NZDUSD H4 | Bullish Bounce Off PullbackMomentum: Bullish

Price has bounced off the buy entry, which is acting as a pullback support. This level aligns with the 38.2% Fibonacci retracement, adding significant confluence and strength to the zone.

Buy Entry: 0.5743

Overlap support

Slightly above the 38.2% Fibonacci retracement

Stop Loss:

Your 2025 space mission is here

Suit up and get ready to explore every highlight of your trading galaxy.

XAUUSD (H1) – Trading by LiquidityXAUUSD (H1) – Trading by Liquidity

Price breaks the channel but buying power is weakening, wait for a pullback to the trendline to enter a trade

Summary of today's strategy

Gold has broken the price channel, but the key point is that buying power is weakening after the breakout. As the market is a

Price Is Rising Fast, but the Key Move Lies in the Pullback to 4Hello, I'm Domic.

Looking closely at the H4 chart, gold is currently in a very strong acceleration phase. A steep sequence of bullish candles has pushed price into the 4.48xx area, while both trendlines on the chart are clearly sloping upward. This confirms that the uptrend remains dominant, but i

DOGE: The Cycle Repeats (1W) FRACTAL DOGE: The Cycle Repeats (1W Timeframe)

The Macro View: We are looking at a textbook fractal setup. The chart highlights four distinct structural points (1, 2, 3, 4). We are currently at Point 4, and the structure is rhyming perfectly with the pre-bull run accumulation phases of the past.

1. The Ro

Giveaway 2025: Merry Christmas & Happy Holidays!Another year, another stack of charts, lessons learned the hard way, and moments where the market reminded us who’s really in charge.

As 2025 winds down, we want to say a genuine thank you. Your ideas, comments, chart screenshots, hot takes, and valuable feedback are what make TradingView what it i

BTCUSDTHello Traders! 👋

What are your thoughts on Bitcoin?

Bitcoin has entered a corrective phase after a strong bearish move and is currently ranging between a clearly defined support and resistance zone. As long as price remains inside this range, no major directional move is expected.

At the moment,

EUR/AUD at a Crossroads!The EUR/AUD pair is trading in an upward trend on the four-hour timeframe following the pullback that took place between November 25 and December 10.

The pair is now at a crossroads between continuing the upward trend from the current support levels at 1.77340 and 1.77154, targeting 1.77792 as the

Navigating Volatility Amid Unprecedented Scale and Future InvestNASDAQ:META Meta Platforms, Inc. (META) presents a compelling bullish case rooted in its unparalleled execution within the digital advertising core business, juxtaposed against significant strategic investments in future technologies—investments that, while costly, are funded by immense cash flows

GC(XAU/USD) technical analysis and directional opinion*In this analysis I will not include macroecnomic analysis as we all know broad financial market is waiting for BoJ to create clear directional bias upcoming end of this week on Friday. However I will make a seperate post regarding "How to decode BoJ decision" on the day before the Japanese rate dec

Nasdaq-100: Lower Low and Lower High?The Nasdaq-100 made a lower low, and now it might have made a lower high.

The first pattern on today’s chart is the November 21 low of 23,854, some 353 points below the October trough. That broke a series of higher lows since April.

