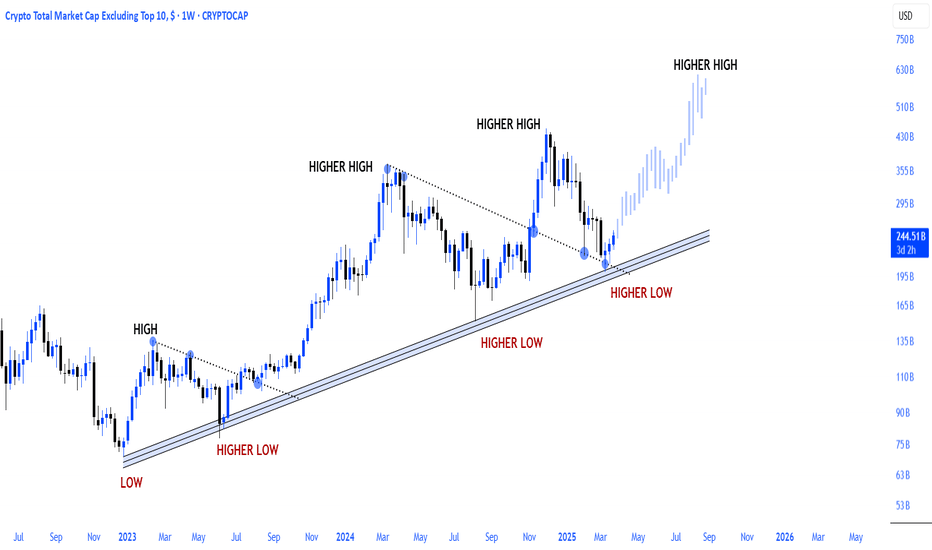

ALTCOINS has already started the new parabolic rally.Altcoins (excluding top 10) are repeating the 2015-2017 market structure.

Based on the 1week RSI we are at levels similar to July 2017 when the market kickstarted the final parabolic rally of the Cycle.

We expect the market to reach the $1 Trillion market cap mark before the end of 2025 and peak the Cycle there.

Follow us, like the idea and leave a comment below!!

Altcoins

EOS Higher Low: Long Analysis With Positive Crypto-Market TalkEOS is now trading three consecutive weeks green.

Higher low after long-term bottom. Double-bottom in 2024.

Good afternoon my fellow trader.

You are the essence of the Cryptocurrency market.

The Cryptocurrency market is alive today and it exists only because of you.

Without you and me, there would be no Cryptocurrencies.

Only your support makes it possible for this innovation to continue to expand, improve and grow.

It is because of your attention and commitment that Crypto will continue to shine; Bitcoin is going up.

We are not only Crypto but we are also the financial markets and all markets.

We are reality, we are life and we are all one and the same.

Let's do this together. We can improve our lives, our environment and achieve success.

Together we can win.

Now, let's trade!

___

EOSUSDT is bullish confirmed.

One being bullish confirms the rest of the market being bullish or moving in this direction. This is only a valid statement because we know the market and how it works. We know EOS is one of the solid projects and we know its patterns and cycles. It tends to move with the rest and this time around it will be strong.

Let's look closer. This week is new but it is green. New and green is good; 100% positive.

The week that produced the higher low, 10-March 2025, is a classic Doji (reversal signal). This reversal is confirmed with the action we are seeing now.

Three weeks green after a long-term higher low means that we are now, already, within the bull-market period. This is the start of long-term growth. Prices are still low. Very low.

EOS will grow really wild. It will go really high. Prices will end up being really strong in 2025. 14X higher or more. You can always use the 'Filter ideas' feature in my profile to find other publications for this and other pairs with the 2025 All-Time High. Type EOSUSDT after tapping on my username and you will see what I mean. This will produce a list of results.

EOSUSDT has been sideways since August 2023. Or June 2023 based on a price average in-between the high and low of the sideways period between that date and present day. We are talking about some 666 days. This is really good. This is a very strong consolidation phase. This confirms and supports what is coming next.

Overall, marketwide. Real Altcoins market. Everything is looking good. The bottom is in and has been in for a long while now and we are getting ready for growth. We are still within the sideways period, but this phase won't be valid and active for long. Notice how we have three green weeks on EOSUSDT. The market will not move straight up but this is the beginning of a new bullish wave.

It tends to fluctuate. This is normal and expected. We have no complaints.

