Contains IO script

SUIUSDT Perpetual Swap Contract (4H - OKX) AnalysisSUIUSDT Perpetual Swap Contract (4H - OKX) Analysis

1. Trend Analysis

Overall Bearish Trend:

The price remains below EMA 50, EMA 100, and EMA 200, indicating a dominant downtrend.

Multiple Sell signals reinforce the bearish momentum.

Price has been consistently making lower highs and lower lows, a classic downtrend structure.

Potential Short-term Reversal:

The price is currently bouncing off a demand zone near 3.914 USDT.

There is a cluster of Take Profits (TP) levels, indicating buyers might be stepping in.

If price holds above this level, a retracement towards EMA 50 or higher Fibonacci levels is possible.

2. Key Resistance & Support Levels

Resistance Levels:

4.2509 USDT (EMA 50): Immediate short-term resistance.

4.4329 USDT (Fibonacci 0.500 Level): A critical level to break for further upside.

4.6965 - 4.9389 USDT (EMA 100 & 200): If price reaches here, expect significant resistance.

Support Levels:

3.914 USDT (Entry Point): Current demand zone where price has shown buying activity.

3.664 USDT: Next major support. If broken, expect further downside.

3.500 - 3.300 USDT: If bearish momentum continues, these are potential downside targets.

3. Risks & Concerns

Weak Buying Volume:

Price has bounced, but volume is not significantly increasing, making this a potential weak reversal.

Needs confirmation with a strong breakout above EMA 50.

Bearish Market Structure Still Intact:

The price is still below key moving averages and in a downtrend channel.

A failure to break above 4.2509 USDT (EMA 50) could lead to another move downward.

Possible Fakeout or Short-term Bounce:

If price rejects near 4.2509 USDT, it could be a short-term liquidity grab before continuing downward.

A failure to hold 3.914 USDT could trigger another leg lower.

4. Trading Strategy

✅ Long Scenario (Bullish Breakout Play):

Entry: If price holds above 3.914 USDT and breaks 4.2509 USDT with volume.

Target 1: 4.4329 USDT (Fib 0.500 Level)

Target 2: 4.6965 USDT (Fib 0.786 Level, EMA 100)

Target 3: 4.9389 - 5.0140 USDT (Major Resistance Zone, EMA 200)

Stop-Loss: Below 3.750 USDT to minimize downside risk.

✅ Short Scenario (Bearish Continuation):

Entry: If price fails to break 4.2509 USDT and shows rejection signs.

Target 1: 3.914 USDT (Demand Zone)

Target 2: 3.664 USDT (Next Support Level)

Target 3: 3.500 - 3.300 USDT (Extended Downside Target)

Stop-Loss: Above 4.350 USDT to limit risk.

5. Summary & Outlook

📌 Bearish Trend Still Intact, but a Short-term Bounce Possible.

📌 If price reclaims EMA 50, a recovery towards 4.4329 - 4.6965 USDT is likely.

📌 Failure to break above 4.2509 USDT may lead to another move downward towards 3.664 USDT.

🔎 Recommendation:

Watch price action at 4.2509 USDT—a rejection here could be a strong short opportunity.

A confirmed breakout above EMA 50 would indicate a shift towards a bullish retracement.

Let me know if you need further refinements! 🚀📊

$COFFEE: Nice weekly up trendPEPPERSTONE:COFFEE has been trending strongly since the long term trend turned up recently, it now offers a low risk entry for commodity traders who use the Forex.com platform (fairly convenient since you can trade from the charts directly here, I have no affiliation with them btw).

Reward to risk is 3.75 to 1, which is very considering the larger than 60% probability than this outcome has...

Best of luck!

Cheers,

Ivan Labrie.

BTCUSDT Perpetual Swap Contract (4H - OKX) AnalysisBTCUSDT Perpetual Swap Contract (4H - OKX) Analysis

1. Trend Analysis

Potential Reversal / Bullish Momentum:

The price has bounced from a demand zone around 97,737.7 USDT.

