Nasdaq is neutral on its 1D technical outlook (RSI = 52.467, MACD = 38.030, ADX = 17.154) since the index has been consolidating for the past 6 weeks. This offers great opportunities to buy low and sell high. At the moment the 1H RSI oversold bounce indicates that we has started a similar Channel Up so Jan 13th and Jan 27th. The symmetric RSI level suggests that...

EURUSD is neutral on its 1D technical outlook (RSI = 49.247, MACD = -0.001, ADX = 21.205) and just formed a 4H Bullish Cross between the 1D MA100 and 1D MA200. This hasn't had a bullish effect in the past 12 months as the two times we saw it in 2024, it immediatelly market the top of the short term trend and caused pull backs to at least the 0.618 Fibonacci level....

Gold has turned overbought on its 1D technical outlook (RSI = 74.055, MACD = 39.900, ADX = 58.383) and even though the long term trend remains bullish and that shouldn't affect it to a great extent, a short term Bearish Divergence on the 1H RSI (LH) and the fact that the price hit today the top of the 1 month Channel Up, calls for a quick sell. The two +4% bullish...

Bitcoin is on the most desirable buy levels long term as apart from only being neutral on its 1D technical outlook (RSI = 47.257, MACD = 281.800, ADX = 29.399) it just validated today the enormous buying zone that was waiting on the 1D MA100. This is a level that has worked as a buy entry over and over again these 2 years of the Bull Cycle. The last time it did...

FARTCOINUSD is about to turn neutral on its 1D technical outlook (RSI = 43.244, MACD = -0.099, ADX = 22.114) as it is approaching the 4H MA50. This is a little under the top of the short term Channel Down and is where the last sell signal flashed. Consequently it is a technical sell entry to target near the S1 level (TP = 0.55000) but tight SL needed. The reason...

Dow Jones just turned bullish on its 1D technical outlook (RSI = 56.676, MACD = 255.440, ADX = 30.051) as it hit the 4H MA50 after an instant rebound on the 4H MA100 inside the same session. This is a strong bullish reversal but the buy signal will be validated if the price crosses over the 4month Rectangle pattern. The rally from its January 13th bottom has been...

Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level,...

The Coca-Cola company just turned bullish on its 1D technical outlook (RSI = 56.409, MACD = 0.210, ADX = 24.907) as it crossed over the 1D MA50 following a clean HL at the bottom of the long term Channel Up. The 1D RSI is already on a bullish divergence and this validates technically the start of the new bullish wave. The previous one increased by +42.18% so a...

