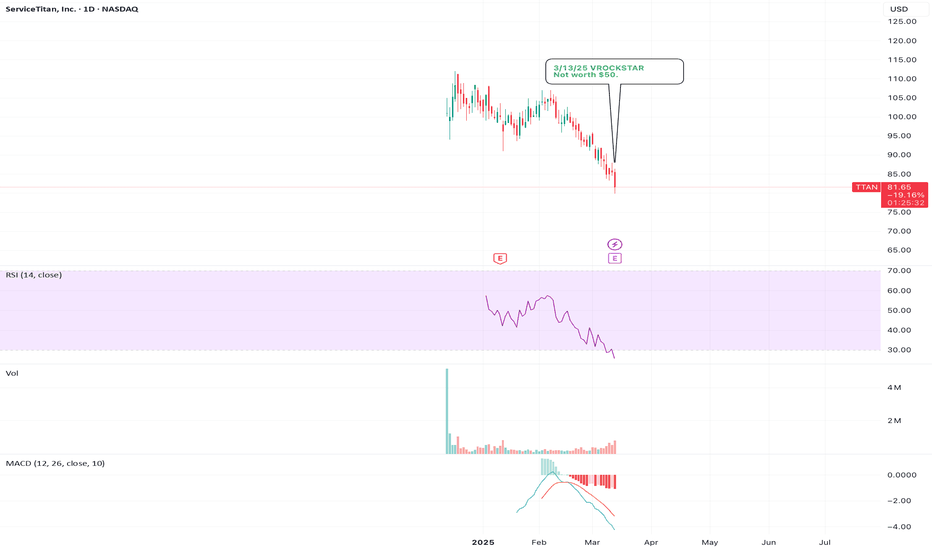

3/13/25 - $ttan - Not worth $50.3/13/25 :: VROCKSTAR :: NASDAQ:TTAN

Not worth $50.

- a total avoid

- this thing pops and i'll be there to fade

- but 10x sales for hardly 20% growth

- mediocre mgns

- hardly 1% fcf flow

- and worst of all, stinky PEs trying to dump their bags on public bag holders. let those trolls hold their own dog poop.

- probably a nice mgmt, good company etc. but i'm purely interested in the stock

- and no way. jose!

V

Fundamental Analysis

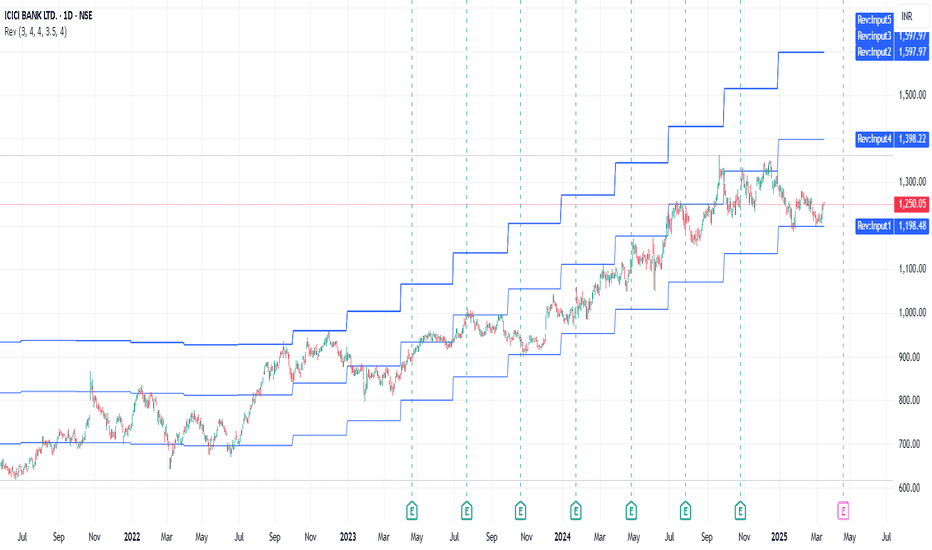

Long ICICI BankSince August 2021, ICICI Bank stock has been trading nicely between Revenue/share multiple of 3, 3.5 and 4. That means it is trading at 3 to 3.5 times it's revenue per share. It is clearly visible using Revenue Grid Indicator applied on daily chart. As per that, this is a good time to buy for a long term view. We can wait for 21 Apr 2025 for it's next earnings results also :) Happy Trading :)

Copper Surges High as Bulls push the Price to mitigate 5.1 zone Expectations that US President Trump will impose tariffs on copper, a move that would pressure the limited capacity of local smelters. The President signed an executive order to initiate a review of copper imports after noting he would tariff the metal in an earlier speech before Congress. These signals suggested that levies would be imposed later in the year, but the escalation of base metal tariffs on Canada sporadically announced by the White House ramped up concerns that barriers on copper may be expedited.

