EpicWasteland

MACD & RSI Trendline breakout towards the downside with support on 100 & 200 EMA. An incoming retest of those levels will provide us with more information whether it's a buy or sell. I am leaning towards a sell because MACD Trendlines has never been wrong yet. Same exact setup for ETH except ETH has fallen 7% since sell signals have plotted and 100 & 200 EMA...

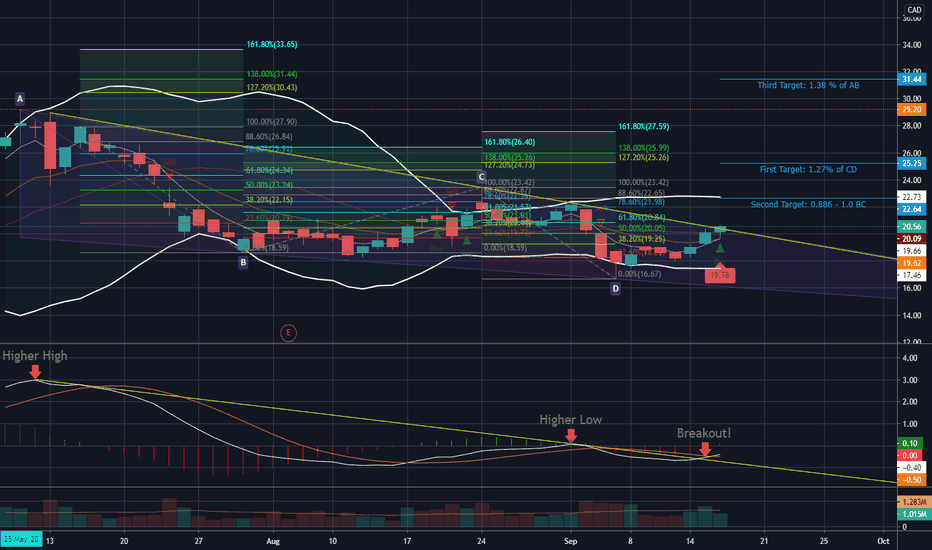

TSX:BLDP breaking out with 2 patterns and one strategy. Firstly, a dragon pattern broke out today with three possible targets: Target 1 = 1.27% of CD, Target 2 = 0.886% - 1.0% of BC, Target 3 = 1.38% of AB. I really love this pattern and it works so well. Secondly and coincidentally, a descending triangle pattern broke out which reveals the dragon pattern....

TSXV:HIVE showing a symmetrical triangle with a long term price target of $0.81. All elliot waves confirm to the rules and the 5th wave target has been reach ($0.58 - $0.59); I will be selling my position in the morning. Price correction is coming and after it will push to complete the target of the symmetrical triangle. I used MACD Trend Strategy to confirm my...

We have a Triangle Pattern completed on TSX:NGD with confirmation on many fronts. Let's look at the confirmations. 1) MACD Trend Strategy breakout occurring. I really love this strategy and it has done really well for me in the past. The sell signal here will be when MACD Line crosses back under the signal line. 2) We are trading above the moving volume...

Dragon Pattern set up beautifully here. We are also currently in the 5th wave of Elliot Waves. This is a buy for me. Once the pattern reaches its targets then TVC:USOIL most likely will have a correction which is in line with the COVID-19 second wave coming.

2 Outcomes here for tomorrow: 1) June Contract expires tomorrow, does this mark the end of the Corrective C wave and will USOIL continue back down? 2) Prices continue up and reach 161.8% Fib Extension which means we can expect a leg down before continuing up even higher. I am leaning towards prices reaching $40 a barrel due to economies opening up. Time will...

This is my first attempt at Elliot Wave Theory and I am enjoying it a fair bit. I followed all guidelines for the Impulse wave and based on fibonacci ratios I believe that the impulse wave for TVC:USOIL has completed and we are now in the corrective wave. Since A and B waves have been completed and so far they adhere to the rules of the corrective wave. Wave B...

I haven't posted any ideas recently but I have been following TSX:FVI for some time now. Double Bottom Reversal is now in play. What do you guys think?

Potential Dragon Pattern for TSX:ALEF . Anatomy of a Dragon Pattern A - Head of the Dragon B - Formation of the first leg C - Hump (must be 0.38 to 0.5 of AB) D - Second leg (can be 0.618 to 1.27 of AB) Looks like this criterion is met. I have written the potential targets for this. Dynamic Gann Box helps with this setup as well.

I have decided to help make a more in-depth analysis covering CSE:LHS since the stock is fairly new. The chart above is where we are currently sitting, which is on the bear side of the gann box but we will get into that later. How I start drawing Gann Boxes: Use the dynamic Gann box tool and draw from high to low or low to high; Configure the settings to...

After recent news I turned to look towards CSE:LHS . insiderfinancial.com finance.yahoo.com If it can stay above the 2X1 angle then a strong trend upward is in play.

TSXV:RIV appeared on the screener for MACD Crossover play. Looking further into trade setup we can see that it found similar support as back in early January with the exact same indicator buy signals. MACD Crossed over Stoch and RSI at healthy levels ADX curve has a fantastic trend strength Wave trend oscillator showing a buying opportunity just a few...

TSX:PEY appeared on my screener for a MACD crossover play. I applied Gann box and it looks like we are coming up on a critical point with the potential for the move upwards. I have shown the 48 Day periods which is part of Gann's 192-day cycle to see if there are any points of reversals and it lines up pretty nicely. It appears that we just passed a 48 Day...

With the Cannabis sector on a decline we have a nice triple top pattern forming. Once TSXV:VIVO breaks through the neckline, the potential bullish bat play will be out the window. If we break through and retest the neckline then we can expect to see a move to the downside in equal distance as from the neckline to the top. I am not one for shorting but I am...

Market Research finance.yahoo.com There are a few things I want to focus on from the article above: Company Revenue Gross Margin Operating Income (Loss) EPS Canopy Growth (NYSE: CGC ) $62.3 million 22% ($117.9 million) $0.16 Aurora Cannabis (NYSE: ACB ) $40.6 million 52% ($60.1 million) ($0.19) Tilray (NASDAQ: TLRY ) $15.5 million 20% ($22.9 million)...

TSX:ALEF has now ACBD Pattern setup and is forming a bullish triangle ACBD Pattern Criteria has all been met: Point C formed at least at 61.8% retracement of AB leg; Point D formed at least at 127.2% extension of AB leg. Point D can also occur at a distance not greater than 161.8% of AB or an extension of 138.2% to 161.8%. Current setup: Entry:...

TSXV:JWCA is an underrated cannabis company with tremendous upside. First lets dive into the technicals and then look at the long term for this stock. Looking at the Fibonacci retracement from the swing high on Sept 19, 2018 to the swing low on Dec 21, 2018 we can see that TSXV:JWCA broke and closed above the 50% Fib Level. If we check back to the beginning...

PXT came up on my screener and I wanted to share some ideas about a possible breakout strategy. My first attempt at looking at Fibonacci levels. So please shoot me some messages on how I can tweak this a little better. Firstly, we are in an uptrend and currently trading above 180 & 200 Day EMAs with good fundamentals. We have entered in the 50% to 61.8%...