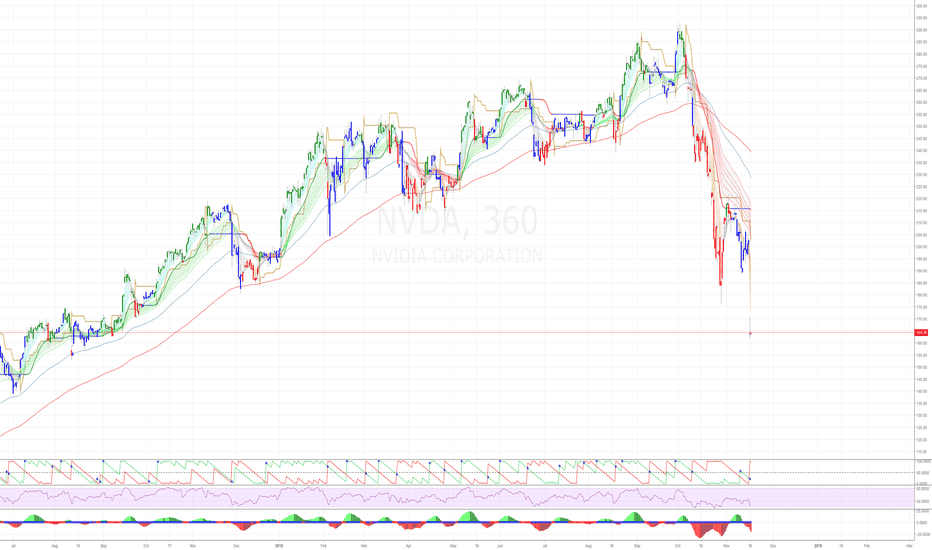

Instructions on how to potentially use the SIG[TP/SL (1H-4H-1D)]It's a HF algorithm for the 1H,4H,1D Time-Frames. Which means whenever the instrument reaches the open price, the algo might give a lot of signals and sometimes it might give plenty of reverse signals. In order to use the specific algo in the best possible way, here's a helpful guide on how to potentially use it:

1)Wait for the instrument to reach the open price.

2) ALWAYS, Follow the signals, e.g: We are at the open price. If it indicates buy signal, then open a long position. If for example 5 seconds later (again at the open price) it indicates a sell signal, then reverse the long position into a short position, and keep doing it until it gives a signal, that will be followed by a good sized candle.

3) The safest way is to close the trade when the price reaches the potential TP1.

4) Happy Trading!

*The text above is not an investment advice, and it does not guarantee any profit.

Entrypoint

PLR (Path of Least Resistance) Strategy Explanation - $SHOPHi guys this is a follow up to a post I have just published about my trading idea on shorting NYSE:SHOP ,

It really doesn't matter if you want to short the market or long the market as it works either way, but for the sake of the example I'll take a 6 months period from the Shopify chart following earnings to better explain you my strategy...

This right here is the NYSE:SHOP chart from approx. Jan/2024 to end of Aug/2024,

2 Earnings have been announced, both having great positive surprises, but regardless of the positive surprise (typically bullish indicator), the stock fell of 45%+.

Let's add the earnings dates to the chart so that you can better visualize them:

What you care about in this image is the earnings dates lined out, as you can see the surprise was positive yet both fell more than 10% in just a day, that I will take as the upcoming trend for at least the time being, till the next earning is announced (so, if for example the 13/Feb earning ended up being bearish, my overview on the market till at least the next earning on 8/May, will be bearish, so all of the trades I will take will be shorts).

Now I will line out the trend and the BoSs (breaks of structure) just to better visualize the trend:

As you can see the Earning date candles signed the beginning of a down trend twice, pre-announced by the Earning candle itself.

The entry strategy is now simple, the idea behind it is to "follow the path of least resistance".. by that I mean that, if your bias is bullish, who enter on candles that are of the opposite direction to the one you are heading to? - Sure you might say that it is to get better entries as ofc, on a short bias, higher sale points = better profits, but the goal here is not maximizing profits, but raising the odds exponentially so that you can take surer trades.

I've tested this strategy from Feb/2021 and so far the win rate is 95.6% (123 out of 136 trades profited .

The way the entries are spread is this:

Basically every time a bearish candle - that closes lower than the previous bearish candle did - is created, a short position of 1% of total equity is generated.

The period begins from the beginning of the current earnings season, and closes the day before the next earnings season as it works within a 3 months frame.

Each entry HAS to be the lowest bearish candle of the period, example:

Only these candles marked in blue count as entries for short positions as their close is lower of more than 0.5% than the previous one,

The pink ones are higher than the lowest up to that point, so they do not count as entries as they are technically part of a pullback that is moving in the opposite direction where you are heading.

