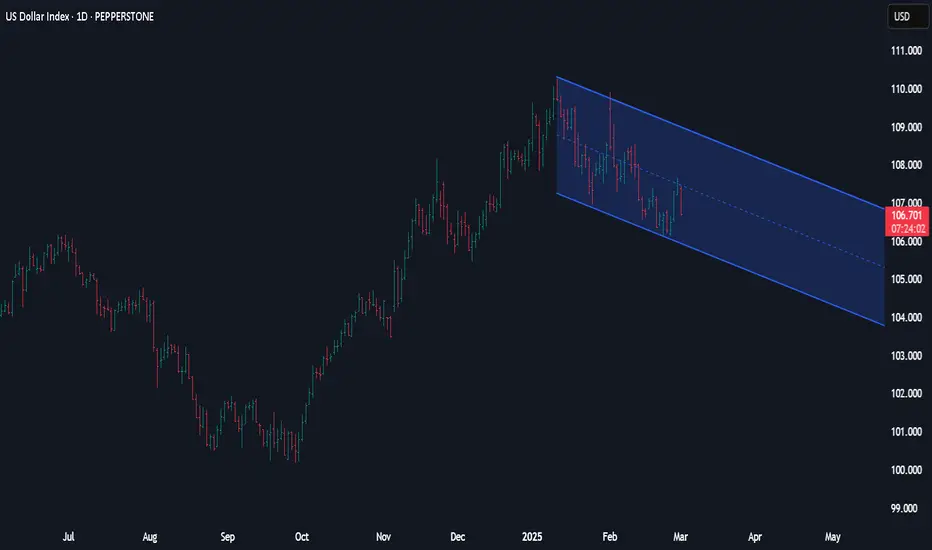

The USD outlook started to improve again last week in response to more tariff tape bombs by President Donald Trump as well as growing uncertainty about global geopolitical developments. The currency could remain supported in the near term given that: (1) Trump’s trade war could start in earnest on 4 March with tariffs on Canada and Mexico and continue with metal and reciprocal tariffs in the following weeks, in a blow to risk sentiment and a boost to the USD; and (2) US rates markets are now pricing in more than 50bp of Fed rate cuts in 2025 and we thus expect no further loss of USD rate advantage.

In the near term, next to tariff headlines, focus will be on the Non-farm payrolls and ISM data for February as well as Fedspeak. On the day, focus will be on the manufacturing ISM for February as well as a speech by the Fed’s Alberto Musalem. With some Fed-related negatives in the price of the currency by now, however, it would take data disappointments and dovish Fedspeak to fan Fed easing expectations and hurt the USD. Even in this case, however, the currency could remain supported ahead of a potential start of the Canada and Mexico tariffs tomorrow.

In the near term, next to tariff headlines, focus will be on the Non-farm payrolls and ISM data for February as well as Fedspeak. On the day, focus will be on the manufacturing ISM for February as well as a speech by the Fed’s Alberto Musalem. With some Fed-related negatives in the price of the currency by now, however, it would take data disappointments and dovish Fedspeak to fan Fed easing expectations and hurt the USD. Even in this case, however, the currency could remain supported ahead of a potential start of the Canada and Mexico tariffs tomorrow.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. We provide Free TradingView Premium and Essential Membership.

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. We provide Free TradingView Premium and Essential Membership.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. We provide Free TradingView Premium and Essential Membership.

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. We provide Free TradingView Premium and Essential Membership.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.