That being said am just taking advantage of all this tariff talk as I find opportunities every time an executive tariff order are signed.

My Tp.1 for the metal is @5.1167 Handle.

3/13/25 - $deck - Rental book3/13/25 :: VROCKSTAR :: NYSE:DECK

Rental book

- ppl ditch their shoes and go homeless chic in a recession, right?

- look. of all the shoe names, this is the only one w the best growth, economics etc. etc.

- but what's probably SHTF 20% case low? 7-handle. instead of high $5s EPS, you probably end up near $5 and so instead of 20x PE you're at 15x (remember the mkt looks fwd, so you have higher EPS and multiple should re-rate). at that pt we're at $75.

- do i think we get there? no. i don't.

- is $100 possible? test of high $90s? sure.

- is the stock a buy here? yes

- do tariffs matter? yes

- so i've added it as a 3% size to my rental book. i am comfortable w these products. it's not an AI-risk issue. mgns and ROIC is solid.

- so Bot decent size here and am in the process of selling the $115C for june this yr at about 15 bucks. this allows me to breakeven if my $100 call is right. and i would love to own the stock there or below and re-rent or keep. and if we just run... that's about 11% yield for 3 mo of what i consider to be a fairly defensible biz and superior to cash and allows me to sit tight and lock away some likely low vol gains as the market chops on any whim of someone sneezing.

so. welcome to the rental book NYSE:DECK :)

V

$ADSK: AutodesK – Designing Profits or Sketching Losses?(1/9)

Good afternoon, everyone! ☀️ NASDAQ:ADSK : AutodesK – Designing Profits or Sketching Losses?

With ADSK at $245 post-Q4 beat and robust guidance, is this design titan a blueprint for profit or a rough draft? Let’s ink out the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 245 as of Mar 13, 2025 💰

• Recent Move: Up after Q4 FY2024 earnings beat, per data 📏

• Sector Trend: Tech sector buoyant, with AI and cloud driving growth 🌟

It’s a tech favorite—let’s see if it’s worth the hype! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $50B (assuming shares outstanding) 🏆

• Operations: Design software for architecture, engineering, manufacturing ⏰

• Trend: Cloud and AI integration boosting future growth, per reports 🎯

Firm in its niche, with digital transformation as tailwind! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 FY2024 Earnings: Billings and revenue beat, per data 🌍

• FY2026 Guidance: Revenue growth 8-9%, FCF $2.075B-$2.175B 📋

• Market Reaction: Stock price up post-earnings, indicating confidence 💡

Adapting to new tech trends, looking ahead! 💪

(5/9) – RISKS IN FOCUS ⚡

• Economic Slowdown: Reduced software spending in tough times 🔍

• Tariff Threats: March 10-12, 2025, impacting new business, per data 📉

• Competition: Adobe, Siemens, others in design software market ❄️

It’s a competitive landscape—risks are real! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in design software, strong brand 🥇

• Subscription Model: Recurring revenue from cloud-based services 📊

• AI Integration: Leveraging AI for enhanced products, per recent announcements 🔧

Got solid foundations and futuristic vision! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuation (P/E around 39), macro headwinds 📉

• Opportunities: Expanding into manufacturing, healthcare, per strategy 📈

Can it justify its price and expand further? 🤔

(8/9) – POLL TIME! 📢

ADSK at $245—your take? 🗳️

• Bullish: $260+ soon, growth story continues 🐂

• Neutral: Steady, risks and opportunities balance out ⚖️

• Bearish: $220 looms, overvalued in current market 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

ADSK’s $245 price reflects strong performance and guidance 📈, but with a high P/E ratio, it’s not for the faint-hearted. Dips could be golden opportunities for DCA investors. Gem or bust?

