Cannabis Sector: Buy per tutto il 2020Dopo un 2019 disastroso per il settore della cannabis, il 2020 potrebbe rivedere la luce dopo i recenti avvenimenti ma procediamo per gradi.

Sul finire di quest'anno abbiamo acquistato due azioni come NYSE:ACB e NYSE:CGC , possibile monitorare il nostro portfolio su nostro porfilo e.toro cercadno AC_Capital.

Scorsa settimana è cambiato il CEO della società NYSE:CGC , le azioni di tutto il settore hanno festeggiato per questo evento. L'attuale produzione spinge i prezzi della cannabis al ribasso perchè l'attuale domande è inferiore all'offerta.

Il mercato canadese è troppo piccolo per reggere questi volumi e i produtttori canadesi cercano di trovare mercati sbocco sui mercati esteri che attualmente vivono un momento di restrizione legale.

Avendo letto un valido report sul settore della cannabis realizzato da Deloitte dal titolo "Nurturing new growth Canada gets ready for Cannabis 2.0", abbiamo deciso di costruire il nostro portfolio con costanti buy on dip.

Non ci conosci anocra?

Cerca su Google Algo Capital Finance, troveri informazioni utili circa la nostra società.

Cannabis

Charlotte's Web Holdings (TSX: CWEB.TO) Dec 12, 2019Currently the entire cannabinoid industry is in a downturn. The sky high valuations that these companies have been commanding past few months have clashed with reality, leaving investors scrambling for cover.

The whole premise for the high valuations was the high growth rate. However, as recent events in Canada show, legitimate cannabinoid companies still cannot compete with the black market given the high taxes and the costs of compliance with regulatory requirements. Furthermore, with the government allowing private citizens to grow cannabis, a chunk of the retail market has vanished for these big players. Now the competition among the bigger players is among niche and value added products.

Coming to CWEB, it's revenue has grown in the double digits but so has the costs. Currently, the stock commands a PE of 213 (Yahoo Finance), which would theoretically take an investor more than 2 centuries to recoup his/her investment (assuming no growth rate). Critics may point out the impressive rate of growth, but the key question to ask: Is the company generating any money?

A quick glance at the Cash Flow statement reveals that although CF was positive from FY17 to FY18; however in the TTM the company has spent 44,000K from its reserves. Furthermore, in the company's short life span, FCF was positive only in 2017.

Based on the analysis, CWEB would not find a space in my personal portfolio. It seems that the company is funding it's growth from shareholder equity. In the absence of shareholders pouring in money coupled with a negative FCF, the company would find it challenging to sustain its growth.

