ONDO Long Spot Trade Setup – Bullish Divergence PotentialONDO is showing relative strength amid the broader altcoin pullback, holding key levels and now pulling into the $0.50 support zone. This area lines up for a possible RSI bullish divergence, which could spark the next leg up.

📌 Trade Setup:

Entry Zone: ~$0.50

Take Profit Targets:

🥇 $0.85

🥈 $1.13

🥉 $1.34

Stop Loss: Daily close below $0.42

Btc!

Bitcoin Technical Breakdown – Bearish Channel in Motionhello guys.

🔻 1. Bearish Channel

Bitcoin is currently respecting a downward-sloping channel with lower highs and lower lows.

Every attempt to break the upper boundary has been met with rejection, confirming bearish pressure.

🔁 2. Retest of Former Trendline

The former ascending trendline (drawn from 2023’s bottom) was broken and recently retested as resistance, failing to flip it back to support.

This retest often signals confirmation of trend reversal.

🧱 3. Critical Support Zone: $62K– FWB:65K

This zone served as a strong accumulation range in the past and aligns with the current downside target.

____________________________

🔮 What’s Next?

Based on this pattern and price behavior:

Bitcoin may continue its bearish descent, following the projected zig-zag pattern in the channel.

The next significant bounce area lies around $64,000, aligning with both volume-based support and previous breakout zones.

The last bullish chance of Bitcoin in mid-term !!BTC is in a Falling Wedge Pattern. This means The Bulls Have Higher Chance To Claim The Trend Than Bears! No Break out Has Happened yet and we shall wait for a Break out But It should Happen Pretty Soon Because there is also a Regular Bullish Divergence On MACD as well! So The Bullish Chance for BTC Is Pretty High and we Shall see a Bullish Movement Up to $100K Pretty Quick!

-BTC is in a Falling wedge Pattern

-No Break out

-(+RD) on MACD

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Bitcoin will be super bullish soon (1D)The market maker has created a scenario that makes everyone believe the bear market started a while ago. However, there are signs on the chart showing that Bitcoin may register a new ATH.

The best zone for rebuying Bitcoin is the green area.

From the green zone, we expect Bitcoin to move toward the specified targets.

The closure of a daily candle below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Breaking: Bitcoin Loses $80,000 Support The price of Bitcoin ( CRYPTOCAP:BTC ) today saw a noteworthy downtick of 2.24% today making it down 7% since last week losing the $80k grip. This move came days after Donald Trump the recently elected president, on Wednesday, announced a minimum tariff rate of 10% and higher rates for 57 economies like China (34%), the European Union (20%), and Japan (24%). Fitch Ratings estimated that the effective tariff rate could hit 25% on average — the highest in more than 115 years.

The asset has tanked to the $76,000- $74,000 support point, placing CRYPTOCAP:BTC on the brink of a selling spree should CRYPTOCAP:BTC break below the $70k support, possible retracement should be around the $60- $50k support points.

Similarly, with CRYPTOCAP:BTC trading below key Moving Averages (MA), and the RSI at 35, CRYPTOCAP:BTC is gearing up for a reversal albeit the market is still volatile. If Bitcoin ( CRYPTOCAP:BTC ) should break the 1-month high resistant a possible uptick to $120k is feasible.

Bitcoin Price Live Data

The live Bitcoin price today is $77,615.23 USD with a 24-hour trading volume of $78,391,741,615 USD. Bitcoin is down 5.64% in the last 24 hours. The current CoinMarketCap ranking is #1, with a live market cap of $1,540,502,278,162 USD. It has a circulating supply of 19,847,937 BTC coins and a max. supply of 21,000,000 BTC coins.

BITCOIN Is it still on track with past Cycles??Bitcoin (BTCUSD) saw a strong correction last week as well as early trade yesterday on Monday, along with all major stock markets, but had an equally impressive round on Wall Street opening, which keeps it so far above its key 1W MA50 on a potentially weekly closing.

So the critical question now is this: Will it continue the pattern of past Cycles and give one more major rally in 2025?

Well based on the BTC Rainbow Waves, it is still on track and actually in a similar situation as July 2013 when after a 3-month correction/ pull-back sequence, it got back to the Blue Buy Zone and near the Fair Value green trend-line.

As you can see all Cycles peaked on the Red Zone and so far on this Cycle we haven't even reached the 1st orange trend-line. Based on the Time Cycles, the next peak should be around November 2025 and if the price action confirms the Rainbow Wave model again, the closest level to the Red Zone by then would be around $180000.