All is good that ends well. All is perfect when the market is set to grow.

Great entry timing is possible now, all across. Buy and hold.

Remember, you can leave a comment with your request for any Altcoins you want me to look at. I will consider it and publish based on the chart and overall market conditions.

Thanks a lot for your continued support.

We are doing good but things will get better.

This is only the start. Wake up! It is not too late.

The 2025 bull-market is on now.

Thank you for reading.

Namaste.

Breaking: $FARTBOY Gearing for 250% Surge Amidst A Falling WedgeThe price of Fartboy coin ($FARTBOY) a token created on the Solana ecosystem is set to go parabolic surging more than 250% amidst breaking out of a falling wedge pattern. The asset is currently looking poised to breakout of the support point range it is currently trading at.

Since listing, $FARTBOY has peaked to as high as $189 million in market cap before retracing to the $33.4 million market cap. With build up momentum, $FARTBOY is set to pull out this same stunt in the long term.

Further solidifying this bullish thesis is the Relative Strength Index (RSI) at 36.68, this metric gives credence to our bullish speculation giving Fartboy more room to capitalize on the oversold nature and weak momentum to pick liquidity up.

About Fartboy

Project is CTO'd by big community over 100k people. X is on 2k followers in 2 days. In talks with some big exchanges hope to get listed everywhere.

This coin was called out via a call out group. People were loving it and then one of the guys who were invested before we even knew about it dumped on us. If you check the chart im sure youll see we made a heck of a comeback!

Fartboy Price Live Data

The live Fartboy price today is $0.033473 USD with a 24-hour trading volume of $669,858 USD. Fartboy is up 0.92% in the last 24 hours, with a live market cap of $33,454,631 USD. It has a circulating supply of 999,440,457 FARTBOY coins and a max. supply of 999,440,457 FARTBOY coins.

BTC Dominance Breaks Out Altcoins Set to Bleed, Be CautiousHey everyone, let’s dive into this BTC Dominance chart on the 4H timeframe. As you can see, BTC Dominance has just broken out to the upside from a descending triangle pattern, which is a bullish signal for dominance. Currently sitting at 62.633%, it’s testing a key resistance zone around 62.71% (the recent high). If this level holds as support, we could see BTC Dominance push higher toward the next resistance around 64-65%, a zone that aligns with the upper trendline of the longer-term ascending channel.

What does this mean for altcoins ?

When BTC Dominance rises, it typically signals that Bitcoin is outperforming altcoins, often leading to altcoins bleeding in value relative to BTC. The breakout suggests capital is flowing into Bitcoin, likely due to market uncertainty or a flight to safety within crypto. Altcoins could face downward pressure in the short term, especially if BTC Dominance confirms this breakout with a strong close above 62.71%.

Key Levels to Watch

Support: 62.62% (recent breakout level) – if this fails, we might see a retest of 61.5%.

Resistance: 64-65% – a break above this could accelerate altcoin underperformance.

Invalidation: A drop below 61.5% would negate the bullish setup for BTC Dominance and could signal a potential altcoin rally.

Altcoin Outlook

Altcoins are likely to struggle in the near term as BTC sucks up market liquidity. However, keep an eye on major altcoins like ETH, BNB, or SOL for relative strength – if they hold key support levels despite this dominance move, they might be the first to recover when BTC Dominance cools off.

Final Thoughts

This BTC Dominance breakout is a warning sign for altcoin holders. Consider tightening stops on altcoin positions or hedging with BTC exposure. Also don't forget this is NFP Week as well. Let’s see how this plays out over the next few days – stay nimble and trade safe!

Very Interesting XRPUSDT Update: Did You Know...This is very interesting for many reasons.

How are you doing my friend in the law?

It's been a while, almost a month since we last spoke.

It is truly my pleasure to write again for you and I hope that you find this information useful in someway if not entertaining.

Whatever you do, you are awesome and you are great.

Life is the best thing the Universe has to offer and you are alive... Let's get to the chart.

Cryptocurrency Market About To Boom! —XRPUSDT

This is an XRPUSDT update on the daily (24-Hours per candle) timeframe.

Why interesting? Because I am still using the same chart I used back in February and XRPUSDT continues to trade above the 3-February low point. It is hardly necessary to highlight this on the chart but, I've done it for your convenience.

