TraderHalai

EssentialBitcoin has seen a nasty capitulation candle down to the 55 Monthly EMA / 0.618 macro Fibonacci level from its all-time highs and has since bounced to the 30k region. Given the rapid selloff, I firmly believe that we are now closer to a bottom than a top. The most bearish calls and technical analysis that I have seen (barring zero), are the 12k calls, 200Week...

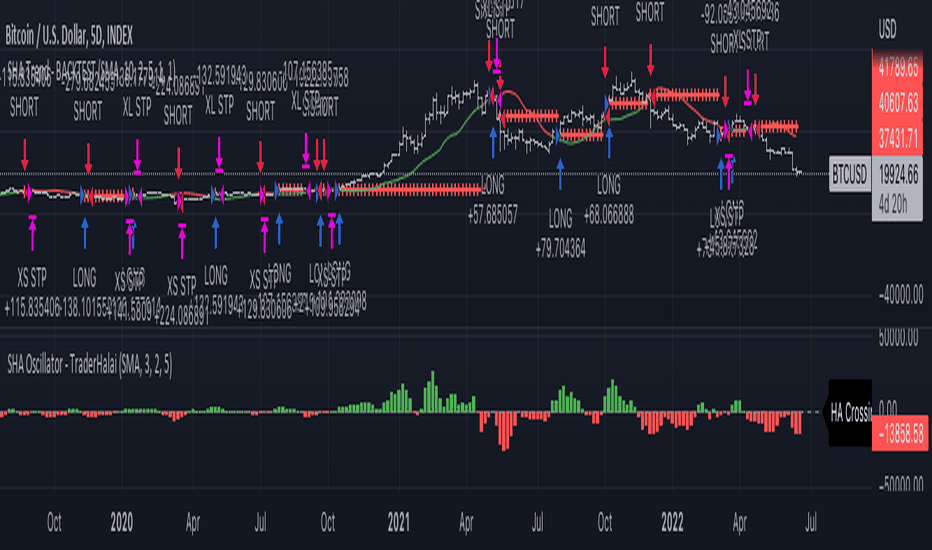

What makes a profitable automated strategy? Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable. This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly...

Do you believe in the long-term future of BTC? Having rallied to 69k for a top in late 2021 from COVID-19 panic lows set in March 2020, BTC has since retraced around 50 percent to the lows of 33.5k set on January 24th, 2022. In the current environment of endless short-term bulls and bears, it is easy to forget the initial reason why we have invested in the...

Bitcoin has been in an uptrend on the past week, and is currently under pressure, backtesting a critical support level. It is at a critical decision point. It is in the process of forming a head and shoulders pattern. A confirmation is needed, however. A break below the neckline would put the downside target at 21k, where it would meet other support zones...