cedarfox

I made a chart for my own reference studying the sine-wave patterns of Decred / Bitcoin. There are 3 different sine waves with different frequencies and impact which I found in the chart. The larger sine waves seem to have more impact and smaller ones less so. The sine waves do not tell us what price Decred will go to either up or down. So there is no...

This chart represents my idea on possible growth of ADA in the next 6 months or so. Although we may see possible temporary drops in crypto in the next week. I am bullish on crypto in general up until sometime between April - June 2022 and if crypto keeps growing I expect ADA will as well. The red and green vertical lines are "time zone" periods of equal width and...

Vertcoin looks like it is ready to pop. As long as the crypto market continues to grow, this looks likely. I don't have a particular target in BTC values for VTC, but a conservative target of $40 . Currently vertcoin is 0.7327 right now. This is just my opinion, but if I am right, this is a rare investment opportunity. Not a recommendation to buy or sell -...

Vertcoin has not yet done a dramatic move upward like some coins have. Its time is coming and likely very soon. $40 seems a conservative target sometime in 2021 - I am looking around September 2021 based on this chart. Please see VTCBTC chart as well This is provided that the overall crypto market continues to grow.

I have been following UVXY for months now and using fib lines & curved lines as support and resistance. So far, the lines have been helpful guides. Tradingview allows us to use curved lines, but it takes some practice to adjust the curved line to fit the trend. I had the light orange curved lines on my chart before the spike in January happened, and the...

Silver seems to have excellent growth potential in the next couple of years. This is a look at longer term fib support and resistance levels of silver. The fib levels on the right - more recent - part of the chart show retrace from April 2011 - Mar 2020. The .382 level was broken through as resistance, but has not gone down again to retest of .382 level as...

Nib is an ETN which invests in Cocoa futures. It has broken through a downward trendline. It appears to be setting up for an inverse head and shoulders. Trading plan: Buy around downward blue support line. Stop loss just under the support line. Targets are at the neckline of the Inverse H&S and also at the previous high where the green arrow shows. Based on...

The Stock market is reaching major headwinds and a downtrend is expected in the overall market. Netflix has experienced epic gains in the past few years and due to that, it is due for a retrace, like many other tech stocks. It has long term growth potential, but after the exponential growth in the stock price, we may see a retrace back to the $127-133 areas. ...

We have a long opportunity in crude oil now. Crude oil has been sitting at the 61.8% retrace around 45.40ish for the last couple of days. A study of the longer term cycles shows that we have just completed a corrective red zone which actually started in March 2018, this cycle reached a low in December 2018 and will reach its next high in June 2019. We...

This is a follow-up on my previous idea. We can see that even though June was a "green" zone, it did not go up as strongly as I had anticipated it might. But it did go up more strongly at the end where the shorter green zone coincided with the end of the 30d green zone. According to my chart of time periods, we are now entering a red zone. There are longer...

Bitcoin and the crypto market have really been hit hard. Who knows how long this will last? We can get a good clue by looking at the shorter cycles. Please check my previous ideas on BTC cycles. I said in my previous idea that the 30-day half cycle (bearish portion) ends June 5. Yet, the price has gone lower. As I also said, the bottom or high points don't...

I believe we are now near a buying opportunity for Bitcoin. Please check my previous idea also, on the link below. Bitcoin, like other markets, has multiple relatively predictable recurring cycles that can be a guide to us to know when to buy or to sell. This chart shows just one of the cycles. Each half cycle is approximately 1 mo, but the time between...

Here is a glimpse into the longer-term predicted future of Bitcoin. Based on several longer term past cycles, we can attempt to predict the future moves. Please see my other ideas for shorter term bitcoin cycles and for cycles in other markets. I have put the links below. Using this chart from the BITSTAMP exchange I have examined 3 different occurring cycles...

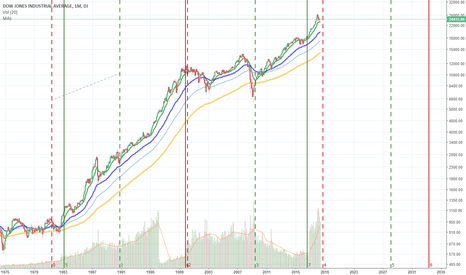

Markets are more predictable than we have been led to believe. Here we are going to examine the 9 year cycles found in the Nasdaq composite. This is a follow-up idea from my previous idea which was Lesson one in Market Cycles in the DOW JONES INDUSTRIAL AVERAGE. Please follow that link for a more detailed explanation on this. In the Nasdaq we can see...

Lesson Two The market is more predictable that we have been led to believe. We will now study the effects of both the 17 year half-cycle and the 9 year half-cycle which are occurring at the same time. There are many other cycles or sine-waves occurring in DJIA and in other markets as well, but for now we will just focus on these two cycles. Please see the Lesson...

Introduction to Market Cycles Lesson One Markets are more predictable than you and I have been led to believe. We have been told that historical data cannot be used to predict what will happen. But is that statement actually true? Answer -- YES and NO. It is not a lie. Even with the best techniques of technical analysis and analyzing the repetitive...

5/10/18 The US Dollar has had a fantastic run over the last few weeks, but now, we can expect other currencies to take a turn to outperform the dollar. Despite the recent run, on the long-term perspective, the dollar is still in a downtrend. I have studied the Aussie Dollar / USD chart time periods, I expect now is a moderately good buying opportunity. We...

As I had expected and had written about in my previous idea, bitcoin is entering a sell-off period in May. It did have a solid run- even more solid than I expected. Now we can expect a correction to the recent move. I expect that we will find a short-term bottom estimated May 15 - 20. ( It may be possible that the actual lowest point could occur even 1-2wk...