TAO ANALYSIS🔮 #TAO Analysis 💰💰

🌟🚀 As we can see that #TAO is trading in a symmetrical triangle and given a perfect breakout. But there is an instant resistance. If #TAO breaks the resistance 1 then we will see a good bullish move in few days . 🚀🚀

🔖 Current Price: $271

⏳ Target Price: $305

#TAO #Cryptocurrency #DYOR

Breakout!

ARC ANALYSIS🔮 #ARC Analysis

💲💲 #ARC is trading in a Symmetrical Triangle Pattern. If the price of #ARC breaks and sustain the higher price then will see a pump. Also there is an strong support zone. We may see a retest towards the support zone first and then a reversal📈

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#ARC #Cryptocurrency #Support #Resistance #DYOR

XAUUSD Head And Shoulder pattern breakdownGold update 15m head and shoulder breakdown

Key Levels:

Resistance Levels:

3,040.000 (Immediate Resistance)

3,050.000

3,060.000

3,070.000 (Major Resistance)

Support Levels:

3,022.000 (Immediate Support)

3,014.000

3,006.500

2,999.000

2,991.000 (Major Support)

Price Action Overview:

Gold is currently trading at 3,033.785, showing a slight upward movement of +1.685 (+0.096%).

The price has been consolidating between 3,031.425 (Low) and 3,034.430 (High) in the last 15-minute candle. The market is testing the 3,035.410 level, which could act as a minor resistance.

Technical Indicators:

USB (Ultimate Support/Resistance Band):

Current Value: 38.301 (-1.279)

Indicates potential support/resistance zones around 3,830.4.

TAT & Skullers Indicator:

Current Value: -38.306 (-1.269)

Suggests a potential retest or breakdown level around 3,830.6.

Market Sentiment:

The market is showing slight bullish momentum, but the price remains within a tight range.

A breakout above 3,040.000 could signal a stronger bullish trend, while a breakdown below 3,022.000 may indicate bearish pressure.

Trading Strategy:

Bullish Scenario:

Entry: Consider a long position if the price breaks and sustains above 3,040.000.

Targets:

3,050.000 (First Target)

3,060.000 (Second Target)

3,070.000 (Major Resistance)

Stop Loss: Place below 3,022.000 to manage risk.

Bearish Scenario:

Entry: Consider a short position if the price breaks and sustains below 3,022.000.

Targets:

3,014.000 (First Target)

3,006.500 (Second Target)

2,999.000 (Major Support)

Stop Loss: Place above 3,035.410 to manage risk.

Risk Management:

Always use proper risk management techniques.

Risk no more than 1-2% of your trading capital per trade.

Adjust position sizes according to your risk tolerance and account size.

GOLD 1H | Demand Zone Reaction & Breakout Plan – CelestiaPipsGOLD on the 1H timeframe is reacting from a previously tested demand zone around 3000 .

Watching for a clean break & retest above 3044 for bullish continuation toward 3065.

Trendline break could act as early confirmation.

Structure-based idea shared by CelestiaPips.

(XAU/USD) Bearish Reversal After Head & Shoulders Formation."

Overview:

The price action of Gold (XAU/USD) on the 2-hour timeframe indicates a potential bearish move. A Head & Shoulders pattern has formed, signaling a possible trend reversal. The market recently tested a resistance level and is now showing signs of weakness.

Key Levels:

🔹 Resistance: $3,044 - $3,055 (Rejection Zone)

🔹 Sell Entry: Below $3,028 (Break of Support)

🔹 Support Level: Around $2,980 (First Key Level)

🔹 Target: $2,940 - $2,931 (Final Bearish Target)

Analysis:

✅ Price has broken below the neckline of the Head & Shoulders pattern, confirming a potential sell-off.

✅ A retest of the broken support as resistance could offer a better entry for shorts.

✅ If the price holds below $3,028, further downside toward $2,940 is expected.

✅ Bullish invalidation if price breaks back above $3,044.

Trade Idea:

📉 Sell below: $3,028

🎯 Target: $2,940

🛑 Stop Loss: Above $3,044

This setup aligns with technical analysis principles, with risk-to-reward favoring sellers. Monitor price action for confirmation before entering a trade.

🚀 What’s your view on Gold? Comment below!

Will this same bars pattern on CHZ repeat?Welcome back dear reader, for another Chilliz post.