Do you think that amidst the trade war chaos, that's a realistic expectation? Feel free to let us know in the comments section below!

P.S. I am attaching a snapshot below in case the waves aren't displayed properly on the chart above:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

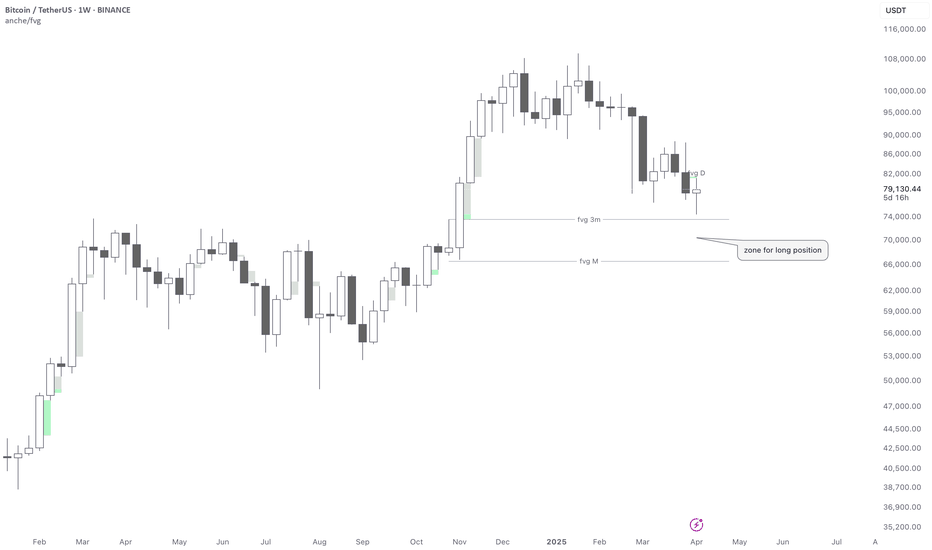

BTCUSDT📊 Bitcoin Weekly Analysis – Smart Money Concept (SMC)

On the 1W BTC/USDT chart, we are currently observing a corrective move after a strong bullish impulse. The price is approaching a high-probability demand zone formed between two significant Fair Value Gaps (FVGs):

• 🔹 FVG 3M around $74,000

• 🔹 FVG M around $66,000

🟩 Long Setup Zone:

The area between these FVGs represents a discounted price zone where smart money is likely to step in. This is labeled as a “zone for long position” on the chart.

⸻

🧠 Smart Money Perspective:

• The market is in a retracement phase, targeting inefficiencies (FVGs).

• If price taps into this zone and shows signs of bullish intent (e.g., weekly bullish engulfing, BOS/CHOCH on lower timeframes), we can expect a strong upward move.

⸻

🎯 Mid-to-Long Term Target:

• Based on the current market structure and SMC model, the next major target is $130,000.

⸻

🔐 Risk Management:

• Ideal entry: within the FVG zone

• Stop-loss: below the lower FVG (around $65,000)

• Confirmation: bullish price action on lower timeframes or weekly candle close with strong momentum

⸻

📌 Conclusion:

This setup offers a potential high-reward opportunity if smart money reacts to this discounted zone. Patience and proper confirmation are key.

⸻

WHY XAUUSD IS BULLISH ?? TECHNICAL AND FUNDAMENTALSXAUUSD is currently trading around the key psychological level of 3000, and as expected, price action has just completed a textbook retest of the previous breakout zone. The support level near 2960–2980 has held strongly, giving gold the momentum it needs for the next leg up. Price has reacted with a clear bullish bounce from this demand zone, confirming the structure and setting up for a potential continuation toward the 3100 target.

From a technical perspective, we’re seeing a classic bullish continuation move. The previous impulse to the upside was followed by a correction phase, which respected the support area now acting as a launchpad. This bounce, combined with strong candle formations on the 12H and daily charts, suggests bulls are regaining control. Volume is gradually increasing, aligning with the anticipated breakout from the recent consolidation.

On the fundamentals side, the gold market remains well-supported. Recent macroeconomic data shows inflationary pressures are still lingering, while expectations for Federal Reserve rate cuts later in the year continue to weigh on the US dollar. Geopolitical tensions and increased central bank gold accumulation are adding further demand for safe-haven assets like gold. These drivers remain bullish catalysts as long as uncertainty stays elevated and real yields remain low.

With price holding above 3000 and a strong structure in place, I expect continuation toward 3100 in the near term. This is a high-probability setup supported by both technicals and fundamentals. I’ll be closely watching for higher lows and continuation signals above 3020 for additional confirmation. Risk management remains key, but the market structure strongly favors further upside.

