Cryptonews

The Future of Blockchain: A New Era of TokenizationGreetings, fellow enthusiasts!

I believe we are on the brink of a transformative era for blockchain technology. Here's my vision for how the future will unfold:

The New Era of Tokenization: We are entering a period where almost every financial asset will be tokenized. Imagine stocks, gold, silver, and various commodities all represented as digital tokens on the blockchain. This shift is already gaining momentum, with big banks and influential players like Larry Fink from BlackRock advocating for the tokenization of everything.

The Impact on Digital Assets: As we move towards this future, traditional financial assets will transition into digital tokens. This will, in my opinion, lead to digital assets without real-world counterparts, such as MARKETSCOM:BITCOIN , becoming "virtually" (pun intended) useless. Why? Because the tangible value of assets like tokenized TVC:GOLD or stocks will overshadow the speculative nature of purely digital assets.

The Role of Big Banks and Institutions: With the backing of major financial institutions, the adoption of tokenization will accelerate. This will bring about a more secure, transparent, and efficient financial system, bridging the gap between traditional and digital finance.

The Future: This is probably the end of the road for MARKETSCOM:BITCOIN and existing cryptocurrencies as we know them. Say hello to a new era of Cryptography that will be as mainstream as it can get.

In summary, the future of blockchain lies in the tokenization of real-world assets, driven by the support of big banks and key industry leaders. This new era will redefine the landscape of digital assets, making those without tangible counterparts less relevant or even completely irrelevant.

I look forward to hearing your thoughts and engaging in a lively discussion!

INDEX:BTCUSD NASDAQ:MSTR NASDAQ:COIN NASDAQ:MARA INDEX:ETHUSD CRYPTO:XRPUSD TVC:GOLD TVC:SILVER BINANCE:BTCUSDT COINBASE:BTCUSDT

Bitcoin (BTC/USD) Bearish Breakdown Potential – Key Support Leve:

🔍 Technical Analysis:

Resistance Zones (Purple Rectangles at the Top)

The price recently hit a resistance area around $92,000.

It also tested an ascending trendline (red line) and failed to break higher.

Support Zones (Purple Rectangles at the Bottom)

There are two significant support areas:

First zone around $87,500 - $88,000.

Second zone around $82,000 - $83,000.

Bearish Expectation (Black Arrow)

The price is projected to break down from the current level.

A potential lower high formation suggests further decline.

Target areas: $88,000 first, then possibly $82,000.

🔥 Conclusion

Bearish bias if the price fails to reclaim the resistance.

A breakdown below $88,000 could accelerate the drop.

Watch for rejection signals at resistance zones before confirming short trades.

Analysis of BTC/USDT double top pattern occurring in the market.Hello traders.

As i mentioned before in my analysis when ever the double top pattern occure the market will move downward but still it is not completed when the neckline breacks then it will be the complete double top pattern and it will move btc more download.

If the btc bounce back from the resistance which is making right here on 8600$ it will be more upword.

Shere your valuable thoughs in comments about btc.

BTC/USD Bullish Breakout Setup – Targets & Stop-Loss StrategyThis BTC/USD 4-hour chart shows a symmetrical triangle formation, with price respecting both the ascending trendline and descending resistance. The price is currently near the support of the triangle and could make another move toward equilibrium before testing the upper trendline.

Key levels and target

- Resistance at 90,726 (target area ).

- Support at the ascending trendline and weak low at 78,913.

- A breakout above the triangle resistance could lead to bullish momentum toward 94,818 .

A reaction at equilibrium may decide whether BTC continues consolidating or breaks out. Keep an eye on volume and momentum for confirmation.

1. 90,726 – A key resistance level and the first bullish target.

2. 94,818 – If BTC breaks above the first target, this level could be the next upside resistance.

83,500 – A safer stop-loss level below recent swing lows, reducing the chances of

getting stopped out by short-term volatility.

