BTC: In Weekly TimeframeHere's how the weekly chart looks for BTC.

With 9 hours left until the weekly candle closes, it's crucial for the next weekly candle to turn green and show a rebound. The support trendline around $80K needs to hold strong to maintain positive momentum.

~ Initial Support: $80K

~ Lower Support: $68K to FWB:73K

Stay vigilant—the upcoming week will be crucial.

Trade safely, and always do your own research and analysis before making any decisions.

Btcusdanalysis

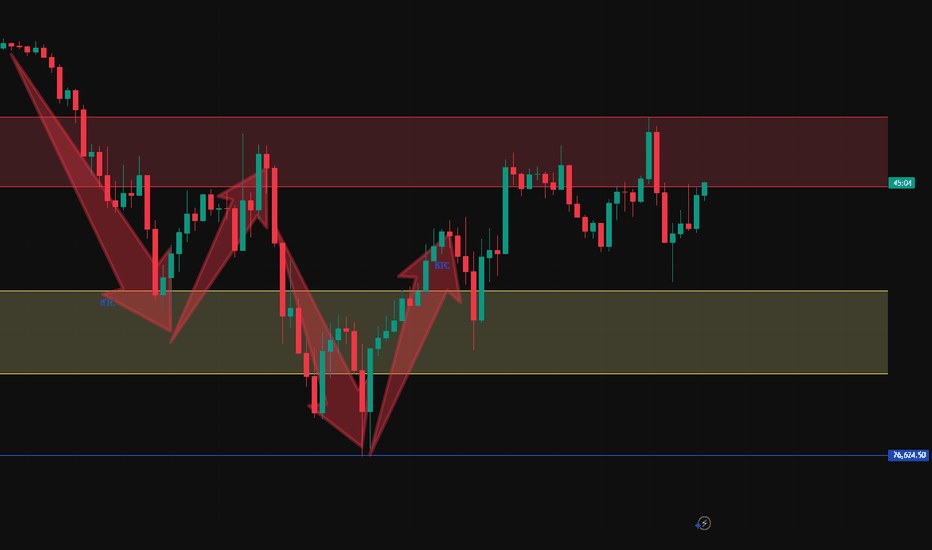

BTC | 4H - 1W | MACRO UpdateBTC has seen a clear bearish trend in the 4h timeframe, after the cup and handle pattern failed to play out. We also notice consecutive lower lows and lower highs, a key sign of a bearish trend.

The technical indicators have turned bearish, and from a macro timeframe is shows a stairstep down may be on the cards.

The moving averages in the daily has turned bearish as we lose the 200d MA.

I hate to say it - but BTC is in full fledge bear mode 🐻

________________

BINANCE:BTCUSDT

Reasons for and against a Push higher by Bitcoin SOON sin November 2022, PA has almost become predictable.

Running on a Pattern of Steps and Always paying attnetion to the Weekly MACD

I have posted in detail about the weekly MACD in other posts so I will not expain much now but here is the chart again, It explains itself really.

We are, once again, Waiting for the weekly MACD to reset to Neutral, were we hope it will bounce again. BUT, as you can see, a 3rd bounce would be unusual but , on this occasion, Highly probable

On the main chart, we can see that PA began running on a Rising trendline and, after ranging for a while, it bounced off it in Mid October 2023. It has Never returned to that line.

PA began Ranging again in March 2024. Note that date on the MACD chart. MACD Peaked and began turning Bearish and fell till it hit neutral in Sep.

At that same moment, in Sep 2024, PA bumped into the 50 week SMA ( RED) and bounced up to a New ATH in Dec 2024

So, we had 2 bounces after ranges, seemingly unconnected - until you look at the day count of each range.

1st -April 2023 to Sep 2023 - 196 days

2nd - March 2024 to Sep 2024 - 189 days

Now also note the Double Tops and then the retrace on Both those Range dates AND on the current Range

And so NOW, Currently, we are in a Range, again, MACD Peaked High and is falling Bearish

But this Range began in DECEMBER 2024

So why do we have a possibility of a push higher soon ?

Look where that RED 50 week SMA is - Just below PA.

Could PA Bounce of it if we bump into it ?

We have come VERY Close in recent days. The 50 is around 75500 - PA got to 76500

If PA touches it, I am sure we will bounce Higher

And so This leads us to why we may NOT bounce soon

I think the Bulls are trying to keep PA off the 50 till MACD is reset. If true, that 50 will level out.

PA will have to touch it BEFORE it begins to fall or PA will have to drop below 70K to reach it.

