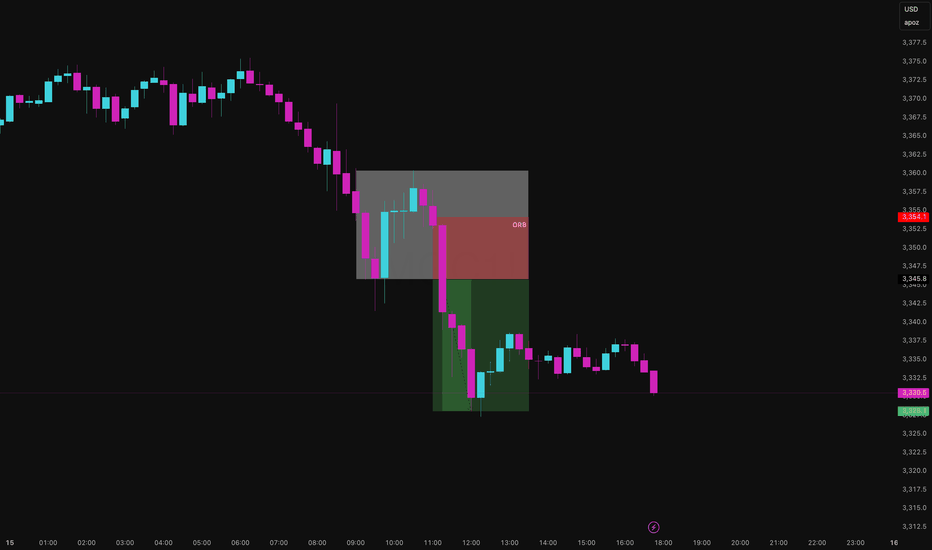

This afternoon I stepped outside my usual mechanical system and ran a classic: the Opening Range Breakout (ORB) on MGC just to see if gold still respects the old-school plays. Marked the range of the first 15-minute candle, waited for the break and confirmation close, then entered on the short side. Asset: Micro Gold Futures (MGC1!) Timeframe: 15-Minute Strategy:...

MNQ is hovering just under local highs after a textbook rally into a potential supply shelf. Price is compressing into a wedge between short-term resistance and dynamic trend line support. This is where the market reveals its hand either we break clean and run, or we roll over and unwind the entire move. Here’s my full breakdown including swing entries, scalp...

Ok a little late but I saw this and thought I'd share. Price has swept liquidity above the prior range high and failed to close strong. Structure is now rejecting under micro trend EMAs, breaking the local trend line and forming a short-term bearish momentum bias into the IFV zone. This is a short-term bearish play following a liquidity sweep at key highs...

We’ve reached a premium zone, tagged prior Buy-to-Sell Liquidity (BTL) above 3,778, and filled a local imbalance. With structure breaking above the previous bearish trend line but reacting to a liquidity zone, we are anticipating a rejection and retracement during the Tokyo and London sessions before NY opens. Thesis: Trendline Structure Clean break above the...

Everyone's chasing the AI hype but Oracle is one of the only companies selling the picks and shovels behind the scenes. While headlines focus on NVIDIA, Meta, and ChatGPT, Oracle has been building the back-end massive AI-ready data infrastructure, hyper scale cloud partnerships, and GPU clusters feeding OpenAI and Nvidia workloads directly. This isn’t some pivot...

ZB has rallied straight into a triple-confluence zone that screams fade risk. We’re stacked beneath a key trend line, sitting inside layered supply, and printing a textbook lower high. This isn’t a breakout, it’s a test. Bearish Confluences in Play: - Macro Downtrend Intact – Still printing LHs/LLs - Descending Trend line – Untouched, respected for weeks ...