So, going back to the entries, we enter on the close of the lowest bearish candle close up to that point.

For safety, we trail the stop loss to the previous high, this is where well defined trend lines come handy:

The thick black line is the trend line, and as new lows are broken, I mark those as BoS (break of structure) and until a new one is created, the SL will go to the previous high, and so it goes.

(viceversa for buys).

We then proceed to target the FVGs left behind by previous quarters:

As you can see there are massive gaps in the chart that we will target and identify as FVGs (Fair Value Gaps) and set the TP at the close (lowest point) of the fair value gap.

Now comes in your exit strategy...

There really are 3 ways that you can tackle this:

1- You set up TP to the lowest FVG of the series (if there are multiple like in this case)

2- You set up TP to the first FVG still open during the quarter following the Earnings Period

3- You tackle both TPs and take each FVG as a partial close to the position (example: if there are 2 FVGs you take out 50% of the position on the first and 50% on the last).

But what to do if your positions didn't reach TP (FVG close) before the next Earning or there is no FVG to begin with???

- In the case the TP you have marked out at the close of the FVG didn't reach, you'll proceed to close the position 1 day before the next Earnings is coming, unless your conviction that the FVG will fill in is so high, then you can let those run at your own risk:

- In the case in which a FVG is not present then you'll target the previous High (in case of a buy) or Low (in case of a sell) as your TP, utilize the previous low (in case of buy) or previous high (in case of sell) as SL and just let it run:

as you can see the 4 trades were all profitable, made little money but sure money in just 15 days

Unless I forget anything, this right here, is my strategy.

Simple, straight forward, high success rate and doesn't leave anything up to the case.

If you have any questions PLEASE leave a comment below and I'll do my best to reply in time ;)

Exploring Ilian Yotov's Quarter Point Theory: Refine Your Entry

The quarters theory challenges the notion that financial markets are chaotic and that market prices are random by demonstrating constant orderly movement of price from one Quarter point to the next. In this publication, I will delve into the fundamentals of Yotov's Quarter Point Theory, its significance, and how it can be applied effectively in forex trading.

What is Quarter Point Theory by Ilian Yotov?

Ilian Yotov's Quarter Point Theory is a technical analysis strategy used in forex trading to identify potential entry and exit points. The theory is based on the observation that currency prices tend to gravitate towards specific levels known as "quarter points," which are key psychological and technical levels in the market.

Key Concepts of Quarter Point Theory

• Quarter Points: These are price levels that divide a currency pair's price range into four equal parts. For example, if a currency pair is trading between 1.2000 and 1.3000, the quarter points would be 1.2250, 1.2500, and 1.2750.

• Psychological Levels: Quarter points often act as psychological barriers where traders tend to place buy or sell orders, causing price reactions at these levels.

• Support and Resistance: Quarter points can act as support and resistance levels, where prices may consolidate, reverse, or experience significant movement.

Identifying Quarter Points

To apply Quarter Point Theory, traders need to identify the high and low of a currency pair's price range. These values are then divided into quarters to determine the quarter points.

The quarters theory focuses on the 1000 pip range between major whole numbers in currency exchange. Each 1000 pip range can be divided into 4 equal parts called Large Quarters

Each Large quarter has exactly 250 pips (1000/4 =250).

A Large Quarter Point (LQP) is a price that marks the beginning and the end of each Large Quarter (250 pips range).

Large Quarter Points that coincide with Major whole numbers are called Major Large Quarter Points (MLQP). MLQP signals the end of a 1000 PIP range and the beginning of a new 1000 pip range.

A Major Small Quarter point is simple the number that coincides with a whole number, for example, 1.30, 1.31, 1.32, 1.33, 1.34…. Each of these numbers mark the beginning of a 100 pip range.

Here is an illustration of this:

Using Quarter Points in Forex

When you study price around this theory, you may notice that price has a tendency to print the high of the day or low of the day around quarter point levels. Here is a example of this over a 5 day period on EURUSD:

With this new-found knowledge, you could integrate this into your strategy. Once you have a directional bias for the day and you have an AOI for entry, you simply need to identify the quarter point within that range and anticipate a reaction at that level.

For a deeper dive into this theory, I highly recommend reading the original work by Ilian Yotov's. If you would like a free pdf copy, drop me a message or leave a comment, I'd be happy to share this with you.

Happy Trading

5 Market entry Orders Easily ExplainedBack in the old days, to action a trade you only had two easy options.

Buy or sell…

Fast-forward into the present day, and today you get slapped with five different options to choose from when you get into a trade.