$BTC is at a critical pointThis is a follow-up to my previous warning about a potential CRYPTOCAP:BTC correction, published in December 2024:

🔗

At this stage, CRYPTOCAP:BTC is at a critical juncture. If we compare the current situation to previous corrections, we can observe that the RSI has reached a potential reversal zone, and price action is currently showing some resilience.

📍 The $81K level appears to be strongly defended by the bulls.

Two scenarios are now in play:

1️⃣ Bearish Continuation

If the MACD continues its downward move and the RSI drops below 30%, we could see this consolidation phase extending until July 2025. In this case, CRYPTOCAP:BTC may revisit the $72K zone.

2️⃣ Bullish Reversal

If the MACD has already bottomed out, we could witness a bullish rally over the next 3–4 months. This would likely propel CRYPTOCAP:BTC to a new all-time high.

Unfortunately, the SPX500 correction adds a layer of uncertainty. Had the traditional markets not started to retrace, the odds of a solid bounce from current BTC levels would have been near 100%.

For now, everything depends on how strong and well-funded the bulls are—can they offset macro pressure and prevent CRYPTOCAP:BTC from sinking with the TradFi indices?

🚨 Do Your Own Research (DYOR)

BTC/USDT 1DAY CHART UPDATE !!A downward trendline connecting the recent high points indicates bearish pressure.

A horizontal support level around 77,500 USDT shows where the price has struggled to drop.

Current Price:

As of your chart's timestamp, BTC is trading at approximately 79,883.75 USDT.

Potential Movement:

If the price can break above the descending trendline and stay above the support level, there could be potential upward momentum. The upward arrow suggests a bullish outlook.

Key Levels to Watch:

Resistance: Look for resistance at trendline breaks and the next significant levels above the current price (e.g., 82,500 USDT).

Support: The 77,500 USDT level is crucial; a drop below it could signal further downward movement.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

It could be worse for Gold and Bitcoin, right? Apple alone has shed nearly $640 billion in market capitalisation over just three days. The S&P 500 has fallen more than 10% during the same stretch—its worst performance since the onset of the COVID-19 pandemic. In Asia, the selloff is even more severe, with Japan's Nikkei 225 down nearly 8%, South Korea’s Kospi 200 off almost 6%, and Taiwan equities falling close to 10%, triggering circuit breakers.

In comparison, Bitcoin and Gold, while under pressure, appear to be weathering the downturn with relatively less panic.

Bitcoin has declined around 10%—a notable drop, but not unusual by crypto standards. Trading near $76,000, it has returned to pre-election levels, breaching both short- and long-term support zones.

Gold is tracking its worst three-day performance in over four years. Although some positive forecasts are emerging. Deutsche Bank has revised its year-end gold price forecast upward to $3,350, citing rising recession risks and renewed safe-haven demand.

BTC.... HOLD THE LINE!!!!BTC is still on a daily downtrend however every lower time frame structure can provide evidence of a reversal. Bitcoins price is at critical levels of support and as long it holds the line Class Bullish Divergence is all we need to get some follow-through. CHOCH is the evidence we need.

Full TA: Link in the BIO

XRPUSDT → The bulls won't hold support. Falling to 1.9BINANCE:XRPUSDT is under pressure despite quite positive news. The coin, being in a downtrend, continues to test the key support. The chance of a breakdown is growing

XRP continues to test a strong support zone on the weekly timeframe, relative to this zone, in the medium term, two scenarios can develop, which depend on the general mood in the market. If the current backdrop persists, the chance of a downside breakdown and further decline is quite high.

At the moment, the focus is on the key support at 2.0637, relative to which the retests continue, and the reaction is getting weaker and weaker, which in general only increases the chances of a further fall to 1.9 - 1.63.

Resistance levels: 2.265, 2.365, 2.509

Support levels: 2.0637, 1.9

The cryptocurrency market is going through bad times (Tariff War, high inflation, stock market decline, disappointment of the crypto community due to expectations) and until the situation starts to change, the technical picture will remain negative. XRP may continue its fall after a small correction.

Regards R. Linda!

EOSUSDT → False Breakeout of resistance (counter-trend )BINANCE:EOSUSDT.P within the consolidation distribution 0.54 - 0.6 reaches the key resistance and forms a false breakdown without the possibility of continued growth.