So here is the thing, I will recap because it's been a while. As long as XRPUSDT trades daily, weekly, etc., above $1.70, market conditions are strongly bullish. The longer it trades above this level the better the situation for buyers. The longer the consolidation phase, the stronger the bullish wave that follows.

Even with the upswing in January XRPUSDT has been sideways since late 2024.

We can say since December 2024 so sideways for four months. How much longer will it stay sideways?

Not much longer. Worst case scenario it goes into consolidation for another 60-90 days. That's the worst case.

Normal scenario would be 30-45 days before a major bullish impulse.

Best and most likely scenario is that the next bullish wave will start within 30 days. We are in-between the last two, the first one is out of the question for now.

Caution: If the market drops, tests and pierces $1.70 the bullish bias remains. In this type of scenario, we look at the weekly and monthly timeframes.

There was a low in early February and higher-low mid-March.

On a short-term basis, trading above $1.89, the 11-March daily low, is considered bullish. (Which means that the inverse would be considered bearish.)

There are no indications or signals coming from the chart pointing towards a new bearish-trend. None. The market has been sideways after a very strong period of growth. Current action is the consolidation of the previous move. When a bullish phase ends, we tend to see a strong decline right afterward, this happens with Crypto. When a bullish move makes a pause, we see sideways and this is what we have here. Actually, this chart is a strong one but still neutral. Neutral is the accumulation period for whales whom need months to load up. Since they purchase billions worth of Crypto, it takes time to plan and to move this money around and that's why it takes so long between each phase.

I am tracking whale alerts all of the time. Most of the money is in place. After the money exchanges hands and is positioned, there is always a small pause before the action starts. Money always moves before the action and never within the action. So the money moves, pause and then lots of price movements. While prices are moving, no big transactions are taking place, these are taking care of beforehand.

Consider the fact that there are hundreds of exchanges and everything moves simultaneously and at the same time. The only way this is possible is through long-term coordination and group planning.

What to expect?

Expect the market to heat up slowly. And after a slow rise and heating up then the bullish impulse and bull-run. It will be a long process and it will develop in many months.

If you are reading this now timing is great.

Spot traders can continue to buy and hold.

For leveraged traders, I have to look at some more charts before giving any suggestions. I will feel more comfortable when I read at least 100 charts.

Market conditions are changing and improving and it will do so long-term, but we still have one more month before May when the force will be in our favor, we are still in the sideways period, accumulation/consolidation. Boring? No! Time to study and prepare. The market gives us time to be at our best before the really good action starts and this is only good, don't you agree?

A bear-market means lower lows and lower highs long-term.

2025 is a bull-market year, likely to be the strongest ever. There is a huge difference. It is like calling night when it is day. It is like saying the sun is about to go up when the sky is ready to rain.

We are about to a see and experience a rain of cash flowing into the Cryptocurrency market and this will in turn send everything up. There is no bear market, we had a correction after a major advance and this is normal. After the correction is over we get consolidation, after consolidation prices will grow. Mark my word.

I appreciate you now and always.

Thanks a lot for your continued support.

Namaste.

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseason to kick off, ETH needs to flip the script and break above its last major high — currently sitting at $2,100.📈

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

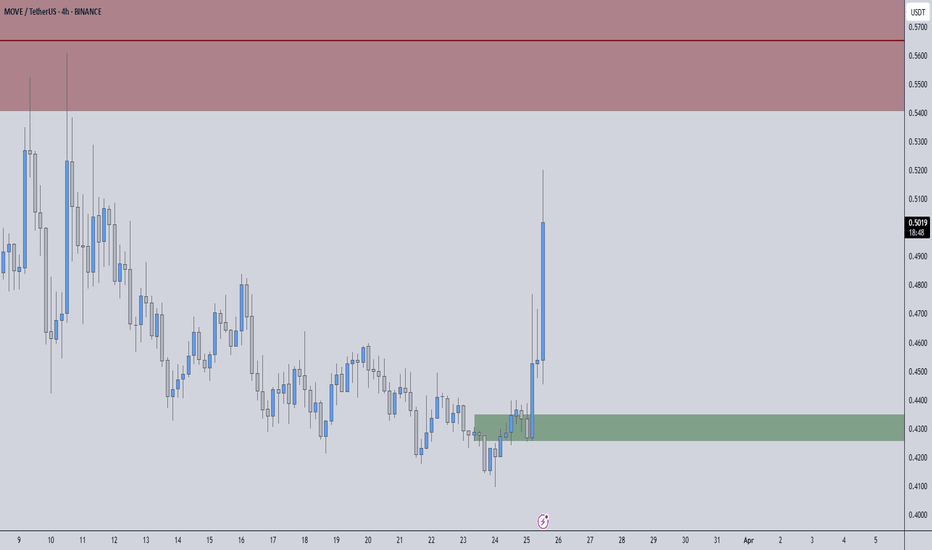

MOVEUSDT – High-Probability Setup, Stay Sharp📌 Key Levels Mapped Out – Now It’s About Execution.