A Break of Structure (BOS) has occurred, indicating a possible trend shift.

The price is now trading above EMA 20 and EMA 50, signaling potential upside continuation.

If the price can hold above these EMAs, we may see further bullish movement.

Short-term Uptrend Formation:

The price has moved above key moving averages (EMA 20 and EMA 50) and is attempting to break the EMA 100.

If the price can break and sustain above 104,099.9 USDT, it could confirm an uptrend towards key Fibonacci levels.

2. Key Resistance & Support Levels

Resistance Levels:

105,154.5 USDT → This is a strong resistance zone that aligns with EMA 100 and previous price reactions.

107,375.0 USDT (Fibonacci 0.786 level) → If BTC breaks above 105K, this could be the next upside target.

108,700.9 - 109,539.0 USDT → A major supply zone that could act as strong resistance.

Support Levels:

102,421.5 USDT (TP1 Level) → If BTC fails to sustain above this, it could revisit lower levels.

100,792.5 - 100,531.5 USDT → A critical support area. Losing this level could bring BTC back to its demand zone.

97,737.7 USDT (Demand Zone) → If BTC retraces further, this is the key level where strong buying interest previously emerged.

3. Concerns & Risks

Overhead Resistance at 105,000 - 109,500 USDT:

BTC needs to break above 105K with strong volume to confirm a bullish reversal.

If it fails, the price could reject and revisit 100K or lower.

Possible Fakeout / False Breakout:

If the price breaks above resistance but lacks volume, it might trap longs and fall back into the lower range.

EMA 100 as Dynamic Resistance:

Currently, BTC is testing the EMA 100; a rejection here could signal a short-term pullback.

Volume Confirmation Needed:

The price is attempting to break resistance, but if volume does not increase, this could signal a weakening move.

Trading Strategy

✅ Long Strategy (Bullish Case)

Entry: Above 103,868.3 USDT (TP2 Level)

Target 1: 105,315.1 USDT (Fibonacci 0.618)

Target 2: 107,375.0 USDT (Fibonacci 0.786)

Target 3: 109,539.0 USDT (Final TP Level)

Stop-Loss: Below 100,792.5 USDT

✅ Short Strategy (Bearish Case)

Entry: If BTC fails to break 105,000 USDT and gets rejected.

Target 1: 102,500 USDT

Target 2: 100,792.5 USDT

Target 3: 97,737.7 USDT (Demand Zone)

Stop-Loss: Above 106,000 USDT if shorting near resistance.

📌 Summary:

BTC has bounced from the demand zone and is showing short-term bullish strength.

A breakout above 105,000 USDT could confirm an uptrend, targeting 107,000 - 109,500 USDT.

Failure to break 105K could result in a pullback towards 100K or lower.

Watch volume and EMA 100 interaction for confirmation.

🔎 Recommendation: Monitor BTC at 105K closely—a breakout could send prices higher, while rejection could mean a retest of 100K levels. 🚀

