The Simplest Trading Strategy Nobody Talks AboutOpen charts. Open six timeframes. Start “analyzing.” and end up more confused than when you started. Daily, 4H, 1H, 15M, 5M, even M1… and somehow you still missed the real move?

Its because, you are looking everywhere and nowhere at the same time.

Problem is not having a simple repeatable plan,

About US 100 Cash CFD

The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies.

NAS100 - Weekly CSL - Model 2 - Double top LiqudityHi friends, new Weekly range createdanm we are about to play model 2 probability. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter on

Why You Keep Losing Money in the Financial MarketsWhy You Keep Losing Money in the Financial Markets 💸

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

One of the main reasons you keep losing money in the financial markets is that this activity is directly associated with turning money into more money.

This blurs the understanding of the value of ski

US100 Price Update – Clean & Clear ExplanationUS100 is currently trading under strong selling pressure after failing to sustain above the ascending trendline and the previous supply zone around 25,700–25,900. The sharp rejection from this area confirms that sellers remain in control.

Price has now broken below key structure support near 25,200

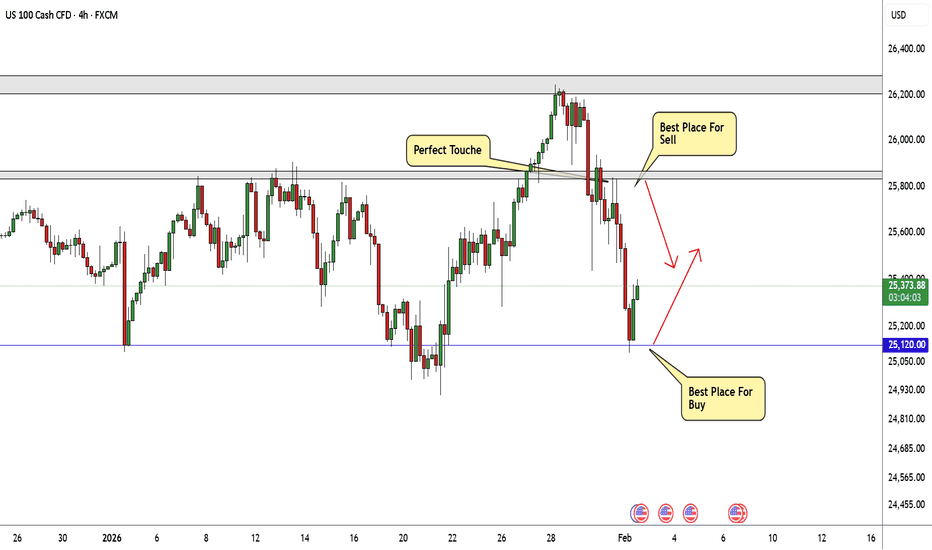

Nasdaq Best Places To Buy And Sell Cleared , 800 Pips Waiting !Here is m y opinion on NASDAQ On 4H T.F , We have a Huge movement To Downside as i mentioned in my last Analysis About Nasdaq & Then to Upside Now , and we have a good range for buy and sell started between 25120.00 to 25800.00 so we can buy and sell n\Nasdaq This Week from 2 areas , 25120.00 will b

US100 Breaks Down From Structure — Bearish Continuation in FocusUS100 Breaks Down From Structure — Bearish Continuation in Focus

US100 has broken down from a clear bearish structure after failing to hold above the descending trendline. The recent move confirms weakness, with sellers firmly in control after the rejection from the upper boundary.

Price attempte

USNAS100 Looking a strong Bearish structureUS100 Price the rising channel support, signalling short-term bearish momentum. Price dropped strongly from the upper channel and is now trading below the previous structure, which confirms weakness.

Tecnically Price around 25,650 – 25,700 is acting as a key resistance area. If price retests this z

NASDAQ similarities with the 2022 Bear Cycle are striking.Nasdaq (NDX) almost tested last week its October 2025 High and got rejected. Unless it breaks soon, this is technically considered a Double Top. With the 1W RSI being already on a Lower Highs Bearish Divergence since July 2023, the whole pattern draws similarities to the bullish build-up that led to

USNAS100 | Bearish Momentum Extends After 400-Point DropUSNAS100 | Bearish Momentum Extends After 400-Point Drop

The Nasdaq 100 declined by around 400 points, moving exactly as outlined in the previous analysis. Selling pressure remains dominant as long as the index stays below a key pivot zone, keeping downside risk active.

Technical Outlook

The index

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.