I was intrigued looking at App Lovin's (APP) rapid climb and what looks like a very high-margin line of business - but I was suspicious at that recent jump, the S&P 500 inclusion rumors, and the P/E ratio was getting scary - it would even make TSLA blush (at TSLA's current price!) The jump was all post-11/5 so I think what originally drew my attention was "Is...

I was in at $10.80 on ABR - it's been a very good run with a cap-gain of about 29'ish %, and earning a dividend of 12.5% while doing it - the dividend was 15.5% at my entry-point! I am still long, and I think it is still undervalued. The ABR earnings and margins are strong and the dividend is still very strong compared to it's peers. I have a sell-order on...

DISH had a pretty good day - all things considered. Forward-looking forecasts are strong - trading below the worst-case scenario for 12 months from now with a likely 130% upside. The 4.6x P/E is also very attractive. I'm sure DISH is still popular in rural areas - but the cord-cutting trends continue and concern me - thoughts? NASDAQ:DISH

I don't like the setup yet on EMTY - but there is a lot of fundamental evidence pointing to a rough 2023 for retail. Container imports are plummeting - that is a sure-fire sign of falling retail demand: www.descartes.com AMEX:EMTY

I have to admit, I didn't dream this one up. I saw an interesting interview from a Case New Holland (CNHI) exec and they were talking about their new technology. One thing is for sure, there is a shortage of and growing demand for agricultural products, technology, and commodities. Ukraine is a major agricultural exporter and they are basically out of the...

I'm a buyer when things turn around.. but I think it's going to be a while before anyone can confidently jump on a Growth/Tech stock. NASDAQ:GOOG

Shorting China has Gone Mainstream - YANG shorts the China market with a 3x levarage AMEX:YANG

NASDAQ:META FB reports next week - without belaboring the real lack of value that thing has as a service on their primary properties, I deleted my account 4 years ago and found an extra hour in every day since, but on the business side - their investment in the "metaverse" is going to be horrifically bad. They have spent $10b to $15b on the thing and only a...

Mortgage rates are penciling-in to be around 10% on a first mortgage note by Jan/Feb - so everyone with a couple of brain cells to rub together knows what that will do to real estate prices. Some good things will come out of this - like the Gen Z's in the market will get a chance to become homeowners, but in trading terms, this is a very good opportunity. ...

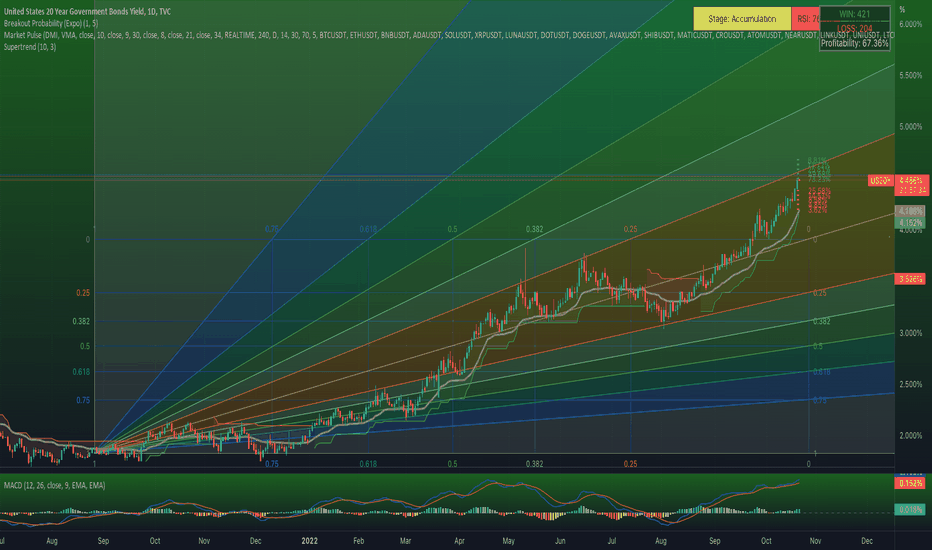

Who would have thought we might be seeing 20 year guaranteed 10% returns on US Treasuries soon.. but it could certainly happen. Short the things on the way up, and keep your cash available to buy every one of them in sight on the way down. Rates on a 3month Treasury are up an astounding 7,780% - Year to Date.

Bond yields are screaming upward, and they won't slow down until they overtake the rate of inflation - so we are basically at 5%+ on a T-bill right now, and probably headed toward double digits by end of winter. Yields Up = Prices Down. Short them until inflation returns to about 2%. Shorting bonds is of course a little hard for a retail investor, but I have...

The ammunition industry has been far behind in production capacity to meet the enormous increase in demand. As long as crime continues to be a problem in America, there will be an outsized level of demand. POWW Just opened a state of the art ammo plant in Q2, revenues have grown from $0 in 2016 (startup) to $62.482 million in 2021; with company and analyst...