Right now, I’m going to simplify these five trading entry orders in way that you’ll never forget.

Entry Order #1: Market Order

The first entry order is the easiest to understand.

This is where you’ll buy or sell at the most current market price.

When you choose a market order, it is the quickest, most effective and easiest way to enter into your ‘long’ or ‘short’ trade at the current bid (buy) or offer (sell).

Entry Order #2: BUY Limit

When you place a ‘Buy Limit Order’, you’ll place your long trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Buy Limit Order price, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Limit

If BHP Billiton’s share price is currently trading at R305 per share and you would like to buy (go long) at R300 per share, you’ll choose the Buy Limit Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #3: SELL Limit

When you place a ‘Sell Limit Order’, you’ll place your short trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Limit

If BHP Billiton’s share price is currently trading at R300 per share and you would like to sell (go short) at R305 per share, you’ll choose the Sell Limit Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘short’ trade.

Entry Order #4: BUY Stop

When you place a ‘Buy Stop Order’, you’ll place your long trade entry price ABOVE where the current price is trading at.

Once the market price hits this entry point or above it, you will be automatically entered into your ‘long’ trade.

EXAMPLE: BUY Stop

If BHP Billiton’s share price is currently trading at R300 per share and you would like to buy (go long) at R305 per share, you’ll choose the Buy Stop Order.

You’ll then wait for the market price to rise to or above your chosen order price, where you’ll then be automatically entered into your ‘long’ trade.

Entry Order #5: SELL Stop

When you place a ‘Sell Stop Order’, you’ll place your short trade entry price BELOW where the current price is trading at.

Once the market price drops on or below the Sell Stop Order price, you will be automatically entered into your ‘short’ trade.

EXAMPLE: SELL Stop

If BHP Billiton’s share price is currently trading at R305 per share and you would like to sell (go short) at R300 per share, you’ll choose the Sell Stop Order.

You’ll then wait for the market price to drop to your chosen order price or below it where you’ll then be automatically entered into your ‘short’ trade.

I hope this helps with knowing how to place an entry order for next time!

Trade well, live free...

Timon

MATI Trader

Supply and Demand Confirmation Entries ☑️The thing that catches most traders out is they don’t know what zone will hold, that’s why it’s always best to wait for the higher time frame zone to be mitigated, wait for the break of structure to confirm the trend is changing, then execute. Wait for confirmation ☑️

How to enter position in sideways market?It wasn't the easiest months to trade.

Like, in normal up/down trend you can enter on a retest of previous range and put stop below that range, so it will react as support for your stop.

In a sideway market like now usually you don't get entry on a retest, becuase movemant is ti squzee/fast. So you need to enter as close as possible to highs/lows and start to pray price won't trigger your stop.

Entry Model | Supply and Demand, and Smart Money ConceptFirst look for the higher timeframe trend is the price making higher highs and higher lows? (For bullish market) or lower highs and lower lows? (For bearish market) bullish or bearish, then go to the lower timeframe and see if the lower timeframe trend matches the higher timeframe trend. After that mark your supply and demand zones, and point of interest(POI). If you guys like this post please hit like👍 and follow. Thanks.

How To : Chart Formations Critical Second Top & Bottom Entry Hi Traders and Investors

This video is a follow up from my previous posting dealing with shifts of momentum.

This time we are looking to add an additional synergy - the second touch in a chart formation - which can be found in Double Tops, Double Bottoms and head shoulder formations. Correctly using the second touch on the chart formations has allowed me to avoid many mistakes in my evaluating my trades and I hope that it will help you in evaluating your trades.

When you look at the Double Top and Double Bottom chart formations, you will notice that high frequency trading and algorithms trading will often create the formation of a second top to the same level as the first top or slightly higher by taking stops pilling at the first top . At this point, you want to wait for the synergies to come into play and use your tools to look for a shift in momentum on the 2nd top touch see video.

Waiting for the shift in momentum to occurs after the second touch, is a critical piece of of information that will prevent you from taking trades that are likely to be stopped out on the first test.

Hope it helps have a great week end

Marc

4 Types of Trading Confirmations"Wait for this confirmation!"

"Look for this confirmation!"

When I first began my trading journey, these are phrases that I kept seeing get thrown around and had no clue what it meant! What am I supposed to be looking for? What do these confirmations exactly mean? It quickly began to get frustrating and confusing...

Then eventually, things started to click one piece after another. Confirmations are a fundamental part of your trading and must be fully understood if you want to be successful in this game.

So, what is a confirmation? Well, it depends on many different scenarios, but in this post I will talk about 4 of the most common forms of confirmations with examples!

