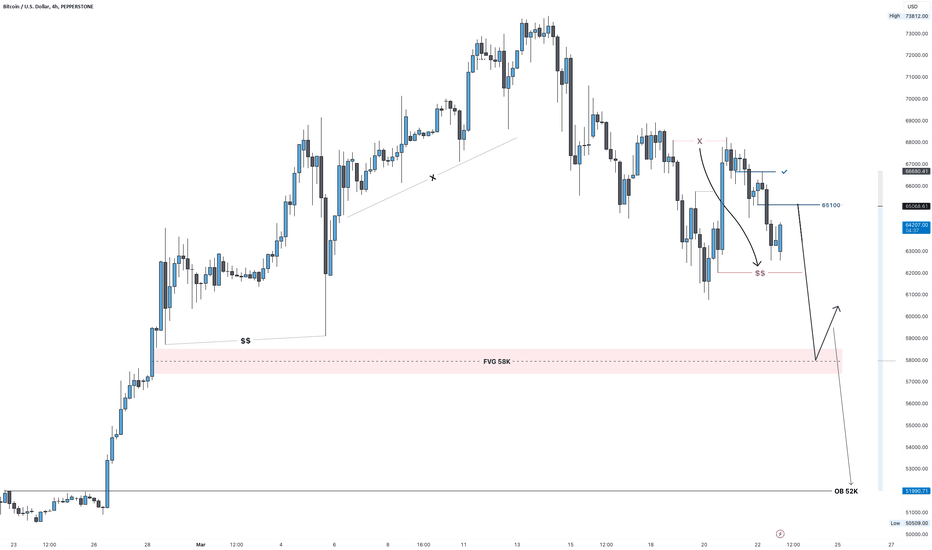

- Price swept 68k high so if price wants to push higher it should sweep the first low's liquidity at least. - Price created SMT with the last bull run at 59k levels so it may drop more lower to sweep the liquidity below 59k also to fill the first imbalance / FVG at 58k as a first target and 52k order block as an extreme target.

- Price closed last week with a strong bearish pressure after reaching 1.09800 supply area lifting behind imbalance with the Thursday daily candle. - We still observing price action as with this closure we may predict a bearish move to the last low at 1.08000, but price did not sweep the 1.1000 highs liquidity also for a full confirmation to short. * We may...

- Price closed last week with weak bearish pressure after reaching 2190.0 areas. Daily Timeframe: - Price left behind big imbalances at 2060/2100 before breaking the all time high an closed last week with a bearish pressure after positive news on US dollar, so price may see bearish pullback move to 2100 (first imbalance) at least. 4h Timeframe: - As you see...

- Price swept an old major high and closed below it with bearish pressure. - As you see on the charts after liquidity sweep price dropped 150 pips sweeping the last minor low and started a pullback to extreme order block 2.08000. - On a lower time frame (LTF) we can observe that price swept all internal liquidity and started going bearish forming minor equals lows...

- Price reached 1.08800 order block and closed with a strong bearish pressure, also last two highs created divergence as good confirmations to drop down to the major lows at 1.07900. - If price closed below 1.07900 that would be a change of character and we can look for shorts to demand zone 1.07000.

- Price closed last week with a big weird bullish move below 2040.0. - As you can see on the charts price broke multiple levels left behind big imbalances also we still waiting for 2008.0 levels mitigation to rebalance price delivery. - As we observe dollar index as an inversely correlated instrument we should see a strong bearish move this week but gold chart is...

- Price swept the last lows (inducement) at 103.800 levels confirming a new higher high. - You can observe the last week extreme low filled the liquidity void the formed in 2 FEB with the last impulsive bullish move. - Full closure above 103.800 is a confirmation to look for long opportunities this week.

- Price Reached 1985.0 Major demand zone after breaking the last major lows with CPI news lifting a huge liquidity void that needs to be filled, So you can see price reacted with a strong bullish move also last bearish move did NOT create any highs to sweep, So we can predict the price to break the last high at 2031.0 before then we may see a bearish move to 2008.0.

- Price reached 190.0 supply level and started going bearish heavily, also you can see price reacted from 188.0 demand zone the started to retest to order block 189.500 also rebalanced price delivery filling the imbalance, and finally a good 4h bearish closure last week, so we can predict a strong bearish move to the main demand zone at 187.0 levels.

- Price retested at 105.0 levels and closed with an impulsive bearish move last week. - As you see on the charts the last impulsive bullish move did NOT create any minor lows, so the major low at 104.0 levels becomes our inducement to confirm our new higher high. - Also price left behind a huge liquidity void that needs to be refilled. * We can predict the price...

- Price reached 1.07000 demand and started good bullish searching for liquidity. - Also price lifted a huge imbalance also in this situation known as fair value gab inversion so we may predict w bullish move breaking first high 108000 (Inducement) to confirm the last lower low and rebalance the price delivery before creating a new lower low in the market.

- Price dropped last week after sweeping the liquidity at 2035.0 creating imbalance also 2 equal lows (liquidity). - market may open bullish to 2030.0 to rebalance then we should see a strong bearish move to last major low at 2000.0 levels.

- Price reached extreme high levels again after retesting at 186.500. - Also as we can see price swept the last high liquidity at 188.500 and closed below it building more liquidity above historical high at 189.0 levels. - Price created unmitigated order block at 187.0 also an imbalance left behind so we may see a bearish move with market opening to rebalance the...

- Price created a strong impulsive move last week after mitigating 72.0 demand zone. - You can observe the price left behind an imbalance after a compression of price action also we still see equal highs at 80.0 (liquidity). * markets may open bearish to 75.0 levels to rebalance price delivery and then we should see a bullish move to 81.0 supply.

- Price dropped last week creating liquidity void (imbalance) forming equals lows (liquidity) and closed with a small bullish move. - With market opening we may see a bullish move to 1.08500 to rebalance price delivery then we should have a bearish impulsive move to 1.0700 as a first target and 1.0600 as an extreme target.

- Price broke the target high at 104.500 and closed below it. - Also price created a liquidity void at the last bullish impulsive move so price may go bearish with market opening to rebalance at 103.500 and then we may see a bullish week closure to 105.0 levels.

- Price swept the last major high last week at 2060.0 and closed the week with big bearish move reaching 2030.0. - Sweeping the last major high gives us a confirmation for sweeping the last low at 2000.0 if price wants to make new higher highs. - Also we still have unmitigated demand zone at 1980.0, so we may predict a string bearish move to 1980.0 levels.

- First we can observe the major structure, price broke the last major structure (change of character) also retested on the supply zone at 1.1000 and dropped +300 pips to first demand zone 1.0800. - Last week we had a reaction from demand zone with fed meeting after that price sweep the last highs with Friday swing high and closed with a strong bearish pressure...