Elliott Wave

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

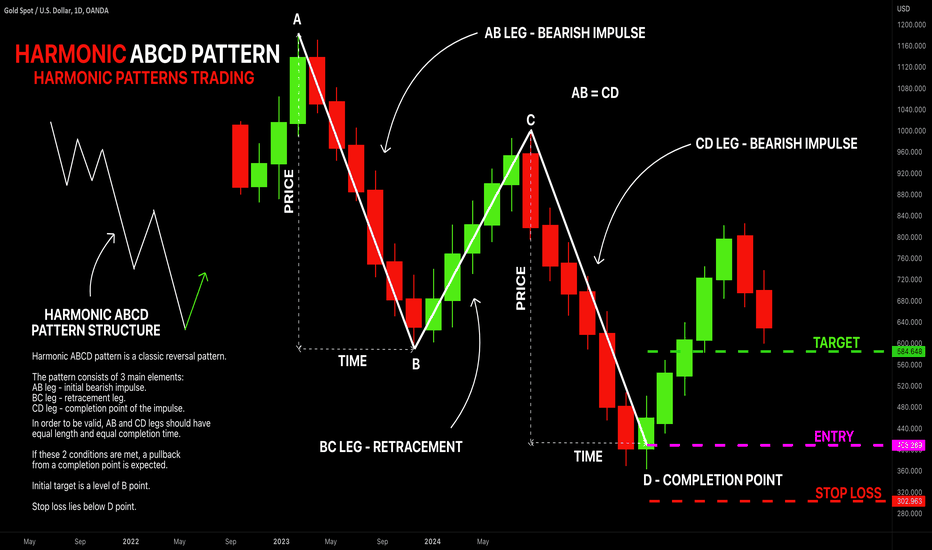

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

How to trade zigzagsThis post is short. But important.

1. identify a directional move (impulse)

2. wait for a correction (our case - a zigzag, a three waves move)

3. draw a corrective channel/ Trend line

4. wait for the breakout

5. wait for a flag. In this example - zoom in to m5 - and see the abc (flat, 3-3-5 structure)

6. buy the breakout

Simple.

Need patience.

This is the A+ entry point

#2 | Understanding Wave Analysis TheoryIt's a simple concept.

Impulsive wave, corrective wave, impulsive wave, corrective wave...

You may think I'm here to talk about Elliot ... (if you know him)

No.

The problem with Elliott Wave Theory is...

IT'S TOOOOO OLD.

It has a lot of problems...

The markets of 1938 aren't the same as the markets of 2022.

I'll show you an updated version...

The biggest mistake beginners make when they trade the flag pattern is

FALSE ENTRY.

Have you ever traded a flag when it breaks the trend line, then it goes straight to hit your stop loss?

Absolutely yes, one reason for this is...

YOU DIDN'T UNDERSTAND THE STRUCTURE OF THE WAVES YOU WERE LOOKING AT.

99% of beginners do rely on stupid strategies that say:

IF THE PRICE BREAKS THE TREND LINE, JUST BUUUUUY.

Because of that, they get disappointed results...

WRONG ENTRY.

WRONG STOP LOSS.

WRONG TARGET.

EVERYTHING GOES WRONG.

I highly recommend you have a basic understanding of Dow Theory and Elliot Wave Theory .

They are the structure of this updated WA version.

That will make you able to understand the upcoming ideas and analysis where I will share with you details and my strategies to trade the regular-flag properly.

If I see likes, I'll post the 3rd idea about the different types of impulsive and corrective waves.

Make sure to follow us.

Don't miss this tutorial!Backtesting and analysis of chart history helps improve your trading. Some traders overcomplicate things and use dozens of indicators, on the other extreme - there are fans of clean charts. The truth is, as always, in between.

In this analysis I will demontsrate some of my usual tools, that proved to be very helpful. Starting from a clean chart - and adding different TA tools step by step, that support every entry shown on the main chart, as well as the overll logic along the price action.

So, let's start. You will find a lot of screens and supporting descriptions in the updates to this post.

Cheers.

What is Potential Reversal zone and how to make it?How can we find a Potential Reversal Zone?

Is it enough to just make a simple Retracement or we can make our support zone narrower? how can we be more confident about our possible supports?

What are Fibonacci levels for different types of Fibonacci and what are typical ones among them? How can we implement different wave degrees to make our PRZ even stronger?

You can find answers to all above questions in this video.

I hope you to enjoy this video and wish you all the best.

Fundamentals of Elliott Wave Theory + Briefly about the typesThis wave theory is based on the psychology of groups of individuals and statistical patterns.

Every market decision is generated by meaningful information and simultaneously generates meaningful information. Each transaction being a result, becoming known to investors, joins the chain of causes of people's behavior (not news drives prices).

The price movement in the same direction as the trend of a larger scale develops in 5 waves. Correction - reaction against a larger trend, developes in 3 waves

Imagine a mango plantation. At the initial period, there is a bullish trend on the plantation stock exchange, which is obvious to the rational majority of mangoes (1/4 of the 3rd wave or 1/3 of the 3rd wave). Because of the confidence that tomorrow will be better, some very rational fruits began to borrow a little in order to earn a little more. This action of very rational fruits caused a faster increase in stock prices (because there is more demand). After learning about the "easy" success, the less rational mango decided to do the same, but since it is not very rational, it invested more. This pattern continued to the most irrational fruits. At the same time, with an increase in the circulation of capital (or monetary base), the borrowing rate falls (because there is a large supply of money in the market => corporations are valued more, they can issue more bonds => receive more money for business development (and not only)(This development is planned at a low rate => zombie corporations appear, and more risky projects are also being taken (not only by corporations, but also by people))). Spending by an average citizens also increased.

