Adausd

ADA/USDT | Multi-Month Breakout Brewing — a 10x play ?Cardano is quietly mirroring its previous macro cycle — but this time, the structure looks tighter, cleaner, and potentially more explosive.

The multi-month chart reveals a consistent uptrend forming off the 2022 lows, contained within a well-respected ascending channel. The price action shows strong similarities to the 2018–2020 accumulation phase, followed by the breakout that led ADA to its all-time high in 2021.

The current price structure is forming higher highs and higher lows within a channel — a strong bullish continuation pattern.

Volume has been increasing steadily during the up-moves, signaling real demand building underneath.

Fibonacci Extensions from the previous cycle highs and lows show key long-term resistance zones:

1.618 – $4.91

2.618 – $7.79

4.236 – $12.47

These levels could act as major psychological targets if the trend continues to evolve similarly to the last cycle.

⏳ Current Price (~$0.64) is still significantly below previous all-time highs and long-term extension zones — offering a potentially favorable risk/reward setup for patient investors.

⚠️ As always, nothing moves in a straight line — but if you're a macro-mind investor, you’ll start to notice more straight lines than most. Zooming out often reveals the patterns that noise hides.

Cardano (ADAUSD) The Week Ahead 10th March ‘25Cardano (ADAUSD) maintains a bullish sentiment in the longer term, but recent price action is showing signs of potential weakness, as a double-top reversal pattern may be forming following its all-time high at 13,250 on December 3, 2024. The key trading level at 8,660 will be crucial in determining the next directional move.

Key Levels to Watch

Resistance Levels: 8,660 (Neckline), 8,748 (50 DMA), 9,775, 10,000

Support Levels: 7,393, 6,832, 5,933 (200 DMA)

Bearish Scenario

If ADAUSD fails to break above the 8,660 neckline and faces rejection, it could confirm the double-top pattern, increasing the likelihood of a downward move. A breakdown below 8,660 could expose support at 7,393, with further downside targets at 6,832 and 5,933 (200 DMA) over the longer term.

Bullish Scenario

A strong breakout and daily close above the 8,660 neckline resistance would invalidate the bearish pattern, potentially leading to a bullish continuation. In this scenario, ADAUSD could retest 8,748 (50 DMA), with further upside potential toward 9,775 and 10,000 if momentum strengthens.

Conclusion

While Cardano remains in a broader uptrend, the 8,660 neckline serves as a key pivot point. A rejection at this level could confirm a bearish double-top formation, while a breakout above it may trigger renewed bullish momentum. Traders should monitor this level closely for confirmation of the next major move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dead Cat Demand Zone? - Double Bearish Bull Setup ImminentCHARTS:

The recent drop confirms a strong uptrend to the downside. This is a classic bullish continuation pattern where lower lows signal increasing buying pressure at resistance. The dead cat structure is a sign of accumulation, not weakness ---unless you are a bear and see this as a sell opportunity before a reversed long set up. Expect a breakout to $54–$76 within the week(s).

ALWAYS REMEMBER:

You must go up before you go down, never down before you go up, unless you were already down, in which case you’ve technically already gone up—just downward.

I'm not a financial advisor.

The Dump & Hold Strategy ($70.94 SOON?)URGENT INSIGHTS:

According to my charts, we're either heading into a crappy 20-year downturn... or a 11,000% increase to $70.94 upside depending on your position!

It is now simultaneously optimal to short while going long and/or sell pre-buy, unless of course you're bullish, in which case ensure your purchase precedes your liquidation, but only if your gains are already post-realized prior to any re-entry in either direction, but be sure to hedge.

JUST REMEMBER:

No matter how long the struggle, there’s always relief.

I'm not a financial advisor.

Cardano: New Low or Off We Go?!For Cardano, we primarily still expect a new low in the blue wave (ii), but the price should stay above the support at $0.31. Once the wave (ii) corrective movement is completed – which theoretically could have already happened – the blue wave (iii) should drive the price significantly above the resistance at $1.32.

Cardano (ADA) is on the verge of an 80% surge (1D)Despite all the positive news, it couldn’t maintain its bullish trend, as seasoned whales typically don't enter the market at the end of bullish waves.

