VWO trade ideas

VWO - Emerging Market Macro Analysis The macro data from this month's Markit PMI's is sending a bit of mixing signals from the countries that VWO has the most exposure to, but I am still optimistic as to the near-future performance of the emerging markets.

Before going into the macro analysis, whats the market allocation of this ETF.

The 80% market allocation is the following:

- China -> 42.5%

- Taiwan -> 16.5%

- India -> 11%

- Brazil -> 5.9%

- South Africa -> 4.1%

After a quick look at the list above, we can see that China and Taiwan are almost 50% of the market allocation, so it is important to follow their situation closer.

China Macro Overview

China PMI's are sending mixed signals regarding the growth of Chianese economy, with a possible hint as to slow down in the next few months.

The manufacturing report is showing a slow down in growth in the production and new orders.

The new export orders are declining again below the 50 level, which indicates a possibility of contraction, there is also an indication of rising costs.

And that's likely to reflect in the results of Q2, or even in the Q3.

Taiwan Macro Overview

In comparison to Chinese PMI's, Taiwanese reports are much more optimistic, with strong growth in the last months.

January Manufacturing PMI is reporting growth in Output and New Orders, which are leading indicators in themselves.

Employment has increased substantially, which is a good indicator as to the health of the Taiwanese economy in the current situation.

In my opinion, the Taiwanese companies will lead the performance in the VWO for the next few months.

Indian Macro overview

India is another country reporting growth in January if we keep in mind the allocation size in this country in this ETF, it gives an optimistic outlook for its performance.

New Orders, Exports and Outputs are rising for another consecutive month. The employment situation is still contracting but at lower levels than before. That may be an indication of possible employment growth soon.

The overall outlook for the Indian economy is positive and in conjunction with positive data from Taiwan, that's good news for the emerging markets.

Additional Macro overview

Brazil, South Africa are other countries in the top 5 of the allocations for this ETF. Their allocation size is reasonably smaller than the countries above so I won't go into much detail.

Brazil situation is not very bright, as to the information provided by PMI reports, even that manufacturing showed slight improvements, the services are contracting again.

The situation in South Africa seems to expand but at a slow pace, there are still many concerns as the effects of the pandemic on the overall economy.

Final Opinion.

As we can see from the macro overview of the countries, which are the key components of the market allocation of this ETF, the outlook is mostly positive.

Some may be concerned by the mixed data from the Chinese PMIs since China is the biggest player in this ETF, it may affect the performance. However, there is a positive outlook for Taiwan and India.

I believe they will compensate for the possible slow down in China, and it'll drive the EM performance for the next few months.

Sources:

- Caixin China General Manufacturing PMI

- Caixin China General Services PMI

- IHS Markit Taiwan Manufacturing PMI

- IHS Markit India Manufacturing PMI

- IHS Markit India Services PMI

- IHS Markit Brazil Manufacturing PMI

- IHS Markit Brazil Services PMI

- IHS Markit South Africa PMI

VWO - following the forecasted trendVWO is finishing a leading diagonal first wave out of the the contracting triangle as forecasted in the April 5 post. It should continue its positive trend ahead with minor corrections on the way. The possible end of minute wave v of minor 1 should be at around 39. After this minor 2 wave should retrace to around 35 before the up trend continues. If prices crosses the lower leading diagonal channel, the odds are that minor 2 correction is already happening. FOLLOW SKYLINEPRO TO GET UPDATES.

VWO - FTSE Emerging Markets ETF - poised for growthVWO just seems to have completed a bullish primary triangle what is the end ov cycle wave IV. In this case, the etf should offer long-term growth ahead. The probable end of cycle wave V up is a growth similar to highest leg of the triangle. This would push the index to around 70, more than double the current value in the long term. FOLLOW SKYLINEPRO TO GET UPDATES.

VWO - DAILY CHARTHi, today we are going to talk about Vanguard FTSE Emerging Markets ETF and its current landscape.

The emerging markets today can face an increase of volatility and perhaps pessimism as Trump's stated that will reinstate Steel and Aluminum tariffs for Brazil and Argentina since, in his perspective, both countries are devaluating their currencies to be "unfairly" competitive in the sale of agricultural goods, which is negative for U.S farmers. We must remember that since the beginning of the Trade War, China has stepped into the gas pedal in buying Brazilian agricultural goods, and the Brazilian currency has reached new record lows against the U.S dollar, which theoretically bases Trump's argument. This could be bad news for the market if imply a new Trade War front against these Latam countries, that doesn't have China firepower to sustain a tariff battle against the U.S.

Trump's movement could be clearly interpreted as an endeavor to take these competitors of the road, to try to suffocate China's lifeline of agricultural goods, and maybe force them to become more friendly with the idea of expanding their spending on U.S agricultural goods.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

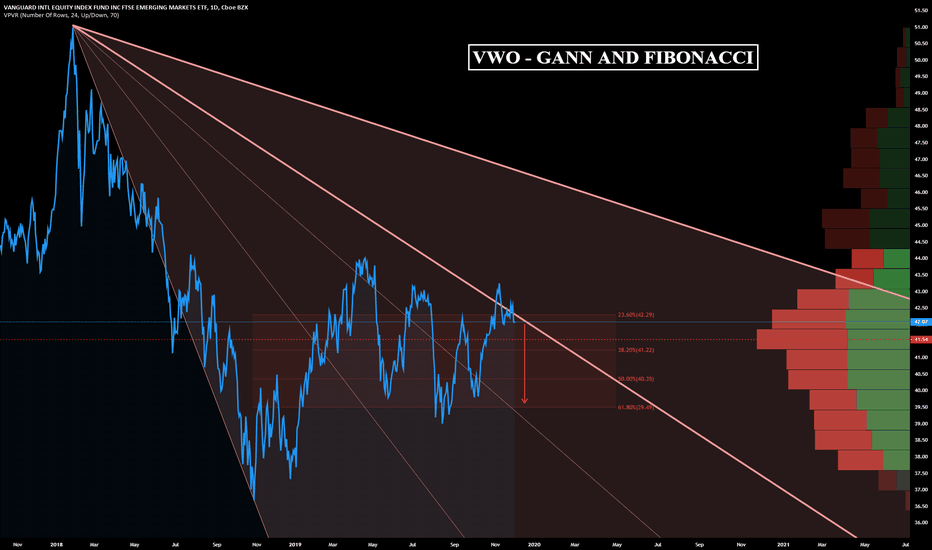

Still Bearish on VWO (Emerging Markets) But Good Buy OpportunityThe rising dollar, increased interest rates, trade wars and all it entails mean that the emerging markets are NOT DONE trending down.

The index has been mean-reverting and will probably go even further down.

This is a great buy opportunity for long-term investors.