As i've been analyzing the chart further my eye fell on the bars pattern from May till October 2020, and noticed that it looks ALOT like the current bars pattern.

The market structure it would form would also make alot of sense from a traders perspective. Allow me to explain while i have your attention.

The only sellers remaining now are from 2021 or earlier, so we might stay in this area for a couple of weeks for people to capitulate. Those that got in earlier are eager for a break-even and will probably get that end of this month or beginning of April. Then around the latter half of May we might see 0.20$ followed by a retest of the lower bounds forming a perfect W as traders suspect it to be the absolute end of the bullmarket. Only for it to be followed by a quick recovery and a massive blowoff top!

Target: Remains around 3$ (The fractal would indicate 17$ and a market cap of 160B, at 3$ it would be 28B which isn't too farfetched)

Stoploss: 0.032$

Final remarks: Do i know for certain that it will happen? No, but the charts tell us a different story.

Rustle

WHAT WILL BE THE NEXT MOVE OF GOLD ?🚀 GOLD (XAU/USD) – High-Probability Trade Setups! 🚀

Hey, traders! Hope you're all geared up for another exciting week in the markets! 🏆 As we get ready for the market open, let’s break down what’s next for Gold (XAU/USD).

📊 Last Week’s Recap

📈 Gold hit 3057, but before the market closed, we saw a strong rejection pushing price back down. Now, Gold is stuck in a range between 3024 resistance and 3020 support—meaning we need a breakout before taking action!

💡 No-trade zone = 3020 - 3024 ❌ Stay out until a breakout happens!

Two Possible Trading Scenarios

🔵 Scenario 1: Buy Above 3024

📌 If a 30M candle closes above 3024, we wait for the next candle to wick down while keeping the previous low safe.

📌 Once price breaks the high of the previous closed candle, we enter buys targeting 3034! 🚀

✅ Break-even after 40 pips—lock in those profits! 💰

🔴 Scenario 2: Sell Below 3020

📌 If a 30M candle closes below 3020, we wait for the next candle to wick up while keeping the previous high safe.

📌 Once price breaks the low of the previous closed candle, we enter sells targeting 3011! 📉

✅ Break-even after 40 pips—protect your capital!

📍 Final Trade Plan

📊 BUY above 3024 🎯 TP: 3034

📊 SELL below 3020 🎯 TP: 3011

📢 Don’t chase trades! Let the market confirm and follow the plan! 📈🔥 #XAUUSD #GoldAnalysis #ForexTrading #SmartMoney

NZD-USD Free Signal! Sell!

Hello,Traders!

NZD-USD made a bearish

Breakout of the key horizontal

Level of 0.5755 so we are

Bearish biased and we can

Enter a short trade with the

Target Level of 0.5695 and

The Stop Loss of 0.5775

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nestle - Long term Bottom formation and Breakout for investmentSupport b/w 2100-2150 since Dec 24 has been holding

50 month SMA at 2106— very strong & rarely breaks

200 week SMA rarely breached & now at 2132

Moving averages: Crossed 20/50/100 day SMA

MACD: Daily +ve, Weekly +ve, Monthly -ve

Daily CCI > 100 (bullish)

Resistance Levels:

- 2280 (range)

- 2380-2400 : 2380 (100 week SMA), 2387 (parallel), 2394 (50 week SMA)—converging soon.

Break above 2280 likely coming week, but break above 2380-2400 with volume needed for long term breakout.

2100 support intact currently

At 2268-2280: Strong 2100 support. Buy on every dip for long term or on 2280 breakout.

Target - 2700 in 06 months

Long term Stop loss- below 2100

For short swing- Target 2380 if it breaks & closes above 2280, make 2270 as stop loss

BTC/USD Trading Analysis – Double Bottom & Rising Wedge BreakoutThis BTC/USD 4-hour chart showcases a potential bullish breakout setup based on technical patterns, key support and resistance levels, and price action analysis. The chart suggests a trend reversal following a downtrend, with signs of bullish momentum building up.

Let's break down the full technical analysis, covering the chart structure, key levels, price patterns, and trading strategy.

1. Market Structure & Identified Patterns

A. Double Bottom Reversal – Strong Bullish Signal

A double bottom pattern has formed, which is a bullish reversal signal that indicates the end of a downtrend.