Bitcoin’s Wild Ride: Up or Down, I’m Watching!Hey there, trading family—just chilling and watching Bitcoin like it’s my buddy on a rollercoaster. It’s hanging out near that FWB:83K spot, and I’m like, “Dude, if you bust through, I can see you tearing up to $120K-$130K—time for a high-five and a snack!” But if you start slipping with those lower lows, no biggie. You might drop to $79,600, then maybe $78,700, $77,000, or even $73,500. I’m just kicking back, enjoying the show—up or down, it’s all good vibes! If you liked this, comment below, boost, or follow—let’s keep the trading love going!

Kris/ Mindbloome Exchange

Trade Smarter Live Better

GBP/CHF Trade Idea – Short Setup🔥 Why Sell?

✅ Momentum Fading – Buying pressure weakening

✅ Supply Zone – Strong resistance at 1.1330

✅ Stochastic Overbought – Price may reverse

✅ Range Market – Stuck between 1.1100 - 1.1330

📊 Fundamentals

🇬🇧 UK: Neutral 📈

🇨🇭 CHF: Bullish 💪

⚠️ Risk Management: Stay alert for news! 📢

💬 What’s your take on GBP/CHF? Comment below! 👇🔥 #Forex #Trading #GBPCHF #ForexSignals

MNQ!/NQ1! Day Trade Plan for 03/13/2025MNQ!/NQ1! Day Trade Plan for 03/13/2025

📈19660 19760

📉19470 19380

Like and share for more daily NQ levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

Long TCS Ltd.According to the Revenue Grid indicator, stock is trading around the revenue per share of 5.5. It went above this valuation level around Oct, 2017, never to return back to it. It crossed it only at the time of market crash caused by Covid virus pandemic in 2020. So this is definite buy here.

MNQ!/NQ1! Day Trade Plan for 03/12/2025MNQ!/NQ1! Day Trade Plan for 03/12/2025

📈19760 19850

📉19570 19475

Like and share for more daily NQ levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

$HRTG: Heritage Insurance – Catastrophe or Opportunity?(1/9)

Good morning, everyone! ☀️ NYSE:HRTG : Heritage Insurance – Catastrophe or Opportunity?

With HRTG at $11.50, is this insurer a risky bet or a hidden gem in the catastrophe-prone market? Let’s dive into the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 11.50 as of Mar 12, 2025 💰

• Recent Move: Slipped 4% post-Q4 earnings, but stabilized 📏

• Sector Trend: Insurance sector steady, with P&C insurers facing claims volatility 🌟

It’s a volatile ride, but potential value lurks! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $200M (assuming 17.39M shares) 🏆

• Operations: Property and casualty insurance in high-risk areas ⏰

• Trend: Niche focus on catastrophe-prone regions like Florida, potential for growth 🎯

Firm in its niche, but risks are high! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 2024 Earnings: Net income $0.66 per share, down from $1.15 YoY 🔄

• Revenue: Slightly missed estimates, per reports 🌍

• Market Reaction: Stock slipped 4%, but stabilized post-earnings 📋

Adapting to challenges, looking ahead! 💡

(5/9) – RISKS IN FOCUS ⚡

• Natural Disasters: High exposure to claims from hurricanes, floods, etc. 🔍

• Regulatory Changes: Potential impacts from state regulations in Florida and other areas 📉

• Competition: Increasing competition in high-risk insurance markets ❄️

Tough, but risks are part of the game! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Niche Market: Focus on high-risk areas with potentially higher premiums 🥇

• Established Presence: Strong foothold in Florida and other states 📊

• Growth Potential: Increasing demand due to climate change and urbanization 🔧

Got potential in a challenging market! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Earnings volatility from natural disasters, regulatory risks 📉

• Opportunities: Expansion into new high-risk areas, technological advancements for better risk management 📈

Can it weather the storms and shine? 🤔

(8/9) –📢HRTG at $11.50, with undervaluation signs—your take? 🗳️

• Bullish: $15+ soon, undervalued gem 🐂

• Neutral: Steady, risks balance growth ⚖️

• Bearish: $10 looms, catastrophe ahead 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

HRTG’s $11.50 price tags potential value 📈, but catastrophe risks add caution 🌿. Volatility’s our friend—dips are DCA gold 💰. Grab ‘em low, climb like pros! Gem or bust?