And THIS Leads us to what I think could Very well happen

IF PA were to have a bounce higher soon , maybe to Top of Range, around 109 ( but probably Lower) this would give PA room to drop back to Bottom of Range while MACD continues to Fall. A Quick push up , say over 10 days, would hardly effect the MACD reset but gives PA room to move without loosing to much more value, Keeping Market CAP stable and Sentiment happy

MACD is expected to reach neutral, at current rate of descent, around May / June.

And Look..that happens to be around 189 days since range began. The same approx day count as the previous 2 ranges this cycle.

We may see a drop lower this month, nothing is for sure but if we fall below that 50 SMA, I will be changing my Bullish Tune and Screaming CAUTION

All to play for in the next few months

BTC 3 MONTHS LONG Starts, this week?Waiting for a last impulse 140 ds/3 months on INDEX:BTCUSD BITCOIN, this week could the 3 months BTC LONG START . Why? Let´s see:

- Channel with 4 elliot waves done. Looking for Wave 5.

- RSI 3D breaking out, like 1 year ago.

- RSI W Just about to Break out, like 1 year ago. Looking for confirmation.

- Rate Cuts this week, lets see.

www.tradingview.com INDEX:BTCUSD

Weekly Support is around 80000.Weekly Support is around 80000.

However, 72500 - 73000 is its previous

breakout level & probably a Best Buying Rage

(if it touches) which is also a Confluence area of

Trendline Support+Important Fib. level.

Bullish Divergence on Shorter Time Frame +

Weekly Support around 80000 (if Sustained)

may push the Price up towards 87000 &

then around 95000 - 96000.

Ultimate Resistance is around 110000.

Crossing this level may open new Highs

Targeting around 136000.

On Shorter Timeframe, 85000 - 86000 is

the Immediate Resistance & Support is

around 80000.

Bitcoin's market share rises despite decline in active usersThe data shows that Bitcoin's dominance has been rising steadily since 2022. It also highlights that Bitcoin's market share of active users has fallen over time. The data shows that on-chain activity in Ethereum and other layer 1 (L1) networks has increased.

OnChain data shows that Bitcoin's dominance has increased since 2022, and the upward trend is the longest in history. The data also shows that Bitcoin's active user market share has fallen as on-chain activity on the Ethereum network has increased.

Amid declining users, Bitcoin dominance has increased;

Matrixport shows that Bitcoin dominance has increased to a new high of over 61%. The analytics platform put the dominance higher, which was stronger than expected in the US jobs report. It said that the increased job rate indicates that the economy is recovering. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

$BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATACRYPTOCAP:BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATA, $95K Soon as Possible?

Bitcoin high-entry buyers are driving sell pressure, price may ‘floor’ at $70K

Bitcoin's “top buyers” are selling heavily, with onchain analytics firm Glassnode calling it a “moderate capitulation event.”

Bitcoin buyers who purchased around when it hit a $109,000 all-time peak in January are now panic-selling as the cryptocurrency declines, says onchain analytics firm Glassnode, which isn’t ruling out that Bitcoin could slide to $70,000.

Glassnode said in a March 11 markets report that a recent sell-off by top buyers has driven “intense loss realization and a moderate capitulation event.”

Short-term holders fled as Bitcoin dropped from peak

The surge in buyers paying higher prices for Bitcoin

BTC $82,482 in recent months is reflected in the short-term holder realized price — the average purchase price for those holding Bitcoin for less than 155 days.

In October, the short-term realized price was $62,000. At the time of publication, it’s $91,362 — up about 47% in five months, according to Bitbo data.

Meanwhile, Bitcoin is trading at $81,930 at the time of publication, according to CoinMarketCap. This leaves the average short-term holder with an unrealized loss of roughly 10.6%.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

On the same day, BitMEX co-founder Arthur Hayes said that Bitcoin may retest the $78,000 price level and, if that fails, may head to $75,000 next.

Glassnode explained that a similar sell-off Bitcoin pattern was seen in August when Bitcoin fell from $68,000 to around $49,000 amid fears of a recession, poor employment data in the United States, and sluggish growth among leading tech stocks.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

BTC SHORT TP:79,500 11-03-2025Bitcoin is currently displaying bearish patterns on the 1-hour timeframe, indicating a potential short opportunity. We aim to close this position within 10 to 13 hours, targeting a take profit in the range of 79,000 - 80,000.

Make sure to follow me to stay updated on this trade and more!

Bitcoin's Natural Correction and the $141K Target Based on Fibonhello dear trader and investors

The cryptocurrency market is always accompanied by strong fluctuations and natural corrections. Bitcoin, as the market leader, requires corrections and liquidity accumulation after each significant rally to pave the way for higher price targets. In this article, we analyze Fibonacci structures and harmonic patterns to demonstrate that Bitcoin's next target could be $141K.