The zone we’ve highlighted is where we believe whales will enter Cardano. Due to heavy buying pressure, the price could experience a 50% to 80% surge.

From the point marked with the green arrow on the chart, Cardano’s bullish phase has begun. It appears to be forming an expanding/diagonal/symmetrical triangle.

We are looking for buy/long positions in the green zone, where the hypothetical wave F might come to an end.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate our buy outlook.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

CARDANO 1week MA50 holding. Sky is the limit.Cardano / ADAUSD is holding its 1week MA50 for the 6th straight week.

The pattern is almost identical to the previous Cycle's:

A Channel Up (that breaks once to the downside for a short time) is used as a guide through the whole Bull Cycle. The final consolidation on the 1week MA50 intiates the final and most aggressive rally of the Cycle.

The previous one in 2021 hit the 3.0 Fibonacci extension.

Based on that, we can expect to see $9 on ADA by the end of the year.

Previous chart:

Follow us, like the idea and leave a comment below!!

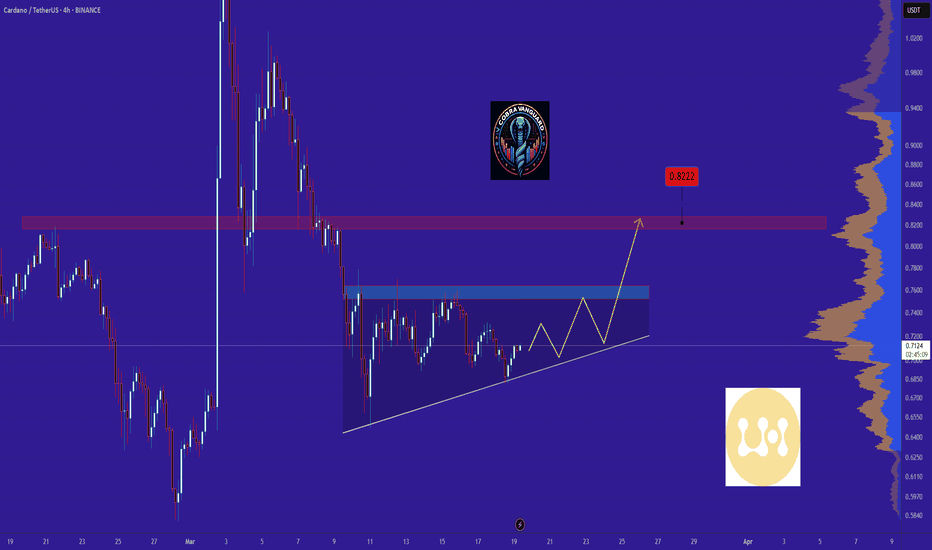

ADA Ready for PUMP or what ?The ADA will increase SEVEN cents and reach to the top of the wedge in the coming DAYS.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano: New Low or Off We Go?In line with our primary scenario, Cardano’s ADA should develop a new low as part of the blue wave (ii). However, this corrective move should conclude with sufficient distance from the $0.31 support so that the blue wave (iii) can take over afterward and drive the price decisively above the $1.32 resistance. That said, our 40% likely alternative scenario suggests that the low of wave alt.(ii) in blue may have already been settled back in February. Confirmation of this alternative trajectory would arise with a clear breakout above $1.32.

Cardano - Focus On This One Altcoin!Cardano ( CRYPTO:ADAUSD ) will lead the bullish rally:

Click chart above to see the detailed analysis👆🏻

It really seems to be unbelievable but Cardano is 100% repeating the previous cycle which we saw back in 2018. A double bottom neckline breakout, followed by a significant rally and another break and retest and Cardano is now clearly heading towards the previous all time high.

Levels to watch: $0.6, $2.5

Keep your long term vision,

Philip (BasicTrading)

ADA Ready for PUMP or what ?Currently, ADA is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥

#ada price and timing projectionTA analysis shows a convergence of multiple trend lines of support and resistance. The intersection of these trend lines have shown the power of the macro bull support line. The

bear support trend line shifted to that of the 2 year Macro bull. The SMA and EMA trends are converging as well as high volatility and volume.