This pattern consists of two significant low points (Bottom 1 and Bottom 2) near the $80,000 - $81,000 support zone.

The pattern confirms strong buying interest at this level, preventing further price drops.

A breakout above the resistance level would confirm the pattern’s validity, signaling a move toward higher targets.

B. Rising Wedge Formation – Potential Bullish Breakout

The price action is consolidating in a rising wedge, forming higher highs and higher lows within a narrowing range.

A rising wedge often suggests a potential breakout.

Since this wedge forms after a double bottom, the breakout is expected to be bullish, rather than a bearish breakdown.

If the price breaks above the wedge’s upper trendline, it will confirm a strong upward momentum.

2. Key Support & Resistance Levels

Support Levels:

Major Support Zone (80,000 – 81,000):

This level has been tested twice, confirming buyer strength.

It serves as the foundation for the double bottom pattern.

Stop Loss Level (72,921):

If the price drops below this level, it would invalidate the bullish setup.

This level is strategically placed to manage risk and protect against potential downturns.

Resistance Levels:

First Resistance Zone (95,000 – 100,000):

This is a critical level, as the price has faced multiple rejections here.

A breakout above this zone would confirm a strong bullish trend continuation.

Take Profit Targets:

TP1 (108,481): The first take-profit target aligns with previous highs and is a logical point for partial profit booking.

TP2 (114,372): This is the second profit target, calculated based on Fibonacci extensions and historical price movements.

3. Trading Strategy & Execution Plan

A. Entry Strategy

To execute a successful trade, we need to wait for confirmation of the breakout.

Ideal Entry: After a strong breakout above 95,000 – 100,000, indicating bullish momentum.

Confirmation Factors:

Increased trading volume → Signals strong buying interest.

Candle close above resistance → Confirms breakout.

Retest of broken resistance as support → Strengthens bullish continuation.

B. Risk Management

Stop Loss Placement: Below 72,921, ensuring limited downside risk.

Risk-to-Reward Ratio: The trade setup aims for a 1:3 or better risk-to-reward ratio.

C. Potential Scenarios

✅ Bullish Breakout:

If BTC breaks and holds above 95,000 – 100,000, we can expect a rally toward 108,481 (TP1) and 114,372 (TP2).

❌ Bearish Rejection:

If BTC fails to break resistance, it could retest 80,000 or drop lower, invalidating the bullish setup.

4. Final Thoughts – What to Expect?

This BTC/USD 4-hour chart analysis provides a high-probability bullish trade setup, supported by:

✅ Double Bottom Formation → Strong Reversal Signal

✅ Rising Wedge Breakout Potential → Momentum Building

✅ Key Resistance Breakout Levels Identified

📌 Conclusion:

If Bitcoin breaks above 95,000 – 100,000, expect a major bullish move toward 108,481 and beyond. However, if resistance holds, we might see a retest of lower support levels. Risk management is essential for a successful trade execution. 🚀

Insmed (INSM) - Breakout Opportunity 📌 Insmed ( NASDAQ:INSM ) – Breakout Opportunity

Insmed is a clinical-stage biopharmaceutical company focused on serious and rare lung diseases. The stock more than doubled in May 2024 following positive Phase 3 results for its drug Brensocatib. The FDA has granted Priority Review, with a PDUFA date set for August 12, 2025 — and commercial launch expected in H2 2025.

Technical Overview:

Since the massive gap up in May 2024, INSM has been trading inside a well-defined horizontal channel between:

🔻 Support: $61.65

🔺 Resistance: $84.82

Currently, price is near the upper third of the range (~$79.92), showing signs of renewed momentum with rising volume and RSI trending higher.

Plan

----

📍 Entry: Daily close above $85 with strong volume ( >2.5M )

Targets

🎯 Target 1: $94 (+11%)

🎯 Target 2: $106 (+25%)

🛑 Stop: $82 (-4.7%)

Risk ratio:

🟠 Target 1: > 2:1

🟢 Target 2: > 5:1

---

📊 Key Indicators to Watch:

✅ RSI > 60 with upward slope

✅ MACD bullish crossover

✅ Break above 20-day EMA with volume

✅ Volume expansion on green candles

⚠️ This content is for informational and educational purposes only and does not constitute investment advice ⚠️