1. Bitcoin Corrections: A Natural Part of an Uptrend

Price corrections in bullish trends are a normal phenomenon that helps shake out weak hands and allows major players to accumulate liquidity. Historically, Bitcoin has experienced 20-30% corrections before resuming its upward trajectory. The current correction is no different and may serve as a base for the next strong move toward higher targets.

2. The $141K Target Based on Fibonacci

Fibonacci levels are among the most reliable tools for predicting price targets. Assuming Bitcoin's recent high was around FWB:73K and the ongoing pullback is a healthy retracement, we can use harmonic AB=CD pattern to project potential upside targets. Based on these levels, Bitcoin could reach $141K in the next bullish phase.

Confirmation Through Harmonic Patterns

Harmonic patterns like Butterfly and Gartley suggest that the current correction is forming a potential reversal structure. If this correction completes within the PRZ (Potential Reversal Zone), Bitcoin could see a strong continuation of its uptrend. The Fibonacci ratios in these harmonic structures indicate that the final price target for this bullish wave could be around $141K.

Volume and Liquidity: Key Drivers for the Rally

Bitcoin needs increased volume and liquidity inflows to reach higher levels. On-chain data shows that trading volumes are rising and large investors (whales) are accumulating rather than selling. This behavior typically precedes a strong bullish move.

Bitcoin's current correction is entirely natural, and technical structures suggest that it could be laying the foundation for a new bullish wave. Based on Fibonacci and harmonic pattern analysis, Bitcoin's next major target is around $141K. Traders and investors should consider these levels in their analysis and avoid emotional decisions during market corrections

good luck

mehdi

Bitcoin at $80,000. A Defining Crossroads: $65,000 or $120,000?Bitcoin stands at a critical juncture at $80,000, where market participants are engaged in a decisive battle between bullish momentum and bearish resistance. The outcome of this struggle will shape the next major move, with two distinct scenarios emerging.

Scenario 1: A Retracement Toward $65,000

If Bitcoin fails to maintain its current momentum, profit-taking and increased selling pressure could lead to a decline toward $65,000. This level serves as a crucial support zone, where demand may re-emerge to stabilize the price before any potential recovery. A break below this threshold would signal a deeper correction, potentially delaying any further upside in the near term.

Scenario 2: A Breakout Toward $120,000

For Bitcoin to sustain a move toward $120,000 by late March or early April, the market must see uninterrupted buying pressure over the next 10 days. There can be no hesitation—buyers need to absorb selling liquidity consistently, preventing any major pullbacks. The key level to watch in this scenario is $109,000, a major resistance zone that has the potential to act as the final barrier before BTC enters price discovery. A clean break and consolidation above this level would significantly increase the probability of an accelerated move toward $120,000.

At this stage, Bitcoin is at a make-or-break point, and the direction it takes from here will set the tone for the coming weeks. Whether it experiences a healthy correction or an explosive rally depends entirely on how market participants respond at these critical price levels.

ETH at a Critical Support Level! Market Poised for a Big Move?Ethereum ( CRYPTOCAP:ETH ) is currently trading at a 261-week-old support level, making this a crucial zone for the market.

Earlier, ETH dipped to $1,754, a price level that has historically been significant. This could very well mark the bottom for ETH and potentially for altcoins. However, it's still too early to confirm.

The next two weekly candles will be key, if this support holds, we could see a strong altcoin recovery in the coming months.

Macro Factors at Play:

The broader geopolitical and macroeconomic landscape isn't great, despite this potential setup. Markets in the US, China, and India are facing turbulence, and the crypto market is experiencing low volume and liquidity. These factors could impact price action in the short term.

That said, as the chart develops over the next few weeks, we might witness significant shifts in market sentiment.

Sooner or later, BTC will make its move—either consolidating or attempting to reclaim $90K—while altcoins could start rebounding rapidly. When this happens, the market could turn bullish in a matter of weeks.

Stay Alert, The Opportunity Is Coming:

Now is the time to pay close attention to the charts and fundamentals. Stay sharp, monitor key levels, and prepare for potential opportunities.

I'll be sharing a handpicked list of altcoins that could perform well in the coming days.

DYOR , Not Financial Advice.

Stay tuned.

Do show your support buy hitting that like button.

Thank you

#PEACE

BTC/USDT updateBefore the correction, we had already shared the most probable scenario for #BTC in Spot Club and, with a slight delay, in this channel. As expected, the price dropped around 11% in spot within wave C, leading to significant liquidity being absorbed in the market.

However, we had already warned tarde-ai.bot members about this potential move in advance.

