Trading-Capital

EssentialPPI comes in super hot. 3.7% vs 2.9% exp YOY 0.9% vs 0.2% MOM exp The SPX does gave higher upside targets but we are getting very stretched in the near term. Liquidity has been flowing into crypto at full force and often moves of 125% in 2 months see profit taking.

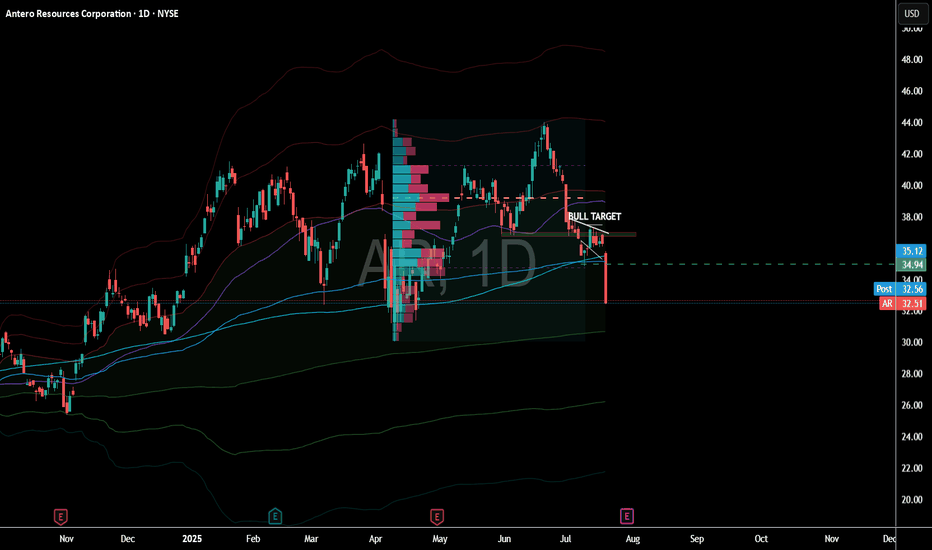

Nat gas has recovered key technical levels with a strong rally today. Looking at the daily chart we got a close above the 7 MA staging a potential 3 bar surge setup. Nat gas looks to be targeting 3.18 in the near term... Inventory report tomorrow: 10B forecast for inventories. A potential arbitrage opportunity setting up for EQT, upside calls for next week.

Bitcoin has sold off sharply in recent session. Allowing alt coins to capture small percentages of bitcoins liquidity which resulted in epic bullish moves. Now that Bitcoin is retesting a major moving average (50 MA) we might see BTC recapture some of that crypto dominance. Other alt coins are well off of their 50 day moving average making them a riskier...

U.S. natural gas inventories increased by 48 billion cubic feet last week to 3,123 Bcf, increasing the surplus over the five-year average. Consensus / forecast was 37Billion Cubic feet. Despite a much higher build than expected Nat gas saw positive price action. This appears to simply be a dead cat bounce before we go lower. A death cross on the daily chart...

Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days. These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge on the daily chart if crude breaks this channel. Keep you eye...

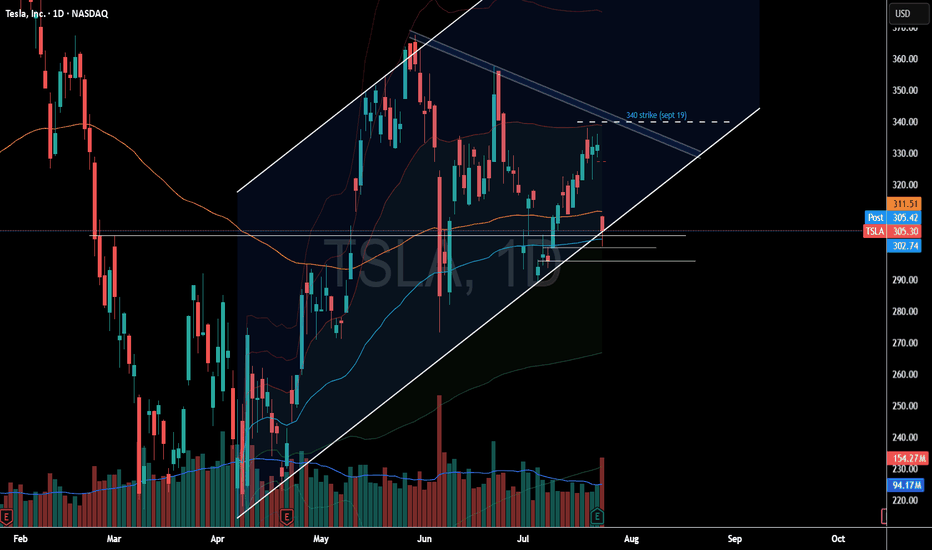

BTC appears to be showing distribution signs. I do believe BTC local top is in, but alt coins like Ethereum can still push a bit higher. Ethereum short around 3900-4000 looks promising Tesla fell sharply on the back of cash flow burn and expenditures. Investors are also fearful of sales decline and loss of EV credits. SPX hit major long term resistance...

Nat Gas plunged to a 1-week low Monday on the outlook for cooler US temperatures. A report came out that Nat gas has heat peak demand which is scaring investors. Nat GAs equities got demolished which could indicate that this breakdown is real. We got rejected off the daily 50 MA & Knifed through the 200 Daily MA. Some clear technical breakdowns are now in...

