BTC/USDT Analysis – Setup for a RangeYesterday, while we were trading within the $78,000–$80,000 zone, no significant market buying appeared, so the price moved to test the local low. The $74,500 level wasn't swept, and we saw strong absorption of market selling, which led to a rebound.

Currently, price is caught between a volume zone and an area of buyer activity, and the signs suggest a developing sideways range.

In the coming days, we expect a full test of the local low. A false breakout of this level could offer interesting long opportunities, though we also can't rule out a full breakdown and a move toward the next buyer zone.

Sell Zones:

$78,000–$80,000 (volume zone)

$82,000–$83,900 (volume zone)

$85,600–$88,000 (absorption of buyer aggression)

$95,000–$96,700 (accumulated volumes)

$97,500–$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zone:

$69,000–$60,600 (accumulated volumes)

Bitcoinprediction

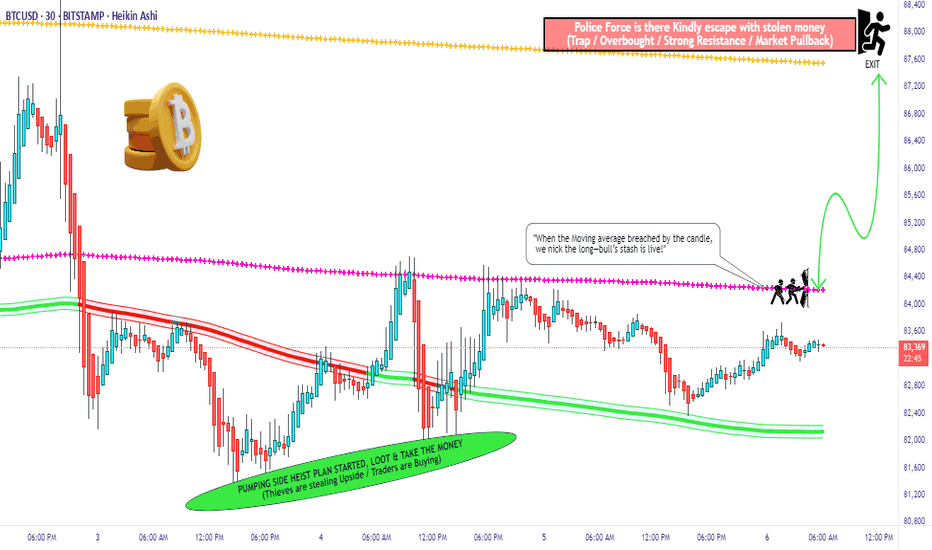

"Bitcoin vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (84.400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

Thief SL placed at the recent/swing low level Using the 30mins timeframe (82.000) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 87.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BTC/USD "Bitcoin vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BITCOIN NEW SWING UPDATESHello folks, crypto folks. bitcoin might go to 3.168 fibs. but only if price can go lower 60k below.

THe idea of zoning for entries are a big risk for it.

This is only my view, this is a continuation pattern.

lets trade it to swing.

check my comments below I post some cool. stuff

THis is not a financial advice.

FOllow for more

Bitcoin Weekly For The Value Hunters & Range Enjoers. With lack of significant bid in the books until 70k. Ideally we drop to value sooner than later & gather demand with a range through summer. Supply has been chasing price down, with perps traders off loading latest positions yesterday in the US session.

This will be painful to most crypto traders but good for range trade enjoyers & spot value hunters.

Key levels: 70/71k Weekly & this is both spot & perps largest resting order blocks in the order books.

#Bitcoin Yearly Analysis #Bitcoin Trading around $83.6k

Now, As per Weekly Chart Analysis-

If you go for Bitcoin 4 years of Cycle of #Halving to #Halving, it includes always #Bullish #Bearish & Stable Zones of Bitcoin & #Altcoins tradings..

Now, as per yearly cycle..

Bitcoin moved always as per 3 Green & 1 Red Cycle, as per that scenario 2023, 2024 & 2025 is Green Candles year & 2026 will be Red Candle year of #BearishZone.

So, this seasons #BullRun last phase will be starts around August onwards to Dec-Jan. 2026 and after that market will be go under deep #BearishZone.

So, don't be panic at hard, that's the last opportunity time frame of 120/150 days, in which you will be make your again entry points on hard max. time around june-July 2025 at last for #Bitcoin Last time Lower-Low of approx. FWB:65K -67k.

