EURO - Price can rise a little and then fall to support areaHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago, the price started to grow inside a rising channel, where it firstly broke $1.0365 level and then reached resistance line.

After this, Euro declined to support line of channel, making a gap, after which, in a short time, it rose to $1.0365 level.

Price some time traded near this level and then continued to grow inside a rising channel, but later it corrected.

Then Euro made strong upward impulse, thereby exiting from rising channel and soon broke $1.0765 level.

Next, price made a retest and continued to move up, so, I think Euro can make a small movement up.

Also, then I expect that Euro may start to decline to $1.0730 support area, breaking support level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

USD (US Dollar)

XAG/USD (Silver) Wedge Pattern (13.03.2025)The XAG/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Wedge Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 32.45

2nd Support – 32.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EUR/USD Triangle Pattern (13.3.25)The EUR/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.0805

2nd Support – 1.0771

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EURUSD: Overbought but 1H Channel Up is still intact.EURUSD is massively overbought on its 1D technical outlook (RSI = 73.384, MACD = 0.012, ADX = 38.553) but on the short term we have a Channel Up pattern that's good until broken. The 1H MA50-MA100 Zone is in firm support of this structure and every time a bearish wave like the current one bottoms inside this pattern, the price rallies by +1.15%. So as long as the 1H MA100 holds, buy (TP = 1.09800). If the 1H MA100 fails and breaks, sell and aim for the 1H MA200 (TP = 1.07500>

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Higher High & Key Resistance Test📊 BME:RED Market Update – Higher High & Key Resistance Test

📈 BME:RED has made a new Higher High (HH) and is now pulling back.

🔄 Current Scenario:

If price breaks the black resistance line, the next targets are at the blue line levels.

Price could return to the HH level, but the gap is located even higher, indicating potential further upside if momentum continues.

The gap area represents a previous strong selling zone, so traders should remain cautious when price approaches this level.

📌 Watch for breakout confirmation before targeting higher levels, and manage risk near resistance zones.

Could the Bitcoin rise from here?The price has bounced off the pivot which has been identified as a pullback support an could rise to the 127.2% Fibonacci resistance.

Pivot: 81,765.85

1st Support: 79,666.99

1st Resistance: 85,798.47

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/USD is shaping up for a solid short entry.EUR/USD is shaping up for a solid short entry. 🤔🤔🤔

The pair has tested the 61.8% Fibonacci retracement level and a key liquidity zone where stop losses tend to cluster.

At the same time, the dollar index is turning upward on a larger scale.

A short position with tight stops could make sense, with a target around $1.00 .

Considering the increasing geopolitical risks in Europe , holding funds in euros doesn’t seem wise anymore.

In times like these, staying in USD looks like the safest bet.

Dollar Index:

SP500/SPY:

GOLD/USD:

Could the Swissie bounce from here?The price is falling towards the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 0.8815

Why we like it:

There is a pullback support level.

Stop loss: 0.8749

Why we like it:

There is a pullback support level.,

Take profit: 0.8913

Why we like it:

There is an overlap resistance level that is slightly below the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPUSD to continue in the upward move?GBPUSD - 24h expiry

The medium term bias remains bullish.

Bearish divergence is expected to cap gains.

A lower correction is expected.

We look to buy dips.

Bespoke support is located at 1.2900.

We look to Buy at 1.2900 (stop at 1.2870)