When speculation, fraud, financial crimes reach a noticeable scale, rational mangoes will start to short, other mangoes will think - Why is this rational mango shorting (the hypothesis of an efficient market)? => The 4th wave will begin (little by little the fruits will begin to notice what is happening).

When we reach the end of the 4th wave, the most irrational fruits begin to enter the market because of this, the 5th wave occurs ( the deceived themselves found pleasure in deception),

At the end of the 5th wave, most likely, some famous fruit economist would ask the fruit society - what's going on? => panic will begin, because everyone will suddenly want to short + "stops" will work => correction will begin.

Waves - more details

Diagonal triangles (wedges) are the only 5-wave structure aligned with the main trend within which wave 4 almost always invades the price territory of wave 1. In rare cases, a diagonal triangle may end with a truncation (form 3-3-3-3-3).The final diagonal triangles (Appear first of all in the 5th wave at those moments when the previous movement has gone too far and too fast)A small part of the final diagonal triangles appear in the wave C at the A-B-C models. In all cases, they are found in the final waves of larger models and indicate the exhaustion of a larger movement.

Triangle (3-3-3-3-3)-three tapering variants (ascending, descending and symmetrical) and an expanding variant, reverse symmetrical. Triangles always occur in the position preceding the last of the acting waves in the model, the degree of which is one more, in addition, a triangle may appear as an acting model in a corrective combination, but even then it usually precedes the last acting wave in the model, the degree of which is one more than the degree of the corrective combination. When it appears on the stock market in the position of the 4th wave, then the fifth - fast -> protracted. Growing impulses of degrees above the intermediate, appearing after triangles in commodity markets, usually turn out to be the longest in the sequence.

Alternation — At the next appearance of a wave similar in nature, one should always expect a different form of it.

Depth of corrective waves - corrections tend to show a return of prices to the price range of the previous fourth wave ( a lesser degree), usually to the level of its end.

If the 5th wave of growth is stretched, then the subsequent correction will be sharp and will find support at the minimum level of the wave 2 of stretching (Sometimes the end of the correction, but in the some cases — the end of wave A => C wave).

Equality of waves (two waves in a 5-wave sequence will tend to equality in time and magnitude (unstretched).

Puncture of the upper boundary - If the volume has decreased, then the wave will end at the level of the upper boundary or will not reach it. If the volume is significant and the 5th wave approaches the upper trend line, a puncture is possible (near the puncture point, the 4th wave of a small degree can make a sideways movement).

In the investment field, it is more important to choose the moment to buy/short/sell than a certain paper. The wave principle is to some extent applicable to individual stocks, but counting waves for them is often confusing and has little practical significance (because the sea of drops owning registered shares is mass psychology, and stocks are one independent drops)(On average, 90% of all stocks move down with the market, 75% - up).

The best Elliott models are generated by important long-term breakdowns of stretched lateral movement models.

The impact of news

An important analytical question is not in the news, but in the importance that the market attaches to the news.((1 and 2 — fear and discouragement, 3 and 4 -favorable news, 5 — less favorable) at the market peak, the fundamental background remains rosy or even improves, but the market, despite this, turns down. Negative fundamental conditions begin to increase again after the correction has already passed a significant part of its path.

Practice

News — lag behind the market in time by one or two waves

Limitations of wave theory

Low liquidity.

Incidents not characteristic to the free market.

Initially impossible business models

Since many people see the same wave in different ways, we must share our knowledge and views with each other - it is necessary to become very rational fruits.

How to trade the Elliott wave triangle correction?Triangles seem very easy to trade but act differently when it comes to trading.

#Elliottwaves have a very important, genuine, consolidated and beautiful pattern that is #triangle correction.

The structure of the triangle is 3,3,3,3,3. It means the triangle has 5 waves in it and each wave is sub-divided into 3 waves which we call (a,b,c,d,e). After 5 waves the triangle should have to burst out in the direction of the main trend. In a special case, when a limiting triangle occurs, it made 9 waves all of 3 sub-waves. i.e. 3,3,3,3,3,3,3,3,3.

An Elliottician thinks that it is easy to judge when the triangle finishes its 5 waves and we can play a move along with the trend. But ain't that easy. Most of the time, two types of problems a trader faces while dealing with the triangle.

A triangle in the Elliott wave which has 3 sub-waves in all 5 waves usually has a zigzag correction in it, but inside that Zigzag, wave B can be expanded flat. It always creates an illusion that the triangle is over whenever an expanded flat is formed, and an expanded flat is made in wave c of the triangle.

A good trader is one who doesn't lose patience and sees the triangle bursting before its actual ending. With this false wave count, sometimes a trader's stop-loss doesn't get hit, but it takes too much time to actually complete the triangle. So, for an option buyer, this false illusion can be a death to the trade as all the premium will decay if he enters too early in the triangle.