AUD_CAD SHORT SIGNAL|

✅AUD_CAD is going down

And the pair made a bearish

Breakout of the key horizontal

Level of 0.9007 which is now

A resistance so we are bearish

Biased and we will be able

To enter a short trade on Monday

With the TP of 0.8970 and

The SL of 0.9030

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

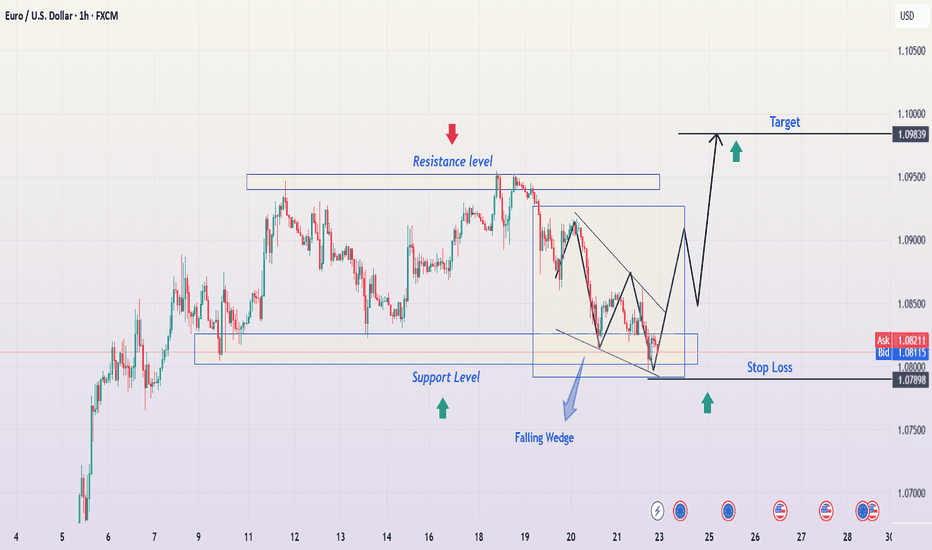

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

EUR_CAD SHORT SIGNAL|

✅EUR_CAD is going down

Now and the pair made a

Bearish breakout of the local

Key level of 1.5580 which is now

A resistance so we are locally

Bearish biased and we will be

Expecting a further move down

So a short trade can be entered

With the TP of 1.5480 and

The SL of 1.5600

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD - Price can decline to support area and then start to growHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Recently price started to decline to falling channel and soon reached $2880 level and then rose to the resistance line.

Then price bounced and in a short time declined to support line of the channel breaking $2880 level.

But soon, Gold bounced from line and broke $2880 level again and some time traded near resistance line.

Next, price made a correction to $2880 level and then started to grow and soon exited from falling channel.

After this Gold reached $3025 level, broke it, and is now traded near this level, which coincides with support line.

So, in my opinion, Gold can decline to support area and then it bounce up to $3085, breaking the support line.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

EUR-CAD Free Signal! Sell!

Hello,Traders!

EUR-CAD made a bearish

Breakout of the key horizontal

Level of 1.5528 so we are

Bearish biased so we can

Enter a short trade with

The Take Profit of 1.5454

And the Stop Loss of 1.5576

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

LAYER/USDT: 100%+ PROFIT POTENTIAL TRADE SETUP!!🚀 Hey Traders! LAYER Breakout Alert – 100%+ Move on the Horizon? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 LAYER/USDT – Double Breakout & Retest in Play! 🚀

LAYER has broken out from both a Cup & Handle pattern and an Ascending Triangle, signaling strong bullish momentum. It’s currently retesting the breakout zone, offering a prime entry opportunity! 💥

💰 Trade Setup:

📍 Entry: CMP, add more up to $1.18

🎯 Targets: 100-120% upside 📈

🛑 Stop-Loss: $1.08

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the breakout wave higher 🚀

💬 What’s Your Take?

Are you bullish on LAYER’s double breakout potential? Share your analysis, predictions, and strategies in the comments! Let’s lock in those gains and ride this pump together! 💰🚀🔥

EUR/JPY Trading Setup – Falling Wedge Breakout Potential1. Overview of the Market Structure

The EUR/JPY daily chart presents a falling wedge pattern, which is a classic bullish reversal setup. This pattern has been forming for several months, indicating that the price has been consolidating within a narrowing range. The falling wedge typically suggests that selling pressure is weakening, and a potential breakout to the upside could follow.