1️⃣ Price Action

When analysing many different instruments whether that is forex currencies, crypto projects or even stocks. You will often see when searching for trading opportunities that there are various confirmations that price will give clues about on the chart that we can trade from.

Price action & candlestick patterns are one of the strongest form of confluences as far as confirmations in trading go. They can be accurate reflections of the current market sentiment and gives you clues of what price is trying to communicate with you. Making them very reliable when used in the right hands of course.

Different types of price action confirmations such as doji's, pin bars, double top/bottoms & engulfing candlesticks have been proven by history time & time again to be a reliable method of identifying and predicting future market movements and is a major part of my technical analysis.

But, is it a good habit to instantly place a trade as soon as we see one of these confirmations? Short answer, NO! I wish it could be that simple... Trading with only one price action confluence will soon bring inconsistencies into your results and will negatively impact your overall success rate.

Instead, we need multiple confluences layered on top of one another to give us the best chance of predicting where price will head next.

2️⃣ Indicators

Whether you're purely a price action trader or an indicator heavy trader. From simple moving averages to complex computer algorithms, indicators play a big role in the trading industry.

Being 100% objective and removing all psychological aspects through providing real numbers, figures and data. They can be extremely beneficial to certain traders when it comes to carrying out their technical analysis.

For many traders, the various signals from indicators are considered to be accurate and reliable information. However, all indicators share one negative thing in common and that is that they are all lagging .

Meaning the data provided is not a live representation since it uses previous price action to pull its data and is unable to account for what is happening in the market in the right here, right now.

Often resulting in traders missing out on the big power moves, getting into positions too late or executing trades with bad risk:reward setups. Not to mention the potential for many traders to rely on indicators too much and begin to lose their own edge in the market (imagine a double edged sword if you will).

3️⃣ Fundamentals

Which are figures deriving from news events such as in an economic calendar, news & tweets etc. Actual fundamental news can become your best confirmation tool. However, the main obstacle right here is the promptness, validity and reliability of the data that you get.

The information shouldn't be delayed and it must be objectively true. The search for such a source is by itself is a very time-consuming and labor-intensive business not even mentioning its potential costs.

And that is not all. Knowing how to make sense of that data, its proper perception, and understanding requires a solid economical and financial background and experience.

At the end of the day, becoming an expert in fundamental analysis, the trader can easily sort the trading zones and trade only the ones that are confirmed by a decent fundamental trigger.

4️⃣ Key Levels

Us retail traders unfortunately don't control the market. There is an average of $5 trillion flowing in and out of the foreign exchange market every single day!

And the majority of this trading volume comes from the big institutional players such as banks & hedge funds etc. Therefore, it's important to know where these big players are buying/selling & why...

When analysing you pairs, you'll often see that price will naturally be magnetised to specific key levels. For example, key whole round figures that end in 0's & 50's such as 1.5000 or 1.5500. These are called psychological levels which the institutional market participants like to trade around purely for ease of mind.

These levels on various pairs have stayed the same for decades and for many years in the future and is one important form of a key level. Trading these key levels will allow you to find great liquidity zones, rejection areas and break + retest setups.

When to enter? Does it even matter?With value investing everyone knows: Buy when there is blood in the street, when a good company has a P/E ratio of maybe under 10.

But with currencies, other than the advice "50% to 61.8% fib" and a whole lot of troll "buy every bottom sell every top with the magic indicator or magic drawing on the chart" there is no common knowledge.

We can look at this recent example where the price dropped, went sideways, and then dropped hard.

We could keep looking at winning examples when selling or buying at the top of these bands or ~61.8% retracement

The only way to know how good they are is by backtesting a large number and writing down the stats.

But are there other ways to enter?

Rather than write an entire novel with chapters I will simply go through a list of screenshots

Some say it doesn't matter where you enter...

It does and it doesn't, depends what you mean by that.

First

Second

Third

Fourth

Fifth

Sixth

Seventh

Eight

Ninth

Final

This is all simplified to make my point, or points I guess.

So you can't just say "entry doesn't matter". People that tried trading, failed, got into "holy grail" safe good boy passive S&P in the last 70 years averaged bla bla bla wake me up, they're the ones saying this. Oh so it does not matter if they buy a stock at a P/E of 8 or 280?

Of course it matters!!! Entry matters!

BUT where you enter EXACTLY does not matter. I'm not sure how to put it, but go through the examples and you see what I mean. Sometimes it matters, but even if you miss it there are other ones, and these entries are going to be at least a small area "of opportunity" anyway. Well it's more complicated than a "yes" or "no". There are plenty of ifs. And plenty of ways to approach this.

