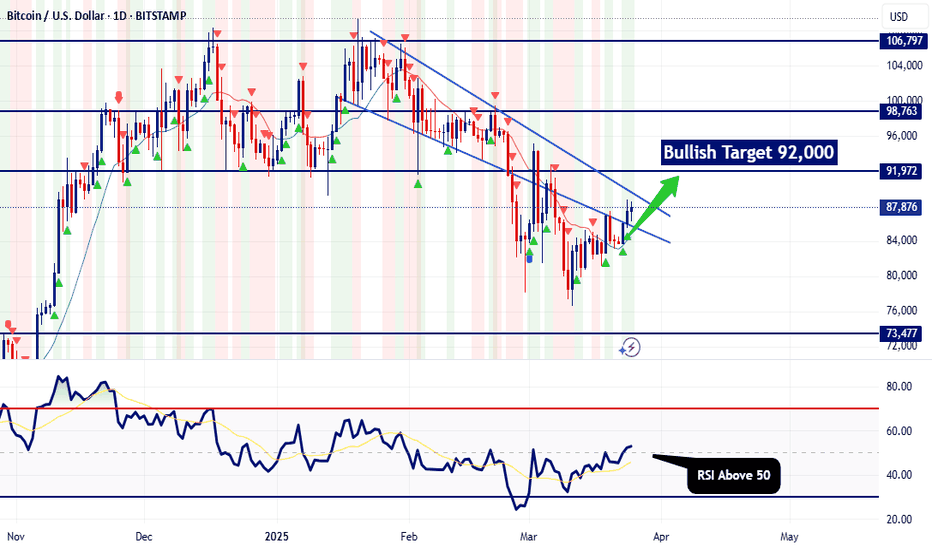

BITCOIN Trending Higher - Can Bulls Maintain Momentum?COINBASE:BTCUSD is trading within a well-defined ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting a potential continuation toward higher levels.

The price has broken above a key resistance zone and successfully retested it as support, confirming the bullish structure. This retest strengthens the case for further upside, with the next target aligning with the upper boundary of the channel near $91,000.

As long as the price remains above this newly established support, the bullish outlook stays intact. However, if the price fails to hold above this zone, a deeper pullback toward the midline or the lower boundary of the channel could come into play.

Remember, always confirm your setups and trade with solid risk management.

Best of luck!

Bitcoin (Cryptocurrency)

Is BTC Bitcoin Overextended? My Bias Is Bullish With Conditions!This 30-minute chart 🌟 shows Bitcoin consolidating within a descending channel after a recent bullish breakout 🚀, with a potential bullish structure forming. The price is currently testing the upper boundary of the channel near $87,500 🛡️. If the price breaks below the channel and retests the equilibrium support, it could present a strong buy opportunity 💰 . Considering the broader analysis 🌍, a break above $87,926 with strong volume 🔥 would confirm bullish momentum toward $90,000 🎯 . Not financial advice. ✨

VELAS IS READY TO IGNITE!🔥 VELAS IS READY TO IGNITE! 🔥

This chart screams massive breakout incoming — and here's why you should be paying attention right now:

📈 Falling Wedge Pattern Detected!

One of the most bullish reversal patterns in crypto. Velas ( LSE:VLX ) is tightening its coil, and once that breakout hits, we're looking at a potential moonshot.

🚀 Explosion Incoming – Targets as High as $0.024!

That massive blue arrow isn’t just for show – it’s pointing to the next major resistance zone. If this breakout plays out (and all signs say YES), we're talking about +400% gains from current levels!

🧠 Technical Indicators Support the Pump

MACD is showing early signs of bullish divergence.

RSI is climbing out of oversold territory.

Stochastic is crossing up — the bottom may already be in.

Money Flow Index is turning — smart money may already be accumulating.

🗓️ Key Catalyst: March 20th Update by Alex Alexandrov

With the Velas 2.0 Subchain Devnet, ERC20 upgrades, EVML support, and more — the fundamentals are aligning with the technicals. This is textbook launchpad energy.

⚡️ TL;DR: Velas is building momentum like a slingshot being pulled back. The tighter it winds, the harder it’s going to snap forward. Don’t miss this wave. Don’t blink. The move could be violent.

🌕 VELAS TO THE MOON – ARE YOU READY? 🌕

BTCUSD Trade Idea: is it gonna move?A bullish trade setup on BTC/USD, targeting a move towards the previous day's high or the nearby Order Block . The price recently swept the previous day's low's liquidity (86,407.34), indicating potential support. A long entry is placed after a retracement, with a stop loss below recent lows and a take profit set near 87,654.55.

I have revised the description of the big picture

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point of observation is whether it can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain the details again when the bear market starts.

-

Thank you for reading to the end.