As shown in my attached previous analysis of #HDFC , there is no genuine way to know from where the actual triangle starts in the Elliott wave. When the correction starts, the first leg can be a wave A of Zigzag, and the triangle can occur in wave B of Zigzag. The other alternative is the whole move is the triangle which starts from wave A and will end at wave B

Now, the first leg i.e. wave A of Zigzag is also a 3 wave move. So, it is difficult to make sure if the whole move is a triangle or if the triangle is in wave B of Zigzag.

So, the best way to trade a triangle is to be patient first of all, and trade only when the price breaks out from wave D. It will save a lot of your time and money. The technical analysis is all about the Price and Time as well.

Happy Trading!

BITCOIN IS THIS BOTTOM OR JUST STARTING At the outset, I would like to inform you that I have been a big fan of the wave theory in the last five years, but in science there are no feelings and biases, as well as in markets, and also the theory has not reached the limit of idealism and some critics say that it did not reach the limits of theory, it is only a hypothesis and It has been going on for such a long time because of its many possibilities. anyway , this discussion will be as simple as possible and easy for the public to understand, even non-specialists, and from them I will present some scenarios that I see as possible to happen on the Bitcoin chart.

# The first scenario:

Have we finished the FLAT and are heading to ATH ???!!!!

I wish if the answer to this question was clear and certain , this perception takes the third place out of four, and the reason for this is the downward wave from the top of 69 to the current levels not clear five wave .

Well, according to this scenario, the end of the correction is expected at the 23k, from which we start a new bull market (remember this scenario takes the third place among the possibilities)

The second scenario:

It is a rare but possible pattern, like what happened in the Dow Jones Index in 1966, which is the expanding triangle

In the wave principle, there are four triangular patterns(Without counting the irregular top) , and the below chart shows the expanding pattern, and it may develop and change into a second type of the family of triangles. One must be careful that the triangle is one of the most difficult patterns to anticipate early, and its volatility is very high.

There may be some intellectual fanaticism on the part of some wave analyzers regarding the internal structure of waves. they assert that they be from the zigzag family, and this condition is not true

The third and fourth scenarios:

They are the most important and most likely, which is that the wave from 69 to the current price is the first corrective wave of the model and it is formed with a 3 waves structure that is very satisfactory to the rules and guidelines, anyway, the main reason for my preference for this scenario is to study time cycles (note that time cycles are more scientific and have been worked on a lot), so since we are in the A wave of the structure and this wave was 3 waves , so the possibilities will be limited to that the pattern It evolves and takes a flat or develops and takes a triangular shape and the balance tends to the triangular model due to the economic and global conditions

I know that this perception of the next movement is boring and takes the sideway character (and sorry, but your Lamborghini will be delayed this time ) and the correction may end in the first quarter of 2024, but remember the markets are not devoid of opportunities

Well, what do we gain after all this talk showing charts ??

It is very simple and here lies the strength of the wave theory, so that all the mentioned scenarios agree in the upcoming movement, which is the rise to the levels of 48-50 thousand. This wave at least gives twice the profit without using the leverage, and what do you expect to happen to the rest of the alt coins in this rally : )

I wanted to post some mysterious Fibonacci sequences for Fibonacci fans but it might take a lot of time

Anyway, a little advice from me

Life is more beautiful than the trading markets, do not be addicted to the price movement and lose the most valuable thing you have (your time) I wish luck to everyone

My greetings

BABA, a beautiful example of ANTI complete cycle !BABA is a beautiful example of ANTI complete cycle !

Many Elliott wave practitioners are not aware of different types of wave cycles ! They may consider themselves as a genius in a bull market ( As everyone else !! ) but suddenly thing change and they can not understand what is happening in a stock or market !

On the left side of the chart there is a schematic drawing showing an ascending complete cycle . In this well know wave cycle waves go up in 5 leg and go down in 3 legs. Correction will never go below the start of wave cycle in this type ( does it go in some other types? of course goes ) !!.

Many investors and traders were hoping for this cycle ( and may be were not aware of alternatives ) in BABA, opened long position at the possible end of wave 4 at related retracement levels and now have lost huge amount of money !!!

An ascending ANTI complete cycle is shown on the right side of the chart. In this cycle waves go up in 3 legs and go down in 5 legs and correction will never go below the start of the wave cycle. Does BABA play like this wave cycle? So far yes.

Is there any other alternative ? Of course yes ! please note we have many other types of wave cycle and we just showed two of them here !. For example, we have neutral or descending antic cycles ( for example of descending anti cycle see my related idea about BROS stock ).

It is worth to note many Chinese stocks like TIGR and XPEV showed anti cycles and this is not a surprise as BABA is leading Chinese stocks in the market.

Things sound complicated? Yes they are ! but we can extract many useful tips among all these complications :

1. Overconfidence is dangerous ! always set stop loss . Things may change suddenly in a way that we did not predict.

2. Be mindful there are many types of wave cycles . Things are not as simple as they may seem at first look.

3. Do not jump blindly into a long position after apparent up going 1 2 3 form of wave !

4. Retracement more than 50 % in what we consider a wave 4 is a dangerous warning.

We can add many other implications to the list by thinking deeply about different types of wave cycles. Hope this publication to be helpful.

Good luck every one !

btc usdt perp ending diagonal tutorialIn this tutorial I'll try and explain how to trade an ending diagonal. You would want to see a market that moves in converging channels(at times these can be too steep like those of rising/falling wedges). Next confirm 5 waves with respect to the channel. Waves 1, 3, 5 should make a triple top, whereas 2 and 4 are joined with one diagonal. Divergences are imperative as well, upon wave confirmation, the RSI divergence should support your bias, in this case, it's a medium bearish RSI, as the price rises, the oscillator remains holding the same region.