Look, Warren Buffett bought too early or later and sold too early all the time. And? Most famous investor in the world. Is there an optimal super entry that gives better results than anything else? Statistically there has to be one, so yes. If we spend ages making stats and we find it do we know it will remain this particular one? Probably not... Can we find it without it just being hindsight bias? Probably not... Would having the mighty perfect entry (I didn't say find every exact bottom, that's not actually possible) make a big difference to our results? Lol you might go from 20% returns to 20.5%. Probably even less.

The endless search for the holy entry newbs seem to all be obsessed with... Fool game. It's same as with video games, Starcraft, Lol, Dota, W3. Or chess... Newbs go "I will farm for 40 minutes full eco ignore military, full Nasus q, full catch his pawns, I'll be a monster and they'll see", 15 minutes later "Ok tough guy just wait late game you will feel sorry", 5 minutes later "Victory!" or "GG easy noob", 1 minute later "Report Nasus useless afk trash ebay account". Haha I laugh every time.

They really make all the same type of newbie "late game" and "magnet logic" mistakes, 80% of retail FX goes into "day trading" because "hey I figured out I'll get more trades and therefore grow my account faster duh", "Hey you can't lose if you don't sell", "Hey I have this brilliant martingale average down", "Hey wassup wassup wassup I found a trick", "hey if I go for lots and lots of little wins, take my profit fast I'll win small but very often and scale", "hey if I run conservative robots that only return 1% but I run 500 of them...", "hey if I add all these conditions". What a circus.

Miss the good old days. Can't humiliate noobs with trading their account is secret, they open their mouths when they get lucky then vanish, and it's not a 1 v 1 or 3 v 3 or whatever it's a 1 v whole market. Even if we cooperate and share ideas it's still a 10 v 10 million or idk. There is however the "bull vs bear" thing. But the Bitcoin bulls from 2018 from 15k to 3k almost all left (losers) and the few ones that stayed pretend they won (or they're too dumb to figure out they were on the wrong side of the market). S&P 500 bear tears are pretty delicious at the moment by the way.

You both can say entry matters and entry doesn't matter and be mostly right. Don't waste too much time trying to perfect it. Calculating max risk, probabilities of drawdown, when to exit, when to hold, when to add, how to trail, correlations, those are at least as important as the entry. What I can say is entering very early, far from the stop, out of fear of missing out is bad, and entering very late for a giant risk to reward is greedy and bad. Around 50% retracement is often a good compromise. Stats will help choosing areas and price action (stats such as: over the past 10 years on breakouts would it work out to enter in the big red candle? How about on the previous low? How about 61% fib when the price reacts near the previous low? Etc).

Entry doesn't go alone, for example when you average in a sideways within a trend well you'll want to move your stop each time you add according to your average price. That's a whole other subject. Coming up with a whole strategy even simple and even once you sort of understand the markets and have the basics of price action is still clearly going to take a couple hundred hours at best... Just writing this took me a little over 2 hours, and I rushed it, and I obviously don't start from scratch I researched all of this. Just writing an intro like this about entries and stops and targets and trends and pullbacks and breakouts and timeframes and risk and all the other stuff, not even with stats, that alone probably would take 100 hours by itself. How long it takes to convince yourself to hold winners and cut losers and quit a gambler mentality however = infinite time, just quit now you'll save time (thousands of hours!), investing is not for you.

Oh and finally, an entry "signal" is a joke. You don't go from 0 to 100 "wow this would be a great buy because of this entry", that's beyond ridiculous. You are supposed to be watching something before getting in and waiting on certain conditions to enter (pullback after breakout), never heard of anyone that had "entry signals". When George Soros went short the GBP it was "because of the entry" but he had a whole theory. The "entry" wasn't a magical signal it's simply he was close to the floor, well ceiling, and had a big RR with big odds! And he explains how "I was selling weeks before", he actually "dollar cost averaged" as I explained. He didn't wait for a certain magical point, he wasn't greedy waiting for a 1 pip stop.

FLAG PATTERNS - Hi

(1) as you see when a bullish pattern wants to be a bearish pattern , after breaking support line , we can see a bullish flag or bullish triangle .

(2) as you see when a bearish pattern wants to be a bullish pattern after breaking resistance line we can see

bearish triangle or a bearish flag pattern .

so these patterns will help you to understand market better .

NZDGBP Confirmation and Entry. Going back to my analysis on the bigger time frame of NZDGBP, we can see the moving to take a closer look on the 15 minute chart, that the price action has made a lower high and a lower low signifying that the price action will or has reversed as it is at a key resistance level.

Additionally, we can see that we have divergence on the histogram signifying a loss of momentum in the price action.