I hope you have a successful trade.

-----------------

BITCOIN on a Bull Flag that targets $94000.Bitcoin is trading inside a Channel Up since the March 11th market bottom.

The recent 2day pull back is a Bull Flag that just hit the 0.5 Fibonacci retracement level.

Ahead of an emerging Golden Cross (4h), this is a triple buy signal.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 94000 (the 2.0 Fibonacci extension).

Tips:

1. The RSI (4h) is also rebounding on its 2 week Rising Support. An additional strong buy signal.

Please like, follow and comment!!

Be careful with BTC !!!If the price breaks the wedge, it will drop to the 0.618 line and then rise to $90K .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

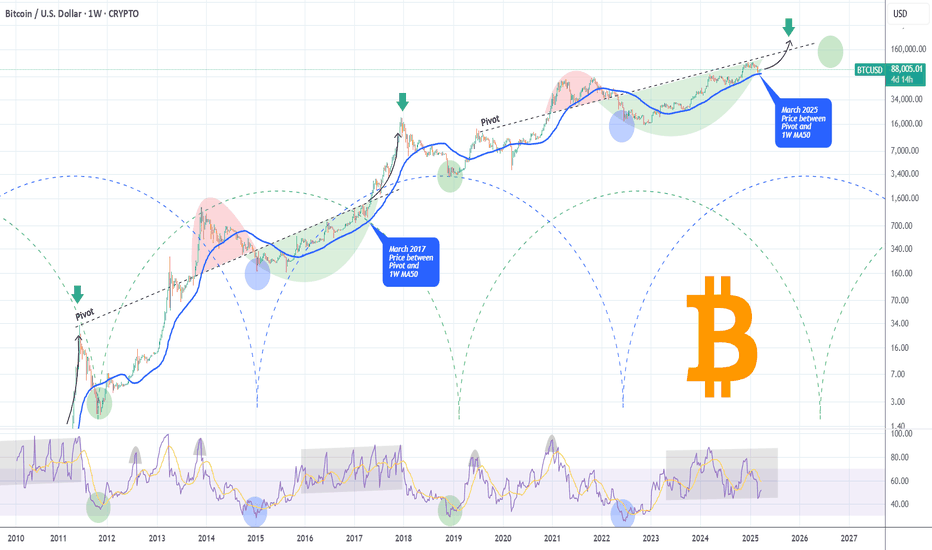

BTCUSD: Can $160k be a very 'pessimistic' target estimate?Bitcoin is neutral on its 1W technical outlook (RSI = 50.359, MACD = 2868.500, ADX = 51.194) and having rebounded almost on its 1W MA50, there couldn't be a better buy opportunity for the rest of the year. Basically the price is now ranged inside the 1W MA50 and top trendline of the Pi Cycle, while the 1W CCI hit the -100.00 oversold limit. This has been the most efficient buy entry in August 2024 August 2023 even on the Cycle before in June 2021.

Even if the market doesn't make an 'excessive top' above the Channel Up, like the last two Cycles, hitting $160,000 would still be under the top of the Channel Up and the top of the Pi Cycle. No matter how high this target seems now, it will still be a pessimistic, 'bad case' scenario.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

BITCOIN Wait For Breakout! Sell!

Hello,Traders!

BITCOIN is trading below

The horizontal resistance

Of 92,000$ and has formed

A bearish wedge pattern so

We are bearish biased and

IF we see a bearish breakout

From the wedge we can

Be expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HelenP. I Bitcoin can little grow and then drop to support levelHi folks today I'm prepared for you Bitcoin analytics. Some time ago price started to decline and when it fell to 93500 points, it rebounded up to the trend line. Then BTC started to fall inside the wedge, where it soon broke the 91200 level and then in a short time declined to the support zone. After which it turned around and rose to the trend line, which is the support line of the wedge as well. Then Bitcoin fell to the support level again, breaking the resistance level again, but later it tried to back up and failed. Price dropped to the support zone and even a little lower, after which it turned around and in a short time rose to the trend line, breaking the support level one more time. A few moments ago price exited from the wedge and some time traded near the trend line. After this, it started to grow, so, in my opinion, I expect that BTCUSDT will almost rise to the resistance level and then it drop to the 81200 support level, which is my goal. If you like my analytics you may support me with your like/comment ❤️

Bitcoin’s Next Challenge – Can BTC Break the Heavy Resistance?Bitcoin ( BINANCE:BTCUSDT ) started to rise from the Support zone($84,120_$81,500) as I expected in the previous post . The question is, can Bitcoin break the Heavy Resistance zone($93,300_$89,200) and Resistance lines ?

Please stay with me.

Bitcoin appears to have broken through the Resistance zone($87,100_$85,800) and is preparing for its first attack on the Heavy Resistance zone($93,300_$89,200) .