Second, the tech-heavy index peaked at 25,835 on December 10. Tha

See all editors' picks ideas

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

See all indicators and strategies

Community trends

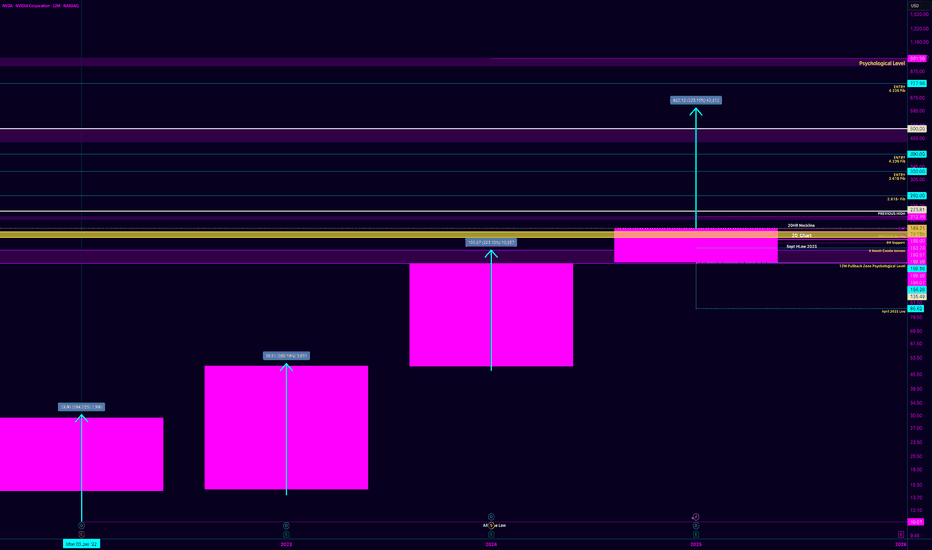

Nvidia (NVDA) Shares Rise On Potential Chip Shipments to ChinaNvidia (NVDA) Shares Rise On Potential Chip Shipments to China

According to Reuters sources, Nvidia has informed Chinese clients of plans to begin shipments of its H200 chips by mid-February 2026. This has been made possible by a recent change in US export policy, which allows the sale of advanced

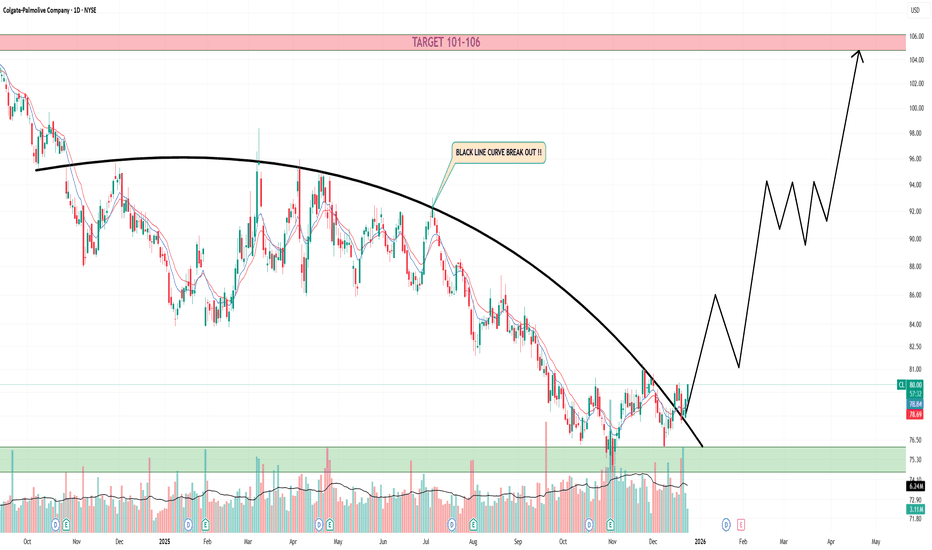

Colgate - CLThis is a rounding top → long decline, now breaking above the down-sloping resistance.

The curved black line = rounding top resistance; price has closed above it → trend change signal.

Current zone (~78–80) is a base + breakout retest.

Bias: Bullish continuation only if price holds above 76–77.

AMAZON Forming a Bearish Rising Wedge AMAZON UPDATE: 🚨🚨

In the Long term I am very BULLISH ON $AMZN.

However as we have seen with the DOT COM Bubble the same RSI weekly Divergence is beginning to appear!