To get further confirmation, we would like to see the price action break short through the 15 minute support at point A.

The price action will then retrace to test this support as its new resistance. We then enter short at the swing low of the break, and place our stop at the point B swing.

Happy trading - The Trading Box

DAX (GER 30) short entry with confirmation. So the GER30 is at a weekly resistance with diminished strength as per my previous analysis attached.

After retesting the weekly high in the red circle, we now focus on the 1 hour chart where we can see a clear resistance being formed.

Moving to the 15 minute chart we need to see confirmation that the price action will break the low making a lower low (Point A) to form a good entry. Instructions are posted on the chart for a good short entry. If the price action goes up to break the high in the red circle then the trade becomes invalid.

Don't enter early. Wait for confirmation.

Happy Trading - The Trading Box.

How to use the Oscar OscillatorOSCAR Oscillator by GenZai

Green line is the Oscar Rough

Red line is the Oscar

By default based on the 8 last candles and smoothed using RMA

Purple line is the Slow Oscar

By default based on the 16 last candles and smoothed using WMA

HOW TO USE

Exit signaling

This indicator can be used as an exit indicator when line cross each other.

Entry signaling

When the green line crosses up, it indicates a long entry

When the red line crosses up, it indicates a short entry

Overbought/Oversold

When the indicator crosses the dashed grey lines it indicates Overbought Oversold

Slow Oscar Add-on

This is an Add-on to the orignal Oscar indicator

Can be hidden if you want the original experience of the Oscar indicator.

Can be used as a confirmation indicator by looking at the direction of the slope to verify is your are trending long or trending short.

Can be used as a baseline to confirm signals given by Oscar

Can be used to tweak your signals and test different settings.

Stock or Forex?

The program was originally written for stocks, but works equally well with the Forex market.

How this indicator is calculated ?

This is the formula we use to calculate the Oscar:

let A = the highest high of the last eight days (including today)

let B = the lowest low of the past eight days (including today)

let C = today's closing price

let X = yesterday's oscillator figure (Oscar)

Today's "rough" oscillator equals (C-B) divided by (A-B) times 100.

Next we "smooth" our rough number (let's call it Y) like this:

Final oscillator number = ((X divided by 3) times 2), plus (Y divided by 3).

SETTINGS:

You can choose between different smoothing options:

RMA: Moving average used in RSI. It is the Adjusted exponential moving averages (also known as Wilder's exponential moving average)

SMA : Simple moving average

EMA : Exponential moving average

WMA : Weighted moving average

The Script can be found here:

GBPJPY 4H 15M RABBIT TRAIL CHANNEL TRADING STRATEGY LONG TRADERule #1: Draw a channel on a 1 or 4 hour chart.

Rule #2 Identify If there is a Breakout on 1 hour or 4 hour chart.

Rule #3 Wait for a Pull Back on a 15 minute Chart.

Rule #4 After Pull Back on 15m, Make Entry.

Rule #5 Find a Stop Loss Placement.

Rule #6 Ride The Rabbit Trail to 50 pips with a TP Order!

Rule #1: Draw a channel on a 1 hour or 4 hour chart.

The first thing you need to do to get this strategy started off is you need to find a channel on a

four hour or one hour chart. Remember there must be two resistance and support points to

validate a channel.

This strategy can use many currency pairs. Make sure you search through all of them. Many say

that they “only trade EURUSD.” There is no reason for that..

Get in the charts and see for yourself! There are channels everywhere. This strategy will work

with any currency pair. The opportunities are endless..

Not too bad. So basically all you are doing here is drawing parallel lines on the tops and

bottoms of the price movement. This example hit a quite a few resistance and support levels

which means that when it breaks this channel it has the potential to make a huge move!

Rule #2 Identify If there is a Breakout on a 1 hour

chart.

The way you find the trade is to find a breakout of the channel that you drew on your chart..

In a perfect world the support and resistance levels will hold on forever..

But the world isn’t perfect..

So that’s why we have what is called a breakout.

This breakout happened on the top of the channel. So that means you will BUY.

If the breakout happens on the bottom of the channel then you will SELL.

Great! We have breakout candle let’s get in the trade and follow the rabbit trail to pip glory!

Rule #3 Wait for a Pull Back on a 15 minute Chart.

Why wait? Because the market is money grabbing machine, and they want your hard earned

cash!

You wait because sometimes the market does a “head fake” and turns against you.

So if you would have got in this trade right when it broke out of the channel you would soon

have got stopped out.

That is why it is so important to Wait for it to pull back.

This is where many people struggle. They see that it broke out so they want to click BUY or

SELL right now!!!