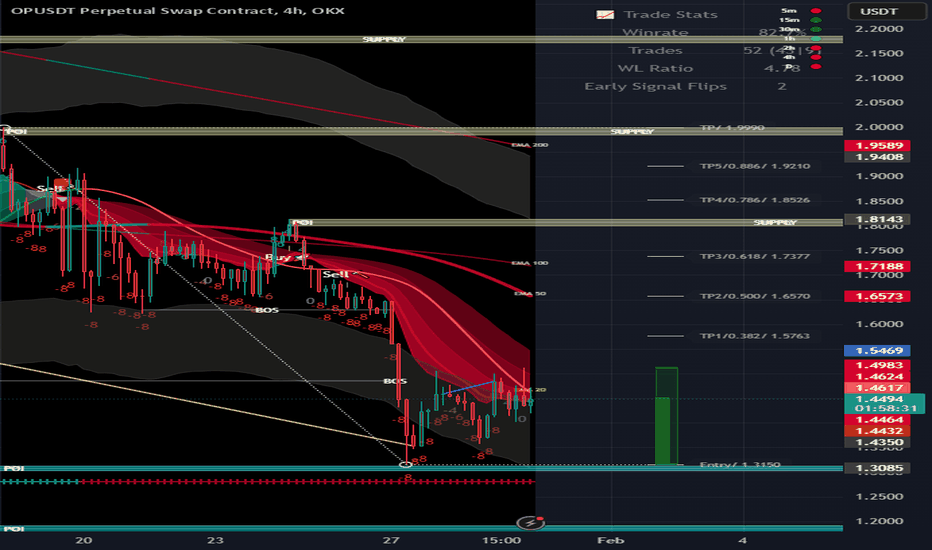

Analysis of OPUSDT Perpetual Swap Contract (4H - OKX)Analysis of OPUSDT Perpetual Swap Contract (4H - OKX)

1. Main Trend Downtrend:

The price has been consistently moving below the EMA 50 and EMA 100, indicating a strong bearish trend.

The EMAs are arranged in a bearish order (EMA 100 > EMA 50), confirming a continuation of the downtrend.

Market structure shows Break of Structure (BOS), reinforcing the bearish bias.

Short-term Recovery:

The price is currently bouncing from a key support level, suggesting a potential short-term reversal.

A large green candle with high volume indicates buying pressure returning.

If the price breaks above the 1.6573 - 1.7188 resistance zone, we could see a further move towards 1.8145 - 1.9409.

2. Key Resistance & Support Levels

Resistance Levels:

1.6573 - 1.7188: This is a supply zone to watch. If the price successfully breaks above, it could signal a potential trend reversal.

1.8145 - 1.9409: The next key resistance level where selling pressure may re-emerge.

Support Levels:

1.4456 - 1.4625: A level where buying interest has appeared.

1.3450: A critical support zone. If the price drops below this level, the next downside targets would be 1.3000 - 1.2800.

3. Risks & Concerns

Supply Zone Resistance: The area around 1.6573 - 1.7188 may act as a strong resistance, leading to another price rejection.

Overall Bearish Trend: Despite the recent rebound, the trend remains bearish as long as the price stays below EMA 100 and fails to form a higher high.

Volume Confirmation: Although there is a strong green candle, sustained buying volume is required for a real reversal.

False Breakout Possibility: If the price fails to break 1.7188, it could result in a rejection and another move downward.

Trading Strategies

✅ For Short-term Traders (Scalping / Day Trading):

Long Entry: If the price breaks 1.6573 with strong volume, target 1.7188 and 1.8145.

Short Entry: If the price tests 1.7188 and fails to break above, consider shorting with targets at 1.5450 - 1.4625.

✅ For Swing Traders:

If the price closes above 1.8145, a long position can be considered, targeting 1.9409.

If the price falls below 1.4456, it could signal further downside towards the major support at 1.3450.

📌 Summary:

The primary trend is still bearish, but a short-term rebound is in progress.

Breaking above 1.7188 could indicate a medium-term reversal.

Failure to break resistance could lead to another leg down.

🔎 Recommendation: Watch the 1.6573 - 1.7188 resistance area and observe price action to determine whether the price can break through or face rejection.

Yen carry trade and NASDAQShort term trade - if Japan increases interest rates as it did in July, there's a high chance the Yen Carry trade will unwind again, causing a large drop. If Japan doesn't raise them, I'd close the trade soon after that.

THE SL is orientational the point of the trade is to hold till the decision on friday.

GOLD 15M CHART UPDATE POTENTIAL SHORT TERM BULLISHDear Traders,

Here’s a quick 15M chart analysis for your reference.

Currently, the price is consolidating between support level at 2730 and resistance at 2744. The FVG provides an additional layer of support within the 2738–2740 range. Additionally, EMA5 has crossed above MA21, indicating a potential shift in momentum.

We will wait for confirmation of EMA5 crossing and locking above the ENTRY LEVEL at 2744 to signal upward momentum toward TP1. If EMA5 fails to lock above this level, the price is likely to drop due to resistance at 2744.

