Today I will share my view on Cathie Wood's ETF and the pending setup I have. * The main structure of the current situation is the yellow descending channel , where we have been observing several contacts there. * The confirmation for me to start thinking about bullish opportunities happened when the inner descending channel was broken. * After that, I...

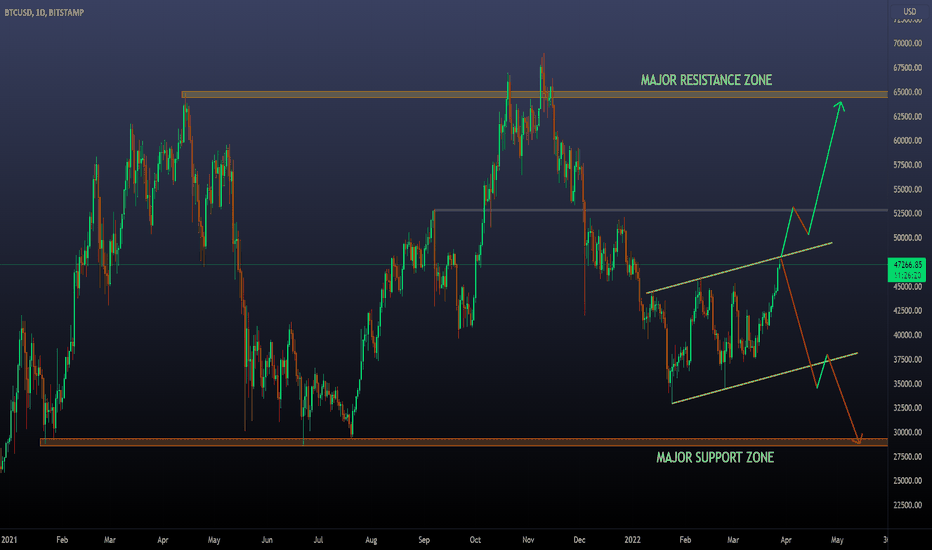

Today I will analyze the two most relevant assets in the crypto world. Bitcoin and Ethereum. Let's start with the Bitcoin chart. When analyzing a chart, the main thing I look at is answering the question, "What are the main levels on the chart?" I try to answer this first because the price tends to move from one level to another in the same hierarchy, making...

Hello everyone, the S&P500 index has broken the main trendline of the descending movement, which may be good news for the bullish team. So here I will show you the situation I'm expecting before developing setups. As you already know, I only trade if I can prove in some way that the pattern I'm interested in has already happened in the past and, most...

Stocks, Commodities, and Crypto. What's going on? Today I will be sharing 4 charts that I think are relevant to the current conditions we are going through. Number one is the Bitcoin chart , representing the crypto sphere. In the same way as Ethereum, I think the optimal situation to start thinking on bullish opportunities is if we observe the price reaching...

Trade idea on NVDA. This is an update on a setup I'm interested in trading if everything gets aligned with the current filter I'm using. In the current context, we can see that the price has been on consolidation for the last 107 days, with a drawdown of 40%. So, based on that context, I looked for similar scenarios in the past using the logarithmic chart, and...

Using the logarithmic chart, I realized that all the corrections on ETH have a common pattern: the double bottom before starting a new bullish movement. That's why I want to observe a bearish movement towards the support zone at 1800.00 If that happens, I will assume that the price has reached the main target of the bearish movement, and from there, I can...

Boeing is one of the biggest airplane manufacturers in the world. Alongside producing other technologies regarding the aerospace industry. * Since 2019, Boeing has been going through tough periods and a clear bearish trend that reached an 80% decline in march 2020. * Since there the price has been moving up, and after the breakout of the descending trendline, we...

A few days ago, I developed bearish setups on the index, and my setup was closed on break-even, which means that the price moved in my expected direction, and I decided to protect my setup by moving my stop loss to the entry-level. After the reversals we observed on Thursday and Friday, the price reached my entry level, and the setup was closed on 0 From here,...

Today I will update my view on ARKK from the previous post I made. I found it super interesting to see how one of the most renowned assets in the post-pandemic era has erased ALL its gains from the beginning of the bear market back in February 2020 until now. From a logarithmic perspective, we can see that the current decline is the deepest one and almost...

Today I will explain step by step the process I use to develop setups. This is how my strategy works. And this can be applied to any asset and using any technical tools. This is as close as I can get to using an empiric approach to define my trading opportunities. Let's start. My trading strategy is composed of 4 steps: 1) Whats the context of the price? ...

XAUUSD is one of my favorite assets to trade alongside S&P500, Crude oil, and BTC. I'm interested in the current zone because we are on the upper level of the range where the price has been moving since May 2021. It's from this type of situation where we tend to observe reversal movements or breakouts of the level for further bullish movements. The filters...

Richard Wykoff developed an interesting concept where he asked a series of questions before developing setups. For example, if the price was falling and he was interested in developing bullish setups, he would ask himself a question "Has the price reached the main target of the bearish movement yet? If the answer was NO, he avoided trading until the price made...

The first thing to say is, "I'm faaaar away from developing a setup right now on PYPL; when things are melting, trying to find a bottom is a really unprofitable business (or at least for me). So that's why I use relevant supports/resistances or trendlines as main levels before thinking about developing new setups. In this case, the first trading opportunity I...

Today, we will look at Master Card, a key name in the information & technology sector, with a market cap of 375B. As a comparative thing, VISA has a market cap of 484B So, what are the main technical elements we can observe here? 1) The price has been inside a massive daily correction of 275 days, and a few weeks ago, we observed the breakout of it. 2) ...

ROKU is down 70% from the previous "ATH" and is below a clear descending trendline; I'm really interested in this kind of name to look for opportunities in case a new bull run comes. My main thesis to support the idea that a new bull run may come is on the logarithmic chart. As you can see, these big drops have already happened in the past , and after that,...

Today we will look at the current situation on ARKK. Technical Elements: -The price has reached the lower zone of the cloned channel. -Inside the descending channel, we can observe a descending trendline. The main element I want to highlight here is that the price had reached a significant target for the bearish movement. Can the price keep falling? Of...

Today we will take a look at S&P500 Futures . In the last weeks, I have been following the index looking both for bullish and bearish opportunities. On Friday, I saw the breakout of the current correction, which continued on Sunday/Monday. That was one of the main things I was looking for before setting orders. Now I can define my last filer. IF the price makes a...

Hello everyone: Today, I will update the new price movements on the US500 chart + Update the setups I'm looking for. The charts you can use are US500 / ES! / SPX (in case you are interested in understanding the index.) Ok, so let's go to the trading plan: Based on past scenarios, I'm interested in developing setups in two situations/scenarios. Bullish...