Anyways,

Always #DYOR and Trade Wisely by using of #StopLoss strategy... 🙏

$$$ BTCUSD MACRO-BULLISH $$$ 1W CHART $$$BITFINEX:BTCUSD 1W Chart

There are many reasons to look at this weekly chart and see that there's absolutely no reason to be bearish on Bitcoin yet.

Holding strong r/s flip support.

Holding regression trend.

Holding parabolic trend.

Stoch RSI at the bottom.

Weekly bullish divergence.

Assuming this plays out in a way that's similar to the last local bottom, the current target is around $134k-$135k.

It would take a lot to invalidate all of these bullish indicators, but if that does somehow happen, with a CLOSE of the weekly candle that invalidated these, then It's pretty much definitely over for a loooong time.

NFA blah blah blah..

BTC/USDT Analysis – Expected ReboundWhile the entire market was panicking and selling off, our primary scenario was a rebound from the buyer zone at $77,000–$73,000, which has played out.

Yesterday, Bitcoin experienced an abnormal spike in volume. A breakout and consolidation either below or above the newly formed volume zone at $78,000–$80,000 will set the trend for the coming days.

Our main scenario suggests a move toward the sell zone above the current price. At the moment, we are seeing a slight absorption of market selling based on delta analysis.

In a bearish scenario, support is expected on a false breakout of the local low at $74,550.

Sell Zones:

$82,000–$83,900 (volume zone)

$85,600–$88,000 (absorption of buyer aggression)

$95,000–$96,700 (accumulated volumes)

$97,500–$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zone:

$69,000–$60,600 (accumulated volumes)

Were To Buy BITCOINMartyBoots here , I have been trading for 17 years and sharing my thoughts on COINBASE:BTCUSD here.

.

BTC is very interesting chart for now that it has dipped 30% and trying to find support.

Do not miss out on BTC at the important levels as this will be a great opportunity

Watch video for more details

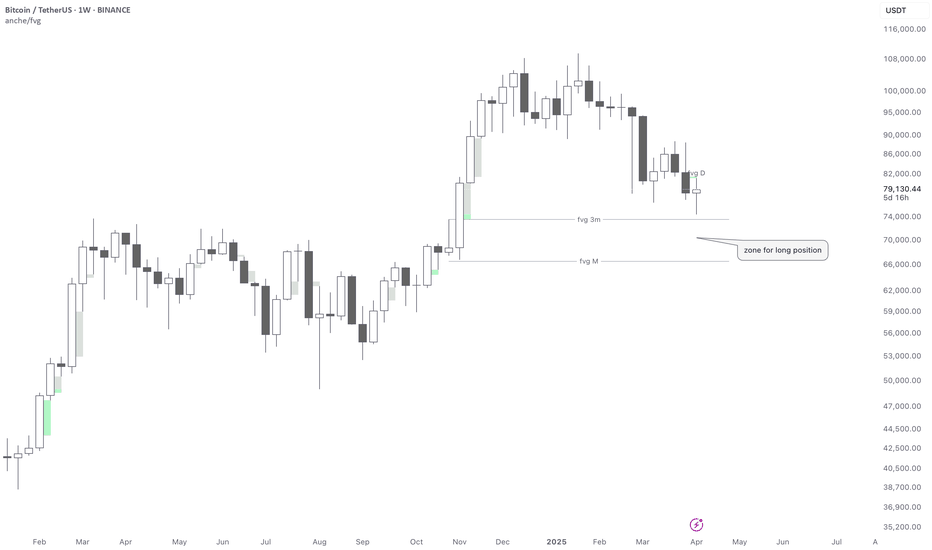

BTCUSDT📊 Bitcoin Weekly Analysis – Smart Money Concept (SMC)

On the 1W BTC/USDT chart, we are currently observing a corrective move after a strong bullish impulse. The price is approaching a high-probability demand zone formed between two significant Fair Value Gaps (FVGs):

• 🔹 FVG 3M around $74,000

• 🔹 FVG M around $66,000

🟩 Long Setup Zone:

The area between these FVGs represents a discounted price zone where smart money is likely to step in. This is labeled as a “zone for long position” on the chart.

⸻

🧠 Smart Money Perspective:

• The market is in a retracement phase, targeting inefficiencies (FVGs).

• If price taps into this zone and shows signs of bullish intent (e.g., weekly bullish engulfing, BOS/CHOCH on lower timeframes), we can expect a strong upward move.

⸻

🎯 Mid-to-Long Term Target:

• Based on the current market structure and SMC model, the next major target is $130,000.