Fundamental Analysis on MultiversX (EGLD | from $20 to $3,180?Fun experiment on crypto fundamental analysis —

I asked Grok 3 AI to evaluate MultiversX (EGLD) [ CRYPTOCAP:EGLD ].

It was a long conversation with interesting outputs.

MultiversX received an 8/10 score.

For Grok, it's a top pick for building apps and for mid to long-term investing.

I shared the complete results and logic in my account on 𝕏 ( vinibarbosabr ).

You can find it at highlights , if you want.

The conclusion is that, per Grok, CRYPTOCAP:EGLD could hit:

Medium term (1 to 5 years):

$10 billion to $30 billion market cap @ $318 to $955.

Long term (5 to 10 years):

$50 billion to $100 billion mcap @ $1,590 to $3,180.

Now, let's dive into the analysis!

In summary, Grok evaluated a list of objective and well-documented MultiversX attributes, giving it a score 8 out of 10. The AI said EGLD does not make a good short-term buy, due to poor price action at around $500 million of capitalization, while saying it is a top-pick for mid and long term fundamental investing eyeing a $100 billion market cap.

From a tech perspective, Grok 3 agrees MultiversX is one of the most advanced blockchains to date. When asked if it would have MultiversX among its AI top picks to build a project, the answer was yes.

First, Grok 3, one of the most advanced AI models to date, evaluated eight categories of blockchain fundamental analysis. MultiversX scored 7.875 on average, with the AI rounding it up to 8 out of 10 points.

Scalability got a 9/10 score, considering the fully implemented sharding technology, transactions per second (TPS) capacity, and performance. With 30,000 current TPS on mainnet, a 263,000 TPS achieved on a testnet, and a theoretical capacity superior to 1 million TPS thanks to its adaptive sharding—increasing with demand—MultiversX is one of the most scalable blockchain networks.

Decentralization got an 8/10 score, showing strong decentralization, but with room for improvements. The network has over 5,500 nodes, of which, 3,200 are active validators, losing only to Ethereum (ETH). Notably, MultiversX has a Nakamoto Coefficient of 9 for liveness, meaning nine entities have over 33% of all the nodes.

Speed and Finality got an 8/10 score, with sub-second finality in the roadmap for 2025, currently taking 6 seconds. The improvement, according to Grok AI, would put EGLD transactions among the fastest layer-one (L1) blockchains.

Security got an 8/10 score, with its proof of stake architecture, ESDT tokens being native assets, and onchain 2FA. Yet, the model warns against possible stake accumulation above the 51% threshold as a potential risk for the future. Which is the same risk for all blockchain networks’ security.

Cost and Accessibility got a 9/10 score, due to approximately $0.002 cost per transaction, below the industry’s average. MultiversX tech stack also offers developers the possibility to offer gasless (no fees) transactions to the end user. Still in accessibility, the chain has one of the lowest hardware requirements for its capacity in the space, which also contributes to decentralization.

Developer Experience (DevX) got a 9/10 score, with a top-down focus on development and a grassroots “build” culture. MultiversX offers familiar tools like Rust framework and WebAssembly, flexibility in programming languages, and a strong open source ethos. Comprehensive documentation and an active community further support developers, making it attractive for building applications and smart contracts.

Ecosystem and Adoption got a 7/10 score, as a small ecosystem’s size and adoption relative to larger blockchains could limit its current reach and utility. Still, the ecosystem is growing, together with implementations and partnerships, having big names associated with EGLD.

Economic Model (Tokenomics) got an 8/10 score, considering a capped EGLD supply, with full distribution by 2030. Moreover, Grok AI mentions a 30% network fees going to the developer of the used smart contract, incentivizing builders.

All things considered, we asked Grok 3 AI what would be the ideal market cap for EGLD, MultiversX base token. Notably, Grok was considering a $565 million capitalization, ranked 95 in CoinMarketCap, trading around $20 per token.

Based on fundamental analysis, a comparison with other leading blockchains at higher ranks, would put MultiversX among them, Grok said. This, however, looking at the mid and long term, as the market would need time to adjust accordingly.

For the medium term (one to five years), the AI predicts EGLD could reach a market cap between $10 to $30 billion, positioning the cryptocurrency next to Cardano (ADA), Polkadot (DOT), and Avalanche (AVAX).