The guidelines for entries and stop losses are simple. Wait for a break of wave 4's extreme and place the initial stop loss slightly above wave 5. At times there is a retest, which pulls back close to where the extreme of the 5th wave, which is ideal for entries and dcaing.

Another approach is entering at wave 5. More often than not, wave 3 of an ending diagonal is shorter than wave 1, and wave 5 is shorter than wave 3, since wave 3 can never be the shortest among 1, 3 and 5.

There are a lot of profit taking strategies out there. For this setup, I take profits as a whole rather than fib levels. A typical ending diagonal results in a correction(abc) that completely retraces it (i.e wave c terminates where wave 1 begins).

Note: for ellioticians, you'll find that with ending diagonals, wave 4 gets into the territory of wave one, which is valid with ending diagonals and usually this is the case where 1>3 and 3>5.

Now this is the setup in summary:

1) entry triggers:

- ending diagonal

- waves 1 - 5

- RSI divergence

- triple top

- breakout/breakdown

2) entry:

(i) at break of wave 4

(ii) at wave 5 (aggressive approach)

If opting for ii, make sure wave 1 is longer than 3 and 5 is shorter than 3

3) stop loss:

slightly above wave 5( can be adjusted once significant gains have been made)

4) take profit:

wave 2, let the price move till it's the same level as wave 2, otherwise use any profit taking strategy of your choice.

5) enjoy the profits !

That's it for this tutorial, take care and thanks for dropping by :)

Elliott Waves - How to Identify Ending Diagonal?Why is it critical to be able to identify Ending Diagonal waves - because normally their completion is followed by the reversal of trend and in some cases with explosive price movements.

Above are the general rules for all the internal waves and for different variations of the pattern - Expanding and Contracting Ending Diagonals.

Why is Ending Diagonal forming instead of Impulse

When in wave 5 - usually it occurs at the end of a growth cycle like we are observing now when the risks of investment (in case of equities) are increasing, and energy of bulls is slowly getting overwhelmed by the strength of bears, and a rapid reversal happens with some trigger point - Covid in 2020

When in wave C of zig-zag - similar but in reverse, the energy of bears is weakening when forming a correction and bulls are taking over and a new growth cycle begins

It is important to note though that with great potential gains for investors, Ending Diagonal can be confused in some cases with complex corrections so traders need to be careful and considering only those cases where there is a very clear structure of waves.

Here are few examples from the real equities to see the different types of this extremely important wave structure.

Booking Holdings - an Expanding Ending Diagonal has been forming since the crash of the great financial crisis and with the current poor fundamentals the upcoming correction may be very deep

Tesla - just recently a lengthy Running Flat correction has completed with an Ending Diagonal in wave C (although it is still risky to assume this scenario given fundamental risks)

Amazon - the historic high in July 2021 was completed by an Ending Diagonal and notice how deeply it has corrected since then

And here are few examples where an Ending Diagonal is potentially developing:

Berkshire Hathaway - waves 1 to 4 have been formed and we are awaiting the final zig-zag of wave 5

AMD - after forming historic high the price has been correcting with ABC pattern and potential Ending Diagonal in wave C

HP - waves 1 to 4 of a global impulse have been formed and it is noticeable how choppy is the movement in the final wave 5 which is likely to be an Ending Diagonal

MA - similar situation as in HP

Thank you for reading my post.

Also let me know if you would like to see other stocks, indices, Forex or Crypto analysed using Elliott Waves.

What makes trading different from gambling? [No Trading Zone]#Notradingzone #Tocademy #PrincipleTrading #Confluence

Hello traders from all over the world.

Observing thousands of retail traders during my lessons, lectures, and consulting, I realized that a lot of novice traders in contemporary market have some bad trading habits. Especially if you are a daily trader or scalper who usually take small and many short-term trades, please pay attention! Someday in the future, hopefully, you will eventually realize that the best and most ideal position in the world is to take neutral position. What I mean here doesn't imply that you should not trade at all and rest the whole time.

After entering this world of trading, within the process of becoming a mature trader there is a time when you realize the power of the TA(Technical Analysis). Once you start to practically utilize what you have studied and even see how the numbers on your account grow, you literally become mesmerized. This magical thing called ‘Trading’ would feel like the ONE you have been searching for the whole life. I know, calm down! It feels great when the price reacts to the lines and indicators you have drawn and put on the chart by yourself. In this particular stage, I see many traders sit in front of the monitors or watch their smartphones all day long, being addicted to trading. Well, here’s a truth that I deducted through years of my trading career and the data that I have researched; addictive traders hardly become successfully.

Always remember that our ultimate purpose of trading is to solely make money, not just for fun. Of course, making money would be fun but for some of you, the priorities of these two are switched. Before you even notice, you might find yourself gambling rather than trading. Now put your hands down, close your eyes, and think for a minute.

Are you anxious when you are not in a position?

Do you frequently regret that you closed your position too early?

Do you become angry when you miss big long or short?

Are you so urgent to recover your loss as soon as possible?

Does trading disturb your primary work? (Hard to focus both, isn’t it?)

Does trading masses up your lifestyle and relationship with people?