Every few weeks since the 2024 we have seen New Highs with Lower Highs in the RSI

2021 and 2022 we had a similar situation with

NVO mid-term TANVO keeps getting stronger, there's a positive accumulation on daily and it's currently under the resistance of SMA50 and it should breakout, let's wait and see. Long-term accumulation is getting stronger as well but the indicators are also under the resistance yet, though it shouldn't be hard for N

RIOT: Watch out for B waveYearend rally might be afoot. For RIOT, it is at a precarious spot. If this is the start of minor wave 3, then it is most likely in process of just 1 of 3. the move from $12 to $16 is a very short one. This opens up a potential zigzag scenario for a wave B of 2. This is also a good entry with a stop

SMCI Loss of this Support can result into crash to $10.Supermicro Computer Inc. (SMCI) has been under heavy pressure since its March 2024 ATH and last month hit and held its 1M MA50 (blue trend-line). This is a key Support level, which even though it broke on the November 2024 crash, the price managed to recover and close the month back up above it. In

$MSTR SAYLLO+R OFF THE SHITS absolutely destroy investor confidence by selling shares in the short term to build a long-term mega corporation.

big saylor big gains -- i never bought any before as i was waiting for a dip -- now its here

shifted out of my AMEX:GLD & AMEX:SLV longs , 1000% gains on leaps from years start ;)

NVDA — Structure, Timing, and the 223.10% TheoryI want to expand on my NVDA thesis by adding one more layer that’s been on my mind — the 223.10% measurement — and how I’m viewing it strictly as a structural possibility, not a prediction.

Everything below is still rooted in market structure and timing.

Quick Recap: Where We Are

Price ran from t

See all stocks ideas

Today

CETXCemtrex Inc.

Actual

—

Estimate

—

Today

RICKRCI Hospitality Holdings, Inc.

Actual

—

Estimate

1.81

USD

Today

IMMRImmersion Corporation

Actual

—

Estimate

0.10

USD

Today

BNEDBarnes & Noble Education, Inc

Actual

—

Estimate

—

Dec 31

JVACoffee Holding Co., Inc.

Actual

—

Estimate

—

Jan 1

LFCRLifecore Biomedical, Inc.

Actual

—

Estimate

−0.14

USD

Jan 1

PKEPark Aerospace Corp.

Actual

—

Estimate

—

Jan 2

HURCHurco Companies, Inc.

Actual

—

Estimate

—

See more events

Community trends

Bitcoin - Channel no one talks about! (new Year's crash!)Bitcoin's price and development (code) are completely controlled by banks and government. They already have a roadmap on Bitcoin price, so they know what the price will be in 2030. Bitcoin technology is great for total control because all transactions are public. How to profit from that? First of al

ETH at Key Support – Breakdown Could Trigger a Deeper Sell-OffETH at Key Support – Breakdown Could Trigger a Deeper Sell-Off

ETH is currently trading at a very critical technical zone after failing to sustain momentum above the rising channel resistance.

Price has already been rejected from the major supply zone and is now retesting the lower trendline supp

Pippin: The Distribution Pattern Everyone's MissingPrice spiked 21.79% to $0.4428, then printed a massive 66.4% upper wick rejection—that's not bullish continuation, that's smart money distribution. We're currently at $0.4180 in PREMIUM territory, sitting in the exact zone where probability favors mean reversion, not continuation.

1. THE TECHNICAL

SOLUSDT may continue its trend after correctionSOL is falling. Downward trend. A cascade of resistance is forming. At the moment, the price is testing the 121 level from D1. I expect a pullback due to a local change in the imbalance of forces after a false breakout of support and a subsequent fall from the 123-124 zone to 116.

Any upward pullba

BTC/USD- H1 - Rejection at Supply (23.12.2025)📝 Description 🔍 Setup (Market Structure) WHITEBIT:BTCUSDT

Bitcoin faced multiple rejections from a strong resistance / supply zone, clearly marked by repeated wick rejections. After the latest rejection, price broke below the rising trendline, signaling trend weakness on the H1 timeframe.