Think about the sayings you have heard since you were a child, “Patience is a Virtue,” Or “Good

things in life take Time”

Just be patient and wait…

This trade would not have burned you, but countless other trades would have!

Think about the pull back as the candle that closes towards the channel. So if the pull back is

above the channel you are looking for a bearish (red) candle. If the pull back is below the

channel you are looking for a bullish (green) candle.

*We only need one of these pull back candles on a 15 minute chart. Once this happens

move on to the next step.

Rule #4 After Pull Back, Make Entry.

We are getting so close to getting on our rabbit trail to make some serious pips!

Our lines are drawn, we identified the breakout, and waited for the pull back. It is now time to

make our trade.

The criteria to make an entry after a pull back on a 15 minute chart to enter a trade is that there

must be two 15-minute candles that support our trade.

If it is a BUY trade we want to see TWO bullish (up) candles after the pull back.

If it is a SELL trade we want to see TWO bearish (down) candles after the pull back.

Enter after the two bullish 15 minute candlesticks close.

So again, we WAIT for a pull back candle to close and then we need two BULLISH (green)

candles to close to many an entry.

Rule #5 Stop Loss Placement

This is probably one of the most important rules of the strategy.

You always need to place a stop loss somewhere for a reason. If you are throwing in stop

losses 5 to 10 pips from your entry order just because someone you read that somewhere, then

you are without a doubt treading some dangerous waters.

In a Buy The stop loss will be placed in the channel below the last support point.

In a SELL The stop loss will be placed in the channel above the last resistance point.

That way if it does come back in the Channel it will hit the support level and end up going back

up in a bullish movement.

Rule #6 Ride The Rabbit Trail to 50 pips!

The last thing you need to do is know when to exit the trade.

This strategy goes for a 50 pip target.

So when you make your entry, you calculate 50 pips take profit mark and place it.

The rabbit trail may be 2 hours, or could take as long as two days. You have your target so

really you have nothing else to do but sit back and watch your trade make you some money!

Stay in the trade and remember your rules. You are going for a 50 pip breakout trade!

[Fibbonacci]: How to get better BTC gains than other traders!In this post, I will probably show you the most time-efficient way to maximize your gains in the BTC bull market.

As you can see graphs moved before, move today and will most probably move in the future in similar waves with strong pushes, followed by consolidation phases.

If you want to maximize your profits you can sell the tops and buy the dips. There is a wonderful tool to help you with that!

Take some time to understand it and you probably won't be sorry.

Here are some tips:

1. The previous top can show you where approximately the next top will be!

a) 310$ top in the previous bubble cycle shows you where the next (s)top will be

- 1.618 Fibbo level is the one that becomes the real boundary on the next run (507$ blue line)

- it might be smart to put sell orders around that level (you can read where exactly to put the order in the text bellow)

b) 5531$ top enabled similar projection in the bubble cycle we have started this year!

- 1.619 Fibbo level shows 8949$ as top (we actually reached 9096 with spike)

- there was a similar double top play as we had it before

c) The last wave top can also be projected from the previous top

- 1.618 Fibbo from the local 2016 double top (467$) took us to 755$ projection (we actually reached 778 on a spike)

- 1.618 Fibbo from the local 2019 double top (8.5k) took us to 14191$ projection (we actually reached 13880 on a spike)

2. Supports and resistances from before are the fine tunning tool you may want to use!

a) As you can see there are always some supports around 1.6 Fibbo level from the previous price movement from the bubble pop. Using the closest one just bellow 1.6 Fibbo can be a smart way to go.

b) Since the spikes are fast you may want to set automatic order in order to maximize your gains.

c) Ex. in 2016 739$ sell order would work nicely if you were not greedy. Similarly in 2019 13790$ sell order would do the same and you would be selling the position nearly perfectly.

3. Buying the dip can be a bit more tricky!

a) As you can see a spike down usually touches the previous high but doesn't stay there for a long time

b) Counting on the touch might be tricky so it might be smarter to find the support line, where you already get a good price and accumulate BTC

c) You can wait for support to get clear and buy the majority of stake on that level and maybe go for the best possible (minority) position with automatic buy order close to the previous top (falling knife spike down)

With this strategy, you use the least amount of time and you will most probably beat 90% of traders and also the hodlers.

Hope this helps and we all know it's not financial advice. It's just an idea. ;-)

Work smart, not hard!

How 2 Maximize the Profit & Minimize the Loss Using ElliotwavesThis is based on the Bitcoin Market Cycle 2017 - 2018. Please note that this for Uptrend Market and it's totally Opposite for Downtrend Market if you are able to Short.