If you replied ‘Yes’ to majority of the questions, please cancel all of the pending orders right now, turn off the chart, get some rest, and forget about trading just for a while. I understand more than anyone that you are full of desire to chase all these micro trends or minor waves in 1 minute chart. Especially those who are trying to recover all the losses you made this week ASAP, before you encounter a bigger loss, trust me, take some time, and cool your head.

I am sorry to say but you might be more of a gambler than a trader right now. Sure, there would be few that still do fine with all those conditions but if you eventually keep ending up bad due to excessive entries or lose entire seed at one cue after series of consecutive wins, your addiction might be interfering your judgment. Irrational trading decisions are the biggest risk that human traders have to face and restraining our emotions during trading is integral. (Please click the image/link below for details)

As the image below indicates, since we humans cannot perfectly control our emotions every single day, the total number of trades and the net performance are not always proportional in a short-term period. In other words, spotting thousands of entries in a single day does not always lead to daily accumulative profit. Not only you pay high transaction fees, but your physical and mental exhaustion can lower your concentration seducing your irrationalized perceptions to break your trading principles. Accordingly, the more excessive amount of time spent looking into the chart, the more likely our logical sense becomes numb and vague which can easily cause FUD and FOMO.

Researches have shown that the relationship between the entry rates and the performance (per certain period of time) of retail traders is averaged out as a curved shape with a local maximum coordinate. This peak point implies the ideal amount of profit and entries of a trader. It would be different for each trader depending on their preferences, capabilities, and other circumstances. For instance, 3~4 entries and $10,000 profit per day might be ideal set or oriented goals for some traders, while 10~15 entries and $100 profit per day might be those for other traders. Hence it is important for us to figure out each of our own boundary and refer to it when designing strategies and PnL first of all.

Therefore, a well systematically designed strategy that can effectively weigh and quantify technical signals based on the scientific and reliable evidences must be adapted. Once validities of each are scaled, we would be able to comprehend which signals are relatively more reliable than others. Shown on the main image above, even though entering a 80% credibility zone will provide low entry rate, higher RR ratio and win-rate can be achieved. We need to train ourselves to be able to call “No Trading Zone” when the identified trends and derived price action zones do not meet the minimum standards of our own.

Some of the talented and successful daily traders I’ve met are not very much different from most of us here. They analyze the market and design trading setups just like we do. If anything, that made them superior, they have a proficient sense for spotting the “No Trading Zone”. They are amazingly good at consistently stepping aside if the signals are not reliable enough or do not meet their standards. They know time is on their side and they wait in patient. It's just simply deciding whether to take certain trades or not, filtering out some of less potential entries and maintaining no position when they are less convinced about the signals, but these tiny differences ultimately result in a huge difference in performances.

Investors who trade with technical charts like us can measure the credibility of signals based on the confluency of technical signs and indicators. Here are two traders: trader A and B. Trader A considers eight signals (techniques, indicators, and theories). For example, trader A observes volumes, trendline, Fibonacci levels, moving averages, Bollinger band, Ichimoku cloud, RSI, Stochastic, and Elliott wave theory. Trader A won’t enter position unless majority of those signals are giving signs simultaneously relatively at the same price and time. On the other hand, trader B only considers trendline and moving averages. If only one of the two gives a signal, trader B enters immediately. Which trader would be more successful? Even though entry rate is low, trader A would be able to secure higher RR ratio and win-rates because the trends and price action zones that trader A has deducted through TA are more reliable than those deducted by trader B.

As mentioned, Confluence Zone is an area where multiple technical evidences overlap at the same price or time period. In TA world which is 2-dimensional, a price action zone would be expressed with a dot, a line or a box. When multiple indicators signal certain trends and PRZs both in price and time wise, we need to keep our eyes on those coordinates. We as a trader, need to utilize these confluence zones which indicate major price range within certain time period, to design trading setups. The more overlapping elements there are, the higher RR ratio and win-rate we can secure. And this is what makes gambling different from trading. Both of us fight with numbers, but we can control that numbers while gambler cannot manipulate the RR ratios and the win-rates they are given.

Thanks for reading my post. I will see you guys next time!

Your subscriptions, likes, and comments are the greatest motivations for me to write more posts!

1977 Interactive Double Zigzag Elliott Wave TheoryS&P 500 Index (SPX)

Trying to dive into some Elliott wave theory and I have a more "interactive" chart to present based off of historical data. I chose this sequence and timeframe because it seems easiest to understand with confirmed examples from some of my own reading materials. This was notated by previously known EWT masters to be a "Double Zigzag" corrective wave, in a bull market. I have taken the time to attempt to notate the subdivisions more clearly. This may not be perfect, but it is the best I can provide of a learning resource at this moment from my current understanding of EWT. The wave degrees may be slightly wrong but I think the wave count is technically correct as long as the first wave C of the first move down is actually some sort of diagonal. I also speculated that it could be a triple-three but I think a diagonal impulse makes more sense in that phase of wave C. Thanks for checking it out! Follow for more EWT ideas!

My Elliott wave analyses could be wrong at any moment , this is practice solely for educational purposes. Please do your own research as always!

Thanks for tuning in :) Disclaimer, anyone in the trade needs to do their own due diligence and decide what is right for YOU. My charts can be wrong at any time and it's very important that you have your own strategies and plans in place. I run this channel for my own educational purposes of learning to trade, and I will never be 100% right, so please do not let me confirm any bias for you! (Dangerous to do so, stay safe and remember the basics & rules of risk assessment.) Expect the unexpected and happy trading!