We still consider our previous outlook as the most probable scenario for Bitcoin's next move. If our perspective changes, we will update the analysis accordingly.

BTCUSDT Price Action | March 12, 2025BINANCE:BTCUSDT.P is now trying to recover from its 50% daily time frame correction. As per my analysis 79444 is now Buyers interest level to go long with stop loss of 76560 for targets of 83593, 85765 (50% Pullback level in 4 hour time frame).

Note. This is my personal analysis, please do your analysis and take decision for buy or sell with strict risk management. Thanks.

The impact of the decline in Tesla's stock price on the BTCUSDThe change in Tesla's stock price has an impact on BTCUSD, mainly in the following aspects:

Investor sentiment transmission: As a highly influential listed company, a significant drop in Tesla's stock price will undermine investors' confidence in technology and innovative assets. This negative sentiment may spread to the cryptocurrency market, causing investors to lose confidence in investing in Bitcoin. Consequently, they may sell off Bitcoin, leading to a decline in the price of BTCUSD. For example, on March 10, 2025, Tesla's stock price plummeted by more than 15%, closing at $222.15, marking its worst single-day performance since 2020. During the same period, the price of Bitcoin also saw a significant drop.

Fund flow transfer: When Tesla's stock price drops, investors may withdraw funds from Tesla stocks and related investment portfolios to seek other more attractive investment opportunities. If there are no obvious other investment targets with high returns and low risks in the market, some funds may flow into the cryptocurrency market, such as Bitcoin, pushing up the price of BTCUSD. However, if the overall market risk appetite decreases, funds are more likely to flow into traditional safe-haven assets, such as gold and bonds, rather than Bitcoin, resulting in a decline in the price of Bitcoin.

BTCUSD sell @84000-84500

tp: 78500-78000

BTCUSD Buy @78000-78500

tp: 82000-82500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

Bitcoin - Weekly Forecast - Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 73777.00, resumption of uptrend is expected.

We make sure when the resistance at 91037.20 breaks.

If the support at 73777.00 is broken, the short-term forecast -resumption of uptrend- will be invalid.

BITSTAMP:BTCUSD

Technical analysis:

A peak is formed in daily chart at 109588.00 on 01/20/2025, so more losses to support(s) 78180.00 and minimum to Major Support (73777.00) is expected.

Take Profits:

86499.57

91037.20

94505.46

98489.63

101430.12

105431.17

109932.89

115000.00

120000.00

125000.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

130000.00

Heiken Ashi Bitcoin chart shows us near Bottom of Range I have posted this chart before so this is an UPDATE

As we can see, PA has come down and now bumped into the rising line of long term support and at the expected % of drop ( -24 )

Does this mean that PA will bounce ?

NO but it does have a higher chance of doing so as the lower Timef rames are now oversold.

The weekly MACD is still falling Bearish and has a few more weeks to go before reaching Neutral.

The Lower Oversold time frames should give PA the energy to rise off this trend line and aim towards Range high

However, as we saw in 2023, PA can drop below and so we need to remain cautious and watch PA closely.

Tomorrow , March 12, we have the USA inflation data being released and this will most likely act as a catalyst to a move in either direction, depending on the data

So, Hang on , Be optimistic while being cautious.. Bitcoin is at a turning point....We are just notto sure in which direction.

BTC/USDT 1H: Bullish Breakout Retest – Targeting $89K?BTC/USDT 1H: Bullish Breakout Retest – Targeting GETTEX:89K ?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure (Confidence Level: 8/10):

Bullish trend confirmed after breaking the Fair Value Gap (FVG) at $83,200.

RSI shows strong momentum, with a bullish divergence from recent lows, supporting further upside.

Smart Money Analysis:

Accumulation phase evident between $77K - $78K, confirming institutional positioning.

Multiple bullish order blocks formed, reinforcing higher-low structure.

RSI confirms institutional buying pressure, with momentum favoring continuation.

Trade Setup:

Entry: $83,200 - $83,400 (current retest of breakout).

Targets:

T1: $86,400 (previous high).

T2: $89,000 (major resistance).

Stop Loss: $82,000 (below recent swing low).

Risk Score:

7/10 – Favorable risk-to-reward, but market volatility must be considered.

Key Levels:

Support: $82,000, $80,500.

Resistance: $86,400, $89,000.

Market Maker Activity:

Currently engineering a liquidity grab above $84K, likely before a continued move higher.

Volume profile supports bullish continuation, with Smart Money positioning for another leg up.

Recommendation:

Long positions remain favorable on the $83,200 - $83,400 retest.

Watch for price reaction at $84K, as liquidity may be grabbed before a strong move to targets.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!