The chart also highlights key support and resistance zones, along with a well-defined trading setup based on technical confluences.

2. Key Technical Levels

Support Level: ~ 155.819 (Marked as Stop Loss)

This level has acted as strong support multiple times.

A break below this level would invalidate the bullish bias.

Resistance Level: ~ 163-164

The price has previously struggled to break above this region.

Currently, it is retesting this level after a breakout attempt.

Target Levels:

175.246 – This aligns with a previous all-time high zone and a strong resistance level.

179.562 – Marked as the ultimate target, indicating a full breakout potential.

3. Falling Wedge Formation & Breakout Analysis

A falling wedge is a bullish pattern that indicates a decrease in selling pressure over time.

The price has tested the lower trendline multiple times, showing strong demand at support.

Recently, the price broke above the upper wedge trendline, suggesting that a breakout is in progress.

However, the breakout needs confirmation in the form of a successful retest at the previous resistance level (~163-164).

4. Retest Confirmation & Trade Setup

Retest Scenario: If the price holds above the previous resistance and confirms it as support, the probability of continuation towards 175-179 increases.

Entry Strategy: A buy entry can be considered after a successful retest with bullish price action confirmation.

Stop-Loss Placement: Below 155.819 (previous strong support).

Risk-Reward Ratio: The target offers a strong risk-reward ratio if the breakout holds.

5. Market Sentiment & Volume Analysis

The previous downward move showed declining bearish momentum, further confirming the validity of the falling wedge.

A volume increase on the breakout would provide additional confirmation.

If the price consolidates near the breakout zone with low volatility, a strong move upward could follow.

Final Conclusion: Bullish Breakout in Progress

The falling wedge breakout suggests that EUR/JPY is poised for further upside.

A successful retest at 163-164 could push the price towards 175.246 and ultimately 179.562.

Risk management is crucial, and a stop-loss below 155.819 is recommended to avoid invalidation of the setup.

This setup presents a high-probability trading opportunity, but confirmation through price action and volume analysis remains key.

Key Trading Plan Summary:

📌 Pattern: Falling Wedge (Bullish)

📌 Breakout Confirmation: Yes, but retesting is ongoing

📌 Entry Point: Above 163-164 after successful retest

📌 Stop Loss: Below 155.819

📌 Target Levels: 175.246, then 179.562

📌 Risk-Reward: Favorable if breakout sustains

Would you like any refinements or a more concise version for your TradingView post? 🚀📈

Bitcoin can exit from triangle and rise to resistance levelHello traders, I want share with you my opinion about Bitcoin. On the chart, we can see that the price entered a downward triangle, where it rebounded from the resistance line and dropped to the resistance level. After that, BTC bounced from the 86500 level, climbed back to the resistance line of the triangle, and then started to decline. Soon, it broke through 86,500 and reached the support level, which coincided with the buyer zone. BTC then broke this support and dropped further to the support line of the triangle before reversing and beginning to rise. In a short time, the price reached 81100, broke through it, and made a retest before continuing its upward movement. However, it later corrected back to the buyer zone, then climbed to 85000, and started declining again. Shortly after, the price dropped to the support level and then rebounded to the resistance line of the triangle. Given this price action, I expect BTC to correct toward the support line of the triangle before bouncing back up and breaking out of the pattern. From there, I anticipate further growth toward the 86500 resistance level, which is why I have set my TP at this level. Please share this idea with your friends and click Boost 🚀