Elliott Wave Theory - Corrective WavesThe Elliott Wave Principle at its core consists of motive waves, movement in the direction of the larger trend, and corrective waves, any correction against the main trend. Market prices alternate between a motive phase, and a corrective phase on all time scales of trend

Please refer to Elliott-Wave-Theory - Motive-Waves post covering rules and tendencies of motive waves, participants psychology at every stage of an motive wave and how to identify/forcast them using both fibonacci relations as well as channeling technique (price action).

This post is about Corrective waves . Corrective waves have a lot more variety and less clearly identifiable compared to Motive waves and are an important component of the Elliott Wave Theory. Corrective waves needs more attention and to be mastered to become a successfull Elliott wave practitioner

Corrective Waves

Corrective waves, consist of three—or a combination of three—sub-waves that make net movement in the direction opposite to the trend of one larger degree

There are many corrective patterns ranging from simple to complex yet they are just made up of three very simple easy-to-understand formations

Disclaimer: below presented figures displays guidelines that elliott waves may form. Guidelines are tendencies, not set in stone rules

a - ZigZag Corrective Wave (5-3-5)

Consist of three sub-waves against the main trend and labeled as ABC. ZigZag is a 5-3-5 structure internally

b - Flat Corrective Wave (3-3-5)

Consist of three sub-waves against the main trend and labeled as ABC. The labelling is the same as ZigZag, the difference is in internal structure. Flat is a 3-3-5 structure internally and differs from ZigZag in the subdivision of the wave A.

There are three different types of Flats: Regular, Running and Expanded Flats.

c - Triangle Corrective Wave (3-3-3-3-3)

Triangle formations are corrective patterns that are bound by either converging or diverging trend lines. Corrective structure consist of five sub-waves labelled as ABCDE, subdivision of a triangle is 3-3-3-3-3

Triangle corrective waves types can be listed as : Ascending, Descending, Symmetrical, and Expanding Triangles

d - Complex Corrective Waves - Double (3-3-3) and Tripple Three (3-3-3-3-3)

Double three is a sideways combination of two corrective patterns, labelled as WXY

Triple three is a sideways combination of three corrective patterns, labelled as WXYXZ

Please refer to Difference between ABC and WXY , for further details and structures of Complex Corrective waves as well as the differences between Simple corrective structures

The Elliott Wave Theory provides constructive insight that can help technical analysts monitor and understand the movements of financial asset prices over the short and long term.

Please note that these patterns do not provide any kind of certainty about future price movement, but rather, serve in helping to order the probabilities for future market action. They can be used in conjunction with other forms of technical and fundamental analysis, including technical indicators, to identify specific opportunities.

Technical Indicators

Ocsillators to detect divergencies (includes 15 different ocsillator) : OSCs

Elliott Wave Oscillator : EWO

Auto Fibonacci Retrecment/Extentions : Auto Fib Retrecment-Extentions

Volume Profile : Volume-Profile-and-Volume-Indicator

Other indicators that are referred among elliott wave practitioners

Pitchforks ( how to apply ), Pitchfans , FibFans ( how to apply ), FibChannels ( how to apply ), FibTime , Linear-Regression-Channel ( what it is ), Raff Regression Channel ( what it is )

How to use different types of Fibonacci in TradingViewWave Relationships and their relation by Fibonacci Ratios are among the most helpful tools for target prediction.

There are different types of Fibonacci and different tools with different names in different software packages. This may make users somehow confused . Here, we try to shed some light on various mostly used Fibonacci types and explain their usage for target prediction. Also we explain their related tool in TradingView and their way of implementations.

As shown on the chart, there are four main types of Fibonacci :

1- Internal Retracement

2. External Retracement (Extension)

3. Expansion

4. Projection

Before going through details, it is worth to mention that knowing wave relationships is a key to implement Fibonacci tools accurately. Different types of wave relationships is beyond the scope of this publication. Here, for simplification, we show most simple type of wave cycle which is ascending complete cycle with one 5 leg up impulse and one abc form of correction . Also, we try to explain more typical Fibonacci Ratios for target prediction and skip less often ones.

1. Internal Retracement:

This is simply for calculation of the amount of correction in the main trend. It means we can predict where a counter trend correction may end.

As shown on the chart, it can be used for target prediction of wave 2 and 4 in an up trend and also wave B in a down trend. It can also be used for calculation of end of wave C which is the end of correction of whole up going wave. Green arrows on the picture show the direction of using this tool which is "Fib Reracement" in TradinView. For example, we put first point at the start of wave 1 and second point at the end of this wave for obtaining possible targets for wave 2 and so on.

Wave 2 can end at 0.382, 0.5, 0.618 and 0.786 Fibonacci Retracement levels of wave 1. Fibonacci levels at which wave 2 ends can send us a signal about the amount of next waves. This is again beyond the scope of this publication.

Wave 4 can typically end at 0.382 or 0.5 Retracement of wave 3. Less and more amount of Retracements are also possible, but those make wave relations more complicated and does not match with our simple shown example.

Wave B typically corrects 0.382 , 0.5 and 0.618 of wave A in a simple zigzag correction. More Retracements signals for more complicated corrections e.g a flat correction.

