Based on your chart analysis: - **Entry Plan:** Expecting a **reversal from the trendline** and **60% Fibonacci level**, you plan to **start Dollar-Cost Averaging (DCA)** at current levels. - **Stop Loss:** Placed at **13 EGP** to limit downside risk. - **Take Profit:** Targeting **27 EGP** for a solid risk-reward ratio. ### **Additional Observations:** ...

# **CONTACT Financial Holding | Bullish Reversal from Golden Fibonacci Zone 🚀** **Ticker**: EGX:CNFN **Timeframe**: 1D **Pattern**: Fibonacci Golden Ratio Reversal + Descending Trendline Breakout ### **📌 Key Analysis:** - The price has approached the **Golden Fibonacci retracement level (0.618 - 0.705)**, a key area where buyers tend to step in. - There is...

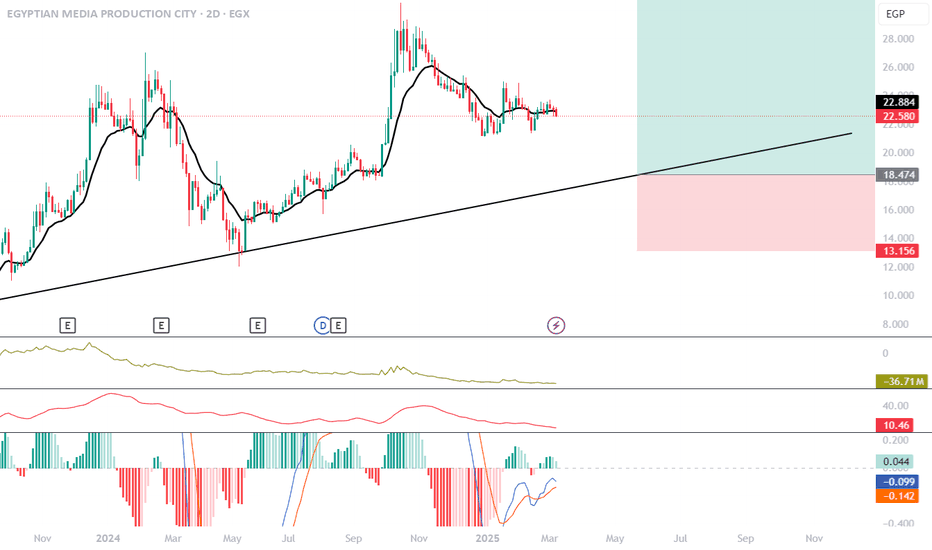

Here’s a TradingView idea for your trendline approach setup with targets set to the previous top: --- **Raya Holding (EGX) – Trendline Support with Upside Potential** 📉 **Technical Analysis:** The stock is approaching a strong ascending trendline, acting as a dynamic support level. A potential bounce from this level could trigger a move towards previous...

Here’s a TradingView idea for your sideways trade setup with a potential breakout: --- **ACT FINANCIAL (EGX) – Sideways Trade with Breakout Potential** 📉 **Technical Analysis:** The stock is currently trading within a sideways range, showing strong support and resistance levels. The price is bouncing between these levels, offering a short-term trading...

Here’s a trading idea you can publish on TradingView based on the image: --- **E-Finance for Digital and Financial Investments (EGX) - Potential Reversal Setup** 📉 **Technical Analysis:** The stock has been in a strong downtrend, forming a falling wedge pattern, which is typically a bullish reversal signal. Currently, the price is testing a key support...

Here’s an idea you can publish on TradingView based on the provided chart: --- 🚀 **Potential Trend Reversal & Fibonacci Golden Ratio Retest!** 🚀 We're approaching a key turning point in the market! 📉➡️📈 🔹 **Descending Wedge Breakout Incoming?** The price has been consolidating within a descending wedge pattern, typically a strong bullish reversal signal....

EUR/JPY is currently in a bearish trend, with strong selling pressure driving the pair lower. On the daily and 4-hour charts, the price is trading below key resistance levels and moving averages, signaling further downside potential. The pair recently broke below a key support zone around 161.50, turning it into resistance. The RSI is trending below 50,...

As of March 5, 2025, the GBP/NZD currency pair is exhibiting a potential bearish **Head and Shoulders** pattern on the daily chart. This classic reversal formation suggests that the prevailing uptrend may be nearing its end, with a possible shift towards bearish momentum. **Pattern Breakdown:** - **Left Shoulder:** Formed around early February 2025, where the...

Here’s a **bullish publication idea** for **M.B. Engineering (EGX: MBEG)**, focusing on its potential rally to **EGP 118**, retesting its **2008 highs**: --- # **MBEG Set to Soar: Poised for a Historic Rally Back to EGP 3! 🚀🔥** M.B. Engineering (EGX: MBEG) is showing strong signs of a **major breakout**, with technical and historical indicators aligning for...

i think there is head and two shoulders now is been created on the 1hr chart as well with the 4hr rejection candle so my wave is the one from 94 k last drop to max peak 1. The wave sequence begins with **Wave 1**, initiating a bullish trend that lifts the price from earlier lows, establishing momentum towards new highs. 2. Following Wave 1, **Wave 2** formed a...

Bitcoin is showing signs of forming a classic cup-and-handle pattern, a structure often indicative of potential price movements. Currently, the handle appears weak, suggesting the possibility of a breakdown if support levels fail to hold. If this bearish scenario plays out, Bitcoin could retrace sharply, with a target as low as $91. The declining volume during the...