⸻

🔐 Risk Management:

• Ideal entry: within the FVG zone

• Stop-loss: below the lower FVG (around $65,000)

• Confirmation: bullish price action on lower timeframes or weekly candle close with strong momentum

⸻

📌 Conclusion:

This setup offers a potential high-reward opportunity if smart money reacts to this discounted zone. Patience and proper confirmation are key.

⸻

MAJOR BULL RUN RALLY INCOMING !!! Starting From MAY 2025 !!!On Big Picture starting from 2020....

Inverse H & S was formed... after breakout we got pull back & then it started 8 months rally from September 2020 To April 2021.

Then after deep bear market, we got Inverse H&S... after breakout, we got pull back & then it started 8 months rally from September 2023 To April 2024.

Now. we got big H&S... after breakout, we are getting pull back & now we are almost near at support level of H&S. From around 74-66K region, reversal bull run rally is expected which will most probably start from next month ( May 2025) and around after 8 months (October-December) we would be roaming ATH around 300K !!! which tags exactly at major resistance line. By copy pasting 2021 rally's candles pattern on current scenario, we can see exactly how things are going to shape in upcoming months.

Lets Hope For The Best !!!

Breaking: Bitcoin Loses $80,000 Support The price of Bitcoin ( CRYPTOCAP:BTC ) today saw a noteworthy downtick of 2.24% today making it down 7% since last week losing the $80k grip. This move came days after Donald Trump the recently elected president, on Wednesday, announced a minimum tariff rate of 10% and higher rates for 57 economies like China (34%), the European Union (20%), and Japan (24%). Fitch Ratings estimated that the effective tariff rate could hit 25% on average — the highest in more than 115 years.

The asset has tanked to the $76,000- $74,000 support point, placing CRYPTOCAP:BTC on the brink of a selling spree should CRYPTOCAP:BTC break below the $70k support, possible retracement should be around the $60- $50k support points.

Similarly, with CRYPTOCAP:BTC trading below key Moving Averages (MA), and the RSI at 35, CRYPTOCAP:BTC is gearing up for a reversal albeit the market is still volatile. If Bitcoin ( CRYPTOCAP:BTC ) should break the 1-month high resistant a possible uptick to $120k is feasible.

Bitcoin Price Live Data

The live Bitcoin price today is $77,615.23 USD with a 24-hour trading volume of $78,391,741,615 USD. Bitcoin is down 5.64% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $1,540,502,278,162 USD. It has a circulating supply of 19,847,937 BTC coins and a max. supply of 21,000,000 BTC coins.

Critical zone for Bitcoin – Pump or Dump!(Mid-term Analysis)Today, I want to analyze Bitcoin ( BINANCE:BTCUSDT ) on a weekly time frame so that you can take a mid-term view of BTC. On November 12, 2024 , I shared with you another weekly analysis in which we found the All-Time High(ATH) zone well.

Please stay with me.

Bitcoin has been on an upward trend for the past 27 months , increasing by about +600% . Have you been able to profit from this upward trend in Bitcoin?

During these 27 months , Bitcoin has had two significant corrections , the first correction -20% and the second correction -33% (interestingly, both corrections lasted about 5 months ).

Another thing we can understand from the two main corrections is that the second correction is bigger than the first correction , and since Bitcoin is currently in the third correction , we can expect the third correction to be either equal to the second correction or greater than the second correction . Of course, this is just an analysis that should be placed alongside the analyses below .

It seems that the start of Bitcoin's correction can be confirmed with the help of the Adam & Adam Double Top Pattern(AADT) . Bitcoin also created a fake breakout above the Resistance lines .

Educational tip : The Adam & Adam Double Top (AADT) is a bearish reversal pattern characterized by two sharp, ^-shaped peaks at nearly the same price level. It indicates strong resistance and a potential trend reversal once the price breaks below the neckline between the peaks.

Bitcoin appears to be completing a pullback to the broken neckline .

According to Elliott's Wave theory , Bitcoin seems to have completed its 5 impulse waves , and we should wait for corrective waves . It is a bit early to determine the structure of the corrective waves , but I think it will have a Zigzag Correction . The structure of the corrective waves depends on the news and events of the coming weeks and months.

I think the Potential Reversal Zone(PRZ) will be a very sensitive zone for Bitcoin.

I expect Bitcoin to start correcting again when it approaches $87,000 or $90,000 at most, and fills the CME Gap($86,400_$85,595) , and at least approaches the Heavy Support zone($73,800_$59,000) AFTER breaking the uptrend line .

In your opinion, has Bitcoin finished its correction or created an opportunity for us to escape again?

Note: If Bitcoin goes above $90,500, we should expect further increases and even make a new All-Time High(ATH).