🟢 Green Box = Strong Support – Buyers are showing interest, but confirmation is key.

🔴 Red Box = Major Resistance – A reaction here could lead to a solid rejection.

How We Approach This:

Support Holds? → We wait. LTF breakouts + CDV confirmation = high-confidence long. No guessing, just data.

Resistance Rejected? → No blind shorts. LTF shift bearish + CDV confirmation = strong setup.

Breakout? → We don’t chase. Retest + volume confirmation = real trade opportunity.

Most traders get caught in emotions—we don’t. We move with structure, volume, and confirmation.

Stay disciplined, execute the plan, and let the market do the work.

✅I keep my charts clean and simple because I believe clarity leads to better decisions.

✅My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

✅If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

BTC - 1H Clean Liquidity Hunt & Bearish Continuation BINANCE:BTCUSDT - 1H Update

Bitcoin remains in a bearish trend on the 4H and daily timeframes. After hunting the liquidity above the resistance zone, price began to drop exactly from our shared short entry at 83,700—and it's now on the move toward deeper targets.

🔹 Key Insights:

BTC grabbed liquidity just above resistance before reversing.

Price is now likely heading toward the liquidation zone below the support, aligning with the broader downtrend.

This setup offered a perfect short opportunity from $83,700, with clearly defined targets and risk.

🎯 Last Target: 80,200

💡 Congrats to all who followed our signal! The move is unfolding as expected.

📊 Stay locked in for the next big setups—follow for precise, real-time trade ideas! 🔔

SNTUSDT Analysis: Avoid Getting Stuck in Mid-RangesI don’t want you to get lost in the mid-range areas . For SNTUSDT, I believe the blue box is a high-value demand zone . Given that overall market conditions are weak , I’ve identified a lower entry point that aligns with a safer and more strategic approach.

The blue box holds significance from multiple perspectives . I used heatmap , cumulative volume delta (CVD) , and volume footprint techniques to determine this precise demand region where buyers could potentially regain control.

Key Points:

Avoid Mid-Ranges: Focus on clear demand zones to avoid indecision.

Blue Box: A critical demand zone identified as a potential buyer area.

Techniques Used: Heatmap, CVD, and volume footprint for accuracy and precision.

If you'd like to learn how I use these tools to pinpoint such precise demand zones, just DM me!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Breaking: $VINE Spike 40% Gearing up for 120% Surge SEED_ALEXDRAYM_BIGMAC:VINE broke out of a falling wedge today, surging nearly 40% and now gearing up for a massive surge with 120% in sight.

VINE, since token listing, saw its value depreciate by over 94% amidst increased volatility and the fade of meme coins on the Solana ecosystem.

Currently up 39%, SEED_ALEXDRAYM_BIGMAC:VINE once surged to as high as almost $500 million in market cap before retracing to $47,745,773.09 million market cap. With about $177,738,447.8 million traded in the past 24 hours representing a 96% surge in trading volume, SEED_ALEXDRAYM_BIGMAC:VINE looks poised for a 120% legged-up with build up momentum as indicated by the RSI at 76.82.

With listings on major exchanges likes Kraken, HTX, Bitget, OKX, GateIO, MEXC, BingX, etc, SEED_ALEXDRAYM_BIGMAC:VINE has already solidified its stay here in the Solana ecosystem and a 120% breakout will ignite the fire once put out by the bears.

About Vine Coin

SEED_ALEXDRAYM_BIGMAC:VINE is a meme coin: January 18, 2025, Elon Musk says he is "looking into" bringing back Vine, and @rus, CEO of Vine, just launched a meme coin. Vine was a once-popular short video sharing platform that allowed users to shoot and upload videos up to 6 seconds long. Launched in 2012, it quickly gained a massive user base, especially among young people. Vine videos usually played in a loop, and users showcased their creativity and humor by producing various types of content. Many videos went viral on social media. In 2017, Twitter (Vine's parent company) announced the platform's shutdown. Although Vine has ceased operations, its impact remains significant, as many creators gained fame on the platform and moved to other sites like YouTube and Instagram.