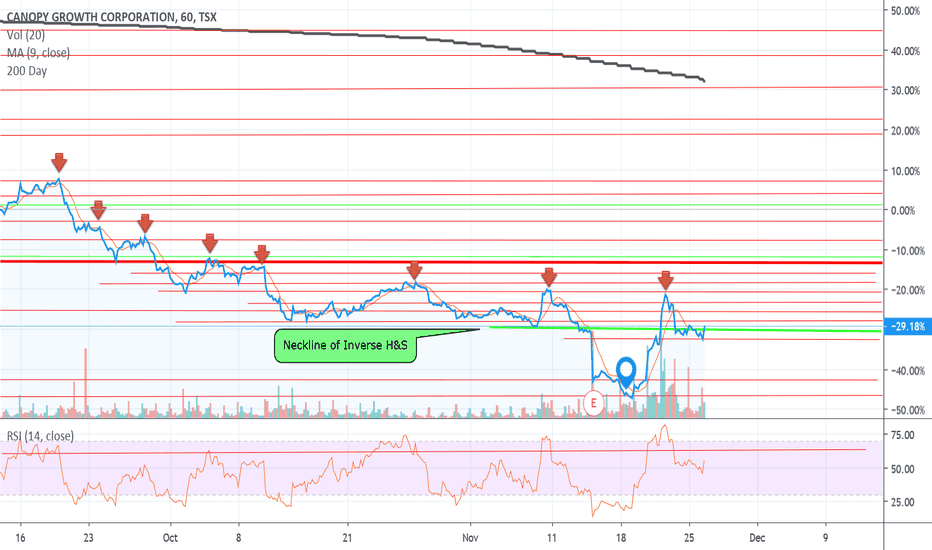

Canopy Growth Corporation inverse head and shouldersWhile we are not seeing divergence on RSI, recent bullish news in cannabis industry are gearing up buyers for 2020. Current resistance is a good confirmation level for a buy. Targeting 30, stop below the recent swing with a buffer of your choice.

Good Luck!

$GRWG... Ready To Resume UptrendRecent uplising news coupled with solid earnings and upgrades should take this back up to the high end of the range... $4.40 in sight... next target $5.00... look for friction @ 50MA 4.11 @ 100MA 4.45... Stop@ $3.60... sell 1/2 @4.80 then watch for direction...

All IMO...

$GRWG

Bull Flag or Descending Triangle.Since my post several days ago linked to this chart, you'll notice $WEED is holding the neckline area of the inverse H&S, forming two additional patterns known as a bull flag & descending triangle.

Seeing how the sector has thrown under the bus for the better part of 1 year, I'm expecting to see the Bull Flag play out.. Simply to go against the bearish narrative that's becoming a bit more hysterical by the day..

Time will tell per usual.

Trulieve Cannabis Corp Trulieve Cannabis Corp., together with its subsidiaries, operates as a medical marijuana company.

Revenue is forecast to grow 39.46% per year.

Earnings grew by 339.5% over the past year.

RISK ANALYSIS

Earnings are forecast to decline by an average of -14.4% per year for the next 3 years.

High level of non-cash earnings.

Highly volatile share price over past 3 months.

Significant insider selling over the past 3 months.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

Cannabis Stocks Crash / HMMJ Marijuana ETFHorizons Marijuana Life Sciences Index ETF (“HMMJ” or “ETF”) seeks to replicate, to the extent possible,

the performance of the North American Marijuana Index (the “Index”), net of expenses.

The Index is designed to provide exposure to the performance of a basket of North American

publicly listed life sciences companies with significant business activities in the marijuana industry.

Currently, 11 U.S. states allow the legal use of recreational marijuana, while 33 states have legalized medical cannabis.

But those numbers could soon change.

Nine states could be on track to hold key votes on some form of marijuana legalization in 2020.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

Cannabis Stocks Crash / Lawsuit Against HEXO Corp.A LEADING LAW FIRM, Announces Filing of Securities Class Action Lawsuit Against HEXO Corp. - HEXO

According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that:

(1) HEXO's reported inventory was misstated as the Company was failing to write down or write off obsolete product that no longer had value;

(2) HEXO was engaging in channel-stuffing in order to inflate its revenue figures and meet or exceed revenue guidance provided to investors;

(3) HEXO was cultivating cannabis at its facility in Niagara, Ontario that was not appropriately licensed by Health Canada; and

(4) as a result, HEXO's public statements were materially false and misleading at all relevant times.

When the true details entered the market, the lawsuit claims that investors suffered damages.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

