The NZDUSD has been trading within a channel since mid-March and has now reached the upper edge of the channel. It has shown signs of reversal towards the downside. I expect the price to respond and fall to around 0.623, where it will meet the 100-period moving average on the 4-hour timeframe and an ascending monthly...

The AUDCAD opened this week below the wedge pattern, but quickly closed above it, indicating a desire for the price to move up. However, it needed to retest the strong resistance level at 0.905, which coincidentally is also where it meets a descending trendline, the upper edge of the wedge pattern, and the 23.6% Fibonacci level. Based on my analysis, this could be...

The silver is forming a clear Head and Shoulders pattern with a visible divergence on momentum indicators. Additionally, it has broken the ascending weekly trendline. These are all signs that the price is likely to fall to 22.150, after which it may rebound to 22.68 and retest the breached neckline. The retest point could present a good opportunity to enter a...

The USDJPY pair tested a yearly bullish trend line and was quickly rejected. There may be a candlestick formation called a "shooting star" on the daily time frame, and a reversal candlestick pattern formed on the 4-hour chart, ending with a bullish engulfing candle. Based on the above, the price is likely to rise to touch the weekly bearish trend line, which is...

The NZDJPY is testing a local resistance zone that has been tested as a support 5 times before. Moreover, the zone includes a Fibonacci level of 38.20, a descending trendline, and the 4-hour 50-period moving average. All of these factors make a strong case for a possible downward reversal, with a potential next target of...

Oil broke through another resistance level and now faces another resistance level at 73.00, which is also the meeting point of the upper trend line of the local ascending channel. Wait for it to rebound to retest the previously broken level at 71, where it will also meet the 38.20 Fibonacci level and a local upward trend line. If any signs of a reversal appear...

Gold FOREXCOM:XAUUSD formed a double top pattern and broke below the neckline. I will wait for confirmation of a rebound from the neckline area at 1985.35, which is the 23.60% Fibonacci retracement level and the 50-period moving average on the hourly timeframe. If the price stays below this level, it is a sell signal targeting 1963 and 1954. However, if the price...

The oil FX_IDC:USDWTI market has reached the previously predicted target, with the current price stopping at $70.95, a strong resistance level due to its support of the price in December. This price level also coincides with the 38.20% Fibonacci level, the 50-period moving average on the 4-hour chart, and intersects with the weekly downtrend. On the 4-hour and...

AUDUSD pair successfully broke below the wedge pattern as I mentioned in the previous analysis. However, it seems that more liquidity is needed to support the downward movement. It's likely that the price will undergo a corrective movement towards the level of 0.6680, which is a very important level where the broken trendline, Fibonacci level 23.60, and the moving...

The USDCAD has successfully broken out of a triangle pattern and also breached a local resistance line at 1.375, but it faced strong rejection after the break. It seems that the price will undergo a correction towards the last support level at 1.375 or even down to 1.370, which I consider a strong and ideal buying zone for the price to continue its upward move...

The GBP/USD has broken the weekly downtrend but faced support at the 1.215 level, which is also the 23.60 Fibonacci level. I expect the price to retest the previous resistance level around 1.228 to form a head and shoulders pattern before reversing down to attempt to break the neckline at 1.220. This would be a signal to enter a bearish trade with a target of at...

The EURUSD broke through the 1.080 resistance level quickly, but was just as quickly rejected and closed below the level, returning to the channel it was previously moving in. I expect the price to retest the resistance at 1.080 before falling to the strong monthly support level at 1.067, where it coincides with the 61.8 Fibonacci and the 100 and 200 moving...

The dollar index has broken the previously mentioned support at 103.5 in the analysis and has reached a strong resistance level at 102.5. The index failed to close below it on any daily candle. Looking at the 4-hour chart, it seems like the index tried to stabilize below the resistance but was unsuccessful. Based on my analysis, I expect trading to be between...

The AUDUSD is moving sideways in a continuation flag pattern. However, there is a clear resistance from top to bottom on the daily timeframe. If we look at the 4-hour timeframe to analyze the upcoming movement, we find that the price is touching the local uptrend line and also the 50 and 100 moving averages for the 4-hour timeframe. From here, I expect the price...

Gold rejected the 2000 resistance level and formed a higher peak on the hourly chart. However, there is a noticeable divergence on the momentum indicator, indicating a weakening momentum. It is also worth noting that the price is approaching the upper edge of the ascending channel and the monthly trend line. We can wait for a break of the small local trend line...

The NZDUSD pair has completed a head and shoulders pattern on the daily timeframe, with two bullish engulfing candlestick patterns appearing in the last shoulder, indicating strong momentum pushing the price higher. On the 4-hour timeframe, we can see that the price has broken out of the downtrend and failed to make any lower lows, supporting our view that the...

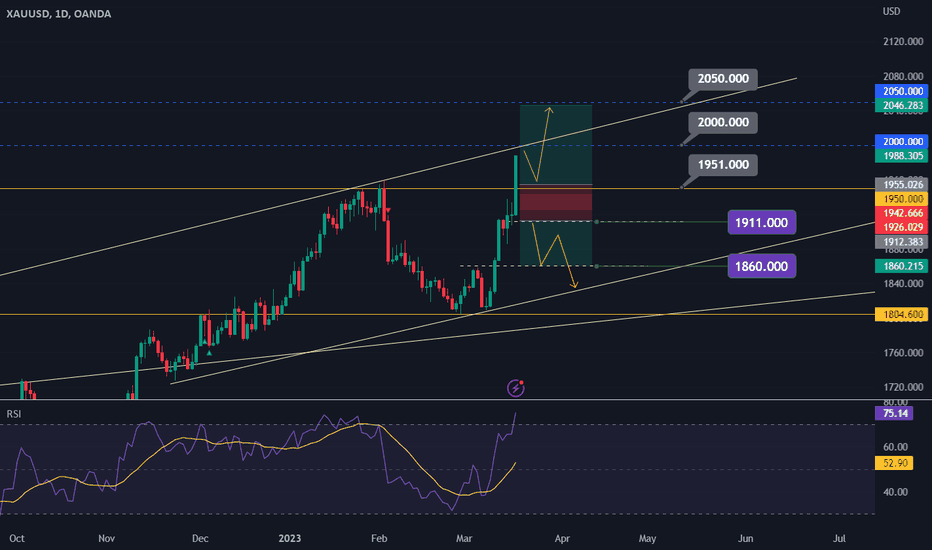

Gold prices have surged to post-1988 record highs due to recent market panic and investors seeking a safe haven. As long as this panic persists, gold is likely to continue its upward trend. However, if it reaches the $2000 level, there may be a correction down to the previous resistance-turned-support level of $1951, before it resumes its upward trend towards...

Oil FX_IDC:USDWTI breaks triangle pattern and touches yearly support level, indicating a potential corrective move. Weak momentum in the downtrend and formation of a reversal pattern support this analysis. To enter a long position, oil must break the downtrend line and the last resistance level at 67.23. The first target is at 69.52 and the second at...