Vine Coin Price Live Data

The live Vine Coin price today is $0.045998 USD with a 24-hour trading volume of $171,878,116 USD. Vine Coin is up 34.31% in the last 24 hours, with a live market cap of $45,997,451 USD. It has a circulating supply of 999,994,104 VINE coins and the max. supply is not available.

TIAUSDT - analysis of the downtrend phase and potentialProject :

Celestia is one of the key players in the new generation of modular blockchain architecture. Unlike traditional monolithic solutions, it separates the execution and consensus layers. This provides flexibility, scalability, and creates the infrastructure for rollup and L2 ecosystems.

📍 CoinMarketCap: #47

📍 Twitter (X): 397.7K

____________________________________________________________

🔎 Technical picture :

I marked the Seed / Series A / Series B zones on the chart — it's clear how early investors locked in massive profits: from listing, the price skyrocketed +634%, and their returns are many times higher!)

From the current levels, the price is down ~87% from its all-time high.

Formation: the price is moving inside a large descending channel. At the same time, a potential “cup” structure and a possibly emerging ascending channel are forming.

We are close to the lower boundary of these formations — it's an interesting zone.

A final sweep/fakeout toward the lower boundary of the descending channel is possible — keep this in mind when calculating risk.

Key level: the orange trendline marks the boundary of the secondary trend. A confident breakout and hold above it would be one of the reversal signals.

____________________________________________________________

💡 General conclusions :

Liquidity — solid.

The coin is traded on major exchanges.

Trend potential is marked on the chart.

As always — everything depends on your strategy and patience.

____________________________________________________________

📌 This review is not financial advice but my personal analysis and observations on the project.

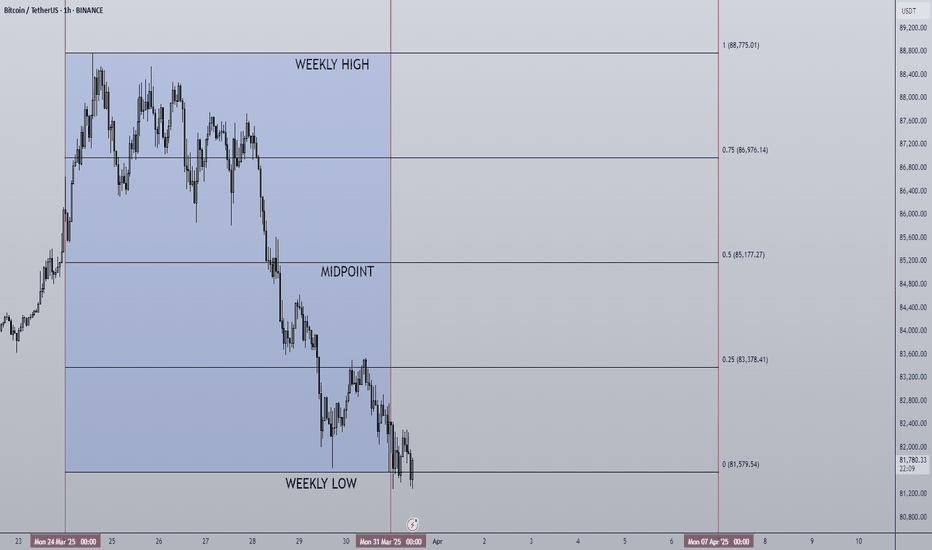

31/03/25 Weekly outlookLast weeks high: $88,775.01

Last weeks low: $81,579.54

Midpoint: $85,177.27

As Q1 2025 draws to a close, last week we saw a mirror image of the March 17th week with a swing fail pattern of the weekly high and a gradual sell=off throughout the week.

The reluctance for buyers to step into the market under the $91,000 resistance is telling me that the bulls are just not confident in current market conditions to bid into resistance. This may be because of the Geo-political factors, ongoing war, tariffs etc. Uncertainty does worry investors and so it's a valid reason.

