Bought put options with strike price 7k and call options with strike price 10k. Also when short perps after being stopped out at 7.3k for a small profit. If this breaksout we are going to see +10k before the end of january. For now, short/sell resistance.

potential last leg down for btcusd looking to kick off panic with a spring below 6k

Gold breaking out from extreme downtrend during the most artificial bull market ever. Buy it and enjoy the blood.

Well the comeback its actually mine. took 3 weeks off and bitcoin just did what he does better, going up. Now im back and its time to hedge risk and/or take profit of the downside potential. Lets see if this wedge+flag structure plays out.

What if we are about to face the last 6 months of the bubble and we top out pre-halving in march at 90k? Just buy 7k and sell x10-x13 when it happens.

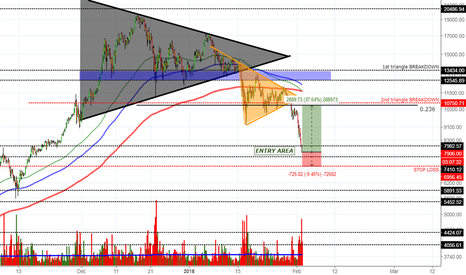

Oscillators divergences. No retail follow up of a 300% gain in 3 months. Sentiment change - bullish exhaustion. Short now. Increase size/risk as we go up, up to 11.7k. Pay attention to 9.3k level, once reached tighten stops. Stop: 11.9k-12k Target: 8.2k Secondary target: 6.2k-6.4k (let a portion of your position ride down here with a stop at 9.3k)

Target 5.5-5.1 area Stop 8455 You can enter now or on a 7.25 break, but it wont be easy to get fills down there.

This is just a couple of custom indicators to plot TROLOLO logarithmic regression and the relative valuation of bitcoin against it. Hope you find it useful.

Sell Bitcoin at resistance amidst the Tether/Bitfinex drama. Rebuy lower at trendline+200week MA retest around 3800. Increase your btc by 50% to be 50% richer after 2020-2021 Bubble to 120k.

Sell house, sell car, sell kids and wifey if available; then buy crypto. Eth reducing block reward/inflation 33% with Constantinople hardfork, probably soon. Litecoin halving block reward in less than 6 months. Bitcoin, Bitcoin Cash and Bitcoin SV reducing inflation by 50% in around a year. Don't wait till it is too late.

Demand areas for bitcoin cash. One of the cryptos I am looking to buy in big this crypto-winter

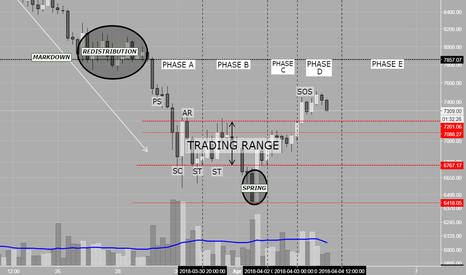

Pay special attention not only to the price structures, but the volumes. This is a wyckoff text book accumulation TR - Trading ranges are places where the previous trend (up or down) has been halted and there is relative equilibrium between supply and demand . Institutions and other large professional interests prepare for their next bull (or bear) campaign as...

Pay special attention not only to the price structures, but the volumes. This is a wyckoff text book accumulation TR - Trading ranges are places where the previous trend (up or down) has been halted and there is relative equilibrium between supply and demand. Institutions and other large professional interests prepare for their next bull (or bear) campaign as...

We are still in no-trade zone for my system. Patience is key. Keep an eye on these levels and specially on this triangle. We are without doubt in a bear market since december 2017, the longest consolidation in +2 years with the worst fundamentals ever. Mt.Gox just liquidated enough bitcoin+bitcoincash to cover creditors claims, but there are still +160k btc...

Not my field, but this is a nice spot to long for a 4:1 Risk/Reward trade I had made a mistake in the previous chart and while i deleted the previous and published the new the price changed. My exact entry can be checked here in twitter twitter.com