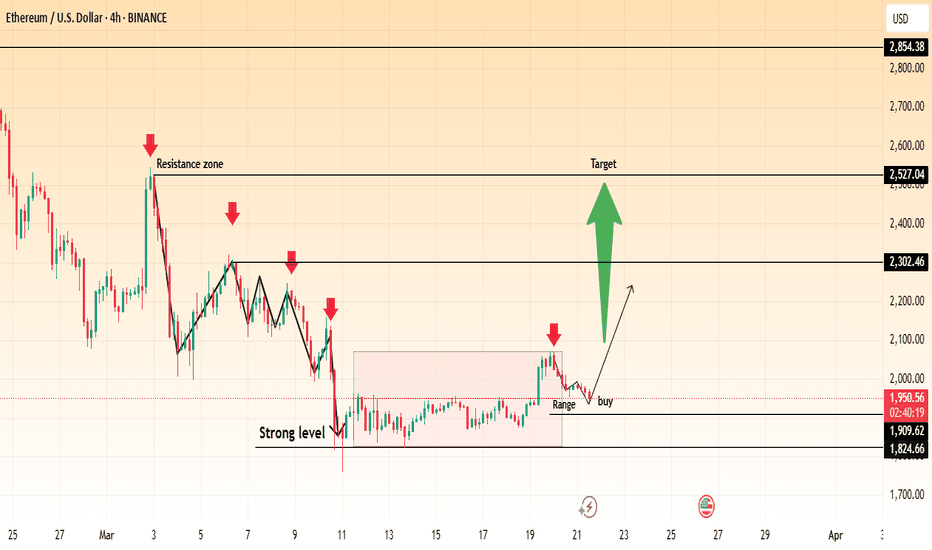

Ethereum (ETH/USD) – Potential Breakout from Range Towards $2,50📊 Chart Insights:

ETH/USD is currently ranging near the $1,950 zone, following a consolidation phase.

A strong resistance zone is visible between $2,302 - $2,527, which has historically acted as a rejection point.

Support levels are established around $1,824 - $1,909, forming a strong base for price action.

A breakout above the current range could signal a bullish move toward the $2,302 resistance level, with a further target at $2,527.

📈 Trading Plan:

✅ Entry: Buy above $1,966 on confirmation of breakout.

🎯 Targets: $2,302 and $2,527 for profit-taking.

❌ Stop Loss: Below $1,909 to manage risk.

📉 Bearish Scenario: If ETH fails to hold $1,909, a retest of $1,824 is possible.

🔥 Ethereum could see a strong rally if momentum builds above resistance! Are you ready?

EUR/USD Technical Analysis – Double Top Pattern & Bearish MoveThis EUR/USD 1-hour chart presents a clear Double Top pattern, signaling a potential trend reversal. The chart displays key technical elements, including support and resistance levels, trendlines, a stop-loss placement, and a take-profit target. Let’s go through an in-depth professional breakdown of this trading setup.

1. Market Structure and Trend Analysis

Before identifying the pattern, it’s crucial to analyze the market structure:

✔ The price had been in an uptrend initially, making higher highs and higher lows.

✔ However, the trend began to weaken after hitting resistance at the 1.0950 zone.

✔ This failure to break higher created a double top, which is a strong bearish reversal signal.

A double top forms when the price reaches a high twice, fails to break above resistance, and then declines past the neckline (support level), confirming trend reversal.

2. Double Top Pattern Breakdown

🔹 First Peak (Top 1):

The price surged upwards, hitting the resistance zone at 1.0950, but faced selling pressure.

The rejection resulted in a pullback to the neckline (support level at 1.0800-1.0820).

🔹 Second Peak (Top 2):

The price attempted another rally but failed at the same resistance zone, confirming seller dominance.

The second rejection suggests a lack of bullish strength, signaling a potential shift in momentum.

🔹 Neckline (Support Breakdown):

The key support zone around 1.0800 acted as a pivot level.

Once this level was breached, it confirmed bearish continuation.

3. Key Technical Levels & Price Action Signals

🟢 Resistance Level – 1.0950 Zone

This level has acted as a strong supply zone where sellers stepped in to push prices lower. The two failed breakout attempts indicate that buyers lost control.

🔵 Support Level (Neckline) – 1.0800-1.0820 Zone

Initially, this area provided buyer support, but once broken, it became a resistance level (previous support turns into new resistance).

⚡ Stop-Loss Placement – 1.09190

A well-placed stop-loss above the resistance zone protects against false breakouts.

If the price rises above this level, it invalidates the bearish structure.

🎯 Take-Profit Target – 1.06916

The projected target aligns with the measured move (the distance from the resistance to the neckline).

The price may find support at this level, where traders should look for a potential reversal or continuation.

4. Confirmation of Bearish Breakdown

For a high-confidence short trade, multiple confluences support the bearish bias:

✔ Break & Retest of the Neckline – After breaking support, the price attempted a retest and failed, confirming resistance.

✔ Trendline Break – The trendline supporting the previous uptrend has been decisively broken.

✔ Bearish Price Action – The formation of strong red candles and lower highs suggests sustained selling pressure.

✔ Momentum Shift – Increased bearish volume further confirms the reversal strength.