In terms of waves, Bitcoin appears to be completing microwave 4 of microwave C of the main wave Y . The waves structure inside the Ascending Channel appears to be of the Double Three Correction(WXY) .

I expect Bitcoin to prepare for its first attack on the Heavy Resistance zone($93,300_$89,200), the upper line of the ascending channel , the monthly pivot point , 50_SMA(Daily) , and the Resistance lines after completing the pullback to the Resistance zone($87,100_$85,800 ) and fill first CME Gap($86,640_$86,520) . I think the Potential Reversal Zone(PRZ) could be the zone to start a new decline for Bitcoin.

I chose the label of this analysis ''SHORT'' because I think Bitcoin is in a bit of a risky zone for a LONG position, what do you think?

Note: If Bitcoin goes over $91,000, we can expect more pumps.

Note: If Bitcoin falls below $85,200 before hitting the Heavy Resistance zone($93,300_$89,200), we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Mega Cycle starting the final Parabolic Rally.This is not the first time we review the Mega Cycle Theory on Bitcoin (BTCUSD). This states that in reality BTC's Cycle's since the beginning aren't 4 as traditional models suggest but 2. And in fact instead of the 4th, we are currently on just the 2nd BTC Mega Cycle.

Well this Theory has for sure a better gel with the stock market trend in the past 15 years but what's more important is that the price is now (March 2025) within the underlying Pivot trend-line and the 1W MA50 (blue trend-line), which is the same level it was coming toward the end of the 1st Mega Cycle. That was when it broke above the Pivot and started the hyper aggressive Parabolic Rally.

This Pivot trend-line is essentially the level that starts after the initial Cycle rally and acts as a Resistance turned Support and then Resistance again until the Cycle's final Parabolic Rally. Practically the Cycle mapping is more effectively viewed on the 1W RSI sequence. We are now at the stage when the 1W RSI ranges for the past 2 years between overbought (80.00) and neutral (45.00) like it was in 2016 - 2017.

In any case, this is yet another study showing that Bitcoin's Top can be at around $150k, which is currently marginally above the Pivot and as we head towards the end of 2025, the bar is raised to as high as $200.

So do you think we are just starting the final year Parabolic Rally to at least $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

levels to watch out The bulls will claim it's on an upward trajectory, while the bears will argue it's heading south. As I see it, we're in a tricky spot, with the markets currently in a no-man's land.

It's respecting the channel, but it lacks clear direction, which means it could swing either way—ultimately pleasing one side while bruising the ego of the other.

If the neckline at 91,000 breaks, we could see the market push towards 108,000 potentially even reaching 125,000. On the flip side, as long as 91,000 holds, we might still see a move towards 71,000 and if that breaks, there's a possibility of the market heading down to 40,000.

BTC Accumulation Zone: Technicals & Cyclical Entry StrategiesBitcoin’s long-term macro structure does not currently align with bear market conditions as defined by sustained price decay below key moving averages or a violation of multi-year structural support. Presently, the market exhibits characteristics of a consolidation phase within a broader uptrend, presenting asymmetric opportunities across micro, medium, and macro timeframes for participants who anchor decisions to quantifiable support/resistance zones, Fibonacci retracements, and volume-weighted price anchors. The current price regime between $70,000 and $80,000 represents a high-probability accumulation zone, validated by the incomplete Wave 5 extension (post-election rally), which implies unresolved cyclical momentum, historical fractal patterns suggesting Wave 5 extensions often retrace 38.2–50% of Wave 3, on-chain metrics such as dormant supply accumulation (declining exchange reserves) and rising HODLer net positions signaling smart money redistribution, and risk-reward asymmetry tied to the 78,000–73,000 zone’s alignment with the 2024 realized price (~$69,000) and the 200-day moving average. Position management should prioritize a dollar-cost averaging strategy within the 70,000–80,000 zone, weighted toward Fibonacci retracement levels (78.6%, 61.8%), and volatility-adjusted sizing using the Average True Range to align risk per trade with portfolio volatility targets. Behavioral risks such as retail panic (measured by Fear & Greed Index extremes) and media-driven FUD create liquidity voids exploitable by informed participants, while Bitcoin’s cyclical patterns (halving-driven supply shocks, four-year cycles) mirror 2013–2017 fractals, underscoring the asset’s asymmetric return profile. Disciplined investors recognize that volatility is the premium paid for non-correlated alpha, and Bitcoin’s current structure—anchored by on-chain fundamentals and cyclical tailwinds—rewards systematic, mathematically rigorous strategies focused on position sizing, risk management, and predefined triggers. Markets oscillate between fear and greed, and the 70,000–80,000 zone represents where capital is deployed by those who understand that risk is managed, not avoided, and that asymmetric opportunities arise from preparation rather than prediction. Ignoring noise and trusting data-driven analysis remains critical to navigating this phase.