Key

Bitcoin at Key Liquidity Zone — Bullish Reversal Loading?Bitcoin ( BINANCE:BTCUSDT ), as I mentioned in my previous idea , has successfully reached its first target($90,217).

Bitcoin is currently trading near Cumulative Long Liquidation Leverage($86,6330-$86,170) and is moving within a small descending channel.

Additionally, from an Elliott Wave perspe

(BTCUSD, 2H timeframe)...(BTCUSD, 2H timeframe):

Current price: ~86,800

🎯 Targets (Upside)

Target 1: 90,800 – 91,000

(First resistance / my marked 1st support turned resistance)

Target 2: 94,800 – 95,000

(Major resistance / 2nd level on my chart)

🛑 Downside Supports (if price drops)

Support 1: 87,800 – 88,000

Support 2: 85,

Elise | BTCUSD | 30M – Bearish Continuation SetupBITSTAMP:BTCUSD

After failing to sustain above the HTF supply zone, BTC printed a clear distribution phase followed by impulsive downside. The current move appears to be a corrective pullback into bearish structure resistance, suggesting continuation rather than reversal.

Key Scenarios

❌ Bearish

BTCUSDT Holds Support - Retest of 88,900 Resistance LikelyHello traders! Here’s my technical outlook on BTCUSDT (2H) based on the current chart structure. Bitcoin is trading within a broader recovery phase after a prolonged corrective move. Earlier, price formed a base and broke out of a consolidation range, signaling that selling pressure was weakening an

Bitcoin Price Update – Clean & Clear ExplanationBitcoin is currently showing weak price behavior after failing to hold above key resistance levels. Earlier, the market was in an uptrend, supported by a rising trendline. However, price has now broken below this trendline, which is an early sign that bullish momentum is fading.

The price faced str

See all crypto ideas

GOLD → Long squeeze support could strengthen the price to 4500FX:XAUUSD continues its aggressive rally. The price has reached a new high of 4497.5, leaving a small gap of $2.5 to 4500 (insurance against profit-taking???). A retest of support could renew interest in buying...

Statements by US Treasury Secretary Bentsen about a possible transition to infla

Gold - This metal is collpasing very soon!😱Gold ( OANDA:XAUUSD ) is preparing a major dump:

🔎Analysis summary:

Gold has been rallying an incredible +175% over the course of the past couple of months. But at this exact moment, Gold is retesting the ultimate resistance trendline. Considering that Gold is totally overextended, we will s

Price Is Rising Fast, but the Key Move Lies in the Pullback to 4Hello, I'm Domic.

Looking closely at the H4 chart, gold is currently in a very strong acceleration phase. A steep sequence of bullish candles has pushed price into the 4.48xx area, while both trendlines on the chart are clearly sloping upward. This confirms that the uptrend remains dominant, but i

The Christmas Silver Finally Breaks FreeFor decades, Silver has celebrated the holidays the same way 🎄

Strong rallies.

Rising excitement.

And a familiar ceiling.

🎄 Christmas 1980

Silver climbed like a Christmas tree, fast, vertical, and emotional.

The star was reached at the $50 level.

And just like that, the lights went out ✨

The

XAUUSD Long: Demand Zone Holds, $4,540 in SightHello traders! Here’s a clear technical breakdown of XAUUSD based on the current chart structure. Gold previously completed a corrective phase after breaking above a descending resistance line, which marked a shift in market control from sellers to buyers. Following this breakout, price entered a co

XAUUSD Maintains Support – Buyers Eye $4,560Hello traders! Here’s my technical outlook on XAUUSD (Gold, 2H) based on the current chart structure. Gold continues to trade within a well-defined ascending channel, confirming a sustained bullish market structure. After a prolonged consolidation phase (range) on the left side of the chart, price s

Price Breaks Higher, Pullback Becomes the OpportunityHi,

On the 4H timeframe, XAUUSD is still clearly trading within a strong bullish trend. The recent sharp move higher was not a random spike, but a solid bullish Break of Structure (BOS), marked by a large candle body closing decisively above the previous consolidation zone.

