Bbriindonesia

BBRI Inverted Head and ShoulderWe can see BBRI in the monthly timeframe showing bullish from the 2000s. This moment can be used by investors for long-term investment. Here I see that the stock is forming an inverted head and shoulder pattern where this pattern will bring the price up, until it is equal to the shoulder. The price target to be achieved is around the price of 6100.

#Disclaimer: Not a suggest to buy or sell

BBRI MAKES FLAG PATTERNBBRI after strong bullish pressure make a rest a little bit which is called secondary trend. This secondary trend makes flag pattern that will bring price continuation to the upside. Also, we can see with 3 EMA (8, 21, 34) which is fibonacci number that i used to determine trend of the market shows bullish to the upside. Please make sure your analysis.

#RiskDisclaimer.

Bullish Bias on BBRIAs wee see that this market formed a huge falling wedge as an indication of big accumulation with several bullish momentum confluence as writen on the price chart, this market would meet it's price target at 4720. Buy on weakness should be your consideration. Invalidation start if the price goes down and close below 3370

Rejected by all-time high or new high BBRI? IDX:BBRI

It will be interesting to see whether or not $BBRI will create its new high or be rejected by its all-time high. Well, the upside potential is still a good opportunity to take profit.

Happy trading, and be safe.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

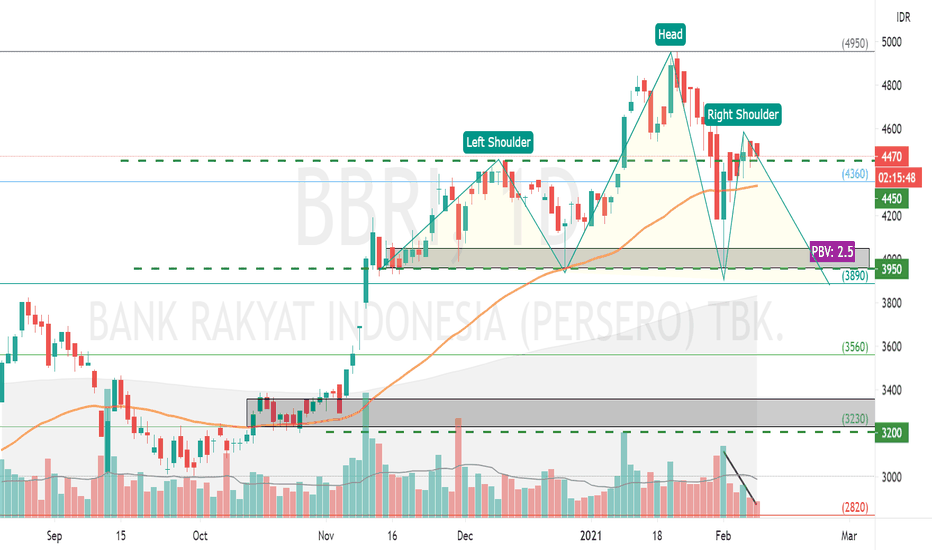

Potential HnS Chart PatternBBRI has the potential to form a Head and Should chart pattern. By looking at last week's movement pattern where the volume at the break of 4470 resistance was not big enough and the trend decreased afterwards, it would be better to wait for confirmation before entry. Possible short-term movement is still sideways.

From the market maker movement side, BBRI is one of the issuers that foreign hold almost 80%, with an average price of around 4400. Currently, Foreign Flow is increasing by a proportion of more than 20%, meaning that the potential will increase and have been accumulated for a long time.

If you want to entry, it's better to wait until technically confirmed.

REKOMENDASI REENTRY BBRI (WAIT OPPORTUNITY, BUY ON WEAKNESS)TEKNIKAL :

- D1 masuk area supply

- D1 belum mampu menembus trendline

FUNDAMENTAL / RUMOR

-

REKOMENDASI :

* BUY LIMIT :

- area 3600 - 3800 reason fibo level 38, level 50 D1, RbS, dan gap

* BUY STOP :

- area 4400 HIGH RISK, reason menembus trendline

TARGET PRICE :

- 4100 - 4200, reason area supplu

- 4700 reason resistent

- HOLD