Our profit targets will be 1.2990 and 1.3020

Resistance: 1.2970 / 1.2990 / 1.3020

Support: 1.2915 / 1.2860 / 1.2820

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

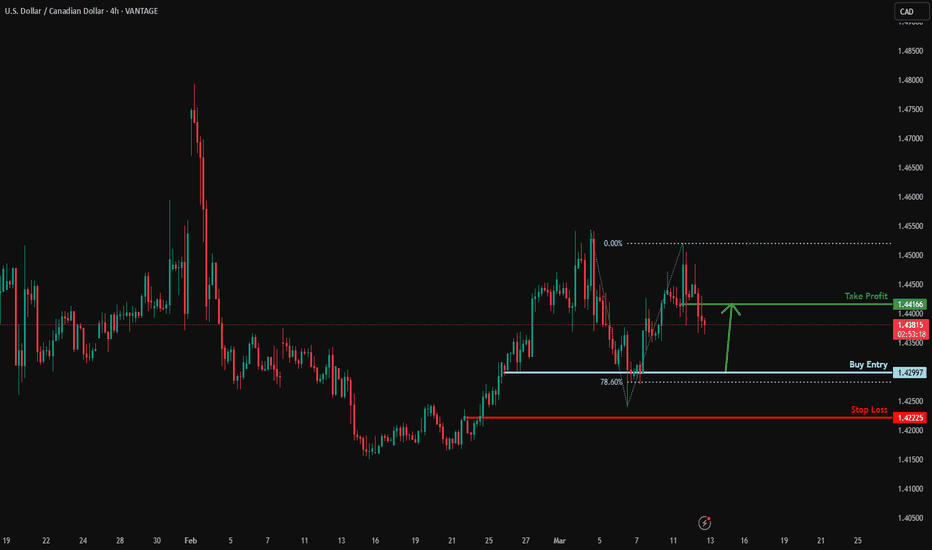

Bullish bounce?USD/CAD is falling towards the support level which is a pullback support that is slightly above the 78.6% Fibonacci projection and could bounce from this level to our take profit.

Entry: 1.4299

Why we like it:

There is a pullback support level that is slightly above the 78.6% Fibonacci projection.

Stop loss: 1.4222

Why we like it:

There is a pullback support level.

Take profit: 1.4416

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Falling towards 50% Fibonacci support?USD/JPY is falling towards the support level which is a pullback support that aligns with the 50% Fibonacci retracement and could bunce from this level to our take profit.

Entry: 148.03

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Stop loss: 149.23

Why we like it:

There is a pullback support level that lines up with he 78.6% Fibonacci retracement.

Take profit: 149.23

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD - Rally overextended? The EUR/USD pair appears to be approaching a significant correction phase after its recent rally to the 1.09 level. As shown on the chart, we're expecting a pullback from current levels, with two key support zones (marked in blue) serving as potential targets for this retracement. The upper blue zone around 1.0650-1.0680 represents the first support area where buyers might step in, while the lower blue zone near 1.0550-1.0580 provides a secondary support level should the correction deepen. These zones represent previous price action areas of significance where demand could emerge. The downward arrows illustrate the expected path of this correction, suggesting a measured move lower before potentially finding stability.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Heading into 61.8% Fibonacci resistance?The Bitcoin (BTC/USD) is rising towards the pivot and could reverse to the 1st support which had been identified as a pullback support.

Pivot: 85,769.28

1st Support: 80,188.79

1st Resistance: 88,718.07

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GOLD Consolidates | CPI to Drive Next MoveGOLD Technical Analysis

Gold remains in a consolidation phase, stabilizing around the pivot zone (2918 - 2905). The price is currently sensitive due to the upcoming CPI release.

📉 Bearish Scenario:

Stability below 2922 keeps the bearish outlook intact.

If the price fails to break above the pivot zone, a drop toward 2895 is expected, with further downside potential to 2859.

📈 Bullish Scenario:

If a 1H or 4H candle closes above 2922, a bullish breakout may occur, targeting 2934.

A break above 2934 could extend gains to 2954.

📊 CPI Impact:

CPI < 2.9% → Bullish 📈

CPI > 2.9% → Bearish 📉

CPI = 2.9% → Bullish Bias 📊 (Since it's lower than the previous 3.0%)

Key Levels:

Resistance: 2934 | 2954 | 2975

Pivot Zone: 2918

Support: 2905 | 2895 | 2880

USDMXN: Mexican Peso Gains Strength and Approaches Key SupportOver the last six trading sessions, the USD/MXN price has dropped more than 3.5% as the Mexican peso has regained ground lost due to the ongoing conflict between Mexico and the White House. For now, the bearish bias has been driven by the March 6th extension on the tariff imposition, which gave the Mexican government a reprieve until April 2nd. This has allowed the Mexican peso to maintain a steady uptrend in the short term, sustaining selling pressure on USD/MXN.