5. Trading Strategy & Execution Plan

✅ Entry Criteria

Sell after the retest rejection at the previous support (now resistance).

Look for a strong bearish candle formation as a confirmation signal.

📉 Risk Management

Stop-Loss: Placed slightly above 1.09190, ensuring the pattern remains valid.

Take-Profit: Target set at 1.06916, aligning with previous structure support.

💰 Risk-Reward Ratio

The setup offers an attractive risk-to-reward ratio, making it a high-probability trade.

6. Alternative Scenarios & Market Considerations

Although the bearish bias is dominant, traders should be prepared for alternative outcomes:

🔸 Fakeout Risk: If price closes above 1.09190, it could indicate a failed breakdown, invalidating the trade.

🔸 Bounce from 1.06916: If the price reaches the target support zone, buyers might step in, leading to a potential reversal.

🔸 Fundamental Influence: News events (such as FOMC, ECB statements, or US inflation data) can increase volatility and impact price direction.

7. Conclusion – A High-Probability Short Trade

This Double Top pattern setup presents a textbook bearish reversal, offering an excellent short-selling opportunity. The combination of technical confirmations, price action signals, and a well-structured risk-reward ratio makes this trade highly reliable.

Final Takeaways:

✔ Bearish Confirmation – Double Top breakdown with a retest rejection.

✔ Sell Setup Validity – Below 1.0800 support.

✔ Stop-Loss & Target Defined – Risk-controlled strategy execution.

📊 Verdict: Bearish trade setup with downside potential toward 1.06916. Traders should monitor price action for further confirmations! 🚀

CHF/USD Bullish Cup Formation | Support & Breakout Target Pattern Formation: Bullish Cup & Handle Breakout Setup

The price action on this CHF/USD 1-hour chart exhibits a Cup & Handle pattern, which is a well-known bullish continuation setup. This pattern suggests that buyers are gradually gaining control and a breakout could be imminent.

1️⃣ Understanding the Cup Formation

The cup shape (curved blue line) signifies a gradual accumulation phase, where price initially declined, formed a rounded bottom, and then started recovering.

This indicates that buyers are regaining momentum after a consolidation period.

The lowest point of the cup formed around March 16, from where the price began a steady upward move.

2️⃣ Key Support & Resistance Levels

Support Level: The strong demand zone is established around 1.1300 - 1.1320, as shown by multiple price bounces.

Resistance Level & ATH (All-Time High): The price struggled to break 1.1450 - 1.1470, indicating a major resistance zone where sellers previously took control.

3️⃣ Handle Formation & Pullback

After reaching resistance, the price formed a slight retracement (small descending wedge), which created the handle of the pattern.

The pullback was necessary to clear short-term overbought conditions before a potential breakout attempt.

4️⃣ Trading Strategy & Price Projection

🔹 Entry & Breakout Confirmation

If CHF/USD breaks above 1.1450 - 1.1470 with volume confirmation, this will validate the Cup & Handle breakout.

A confirmed breakout suggests further upside momentum toward 1.1570 - 1.1600, aligning with the pattern’s measured move.

🔹 Stop-Loss Placement

A logical stop-loss should be placed below the handle’s low (~1.1300 - 1.1320), in case of a false breakout or sudden market reversal.

🔹 Target Projection Based on Pattern Measurement

The height of the cup (~200 pips from bottom to resistance) is projected upwards from the breakout level.

This results in a take-profit target of 1.1575 - 1.1600.

5️⃣ Additional Technical Confluences

✅ Trendline Support: The price is respecting an ascending trendline, indicating continued higher lows and bullish sentiment.

✅ Bullish Momentum: The series of higher lows confirms a strong uptrend, favoring buyers.

✅ Potential Fakeout Risks: A failed breakout below 1.1300 could invalidate the bullish outlook, leading to a deeper retracement.

6️⃣ Final Thoughts: Is This a Good Setup?

📌 Overall Bias: Bullish ✅

📌 Breakout Confirmation Needed: Above 1.1450 - 1.1470

📌 Target: 1.1570 - 1.1600 🎯

📌 Risk Management: Stop-loss below 1.1300

If CHF/USD sustains momentum above resistance, traders can anticipate a strong bullish rally toward the projected target. However, it’s essential to wait for confirmation before entering long positions. 📈🔥