Natural gas had an astonishing move to the upside. Closing up over 5% today. This volatility can make all tarders head spin if youre not used to it. Why did Nat gas pop today? Partly from being oversold and into really good technical support, Natural gas inventories were released today at 10:30am. The inventories showed a smaller build than the market...

Crypto has been soaring today. Ethereum and BTC pumping liquidity! Fed minutes came out today around 2pm, indicating rate cuts at next meeting and throughout the rest of the year and crypto absolutely loved that. Crypto thrives in a cheap liquidity environment, rallying in potential rate cuts. We took profits on IBIT calls - still holding longs in the BTC...

SPX is still holding very bullish price action. Technicals are pointing towards higher price and todays inside consolidation day certainly helps digest recent gains. Along with the flat indices market session, we did observe some massive capital rotation trends. Financials saw a pretty strong down move across the board. JPM / BAC / C all saw large outflows. We...

Iran suspended cooperation with the U.N. nuclear watchdog, amid a surprise build in US crude inventories. Iran’s move added a modest risk premium to prices, though analysts noted that no actual supply disruptions have occurred. $66 is a key level for WTI crude to hold above. If it can maintain this area, we will likely see higher price. $66 is a multi year...

Natural gas got demolished today, down over 8%. The one headline we saw hitting the tape that is having some partial influence: "Vessel Arrives at LNG Canada to Load First Cargo, Strengthening Global Supply Outlook – LNG Recap" Today, we did hedge our core long UNG position with a short dated $56 put on EQT. We are already green on that trade and looking...

Bitcoin gained 13% in H1 2025, outperforming Ethereum and Solana, which dropped ~25% and ~17% respectively—highlighting BTC's strength in turbulent market conditions. Institutional wedge: spot-BTC ETFs saw huge inflows—BlackRock’s took in $336M, and total crypto product inflows approached $45B+ this year. AI models foresee BTC holding $105K+ by end-June, with...

Natural gas is ending the day with a daily bottoming tail. Potentially forming an inverse head and shoulder pattern that takes us above the key $3.83 level. We took profits on our EQT put hedge! The put contract went up over 100% Lets see if Nat gas can build some pressure.

Iran and Israel de escalation is causing nat gas to plummet. Fear of the "Hormuz Strait" closing have slipped away! Roughly 20% of global liquefied natural gas (LNG) trade flows through the Strait of Hormuz, primarily from Qatar (~9.3 Bcf/d) with smaller volumes from the UAE (~0.7 Bcf/d) In 2024, approximately 83–84% of those LNG volumes were destined for...

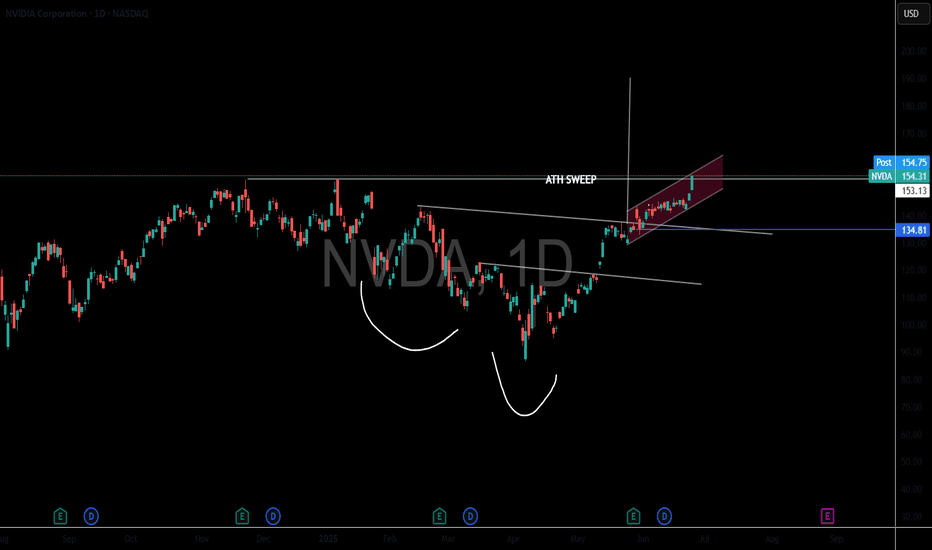

Record-high share price: NVDA hit a new all-time high as U.S. stock markets rallied and Wall Street analysts forecast continued upside Nvidia is pushing towards the first ever $4 Trillion market cap. Today it surpassed MSFT as the largest company in the world closing up over 4% on the session. Micron earnings are adding extra fuel to the fire for semi...

Circle stock has been on a wild ride lately After a meteoric rise of over 700% since its IPO on June 5, it's now facing some turbulence: - Today, the stock dropped nearly 16%, partly due to Cathie Wood’s ARK Invest selling $110 million worth of shares. - Analysts are also sounding caution. Compass Point initiated coverage with a $205 price target—below its...

Hims & Hers Health HIMS shares were down more than 34.63% in Monday trading, while Novo Nordisk NVO stock was down over 5% after Novo Nordisk said it has halted its collaboration with Hims & Hers on the sale of weight loss drugs, including Wegovy. The two companies launched a collaboration in April to bundle Wegovy through Hims & Hers' telehealth...