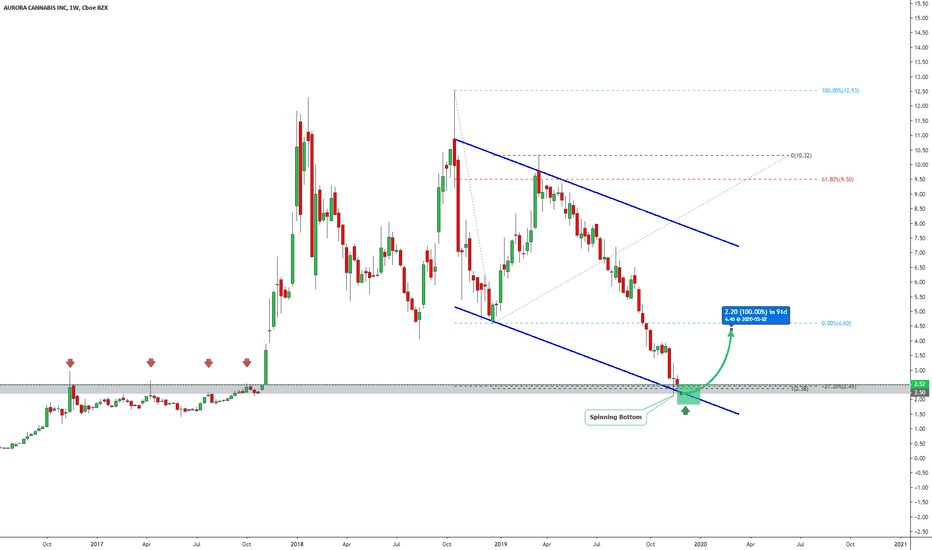

AURORA CANNABIS (ACB) | Risky, But Probably Worth It!Hi,

Aurora Cannabis Inc. produces and distributes medical cannabis products.

Obviously, it has some mixed fundamentals but technically it may find some buyers around 2.00 - 2.50.

Technical criteria are pretty strong, some of them are a bit subjective but in general, we have a strong crossing area. The green box consists of:

1) 2016 & 2017 high/resistance should start to work as a support level.

2) Actually, it has already started to act as support. In the last week, the price got a rejection upwards from the gray area (2016/17 high) and formed a Spinning Bottom candlestick pattern - bullish candlestick pattern.

3) Now, a bit subjective but still, channel projection worked as a support level and they make up a crossing area with the gray zone.

4) The crossing area becomes even stronger because we have D point exactly inside of it from the pattern called AB=CD

5) Fibonacci Extension 127% should make it (marked bounce area which stays between 2.00 - 2.50) also a bit stronger.

6) The current seasonal "pattern" favors buyers. It means that the end of the year has been pretty profitable for Aurora and the last upwards rally started about a year ago also in December.

Target is up to you but the strongest resistance level stays around the 5.00 and if it reaches there from the current area then it will be 100%+ profit.

Do your own research and please, take a second and support my effort by hitting the "LIKE" button, it is my only FEE from You!

Best regards,

Vaido

Canopy Growth Corporation updates planAfter setback in the cannabis industry and lack of liquidity, we had a slump in stocks. Now it seems 22 is a strong resistance level.

Earlier entry is possible on the close of the recent gap.

Good Luck!

CGC 15 min chart and the AlphaBotSystem IndicatorsJust discovered these guys recently. They have built an impressive suite of indicators that cater to both equities and crypto traders. There is also a series of bots for trading crypto. The visual trend change blends in nicely with my charts and gives one confidence to take the trade after the trend change is indicated and then a technical setup presents itself.

Cannabis will reach the US... sooner than later!Recent significant events:

House Passes Bill to Protect Banking for Marijuana Businesses

Measure would prevent federal regulators from penalizing institutions that serve companies operating in states where cannabis is legal. // September 25th, 2019

House committee approves landmark bill legalizing marijuana at the federal level

The House Judiciary Committee (Democratic-controlled) approved a bill that decriminalizes marijuana on the federal level, removing it from Schedule 1 of the Controlled Substances Act.

The legislation, which passed 24 to 10, has a high chance of approval in the full House where Democrats control the chamber with 234 seats. It’s likely to face a tougher battle in the Republican-controlled Senate, where Majority Leader Mitch McConnell opposes marijuana legalization. // November 19th, 2019

There is no date for the senate to review the bill; we could see large volatility then. (will update asap)

Technical analysis:

Volume on the ladder of the events created the 3rd largest volume daily since MJ ETF was created (2016).

20SMA is our nearest resistance.

--Keeping cannabis related stocks/ETFs closely watched.