Also note that you can apply the same for any Market not just for Bitcoin.

- In a Uptrend We have 5 Waves followed by 3 Corrective Waves

- In that 5 Waves 1,3 & 5 are Impulsive Waves Going up and 2 & 4 Corrective Waves going down.

- We only buy in the beginning of the above waves 1,3 & 5 and sell in the top of those waves

- Wave (1) (2) (3) (4) (5) are Intermediate Waves

- Wave 1 2 3 4 5 are Minor Waves which is Sub waves of each (1) (2) (3) (4) (5)

- Wave (1) price movement can take upto ~2months or more

- Wave (3) price movement can take upto ~4months or more

- Wave (5) price movement can take upto ~3months or more

- Use Daily Chart see the big picture and 4hr to check and confirm the Waves (1) (2) (3) (4) (5)

Now lets assume that you are going to invest 1000$

You can adjust this to match your investment amount

Start of the Uptrend is Point 0 and End of Uptrend is Point T

To find the Entry Point or Point 0 we need to find a new market cycle by doing the following in Daily Chart & 4hr Chart to confirm the trend change

-Using Wave 5 channelling technique of the previous market cycle

-Reversal chart patterns (wedges, double/triple bottoms, broken trendlines etc)

stockcharts.com

-8,13,21, and 34 day Fibanacci Ema filter

investorji.in

After finding the Entry Point 0 then its time to find the Targets for Buy, Sell and Stop Loss

Entry Points (Buying Targets)-

Wave (1): Buy 300$ @ Wave 1 of Wave (1) Retrace 50% to Wave 2

Wave (3): Entry 1: Buy 500$ @ Wave (1) Retrace 50% to Wave (2)

Entry 2: Buy 400$ @ Wave 2 of Wave (3) pass Wave 1 level going up.

Wave (5): Buy 200$ @ Wave (4) Retrace 38.6% of Wave (3)

See the highlighted boxes for the 4 Entry Points

Stop Loss (Protecting Investment)-

Wave (1): Sell all if the Price goes below Point 0. You can reverse and go Short if your exchange allow to do so.

Wave (3): Stoploss 1: Sell all if the Price moves below Point 0.

Stoploss 2: Sell all if the Price moves below Intermediate Wave (2)

Wave (5): Stoploss 1: Sell all if the Price moves below Intermediate Wave (4)

Stoploss 2: Sell all if the Minor Wave 4 moves below Minor Wave 1 of Intermediate Wave (5)

See the highlighted boxes for the 5 Stop loss Points

Exit Points (Selling Targets)-

Wave (1): Sell 200$ @ End of Wave (1). Do 2.618 Fibonacci Extension of Wave 1 of Wave (1) to find end of Wave (1)

Project Wave (3) with 3.618 - 4.618 of Wave (1)

Wave (3): Sell 700$ @ End of Wave (3). Do 3.618 - 4.618 Fibonacci Extension of Wave 1 of Wave (3) to find end of Wave (3)

If Wave (3) is extended then End of Wave (3) is closer to 4.618

Wave (5): Sell 500$ @ End of Wave (5). Do 1.618 - 2.618 Fibonacci Extension of Wave 1 of Wave (5) to find end of Wave (5)

If Wave (3) is extended then End of Wave (5) is closer to 1.618

See the highlighted boxes for the 3 Exit Points

Ideas & Comments are welcome to make this Idea much better. Thanks

RISK DISCLOSURE:

Please note that this is purely Educational purposes only and not as Individual Investment Advice. If you choose to follow the above techniques you do so at your own risk after giving thorough and reasonable thought and consideration to your actions and their potential consequences

How to Trade a Range and Potential BreakoutHello Traders,

All of us want the price action to follow the direction of our trade but that doesn't happen always. The price action has a natural tendency to move up and down; build ranges and develop patterns. Most of the ranges and patterns are like whipsaws and many traders stuck in these situations and lose money. The most effective ways to deal with such a price action is patience and a better strategy. When I say better strategy that means the one which keeps you ahead of the others.

In this backdrop, I have tried to spot better entry points in case the price action builds a range after a nice up move and we are visualizing a potential breakout on upside. The basic principle behind the strategy is to "Buy at the low and Sell at the high". It should be noted that the entry spots can not guarantee sure win but surely minimize our risk and increase the chances of reward. After an entry, stops can be placed either below the range or below the prior swing low -- whichever suits the situation.

Same strategy can be applied, in opposite direction, in case the overall trend is down and we visualize a potential breakdown after a range.

Notes on the chart.

Hit like for better educational publications in future. Comments are welcomed.

Trade safe.

Best Regards

Bravetotrade