From a TA standpoint however is a bigger worry in my opinion. Bitcoin failed to flip the 4H 200 EMA after the 8th time of trying since mid February and that is the biggest concern for me. As long as this moving average caps and reversal pattern then the trend is still bearish and should be treated as such.

$73,000 is still the target for a downward move IMO, a further -10% move from current prices. For the bulls a SFP of the weekly low could set up another bounce to weekly highs that have remained in approximately the $88,000 zone for two straight weeks. Major resistance around those levels and of course the dreaded 4H 200 EMA must be flipped too. Currently this is a tall order given how price action has been of late, sentiment is poor and altcoins are completely decimated in most cases. So I can't see the majority wanting to buy in until these criteria are met and we're trading back above $91,000.

This is still a traders environment, not a Hodler/investor.

First blood baths, then money baths.It is always useful to look at charts over the longest possible period.

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

Think simple.In such falling channels, the 3rd bottom point is the ideal buy point for me for bullmarket portfolio

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

UFTUSDT – High-Precision Short Opportunities!UFTUSDT has faced a sharp decline, confirming the accuracy of our pre-identified key levels. Now, we focus on the red box and red line as prime shorting zones. This is not guesswork—these levels are carefully selected using Volume Footprint & Time Price Opportunities, tools that most traders don’t even understand.

🔥 Key Trading Strategy:

✅ Red Box & Above Red Line = Short Opportunities

These areas have historically acted as strong resistance, and without a breakout with volume, they are ideal for potential reversals.

✅ Risk Tolerance Matters

For a more conservative approach, wait for a rejection at resistance. If you prefer more aggressive entries, every downward breakout from key levels could be an additional opportunity.

✅ Confirmation is Everything

Blind entries are amateur moves. Every position should be backed by CDV analysis, volume profile validation, and LTF breakdowns. That’s how professionals trade.

📌 Why My Analysis Stands Out

This is not just charting, it’s high-level trading backed by data and years of expertise. My levels are not random lines; they are calculated, tested, and used with high precision. You can check my high success rate from my profile. Most traders don’t have access to these techniques, and that’s why they struggle.

Don’t trade like the crowd, trade with an edge. Follow the plan, follow the data, and dominate the market.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Market Moves & Token Trends – Analysis with Me!Hi everyone, I hope you're all having a fantastic weekend!

To receive a token analysis , please follow the format below and leave your request in the comment section:

Example:

Project Name: Bitcoin

Token Symbol: BTC

Important Notes:

I will analyze a maximum of 20 tokens.

Each follower is allowed to submit one analysis request.

Once submitted , your token analysis will be shared directly below your comment .

Looking forward to your requests! 😊

If you found this helpful, please hit the ✅ Like Button ✅ (It fuels my energy) 💪 and Share it with your friends! Let’s grow together! 🙏😊

Wishing you health, wealth, and success! 🚀💸

LONG $900BMorning fellas,

I have been getting some spite, and about 75% of people who follow me stopped liking or commenting on my posts just because I've been sold since $100k and calling non-stop for this drop.

The drop came, and the moonfellas out there finally gave in.

Now it's time to look for longs and nothing better than a few select alt coins. I'm thinking $888B to $900B should hold and then we fly. Check trajectory line.

You people need to stop only posting that it's going up to the moon, and be realistic about things. Buy blood not green, buy LINK at $7 and not $25. Buy dot at $2 and not $15, and so on.

Trade thirsty, my friends.

FARTCOIN Long Entry Signal for FARTCOIN / USDT 3Day Time FrameTicker: FARTCOINUSDT

Timeframe: 3D

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the price, reinforcing the uptrend.

Price > SMA 21: Price is above the 21-period SMA (GREEN), indicating mid to long-term bullish strength for the 3Day time frame.

Trade Idea:

Entry: Consider a long position at this bar close.

Stop Loss: Place SL at the last PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: All indicators align for a bullish move. Stay alert for reversal signals or trend shifts.

Risk Warning: Not financial advice, trade at your own risk

Render: Running on Empty?Render has climbed nearly 50% since the low in the second week of March but lost notable ground recently. The price remains within our magenta Target Zone between $5.43 and $1.81 and could still dip toward the lower boundary as it works toward completing the turquoise wave 2. Once a sustainable bullish reversal takes hold, we expect a strong rally in the turquoise impulse wave 3, which should target new all-time highs. The resistance at $11.88, which marks the top of the magenta wave from early December, should be surpassed decisively as momentum builds.