EXMceuticals - Licences for European MarketAfter a long time back and forth, EXMceuticals announced today that it has obtained the import license of cannabis for Portugal and the European market. Now the import can finally start and the processing to CBD can take place.

A doubling would not surprise me.

Cannabis in Free fallAs we looked at this stock yesterday and shorted into the close. It was almost too obvious it would shoot down with the earnings report release. Now there is very little support going into this last downward leg until we reach 2$.

Capitulation mode is in full effect. didn't think it would happen this soon but investors are giving up on cannabis stocks sooner than I expected (this looks really bad for the overall stock market because cannabis is a perfect demonstration of pack psychology and a good measure of impulsivity in the markets). Time to hold shorts until this makes another BIG flat bottom which is characteristic of most bubbles.

C21 Investments - Light at the end of the tunnel?Short and crisp.

Q.2 Numbers were ok. At least one cannabis company that earns money and thus the company delivers what everyone expects. Increasing turnover but above all also profits!

Weekly closing price above 0.71 CAD unlocks the next target at 0.88 CAD.

If this is also taken out at weekly closing, maybe it could run to 1.20 CAD.

If a weekly closing less than 0.71 CAD another downturn should not surprise.

Highlights

- Net sales increased 27% to $9.86 million in the second quarter compared to $7.76 million in the first quarter

- Adjusted EBITDA was $0.8 million, compared to $0.2 million in the first quarter

- Slight increase in gross margin to 44% (43% in Q1)

- The acquisition of Swell Companies was completed on May 24, 2019 and the C21 portfolio was expanded to Hood Oil and Dab Society brands.

- Hood Oi brand sold 36,000 units at the beginning of the year, with sales in excess of $1 million.

- Customer growth in Nevada to 159,932 customers compared to 139,392 in the first quarter

Tilray vs the rest Pot stocks have had a rough few months, and shareholders of Tilray have been hit especially hard as shares have dropped 55% since early August. Much of that decline can be traced to disappointing earnings results. In mid-August, Tilray showed sales growth in Q2, as revenue jumped nearly 400%. However, management's aggressive spending produced net losses, and investors responded to the news by shedding shares.

Tuesday's earnings report will likely contain these same themes of high sales growth paired with soaring expenses. That means there's little reason to expect a dramatic shift in Tilray's stock-price trend - at least until investors get more concrete signs that point to the likelihood of sustainable earnings generation in this unproven industry.

The good news is that with shares battered so far in 2019, even a modest step toward profitability could spark a rally in the stock as early as this week.

TNY Update.Tinley appears to be trading in a Ascending Triangle creating a series of "micro" higher lows & higher highs.

The 46c range would be ideal to hold because that's where we created our first "significant" higher high on a micro level that was representative of a potential trend change.

On the RSI we can clearly see higher lows & higher highs forming a Ascending Triangle as well.

Worth noting.

We've seen a double top where I have the two red gavels that coincides with an increase in short positions during this exact time period, but I wouldn't be surprised to see them cover if they didn't already with the pending news of Canadian expansion with two unkown LP's, one Big & one Small, IMO only.

Time will tell per usual.

GrowGeneration: Wrong-way cannabis earnings play of the dayGrowGeneration killed it on today's earnings report, but dropped about 5%. This presents a buying opportunity.

The company reported GAAP earnings of $.03 per share, beating analyst estimates of $0.02/share. It reported revenue of $21.8 million, vs. the forecast of $20.621 million. These are big year-over-year increases. This time last year, the company reported a loss of ($.02) per share. Revenue is up $13.4 million, or 159% over last year's quarterly report of $8.400 million. The company raised its full-year revenue forecast to about $75M. Same-store sales and profit margins both saw large increases.

Coming after analyst downgrades for Aurora Cannabis and CanopyGrowth, GrowGeneration's results make it a standout small-cap player in the ever-popular cannabis sector. Overall, this company is executing like a boss.