Please note: It’s a busy day on the forex calendar with multiple high-impact news events. Exercise caution, as high volatility is expected!

Key Updates:

Resistance Levels: 2745, 2771

Support Level: 2730

Bullish Targets:

If EMA5 crosses and locks above 2744, the next target is 2752.

If EMA5 crosses and locks above 2752, the next target is 2760.

If EMA5 crosses and locks above 2760, the next target is 2768.

Bearish Targets:

Key Level: 2744

If EMA5 crosses and locks below 2734, it will open the path to 2719.

If EMA5 crosses and locks below 2719, the next target is 2710.

If EMA5 crosses and locks below 2710, the final target is 2694.

We will closely monitor these levels and provide updates as EMA5 interacts with the weighted zones.

The QUANTUM Trading Mastery

GOLD 1H ROUTE MAP UPDATEHello Traders,

We closed last week with our analysis playing out as predicted, achieving all our leveled targets as confirmed by range-to-range breaks. Corrections like these are welcome, as they provide safe opportunities to buy dips and ride the long-term trend.

For now, the price is fluctuating between 2770 and 2730 range. we anticipate levels being tested back and forth until one of the weighted levels breaks and locks to confirm the next directional range. Updated levels will help us track downward movements and identify optimal bounce points to enter trades.

Key Updates:

Resistance Levels: 2770, 2785

Bullish Targets: 2771

If EMA5 crosses and locks above 2771, the next target is (2784)

If EMA5 crosses and locks above 2784, the next target is (2796)

If EMA5 crosses and locks above 2796, the next target is (2808)

Key Level: 2742

If EMA5 crosses and locks below 2742, it will open the path to TP1 (2726).

TP1: 2726

If EMA5 crosses and locks below 2721, the next target is TP2 (2710).

TP2: 2710

If EMA5 crosses and locks below 2710, the next target is TP3 (2694).

We will closely monitor these levels and provide updates based on EMA5’s interaction with the weighted zones.

The QUANTUM Trading Mastery

Supra at the tip of the falling wedge. $SUPRA is at the tip of a falling wedge. The interesting part is that it is also confluent with some horizontal support. The daily TF is showing some signs of divergence however the 4h has some stronger signs.

The most important thing is to wait for the market structure to pivot bullish. A chofch would be a DCA zone.

2025 S&P500 Forecast Guess by Tim WestI included 2024's guess that I posted here in January last year which turned out to be quite accurate in terms of "action" and "direction". The volatility the market saw with wild swings back and forth was outlined on here as we reached the clusters of guesses from Wall Street estimates.

This is an old technique that I learned from Ken Fisher of Fisher Investments and from Forbes Magazine. His wise and witty insights were the foundation of my investment strategy when I started investing in the mid 1980's.

Basically, when you see what the "market expectations" are for a market like the FOREXCOM:SPX500 or S&P500 Index, you can then figure out what needs to happen to get the market to their estimates and realize the market will go to somewhere else other than their guesses.

With 2024 showing a majority of "less than historical average" forecasts and more downside forecasts, it was quite clear that the market could easily outpace or outperform those forecasts.

Now that 2025 shows that analysts are looking for an average year or more, I think it is safe to say that we won't get an average year.

We now have a rising US dollar, which hurts overseas earnings. We also have higher energy prices which also hurts earnings. And yet we have plenty of cash on the sidelines as everyone who missed the rally is hoping to buy on a decline and others are just happy to earn 5% on their cash balances thanks to an ultra-tight Fed (compared to the last 20 years).

So, I expect more of the same that we have seen in January and I also expect sharp declines if we get any moves above the highs and up towards 6500 on the SPX.

eurusd break and retest?I think eurusd will go down to 1.0365 and I see this up move a retest of that longterm broken trendline. today i think they will hold Federal Funds Rate unchanged at %4.5 so I see usdindex getting strong and causing more downtrend for eurusd... let see If I am correct?

1.0460 is my sell stoploss.

or they will reduce rates to 4.25 so usd weakens and eurusd continues upward.