motleifaul

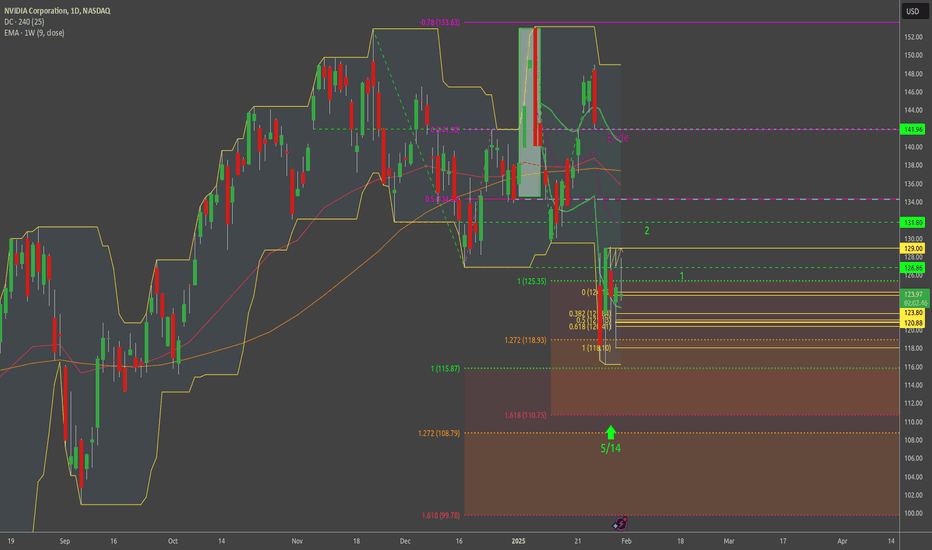

And the momentum is vaining. A correction of the rise since mid January may be expected. The more that there is an unclosed open window since 13th-14th January as well.

This is related to the previous short 2 days ago. The position has been just closed but I realize that the momentumis still given. Thus I am renewing the short position and wonder wether the correction of the October- December rise may even further continue.

My idea dd January 24th is still valid. Nothing has changed so far. Thus I had taken the profit yesterday and now I am using today's rise to sell again waiting for the downward correction of the rise since October.

There is really not much to say. The price has run to fast today to get bthrough without any profit taking. We don't have much price history and an see 3 waves only. But we see that we have fulfilled each Fibonacci extension so far. Each such rise has been followed by a correction. It may be same now.

We have reached the bottom of September and October again now. It had been broken at the end of September but was fulminantly confirmed wid a long spike and a window afterwards. ThusI expect it to hold now again.

It looks that we are building a bottom after the broad spike 2-3 days ago. There is big volatility as the market is not yet aware whether the fallis over already. The more it is option expiration day today. Thus today is decisive whether we are able to close the spike which would be healthy. I think that we we settle down today to open higher on Monday when the...

We may get an Engulfing pattern this month. The downward correction of the spike since August has been done. And we are holding well above the MA. May be that it is time for another and this time bigger corrective wave up to test the downtrend prevailing since 2021.

Since October 2023 we have risen without a major correction. it's time now. As the trend is still intact I don't see a correction of this whole way up now. But an attempt to correct, i.e. short term profit taking shall be possible at least. The ADX is turning Southand the first red candle is going to built which may result in a star in the weekly chart. I repeat:...

The extended split that the market has done 2-3 days ago has not yet been digested. The window has to be closed. When it becomes cold and you sit in a split ypo will get cramps definitely. I mean it would be healthy for the market to correct the steep fall and to close the window. Today will be decisive to learn whether the market is ready to build a bottom here....

We have done the correction of the rise since August. But this shall not mean a renewal uf the rise. Instead we have to look at the weekly chart to see that we have just corrected this retracement as well. Thus I assume that we are still within a longer downward correction that begun in December and has still sufficient space to fill on the downside.

A fall fromthe high tothe present low within less than 2 days is a real split. Nobody can very long hold such a position without getting a cramp. Thus the spilit shall be closed to a normal position again, i.e. the market will take profit.

Not only my first long has failed past week but the test of the fresh bottom as well. We are still within the support zone but it seems to become clearer now that there is a serious bottom building. It is nor all decided yet as there is an open window to be closed at 121.35-122.29. Buit when this will have been overcome we may see a further run up. Another long...

I was short since December 20th and had taken the profit in time. Now the downeard move has been retraced and nothing has changed in the bigger view. As the correction of the rise from August to December has been 36 % only so far the correction may likely continue.

Of the 3rd rising wave since November 50 Fibonacci-% are retraced now. Give SUI a chance to continue the trend.

We could not built new highs but fell through the rising trend line and the rising MA. In an overbought status this may seen as sell signal.

From the second December week until the end of the first January week we saw a top building. This had been followed by a downward correction completed by Fibonacci rules. This resulted in an attempt to reach to top again which seems to have failed now. The rise is a completed Fibonacci retracement again. That's why it is more likely that it will stop at this...

It seems that we have got a bottom within the present downward correction. Palantir has to ecide now whether to get back into the still prevailing uptrend or to correct further. At moment we try to retain the trend cautiousely. But no decision has been made yet. As the Williams indicator is gaining some strenght again I dare to asume that the next move will be a...

With its little candles the chart looks toppish. This is no wonder after the 70 % rise within less than 1 month. One can imagine that the last 10 candles are rising within a rising wedge. This would confirm the forthcoming correction but I don't put much attention on it as the candles are to small. I expect the outbreak to the downside as there is a large open...