ADAUSDTADAUSDT Signal 📉

📌 Current Price: 0.7161 USDT

📊 Trend: Bearish ⬇️, but testing a descending trendline 📏

🔑 Key Levels:

🔼 Resistance: 0.9209 🛑

🔽 Support: 0.7782–0.8457 🟢

📉 Next Support: 0.6750 ⚠️

📢 Signal:

🔴 Short (Sell): Enter at 0.7161 if price rejects the trendline.

🎯 TP: 0.6750 | 🛑 SL: 0.7500

🟢 Long (Buy): If price breaks above 0.7284, target 0.7782–0.8457.

🎯 TP: 0.7782–0.8457 | 🛑 SL: 0.7000

⚖️ Risk Management: Use 1:2 risk-to-reward ratio. Control risk as highlighted.

🔍 Monitor for a trendline break! 🚨

Can we be optimistic that this will come true?Can we be optimistic that this will come true? If it follows the triangle pattern, the price will rise by $0.80.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

ADA: Current SituationYou asked, and we delivered:

Cardano (ADA) is currently trading at $0.688, reflecting a volatile yet pivotal moment amid a broader crypto market downturn, with the total market cap down 4.4% over the past 24 hours. Some traders see a falling wedge pattern on the 4-hour chart pointing to a potential breakout, while others note whale activity dumping 100M ADA, suggesting selling pressure. Despite this, ADA’s fundamentals, like its 92M organic transactions and $380M daily DEX volume, hint at underlying strength. The market’s cautious mood, combined with Cardano’s utility-driven ecosystem, sets the stage for a critical juncture.

Technical Indicators and Key Levels

Short-Term (1-Hour and 4-Hour Charts):

Support: $0.65-$0.68 – A key demand zone holding firm so far; $0.53 if selling intensifies.

Resistance: $0.78 – A breakout here could signal bullish momentum; $0.92 as the next target.

Indicators: RSI at ~46 (neutral with upside room), MACD showing bearish momentum. A falling wedge on the 4-hour chart suggests a possible reversal if volume supports a break above $0.78.

Long-Term (Weekly Chart):

Support: $0.60 – A major floor; $0.48 if a deeper correction hits.

Resistance: $1.00 – Psychological and historical barrier; $1.54 as a 2026 target per some forecasts.

Indicators: The 200-day MA is falling, reflecting long-term pressure, but a rising 50-day MA below the price could act as support if tested.

Potential Scenarios

Short-Term:

Bullish Case: If ADA holds $0.68 and breaks $0.78 with strong volume, it could rally to $0.92 or higher. This aligns with the falling wedge breakout narrative from X posts.

Bearish Case: A drop below $0.65 might test $0.53, especially if whale selling persists and volume confirms the move.

Long-Term:

Bullish Case: Holding $0.60 could set up a climb to $1.00 by late 2025, with potential to hit $1.54 in 2026 if adoption grows and market sentiment flips.

Bearish Case: A break below $0.60 risks a slide to $0.48, though fundamentals like network activity could cushion the fall.

Broader Context and Tips

ADA’s strength lies in its research-driven blockchain, scalable PoS consensus, and growing DeFi ecosystem. Long-term, its utility could drive value, but short-term volatility ties to market trends and macro events (e.g., US CPI data). Traders should watch $0.78 for a breakout signal and $0.65 for downside risk, volume will tell the story. Use tight stops (e.g., below $0.65 for longs) and stay alert for news on adoption or whale moves. Investors can lean on Cardano’s fundamentals but should brace for choppiness until the market stabilizes.

Cardano ADAUSD The Week Ahead 17th March ‘25The ADA/USD pair is currently exhibiting a bearish sentiment, sustained by the prevailing downtrend. The critical trading level to monitor is at 8,530, representing the current intraday swing low and the 50-day moving average (DMA) level.

In the short term, an oversold rally from present levels, followed by a bearish rejection at the 8,530 resistance, could lead to a downside move targeting support at 6,576, with further potential declines to 6,000 and 4,846 over a longer timeframe.

Conversely, a confirmed breakout above the 8,530 resistance level and a daily close above it would invalidate the bearish outlook. This bullish scenario could pave the way for a continued rally, aiming to retest the 9,775 resistance, with an extension to 11,244.

