A daily morning briefing reviewing the previous day's trading and my trading plan for the day.

A daily morning briefing reviewing the previous day's trading and my trading plan for the day.

Using this weakness and the major indices trying to dig in here to look for a move back towards the top of their range. Using this failed breakdown on the 5-minute chart to define my risk and as a catalyst to get some upside going.

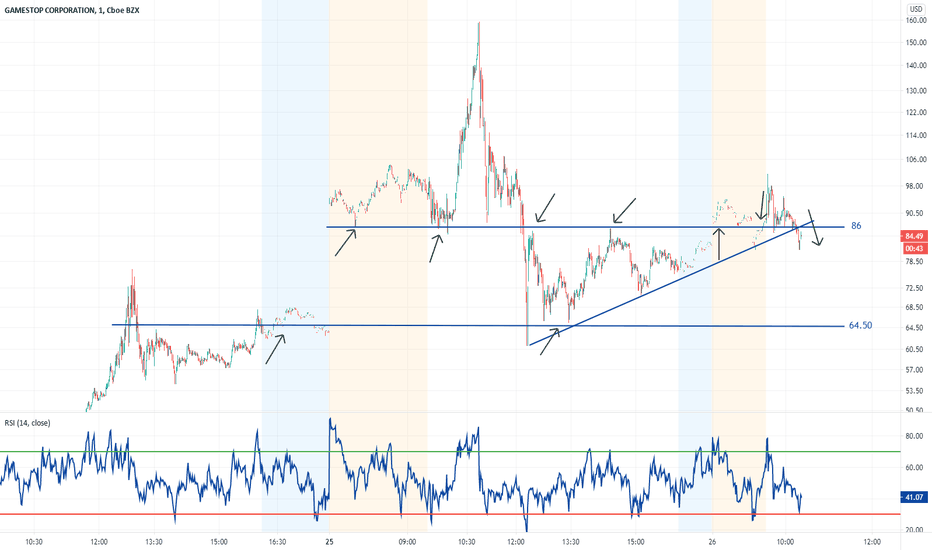

Taking a quick look at the levels that have been relevant for Gamestop $GME intraday since Friday. Super interesting take on trading and how markets behave. Not trading it, just observing it as a barometer of market risk appetite.

Talking about the adjustments I've made to my trading plan over the last two weeks.

In this video, I outline the characteristics of environments where I'm looking for mean reversion and rangebound trades. I define what constitutes a rangebound market and how I should trade these setups from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during...

In this video, I outline the characteristics of environments where I'm looking to buy subsequent breakouts for a day/swing trade. I define what constitutes a breakout and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

In this video, I outline the characteristics of environments where I'm looking to sell subsequent breakdowns for a day/swing trade. I define what constitutes a breakdown and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

In this video, I outline the characteristics of environments where I'm looking to sell strength within an already established trend for a day/swing trade. I define what constitutes strength and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on...

In this video, I outline the characteristics of environments where I'm looking to sell initial breakdowns for a day/swing trade. I define what constitutes a breakdown and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

In this video, I outline the characteristics of environments where I'm looking to buy a pullback within an already established trend for a day/swing trade. I define what constitutes a pullback and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on...

In this video, I outline the characteristics of environments where I'm looking to buy initial breakouts for a day/swing trade. I define what constitutes a breakout and how I should trade it from an entry, stop, and target perspective. This is part of an effort to more clearly define my trading plan so that I only need to focus on execution during market hours.

A daily morning briefing to review the previous day's trading and my trading plan for the day.

A daily morning briefing to review the previous day's trading and my trading plan for the day.

A daily morning briefing to review the previous day's trading and my trading plan for the day.

In this video, I discuss the different performance between leaders like the Russell 2000 + Nikkei 225 and laggards like the S&P 500 and German DAX, as well as what's driving it. I also update my thesis on the upside breakout on the S&P 500 and how I'm looking to trade it if/when we get a move above 3815-3817.

The Nikkei 225 continues to show relative strength and has one of the cleanest absolute trends of the global indices I track. It's already breaking out ahead of the US and European indices, which suggests to me we could see them follow it higher in the next day or two. If you're trading the equity indices --- keep your eye on the Nikkei 225 for clues.

A daily morning briefing to review the previous day's trading and my trading plan for the day.