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), Weekly time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Market overview

WHAT HAPPENED?

Last week, US President Donald Trump announced the amount of trade duties on imported goods. Bitcoin was restrained from falling in the $83,600–$82,500 zone, but the selling pressure turned out to be stronger, and we updated the local minimum.

At the moment, we’ve dropped to the buy zone of $77,000–$73,000 (volume anomalies pushing volumes). Volumes have been increased, and most liquidations are priced at $75,200.

WHAT WILL HAPPEN: OR NOT?

We expect a rebound from the current buyer's zone. The reversal formation hasn’t been formed yet, so long positions are only possible on the spot asset. For margin trading, it’s necessary to wait for additional confirmation.

A more negative scenario is a decrease to the next zone of accumulated volumes of $69,000-$60,600. The probability of such a decline without a proper rebound is very low.

Sell Zones:

$82,000–$83,900 (high-volume zone)

$85,600–$88,000 (absorption of buyer's market aggression)

$95,000–$96,700 (accumulated volumes)

$97,500–$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$77,000–$73,000 (volume anomalies, pushing volumes)

$69,000–$60,600 (accumulated volumes)

IMPORTANT DATES

We’re following these macroeconomic developments:

• Wednesday, April 9, 2:00 (UTC) — announcement of the New Zealand interest rate decision;

Wednesday, April 9, 18:00 (UTC) — publication of FOMC minutes;

• Thursday, April 10, 12:30 (UTC) — publication of the basic US consumer price index for March, as well as in comparison with March 2024, and the number of initial applications for US unemployment benefits;

• Friday, April 11, 06:00 (UTC) — publication of UK GDP for February and German consumer price index for March;

• Friday, April 11, 12:30 (UTC) — publication of the US producer price index for March.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

Time Has Came For Bitcoin NOW!!!As Updated previously on Macro, We have reached at crucial zone. According to Elliott wave count on big picture, BTC formed ending diagonal and now approaching at it's reversal points. From this area of 75-69k region, there's high probability of trend reversal and we will soon see shorters getting rekt

Bitcoin: Breaking Below $80K Soon,10% Correction on the Horizon?Hey Realistic Traders, Bitcoin is consistently hitting new lower lows. Could this signal that the bear market is here to stay? Let’s dive in.......

On the H4 chart, Bitcoin is clearly in a bearish phase. It consistently trades below both the trendline and the EMA 200, reinforcing the downtrend. Additionally, a rising wedge pattern has formed and broken out, and the MACD has shown a bearish crossover. This crossover is a key indicator, signaling that momentum is shifting from buyers to sellers.

Together, these signals suggest that Bitcoin may drop toward our first target at 79,081. After reaching this level, a short pullback is expected as traders take profits before the price continues its descent toward a new low at 73,633.

This outlook remains valid as long as the price moves below the stop-loss level at 89,557

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Bitcoin.

Bitcoin Bullish Idea I'll be buying for that point of interest 78544.71 if I see confirmation for reversal. Though H8 zone 79100.20 looks valid too as the price has triggered it and rejects it awesomely.

My projection is this new week is going to be Bullish not just for Bitcoin but some other. Crypto pairs too.

I'm bullish on Eth as well.

Kindly boost if you find this insightful 🫴

BITCOIN SEEMS TO FOLLOW THIS PATH TOWARDS 120k !!!According to elliott wave count, If BTC has completed it's macro wave (IV), then we can expect it moving to complete it's macro wave (V).

In this case if recently impulse move is counted as micro wave (i), then we can expect reversal from 81-79K region very soon.

Otherwise, if micro count gets Invalid, then reversal can be expected from up to 76-70k .

Important key level is breakout of 95k which would confirm reverse in trend.

Bitcoin Holding PRZ Support Lines – Is a Weekend Rebound Coming?First of all, I would like to say that the Trading Volume is generally low on Saturdays and Sundays , so I don't expect the Support Lines and Potential Reversal Zone(PRZ) [$82,340-$82,000 ] to break. Of course, we should always be prepared for any scenario.

Bitcoin ( BINANCE:BTCUSDT ) is moving near the Support lines and PRZ , and with the help of the Failed Falling Wedge Pattern , Bitcoin has declined in the last few hours .

Educational Note : In technical analysis, if a Reversal Pattern fails , it often acts as a Continuation Pattern instead .

I expect Bitcoin to trend upward in the coming hours and be able to reach the targets I have outlined on the chart.

Note: If Bitcoin touches $81,900, we should most likely expect more dumping.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.