UnknownUnicorn2239932

BITSTAMP:BTCUSD broke down from its rising wedge alongside bearish divergence. It is now sitting on the 50MA. The Demand Index shows week demand, RSI strength is below 50. For these reasons, I don't expect the 50MA to hold much longer, bringing btc to my two targets of $56,425.00, and $53,833.22.

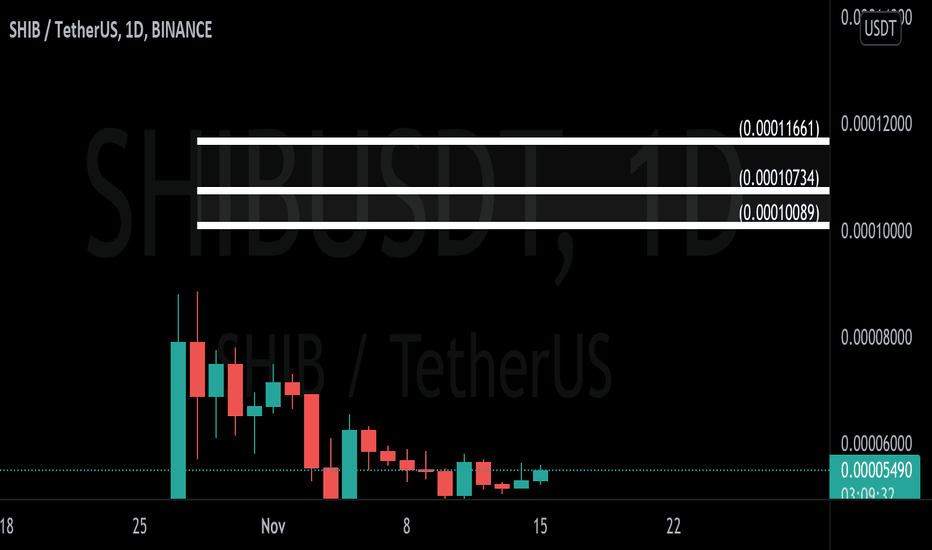

BINANCE:SHIBUSDT has consolidated and is on the verge of a breakout. See my next three targets on my chart.

#bitcoin ended the week with its highest weekly closing candle ever. The daily closed with a hammer. Today's candle triggered a new long. All of this on the heels of the ProShares bitcoin futures ETF, BITO, launching this week. The perfect storm to take BTC to new all-time highs. Always use a stop loss when trading.

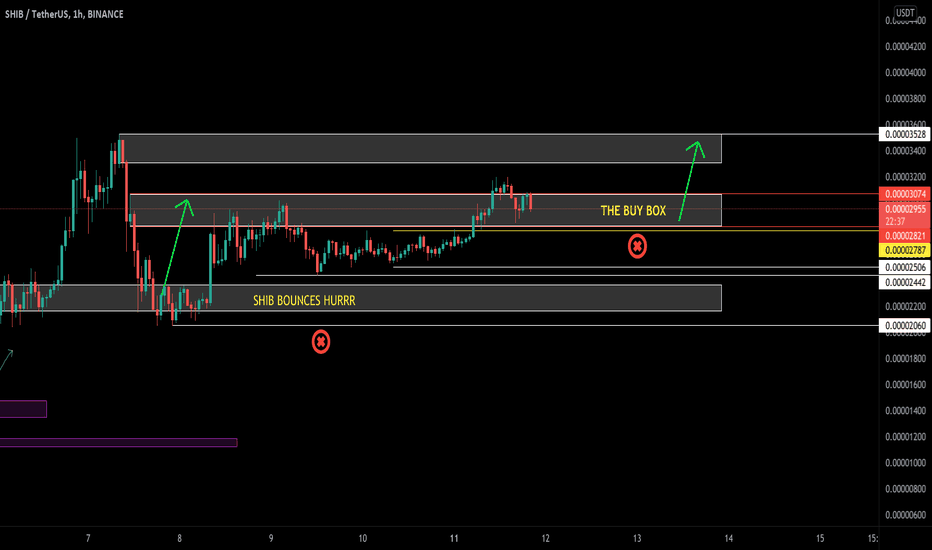

Buy BINANCE:SHIBUSDT inside the box AKA demand zone. You can set a tight or loose stop loss, depending on your risk tolerance, below the box. If you get stopped out, you can get back in at a lower support level for less.

