Cocoa Futures ( CC1! ), H4 Potential for Bullish ContinuationTitle: Cocoa Futures ( CC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 2838

Pivot: 2660

Support: 2565

Preferred case: Looking at the H4 chart, my overall bias for CC1! is bullish due to the current price above the Ichimoku cloud, indicating a bullish market structure. If this bullish momentum continues, expect price to retest the pivot at 2660 where the overlap support and 50% Fibonacci line is before heading back up towards the resistance at 2838, where the previous swing high is.

Alternative scenario: Price may head back down towards the support level at 2565, which is the overlap support.

Fundamentals: There are no major news.

Agricultural Commodities

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

May Wheat futures: Daily trend reversalThis setup can lead to a larger failure of a weekly decline signal, which could cause a major move in $ZW_F. I'm long May futures here, paying close attention to how it develops, if the signal isn't stopped the trade could be held for longer until the chart evolves into a higher timeframe trend potentially, that would be the ideal scenario here.

Best of luck!

Cheers,

Ivan Labrie.

easyMarkets Cotton Daily - Quick Technical OverviewDisclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

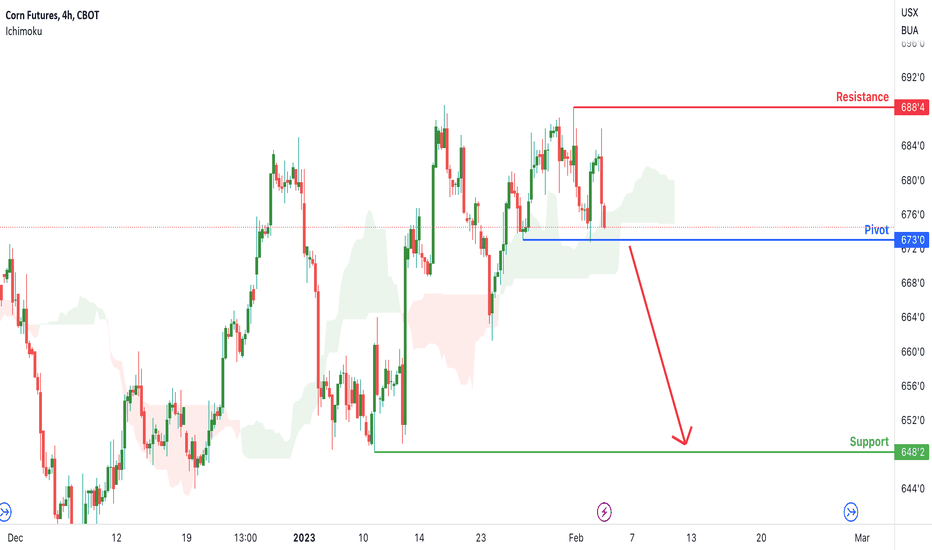

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly head towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 214.05

Pivot: 172.60

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to retest the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before continue heading towards the resistance at 214.05, where the overlap resistance is.

Alternative scenario: Price may head back down to break the pivot at 172.60, where the 23.6% Fibonacci line and overlap support are, before heading towards the support at 142.05, where the previous swing low is.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish ContinuationTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 706.50

Pivot: 6681.00

Support: 673.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 673.00 where the recent low is located.

Fundamentals: There are no major news.

Soy Bean (The Future is Bright?)View On Soy Bean (26 Jan 2023)

What a lovely Bullish Price action we had.

It also have a strong monthly swing level (1450~1470) to boost.

I am expecting the price of Soybean is to go UP further.

The momentum will pick up stronger once the price has broken up 1510 region.

Le't find out.

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

CT1! Potential For Bearish DropLooking at the H4 chart, my overall bias for CT1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 85.49, where the 23.6% Fibonacci line and overlap resistance is.

Stop loss will be at 88.88, where the recent high is. Take profit will be at 77.50, where the previous swing low is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 706.50

Pivot: 688.75

Support: 661.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 661.25 where the 61.8% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

Coffee C Futures ( KC1! ), H4 Potential for Bullish ContinuationTitle: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 174.95

Pivot: 157.55

Support: 142.05

Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. If this bullish momentum continues, expect price to continue heading towards the resistance at 174.95, where the previous swing high is.

Alternative scenario: Price may head back down to retest the pivot at 157.55, where the 38.2% Fibonacci line is.

Fundamentals: There are no major news.

Sugar Futures ( SB1! ), H4 Potential for Bullish ContinuationTitle: Sugar No. 11 Futures ( SB1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 21.18

Pivot: 18.94

Support: 20.04

Preferred case: Looking at the H4 chart, my overall bias for SB1! is bullish due to the current price crossing above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to continue heading towards the resistance at 21.18, where the previous swing high is.

Alternative scenario: Price may head back down towards the overlap support at 20.04, slightly below where the 38.2% Fibonacci line is.

Fundamentals: There are no major news.

CC1! Potential For Bearish ContinuationLooking at the H4 chart, my overall bias for CC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 2602, where the overlap resistance and 61.8% Fibonacci line is. Stop loss will be at 2675, where the recent high is. Take profit will be at 2507, where the recent low is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Cocoa Futures ( CC1! ), H4 Potential for Bullish RiseTitle: Cocoa Futures ( CC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 2699

Pivot: 2564

Support: 2451

Preferred case: Looking at the H4 chart, my overall bias for CC1! is bullish due to the current price above the Ichimoku cloud, indicating a bullish market structure. If this bullish momentum continues, expect price to head back up towards the resistance at 2671, where the previous swing high is.

Alternative scenario: Price may break the pivot at 2564, where the 23.6% Fibonacci line is before heading towards the support level at 2451, where the 50% Fibonacci line is.

Fundamentals: There are no major news.