For the long term (five to ten years), Grok is even more bullish, siding MultiversX with Solana (SOL) and Ethereum. In this case, EGLD could reach between $50 to $100 billion market cap.

In conclusion, Grok AI agrees that MultiversX is one of “the most technically advanced blockchain today.” It has achieved a remarkable fundamental analysis score and offers an interesting investment opportunity for mid and long-term investors.

Furthermore, it features among one of the AI’s top picks of decentralized infrastructures to build applications and smart contracts.

Nevertheless, investing is risky and fundamental analyses can often be complex and highly nuanced. Investors and builders should do proper research and due diligence before making important decisions. The short-term for EGLD is also risky, as mentioned by Grok in the analysis.

EGY short ideaEGY is showing weakness after a period of growth, which may indicate buyer exhaustion. The upcoming earnings report adds uncertainty—weak financial results could act as a catalyst for further decline. Volume suggests liquidity outflow, while technical levels fail to provide a strong upward impulse. If the market reacts negatively to the report, there is a high probability of a support break and continued downward movement. It is crucial to closely monitor the market’s reaction to the data.

Bearish thesis for GOLD for the weekend XAU had been on a steady Bullish Run , Rightfully so.

if any asset deserves to appreciate in its price while doing the most amount of Good, its GOLD

But we traders , look for technical opportunities

that's where this trade idea comes in.

- Gold is pressuring its recent range with limited bullish strength

- also its its most popular cross - USD gaining substantial momentum the last 2 Quarters can make room for a correction before the trend continues to the upside.

therefore falling back on pure technical calculations leads us back to our excel sheets for daily range projections which put our range to be exactly 1.03% or 3034 /303* pips depending your brokerage metrics.

which leads me to make this 1:4 Trade idea for this week.

cheers.

Euro Surges, Dollar Stumbles! What’s Next for EUR/USD?With the recent decline of the US dollar to its lowest level since November 2024, the euro has surged, reaching 1.09365 its highest level since November 2024. This rise is primarily driven by the recent weakness of the US dollar.

Possible Scenarios for EUR/USD in the Coming Period:

Scenario 1:

The pair continues its general upward trend, forming higher highs. A pullback to 1.08046 would be seen as a positive signal for further upside, targeting 1.09044. However, this scenario is relatively weaker due to the recent sharp rally in EUR/USD, which limits the bullish momentum.

Scenario 2:

If the price declines and closes below 1.07658 on a daily basis, this would signal a trend reversal from bullish to bearish, opening the door for further declines toward 1.06370 and 1.05592. A key confirmation for this bearish outlook in the short-to-medium term would be the RSI dropping below 50 and holding there.

Market Watch:

Markets are awaiting the US Producer Price Index (PPI) monthly report today. Forecasts suggest a decline of 0.1%, bringing it to 0.3%, while the Core PPI is expected to remain stable at 0.3%. Any reading above expectations would be positive for the US dollar, impacting EUR/USD movements.

Additionally, US jobless claims data will be released, with expectations of an increase from 221K to 226K. A further rise in jobless claims would be negative for the US dollar!

EUR/ZAR is going up to R22.00 and I hate to tell you this! Here's an analysis I really don't want to do.

The EUR/ZAR is showing strong upside to come. Great for the EURO, great for Europe, Great for South African exports.

Not great for the South AFrican consumer who was planning on sailing to Mykonos this year.

Anyways, here are some reasons for the EURO strength and why we could see the ZAR come down a bit.

Economic Woes:

South Africa's economic struggles and political uncertainty are weakening the Rand, pushing the EUR higher 😟💔

Commodity Concerns:

Falling commodity prices hit South Africa hard, making the Rand lose steam against the euro 📉⛏️

Monetary Policy Gap:

Divergent monetary policies—stable ECB rates vs. easing in South Africa—favor a stronger euro 💶🔄

Global Risk Aversion:

Investors seek safe havens during uncertain times, boosting the euro over emerging market currencies like the Rand 🌍🛡️

Capital Outflows:

Local capital is fleeing South Africa amid domestic worries, further devaluing the Rand and lifting the EUR/ZAR pair 🚀💸

TECHNICALS

What can I say. W FOrmation with the price breaking above 20 and 200MA.

The target is on the way to R22.00 if the uptrend continues.

I hope I am wrong.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.