Alex Kostenich,

Horban Brothers.

Bitcoin correction. Waiting for 70k-76kBitcoin correction. Waiting for 70k-76k

The previous idea suggested Bitcoin would reach $95,000-$100,000 before entering a 1-2 year bear phase alongside the U.S. stock market decline.

Bitfinex:

However, based on Coinbase orders in the $70,000-$76,000 range and recent BTC sell-offs on Bitfinex over the past three days, it looks like this correction is being dragged out to trigger more liquidations.

This crypto correction might also align with an SP500 drop. Waiting for lower levels to find good entry points.

Coinbase orders:

BTC/USDC Liquidation Heatmap

Stablecoin liquidity = Bitcoin bullish thesis --> $109k?Can BTC soon climb to the $109,000 level thanks to stablecoin liquidity? Maybe yes!

An increase in stablecoin market cap often signals more money entering the crypto space, indicating bullish sentiment as investors prepare to deploy capital. This increased liquidity can lead to smoother trading and attract more participants, potentially driving up Bitcoin's price.

The chart clearly illustrates this relationship:

Purple line ( CRYPTOCAP:USDT + CRYPTOCAP:USDC + CRYPTOCAP:DAI + CRYPTOCAP:USDEE market cap) shows steady growth

Bitcoin candle chart ( COINBASE:BTCUSD price) follows with more volatile increases

Blue line at the bottom: BTC and stablecoin correlation coefficient of 0.9 😊

This correlation can serve as a leading indicator for Bitcoin price movements. During downturns, investors might sell Bitcoin for stablecoins, but as sentiment shifts, this "dry powder" can quickly flow back, driving Bitcoin's price up.

Adding to that, the long-term correlation coefficient between stablecoin liquidity market cap (USDT+USDC+DAI+USDE) and Bitcoin is 90%. So, yes, there's a strong long term correlation and usually BTC and stablecoin liquidity converge.

According to my views on the stablecoin liquidity, the Bitcoin price should target the $109k level.

Last time I made this analysis, Bitcoin jumped from $58k to my price target of FWB:73K in the span of 2 months.

Let me know your thoughts.

BITCOIN Correction in Play - Can Bulls Regain Control?COINBASE:BTCUSD is experiencing a corrective move after forming a double top near the upper boundary of the channel. The rejection from this level has led to increased selling pressure, with price steadily approaching a significant support zone around $73,000. The confluence of the trendline support and the horizontal demand zone increases the probability of a bullish reaction.

If buyers step in at this level, we could see a rebound, with a potential move toward the $90,000 resistance zone. This level could act as a short-term target within the current market structure.

However, failure to hold this support could signal further downside, potentially extending the retracement toward lower levels. Traders should monitor bullish confirmation signals, such as rejection wicks, increasing volume, or bullish engulfing patterns, before anticipating a continuation to the upside.

If you agree with this analysis or have additional insights, feel free to share your thoughts here! 🚀

BTCUSD - Buy Trade SetupTaking a look at the daily chart, BTCUSD is now above 88k and I'm expecting further upside towards 92k, This week we have PCE inflation data from the US on Friday. Should inflation come in weaker then analyst forecast, that should weaken the dollar and thus power up Bitcoin.

We will have to wait and see what happens but as of right now, technicals are indicating of a good possibility.

Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker.

Trade Safe - Trade Well

~Michael Harding

What will happen first? BTC to 67k or to 100K?Hey traders! Long time no see.

Looks like Trump and his team won’t be responsible for keeping the market healthy anymore—or maybe they just don’t care right now...

So let’s check some technicals and try to figure out what to expect next.

Not gonna lie, the picture isn’t looking too bright 🥹

Even though we’re moving up a bit, this price action feels more like a bearish flag—meaning we could be setting up for further downside (nervous laugh). Plus, that golden cross on the weekly chart isn’t giving bullish vibes, and volume is confirming our fears.

So… if this plays out, does that mean no bull season for now?

What do you think, guys? Any promising news out there?

BTC/USDT Analysis: Buyers Have Lost Initiative AgainYesterday, Bitcoin attempted to break the $87,500 level but encountered strong selling pressure, as indicated by the cumulative delta. Each new high appears weak, suggesting that buyers need more strength to develop a full-fledged trend. To achieve this, liquidity below must be tested. If this scenario unfolds, we expect a move toward the local low since only technical levels remain as support, with all major volume zones already tested.

We are looking for short positions upon a reaction in the local sell zone of $88,000-$88,600.

Sell Zones:

$88,000-$88,600 (local volume zone)

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$77,000-$73,000 (volume anomalies, pushing volumes)