Wave C Retracement levels are similar to wave 2 in shown wave cycle since it is end of a larger degree wave 2.

2. External Retracement:

This Fibonacci which is also called " Extension" can be used for calculation of end of wave 3 or 5 in an up trend and end of wave C ( which is end of whole correction) in a down trend.

We have same tool as internal retracement in TradingView however ,unlike internal Retracement, an extension should be drawn from a high to a low in an up trend and vice versa as shown by green arrows on the related figure.

Wave 3 Fibonacci Ratios by extension depends on the amount of wave 2 correction. For example, 1.618 or 2.618 extension of wave 2 can be the target for wave 3. Robert. C. Miner has proposed a very useful table for targets using external retracement.

Wave 5 typical targets are 1.272, 1.414 and 1.618 extensions of wave 4. This ratios are also the same for calculation of end of wave C.

3. Expansion:

Based on my experience, Fibo expansion is most useful when we have over extended waves for example over extended wave 3. In this case , 1.618 or even 2.618 Fibo levels can be the typical targets.

Related tool in TradingView is Trend-Based Fib Extension. Please note that this tool in TradingView is a three point Fibonacci while expansion is two point Fibonacci tool. Therefore, Implementing this tool for obtaining Expansion levels is a little tricky. For example, for calculation of wave 3 we should put first point at the start of wave 1 and double click on end of wave 1.

There are also more details in implementing Fibo expansion for example we have different types of Fibo expansion. We can skip details here to keep this publication as simple as possible.

4. Projection:

This is the only 3 points Fibonacci that we have. Some software packages call this Fibonacci as Expansion !!. Its related tool in TradingView is Trend-Based Fibo Extension. It is a very useful tool for calculation of end of wave 3, 5 and C.

Again green arrows show how to use this tool . For example, For wave 3 target calculation we set first point at the start of wave 1, second point at end of wave 1 and third point at the end of wave 2 or start of wave 3.

1.618 and 2.618 Fibo levels are typical for end of an extended wave 3 when using Fibo projection.

100 % Projection of wave 1 from low of wave 4 is a typical one for end of wave 5 target. Also 0.382 or 0.618 projection of wave 1-3 from low of wave 4 is a helpful ratio for wave 5 target calculation.

For a wave C, most common projection is 100 % of wave A from top of wave B.

How to make a Potential Reversal Zone ( PRZ) :

We can make our potential reversal zone stronger by combining all proposed tools . Take another look at the figures. What can we see? yes. We know four tools now for calculation of end of wave C. Suppose how strong a possible buy zone can be when 4 different tools suggest it as potential reversal target !

Hope this to be helpful. Please do not hesitate to ask questions if you feel need to ask.

Good luck every one.

Running triangle and Leading DiagonalsTriangles are corrective patterns and diagonals are motive patterns.

Upon completing a triangular pattern the trend resumes.

Ending diagonal marks the end of a major wave or a trend and signals upcoming trend reversal or major correction.

Leading diagonal marks the start of a major wave or a trend after a major correction or reversal to previous trend. After a leading diagonal, a short correction can be expected before the trend resumes in the direction of leading diagonal.

In the previous post, the comparison is between running triangle and ending diagonals.

This post compares running triangle and leading diagonals.

Chart1: Running triangle and leaning diagonal in uptrend

As mentioned the comparison is in an uptrend. Accordingly upward move is termed as directional move and move to the downside is termed as non-directional.

A running triangle has non-directional momentum ie faster moves to the downside (wave A, C and E) than the upward moves (Waves B and D). These non-directional moves donot retrace the previous move completely.

On the contrary, Leading diagonal has directional momentum ie faster moves to the upside (waves 1, 3 and 5) in the direction of trend and these upward moves completely retrace the previous non-directional corrective moves (wave 2 and 4).

Chart2: Running triangle and leading diagonal in downtrend

As mentioned the comparison is in a downtrend. Accordingly downward move is termed as directional move and move to the upside is termed as non-directional.

A running triangle has non-directional momentum ie faster moves to the upside (wave A, C and E) than the downward moves (Waves B and D). These non-directional moves donot retrace the previous move completely.

On the contrary, Leading diagonal has directional momentum ie faster moves to the downside (waves 1, 3 and 5) in the direction of trend and these downward moves completely retrace the previous non-directional corrective moves (wave 2 and 4).

Elliott Wave Theory - Motive WavesElliott Wave Theory , developed by Ralph Nelson Elliott, proposes that the seemingly chaotic behaviour of the different financial markets isn’t actually chaotic. In fact the markets moves in predictable, repetitive cycles or waves and can be measured and forecast using Fibonacci numbers.

The very basics of Elliott Wave Theory ;

The Elliott wave principle at its core consists of motive waves, movement in the direction of the larger trend, and corrective waves, any correction against the main trend. Market prices alternate between a motive phase, and a corrective phase on all time scales of trend.

Wave analysis offers insights into trend dynamics and helps you understand price movements in a much deeper way and offers the trader a level of anticipation and/or prediction when searching for trading opportunities

Motive Waves

Motive waves in general can be categorized as Impulse and Diagonal waves

a- Impulse Waves

Impulse waves consist of five sub-waves in the same direction as the trend of one larger degree.

Elliott proposed that financial price trends, the waves, are created by investor psychology or sentiment and the waves can be measured and forecast using Fibonacci numbers . In adition to using fibonacci retracments and extetion to forcast probable targets, channeling technique is also presented, where channeling technique is used to forecast wave formations and targets using price action .