Conclusion:

The sentiment for ADA/USD remains bearish, with the 8,530 level acting as a critical resistance. Traders should remain cautious, waiting for either a bearish rejection or a breakout and daily close above this level to assess the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ADA/USD "Cardano vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ADA/USD "Cardano vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.7000) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.5200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

ADA/USD "Cardano vs U.S Dollar" Crypto Market is currently experiencing a Bearish trend in short term, driven by several key factors.

⚡⭐Fundamental Analysis

Market Capitalization : Cardano's market capitalization stands at $23.12 billion USD, with a circulating supply of 35.21 billion ADA.

Tokenomics : The total supply of ADA is capped at 45 billion, with a significant portion already in circulation.

Blockchain Technology : Cardano's blockchain technology is based on the Ouroboros consensus algorithm, which provides a secure and energy-efficient way to validate transactions.

Development Activity : The Cardano development team is actively working on improving the blockchain's scalability, interoperability, and usability.

Partnerships and Collaborations : Cardano has partnered with various organizations, including universities, research institutions, and businesses, to promote the adoption of its blockchain technology.

⚡⭐Macro Economics

Inflation : The current inflation rate is not explicitly stated, but it's essential to consider its impact on the cryptocurrency market. Rising inflation can lead to increased adoption of cryptocurrencies as a store of value.

Interest Rates : Interest rates can influence the attractiveness of cryptocurrencies like ADA. Higher interest rates can make traditional investments more attractive, potentially reducing demand for cryptocurrencies.

Global Economic Growth : The global economy is experiencing a slowdown, which can impact the demand for cryptocurrencies. However, some investors may view cryptocurrencies as a safe-haven asset during times of economic uncertainty.

Regulatory Environment : The regulatory environment for cryptocurrencies is constantly evolving. Changes in regulations can impact the adoption and price of cryptocurrencies like ADA.

⚡⭐Global Market Analysis

Trend: The ADA/USD pair is experiencing a mixed trend, with a 4.27% increase in the last 24 hours, but a 12.92% decrease in the last week.

Support and Resistance: Key support levels are at $0.63 and $0.61, while resistance levels are at $0.68 and $0.70.

⚡⭐COT Data

Speculators (Non-Commercials): The current COT report shows that speculators are holding 26,729 long positions and 9,961 short positions.

Hedgers (Commercials): Hedgers are holding 7,275 long positions and 24,341 short positions.

⚡⭐On-Chain Analysis

Transaction Volume: The 24-hour transaction volume for ADA is approximately $868.36 million USD.

Active Addresses: The number of active addresses on the Cardano network is not provided.

⚡⭐Market Sentiment Analysis

Sentiment: The overall sentiment for ADA/USD is neutral, with a mix of bullish and bearish predictions.

Fear and Greed Index: The current fear and greed index reading is not available.

⚡⭐Positioning

Long/Short Ratio: The long/short ratio for ADA/USD is not provided.

Open Interest: The open interest for ADA/USD is approximately $776.6 million USD.

⚡⭐Next Trend Move

Bullish Prediction: Some analysts suggest a potential bullish move, targeting $0.70 and $0.80.

Bearish Prediction: Others predict a potential bearish move, targeting $0.52 and $0.50, due to the recent downward trend and potential selling pressure.

⚡⭐Overall Summary Outlook

Bullish or Bearish: The overall outlook for ADA/USD is neutral, with a mix of bullish and bearish predictions.

Real-Time Market Feed: As of the current time, the ADA/USD price is $0.66, with a 0.42% increase in the last 24 hours.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Can Cardano hold $1, or will it drop to $0.74?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Cardano 🔍📈.

Cardano broke out of its downward channel on positive news but quickly retraced its gains. It now trades near the key psychological level of $1, with major monthly support below. Losing this support could trigger a decline of at least 20%, targeting $0.74. This level aligns with a crucial daily support zone, making it a key area to watch.📚🙌

🧨 Our team's main opinion is: 🧨

Cardano briefly surged on positive news but quickly dropped back, now hovering near $1; losing key support could trigger a 20% drop to around $0.74. 📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

#ADA/USDT#ADA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.5923

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.6615

First target 0.7111

Second target at 0.7585

Third target at 0.8205

#ADA/USDT#ADA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.6400

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.7280

First target 0.7584

Second target 0.8267

Third target 0.9112