The cryptocurrency market is showing weakness, especially after yesterday's Trump speech and the approval of new Tariffs, which creates risks and pressure on the cryptocurrency market. Bitcoin is back in the red zone after rallying, while altcoins will continue to look for a new bottom. EOS stands out in this list, which strengthened quite strongly and the purpose of this maneuver was countertrend accumulation and liquidity capture relative to the range of 0.7 - 0.8. The distribution is tempered by a false breakout of the level 0.82 - 0.86

Resistance levels: 0.82, 0.86

Support levels: 0.793, 0.666

If the bears hold the resistance 0.82 - 0.86 and the consolidation under the level will end with the breakout of the trigger 0.793 and price consolidation in the selling zone, it may provoke a reversal and fall to the zones of interest: fvg, 0.64, 0.541.

Regards R. Linda!

Has Bitcoin entered a downtrend?Bitcoin is going down, the whole crypto market is going down, too. So, does this mean Bitcoin has entered a downtrend cycle? That is a million- or even billion -dollar question.

Let's analyze Bitcoin's two previous downtrends. The first correction wave dropped about 21.7%, and the second one dropped about 32.8%. If this pattern continues, the current correction wave could drop at least 32.8%; the latest Bitcoin's bearish candle is a little short of this amount.

Also, the previous horizontal resistance area, which is now a support area, coincides with the 32.8% drop value and the 0.5 and 0.618 Fib retracement levels, too. So, this area seems like a good place for Bitcoin's correction to end.

Moreover, the major uptrend line is the last line of defense for Bitcoin to keep the bullish phase alive. Let's see what happens.

BTCUSD: Can this M2 supply signal trigger a massive rally?Bitcoin has neutralized the previously oversold levels on its 1D technical outlook (RSI = 35.383, MACD = -1887.100, ADX = 31.814) as it is making a strong technical rebound on the 1W MA50. Today's analysis features the Global M2 supply, which is a leading indicator for Bitcoin. Both in July 2024 and November 2022 (the last two major bottoms for the market) when the M2 started to rise aggressively, Bitcoin declined and consolidated. It followed the bullish trend of the M2 with a rise of its own much later. This is similar to what the market has been experiencing since January 2025, when the M2 started rising but Bitcoin peaked on its ATH and started a decline that continues to this very date. If the pattern gets repeated then by end of April - start of May we are in for a strong Bitcoin recovery (if not earlier).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

We've now hit our level 6.1-6.2% precisely! We’ve finally hit our ultimate target of 6.1-6.2% (3-drive pattern ✅), which we first talked about back in March after taking the 5W/5D HOB at 5.3%. We said that as long as USDT.D stays above the 4.76% SL, 6.1-6.2% would be the next target - and here we are.

We did see a very decent reaction from the level, as mentioned before. Scalp longs could’ve been taken, but personally, I only took a small, quick scalp long on BTC. I’m not really interested in longs until CRYPTOCAP:BTC takes its 🗝️level.

I got asked a few times today about my plans for BTC, as the boss hasn’t taken the 🗝️ level yet (though it’ll very likely take it eventually). While it’s difficult to know exactly what’s going to happen or how it’ll play out, I’m simply going to focus on the USDT.D 6.5-6.8% resistance levels/EP (no liquidity). If that matches with 72K on BTC, it’d give us additional confluence to open a long.

So yeah, even though it’s hit our level perfectly - including other majors like CRYPTOCAP:TOTAL and #ETHBTC - BTC hasn’t taken its 🗝️ level yet, which probably means we’ve got a tad higher to go on USDT.D. That level could be the HTF resistance/EP at 6.5%-6.8%.

Conversely, if we reject and see a pullback, watch the 18H HOB at 5.63% and potentially even the 17H Demand at 5.49% (wickfishing), where some profits on longs could be taken. Watch 5.03% - if it breaks below this = MTF bullishness on assets.

USDT.D hit our target of 5.6-5.7% as mentioned in my last idea. USDT.D has closed above PSH at 5.51%, which warrants caution. However, I’d like to wait for the weekly close to confirm the direction USDT.S is headed toward. That said, we’ve now taken the 5.6-5.7% level I mentioned last week in my idea, and this should provide enough liquidity to target downside levels. If we overshoot and wick, keep an eye on the 6.1-6.2% level as our next liquidity target, which will likely align with BTC’s 68K-72K range. On LTF and MTF, there’s not enough liquidity left in the current range, and I think if we go down, we’ll see a smooth ride until 4.35%

Shorting BitcoinBINANCE:BTCUSDT

Bitcoin put a massive Bearish Engulfing Candle yesterday, with high volume, which is very bearish, and now I’m expecting it to continue to decline.

It also tends to follow the US Indices, which are heading lower.

My target is about 70k, maybe even lower.

Good luck to you