Disclaimer: besides the rules, the below presented figures displays guidelines that elliott waves may form. Guidelines are tendencies, not set in stone rules

b- Diagonal Waves (Wedges)

Another form of motive waves are diagonals, they appear in the beginning of a larger trend, called leading diagonal and at the end of the larger trend, called ending diagonal

They are five-wave structures in the direction of the main trend within which wave 4 almost always moves into the price territory of (overlaps) wave 1, breaking the rule of impulse motive wave

Diagonals take a wedge shape within two converging lines

Elliott was careful to note that these patterns do not provide any kind of certainty about future price movement, but rather, serve in helping to order the probabilities for future market action. They can be used in conjunction with other forms of technical and fundamental analysis, including technical indicators, to identify specific opportunities.

Technical Indicators

Using various technical indicators among elliott wave practitioners is not so common, except few, probably the common one used is a kind of momentum indicator, such as RSI or MACD , to detect divergencies

Fibonacci retracement and extension drawing tools are essential for elliott wave practitioners. In todays computerized era many of the darawing tool's auto indicator versions are availabe on the trading platforms, such as Auto Fib ( where and how tp apply )

Elliott Wave Oscillator ( EWO ) , is inspired by the Elliott Wave principle and helps counting the waves

Volume and Volume Profile ( Vol / Vol Profile ) combined with price action is esential in technical anlaysis and for elliott wave practitioners helps to identify impulse and correction phases

Other indicators that are referred among elliott wave practitioners

Pitchforks ( how to apply ), Pitchfans , FibFans ( how to apply ), FibChannels ( how to apply ), FibTime , LinReg Channel ( what it is ), Raff Regression Channel ( what it is ), etc

Learn Trend Analysis | Impulse & Retracement Legs 📈

Hey traders,

As you asked me, in this educational post we will discuss some price action basics.

No matter whether you are a fundamental trader or a technical trader you should be able to execute trend analysis.

You should always know where the market is going; if it is bullish or bearish.

One of the simplest ways to execute trend analysis is to perceive a price chart as a sequence of impulses and retracements.

➖The impulse leg is a trend-following move.

It is characterized by heightened movement dynamics and speed.

Usually the completion point of the impulse:

sets a new lower low in a bearish trend,

sets a new higher high in a bullish trend.

➖A retracement leg is a correctional movement within the trend.

Its’ initial point is the completion point of the impulse or retracement leg and

its completion point might be an initial point of a new retracement leg or of a new impulse leg.

Usually, a retracement leg is characterized by a slow zig-zag movement.

Usually the completion point of the impulse leg:

sets a lower high in a bearish trend,

sets a higher low in a bullish trend.

Perceiving the price chart as the set of impulses, one can easily and objectively identify a global, mid-term and short-term market trend, price action trend-following, reversal and correctional patterns.

What do you want to learn in the next educational articles?

❤️Please, support this idea with like and comment!❤️

FHZN - The power of elliot waves | Volume 2The zurich airport is tough, but in the coming months this toughness will be tested once again! SIX:FHZN

Our last analysis on this share was published on January 12, in which we warned about a potential sell-off.

In this analysis we highlighted the importance of the wedge formation to our subscribers. In the last days the stock fell by more than -20% and we have now left this formation.

Today zurich airport published its earnings and based on them we can evaluate the progress of the company.

The airport was able to slightly reduce its net loss in the past year but disappointed investors with lower revenues than expected .

Revenues were just under 680 million , which is about half of what they were before the Corona crisis. The management announced that a full recovery to the pre-crisis level of 2019 is not expected until the end of 2025. Investors will have to be patient with the company and as most assumed there won't be a dividend payout again this year. This however gives the management the opportunity to direct the money to where it's most needed.

Overall, the airport is recovering in small steps from the shock of the Corona crisis.

The upcoming years will bring further difficulties, but the management will concentrate on navigating the company back to profitability.

Technical explanation of the elliot wave structure:

As mentioned above, the share price has fallen by almost -20% since we last warned of a sell-off. We as Mendenmein Capital see this as another confirmation of our calculations.

Nevertheless, we assume that the share has now expanded a first downward impulse in the white wave (1) and in the coming weeks a slight recovery must be expected in the white wave (2). This wave will lay the foundation for further sell-offs and the target for the next year is located at just 95 swiss francs. The white wave (3) should be able to reach this target without any problems.

After a short recovery in the white wave (4), a final wave (5) will continue to correct towards our final target of 80 swiss francs. We assume that this downward impulse will occupy us in the coming months and years.

In the long term however, we are extremely bullish and the formations of the last years point towards a very large wave I / wave II super cycle. This means that we have a multi-year bull market ahead of us after the completion of wave II, our subscribers are familiar with this term by now. The long-term price target for this stock is 450.- and we at Mendenmein Capital are extremely confident in our optimistic views.

On our website investors can learn more about the zurich airport share and other stocks! www.mendenmein-capital.com

Disclaimer:

According to legal regulations, Mornau-Research is not a certified or legally recognized financial advisor and any transactions based on published content are at your own risk.

Mornau-Research cannot be held liable for any losses whatsoever according to the legal regulations in it's country of residence.

===============================================================================================================

If you have questions related to a specific stock or the Elliot Wave theory, feel free to contact us.