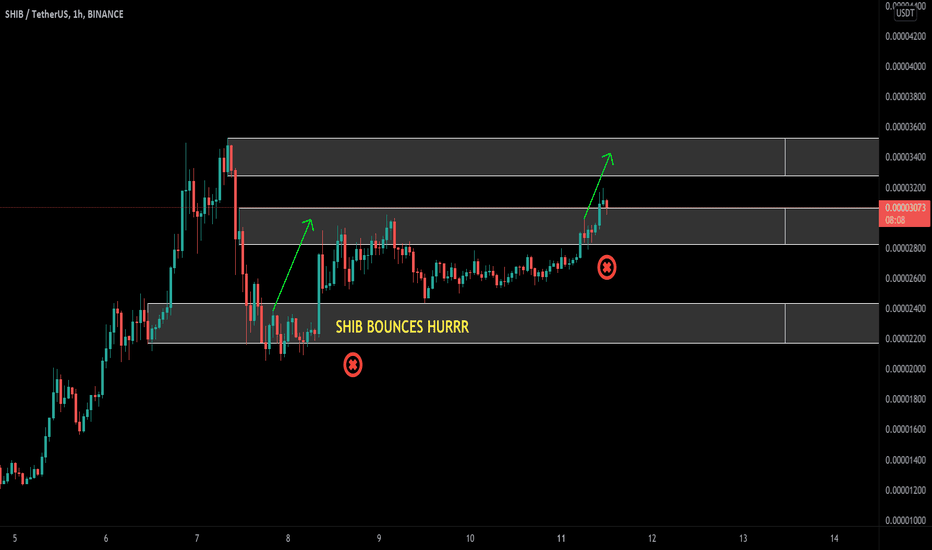

SHIB bounced off demand, as I predicted in my original post, into supply. Strong demand here, as SHIB gets ready to test next supply zone up and ATH. This demand zone is for buying. You can move your stop loss up to below this new demand zone.

I called the 350% SHIB breakout on my Twitter. Follow me there so you don't miss out. SHIB is having an awesome week. Natural pullback to demand zone here for a bounce. Demand zones are for accumulating. Stop-loss under the demand zone or according to your risk tolerance.

Enter on the break of the white flag line. Take profit at resistance. Place stop under support.

NASDAQ:TLRY is attempting to break out of an inverse head and shoulders pattern. The pattern calls for a measured move target around $13.

PLTR is breaking out of and ascending triangle on strong volume. My target is the top of the gap.

See the chart. You can trail your stops once you’re in profits. NASDAQ:RIOT

BINANCE:HOTUSDT Trend is up with the 8 ema leading Volatility is starting to expand RSI crossed above the 21 ema and into the bullish control zone ALWAYS USE A STOP LOSS ACCORDING TO YOUR RISK TOLERANCE LEVEL.

My bear targets of $52K, $46K, and $42K were hit. New target zone for me is $32K - $30K.

BITSTAMP:BTCUSD Targets 1. $51445 2. $53315 3. $55135 Depending on your risk tolerance: 1. Stop Loss 1: $48315 2. Stop Loss 2: $46512

See chart for entry, stop loss and targets. I will update targets once these are hit.

is breaking out. - GRT has broken out of long-term resistance. Flipped the EMA Ribbon; and, Conquered the 200 EMA Targets are $1.2, $1.5, and $2. Use a stop-loss according to your risk appetite.

Each horizontal line is a key level of support and resistance. BTC filled the upper CME gap and is testing (weak) support. If BTC bounces here and confirms a resistance to support flip, BTC is in relatively safe waters. If it breaks here, it makes sense for BTC to visit the major long-term resistance it broke out of in last month's bear trap to confirm...

BTC is on the way to filling the upper CME gap. Short-term target is the top of the gap.

KUCOIN:TRIASUSDT has had quite the ride up and down. As it reclaims ground to the upside, the targets are the blue lines. If Trias gets rejected at the red lines a retest to confirm the breakout of resistance to support is likely.