KAS has been dealing with a downtrend after a large distribution. Eventually, the trend will end; unfortunately, there are few signs of this. However, now is the time to put Kaspa on a watch list. The price hit a very good level of support and if the price can give us indications of a reversal it is time to get risk on. Full TA: Link in the BIO

BTC is at horizontal support that can pivot the short-term trend. However, without market structure pivoting and breaking the short-term trend the trend is likely our friend. A confirmed higher low and higher high would build a strong bullish thesis. Full TA: Link in the BIO

CPOOL is falling into support. We likely see the price react at the horizontal liquidity levels below. A ChofCh would be ideal before deploying capital. In the meantime DCA slowly. Full TA: Link in the BIO

SUI hit a good level of support but we need evidence of a reversal. A pivot point structure would give us the confidence that we are no longer in a downtrend. Full TA: Link in the BIO

HBAR is in a weird spot it either is going to make a complete 3-wave retracement through the volume gap, or get over-bought and move up. Regardless, of the way the chart looks it is most likely going to get a lower high without more volume. Spot is your friend.

VET is approaching strong levels of support. There are signs of bullish divergence on momentum and trend oscillators. Although this is a good sign a chofch would confirm a pivot to the upside. DCA

BTC filled the CME gap and almost retraced to the golden pocket fib level. There is a decent volume gap below before we get more support. This is a critical level for Bitcoin a CHofCH would be ideal.

PLUME is looking for a breakout of a symmetrical triangle. Technically it is a continuation pattern and given that the price is about 70% towards the structure's apex, it is likely to get a breakout soon. Momentum is also trending upwards. Goons are accumulating within the volume range in preparation.

SOL is testing horizontal support again. The good thing is that invalidation is clear. There is a class A bullish divergence on the 4h while the daily time frame is still not showing much.

AVAX is back revising bottoms. If the price doesn't use it as support it is likely to see the price extend to lower levels. Momentum is oversold which is the ideal time to spot divergences and pivot structures.

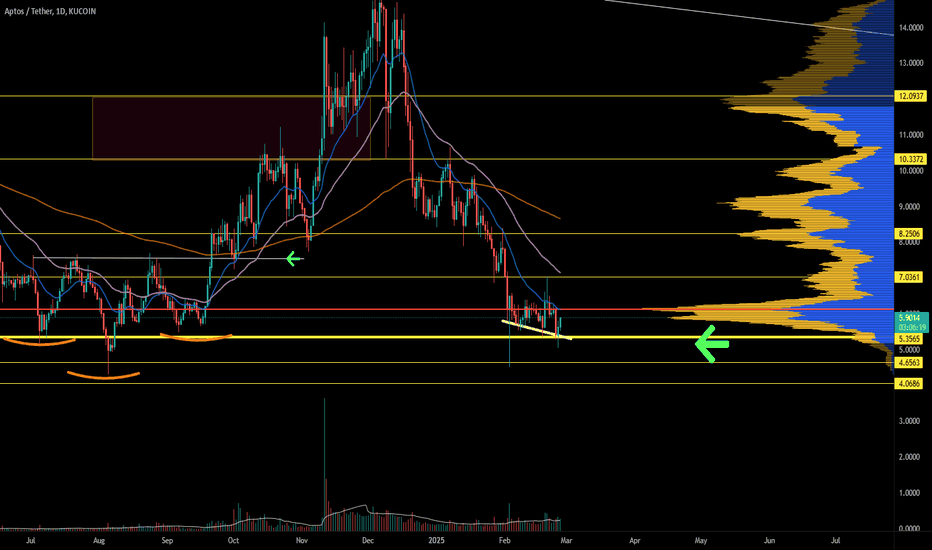

APT is looking for support at the bottom of the range. The momentum is oversold, and there are signs of bullish divergence. Historically this level has always acted as support for Aptos, DCA appropriately.

COTI Is looking for support however volatility is now coming down while mementums is trying to get out of oversold conditions. A pivot point structure would provide evidence of a reversal. There is a small volume gap that could bring the price lower. DCA