Lateral Range:

Since early November 2024, USD/MXN has been oscillating within a sideways range, marked by a ceiling at 20.89 pesos per dollar and a floor at 20.07 pesos per dollar. The current bearish bias has pushed the price back to the lower boundary of the channel, and the weakening momentum of the last few sessions could reinforce the support barrier that remains intact.

ADX Indicator:

The ADX line has started showing consistent neutrality near the 20 level, suggesting that recent movements lack strong trend direction. This indicates that neutrality may persist as the price continues approaching the support level.

MACD Indicator:

The MACD histogram shows a similar scenario, with oscillations remaining very close to the neutral 0 level. This reinforces the current indecision in the market as the price approaches the support zone.

Key Levels:

20.43: Near-term resistance zone, aligning with the midpoint of the broad sideways range and converging with the 50- and 100-period simple moving averages. Sustained oscillations above this level could keep the sideways range active in the long term.

20.07: Crucial support zone, located at the lower boundary of the broad sideways range. Consistent oscillations below this level could break the current range and pave the way for a more prolonged bearish move in the coming sessions.

20.89: Distant resistance zone, marking the upper boundary of the sideways channel. If the price reaches this level, it could reactivate the forgotten uptrend.

By Julian Pineda, CFA – Market Analyst

EURUSD entering multiyear Sell Zone, but might go to 1.160 firstEURUSD hit this week its 1month MA50 for the first time since October 2024. This is the first long term Sell Zone for the pair.

The 1month MA50 - MA100 Zone has formed the last two major peaks of the market (September 2024 and July 2023), so it is highly likely to see a top getting formed here in March-April.

Since however the 10year pattern is a Channel Down and the major bullish wave in 2017 was +21.67%, there is a possibility to see an overextension of the trend a little higher than the 1month MA100.

A max +21.67% rise would take the price a little over 1.1600, which would approach the 1month MA200 (10year Resistance).

This scenario is also supported by the 1month RSI, which during this 10 year span has topped twice at 665.00 and as you see makes a very distinct (nearly) Double Top formation.

In both cases, long term traders/ investors may target below parity prices at around 0.9000.

Follow us, like the idea and leave a comment below!!

STBB FX Weekly Analysis - Week 11 2025Tradingview Ideas:

Hello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my Video!

I am giving updates on my Weekly Analysis, mainly in the forex market!

Do check them out!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

Bearish drop?XAU/USD is rising towards the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 2,925.63

Why we like it:

There is a pullback resistance level.

Stop loss: 2,953.39

Why we like it:

There is a pullback resistance level.

Take profit: 2,876.15

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop?USD/CAD is reacting off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.4430

Why we like it:

There is a pullback resistance.

Stop loss: 1.4539

Why we like it:

There is a pullback resistance level.

Take profit: 1.4382

Why we like it:

There is an overlap support level that aligns with the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop?USD/ZAR is rising towards the pivot and could drop to the 1st support.

Pivot: 18.32616

1st Support: 18.05807

1st Resistance: 18.46573

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Heading into overlap resistance?GBP/USD is rising towards the resistance level which is an overlap resistance that is an overlap resistance that is slightly above the 127.2% Fibonacci extension and could reverse from this level to our take profit.

Entry: 1.3045

Why we like it:

There is an overlap resistance level that is slightly above the 127.2% Fibonacci extension.

Stop loss: 1.3264

Why we like it:

There is a pullback resistance that lines up with the 161.8% Fibonacci extension.

Take profit: 1.2812

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD is facing a Trendline resistance Vs INRUSD is facing a trendline resistance Vs Indian Rupee. Support zone currently for USD is near 87.06 followed by 86.82. Below this level we have the Mother line support for USD. This mother line support is at 86.55. If that is broken by the slide in USD 86.36 or 86.13 levels. Final support for USD will be at 85.65 before it hits Father line at 85.02. Resistances for USD are at 87.41, 87.55 and 87.76 before it can hit all recent high of 87.97. Shadow of the candle right now for USD is negative. Huge volatility in USD on either sides can be expected as Trump Tariff announcements continue for few months.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.