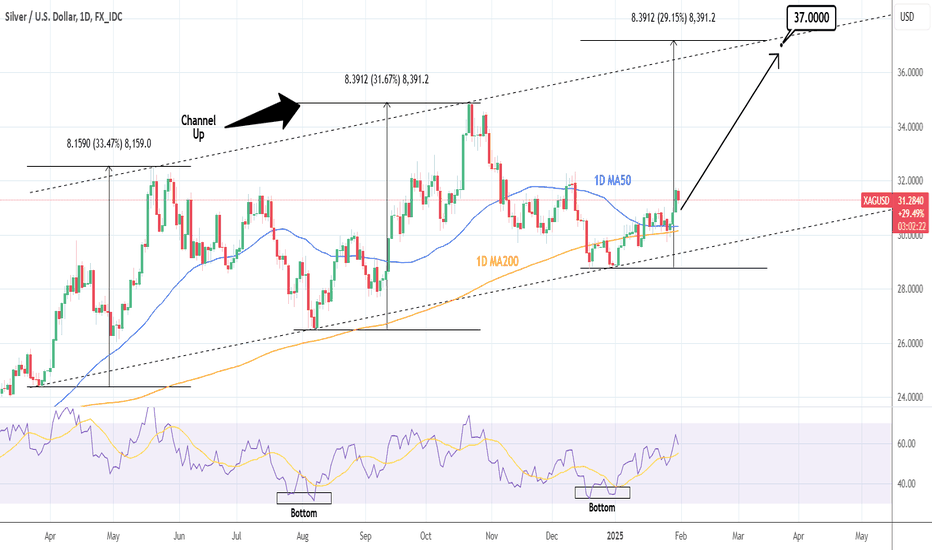

Silver turned bullish on its 1D technical outlook (RSI = 59.696, MACD = 0.197, ADX = 24.838) as it has validated the start of the new bullish wave of the long term Channel Up. The price has been detached from the 1D MA50 and is approaching the December 12th high. The 1D RSI is expanding a rebound from a Double Bottom much like Silver's previous low on August 7th...

Pepe is still bearish on its 1D technical outlook (RSI = 42.958, MACD = 0.000, ADX = 31.752) despite today's rise as the price remains close to the bottom of the 10 month Channel Up. Still, the 1D RSI just got oversold and immediately rebounded, which is what happened on the August 5th 2024 bottom that gave rise to the new bullish wave. Both prior bullish waves...

AUDJPY is neutral on its 1D technical outlook (RSI = 45.920, MACD = -0.220, ADX = 20.692) as it is trading inside a Rectangle pattern. The price hit the pattern's bottom yesterday and today is rebounding towards the 4H MA50, already hitting the 0.382 Fibonacci retracement level. Such rebounds have always reached the 0.786 Fib at least, so with the 4H RSI also...

WTI Crude Oil is neutral on its 1D technical outlook (RSI = 46.798, MACD = 0.400, ADX = 43.927) as it hit the 1D MA50 and so far it is holding it. The correction of the past 2 weeks has been significant but the 4H RSI is posting a bullish divergence on HL and we might be technically having a bottom like February 27th. We anticipate an identical +18% rise (TP =...

Bitcoin turned bullish on its 1D technical outlook (RSI = 59.434, MACD = 1198.600, ADX = 26.499) as it found support on the 1D MA50 and is rebounding. The emerging pattern is a Channel Up and coming off an Arc consolidation in December, it draws strong comparisons with the price action after August 2024. The 1D MACD shows that once BTC rebounded on the 1D MA50...

Tesla is about to turn neutral again on the 1D technical outlook (RSI = 44.564, MACD = 2.800, ADX = 35.697) in an attempt to recover the 1D MA50 that it lost yesterday. The pattern since the ATH correction started looks a lot like July-September 2024, where a Channel Down made the necessary technical correction of the June rally and then a subsequent Channel Up...

SUI turned neutral again on its 1D technical outlook (RSI = 46.494, MACD = -0.196, ADX = 48.385) as its 6 month Channel Up has hit its bottom and is rebounding. We are still under the 1D MA50 and that's why the outlook is still neutral but the 1D RSI crossed over its MA trendline, which was what confirmed the start of the bullish waves on October 29th 2024 and...

Gold is bullish on its 1D technical outlook (RSI = 59.990, MACD = 28.040, ADX = 55.806) despite consolidating for the past 7 days. The reason is that the long term Channel Up is intact and in fact has started its new bullish wave by crossing over the HH trendline. This has already happened twice inside the pattern and in those instances, as long as the 1D MA50...

Chainlink is neutral on its 1D technical outlook (RSI = 47.590, MACD = 0.090, ADX = 17.477), trading around its 1D MA50 but on a technical bearish wave of the December Channel Down. This pattern draws many comparisons with the one in June-July 2024, having so far identical RSI fractals. This suggests that the current rejection can test the 1D MA200 at the bottom...

The S&P500 index is neutral on its 1D technical outlook (RSI = 54.213, MACD = 29.690, ADX = 23.794) as it has completed the technical dive following the 4H Golden Cross just like August 21st 2024, and is rebounding. The two patterns are so far similar, both rebounding on oversold 4H RSI, and the September 2024 rebound almost reached as high as the 1.5 Fibonacci...