From a fundamental pe

Elise | XAUUSD | 30M – Bullish Continuation Inside ChannelOANDA:XAUUSD

After tapping HTF demand, XAUUSD printed a strong impulsive move followed by a controlled pullback. The current price action suggests a corrective phase rather than distribution, keeping the bullish structure intact while price holds above channel support.

Key Scenarios

✅ Bullish Ca

Lingrid | GOLD Short-Term Pullback Expected After ATHOANDA:XAUUSD perfectly played out my previous trading idea . Price has pushed into a fresh all-time high zone after a strong impulsive leg, but momentum is starting to stretch near the upper boundary of the rising channel. The latest higher high was formed directly into major psychological level.

See all futures ideas

EURUSD Long: Trend Line Support Keeps Buyers, Move to 1.8200Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. EURUSD is trading in a well-defined bullish trend, supported by a rising trend line that has guided price action from the recent pivot low. After an initial consolidation phase, price broke out of

USDJPY Approaches Key Sell Zone at 156.60!!Hey Traders,

In today’s trading session, we’re closely watching USDJPY for a potential selling opportunity around the 156.600 zone.

From a technical perspective, the pair remains in a clear downtrend. Price is currently in a corrective rebound, retracing toward a key trendline and support/resistan

EUR/USD | Retesting the supply zone (READ THE CAPTION)As you can see in the 4H chart of EURUSD, it reached the supply zone, and then with the news coming out, it started dropping in price. It went as low as 1.17744, just below the low of FVG. I believe EURUSD will go back to yet again challenge the supply zone and sweep the liquidity above there. We sh

EURUSD: The Uptrend Remains Intact – BUY Still Holds the AdvantaHello everyone, below is my view on today’s EURUSD outlook.

From a fundamental perspective, the overall backdrop continues to support the euro. The U.S. dollar remains under pressure as expectations for U.S. interest rates weaken, despite occasional short-term technical rebounds. The key point is t

AUDUSD (4H) chart pattern...AUDUSD (4H) – Targets

Based on the chart, price is in a bullish trend and has broken above the rising trendline.

Buy Setup:

Entry: 0.6700 – 0.6720

Target 1: 0.6760

Target 2: 0.6810

Final Target: 0.6850

Stop Loss: 0.6660 (below trendline)

Breakout Buy (aggressive):

Entry: 4H candle close above 0.6735

NZDUSD H4 | Bullish Bounce Off PullbackMomentum: Bullish

Price has bounced off the buy entry, which is acting as a pullback support. This level aligns with the 38.2% Fibonacci retracement, adding significant confluence and strength to the zone.

Buy Entry: 0.5743

Overlap support

Slightly above the 38.2% Fibonacci retracement

Stop Loss:

EURAUD to find buyers at market price?EURAUD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move throu

EURUSD Awaiting Confirmation Before Bearish ContinuationQuick Summary

EURUSD has rallied strongly in recent days leaving a clear liquidity void below price .. A break above 1.18039 is expected first After that a bearish structure is required to confirm that the upside move is complete and that price is ready to target lower levels

Full Analysis

After

USDJPY Retests Broken Resistance — Next Leg Up?The USDJPY ( FX:USDJPY ) has indeed performed as I expected in the previous idea , breaking through the falling wedge pattern and surpassing the anticipated targets, even reaching above the resistance zone(156.960 JPY-156.130 JPY).

Currently, it seems that USDJPY is undergoing a pullback towards

EURUSD Fake Breakout Signals Pullback to 1.1700 SupportHello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD is trading within a broader bullish recovery after completing a prolonged corrective phase. Earlier, price broke above a descending resistance line, which marked a clear shift in market structure a

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.