A breakout above the symmetrical triangle with strong momentum could push BTC toward these levels. Watch for confirmation at the equilibrium zone and a successful breakout for further upside movement.

ADA/USDT at Decision Point – Major Move Incoming!ADA/USDT is testing a major resistance zone after retesting the 100 EMA and bouncing from the rising support line. The price remains in a long-term symmetrical triangle, with the resistance trendline as a key breakout level.

The Stochastic RSI is recovering from oversold levels, indicating potential bullish momentum. A breakout above resistance could trigger a strong uptrend continuation, while rejection may lead to a pullback toward support.

Potential Reversal of the Trump Coin!Hello Every one ! The Trump coin experienced an 85 percent drop after reaching its highest price, forming a falling wedge pattern. This could indicate a potential reversal point for the coin. Although the chart is limited, it may be worth considering a better entry point below $12 or near $10, although it might not reach that level. Please note that this is not financial advice. BINANCE:TRUMPUSDT BINANCE:TRUMPUSDT.P KCEX:TRUMPUSDT

Did Bitcoin Just Trick the Bears? RSI Says Yes!Bitcoin's recent price action suggests a potential bear trap, as the price sharply dipped below a key support zone before rebounding. The sudden breakdown may have triggered panic selling, but the rapid recovery and bullish divergence on RSI indicate that this could have been a false breakdown designed to shake out weak hands before a stronger upward move.

The price is now reclaiming levels above the previous demand zone, signaling a possible reversal. If Bitcoin sustains momentum and reclaims the $90,000 region, it could invalidate the bearish breakdown and push toward new highs.

Bitcoin Has Dropped $20K in a Single Week! Where’s the Bottom?Hey followers,

Crazy times, huh? I was just looking at the Bitcoin chart, and I don’t see any other week in history with a $20K retracement, absolutely wild.

I haven’t done much BTC analysis lately, but the last time I did, I warned: “Money on your screen won’t feed your family—turn it into real gains.” Well, here we are. Once again, two simple criteria have proven their ability to predict profit-taking areas and potential corrections:

📌 Channel projection

📌 Equal waves

Now, with this massive sell-off, it’s time to hunt for strong support zones. Percent-wise, the weekly drop might not be extreme, but in raw dollar terms, it should be the biggest in BTC’s history. So, where could this madness stop?

For me, the 48K–$66K range is where things get interesting. Somewhere inside this zone, I expect a reaction, and I’ll be looking for possible reversal setups. Let’s break down the key reasons why this area is a potential landing spot:

🔹 1. Previous yearly highs acting as support

In 2021, Bitcoin saw two major sell-offs in the $60K–$70K range. Then, in early 2024, the same zone acted as a strong resistance before BTC finally broke through.

When a zone like this is left untested, it often pulls the price back like a magnet for a retest, a classic case of liquidity seeking validation. That’s why this area forms the foundation of my support box.

🔹 2. Short-term trendline alignment

This trendline, drawn from wick touches, is valid because the third touch happens higher than the peak between the first and second touches, comes to retest the trendline from higher high levels (HH). Even though it’s short-term, it perfectly aligns with the horizontal support zone, adding extra confluence.

🔹 3. 50% retracement from the all-time high

From my past crypto analysis, BTC loves its 50% retracements from all-time highs—like clockwork. And guess what? This level perfectly overlaps with the marked support zone, reinforcing its strength.

🔹 4. The psychological $50K level

Round numbers play a big role in trading, humans love them. Back in August 2024, $50K acted as a key level. I even mentioned on a local radio station earlier that year that buying the dip around here could be a smart move… and, well, lucky me, it worked out. :)

So once again, this simple but effective criterion strengthens the case for this area.

Putting all these criteria together:

Summary:

The more confluences in a single price zone, the stronger it is. Sure, we could add some fake trendlines or EMAs, but for me, price action and human psychology tell the real story. Think of it like tracking footprints in the snow, BTC leaves clues, and it’s our job to follow them.

- For long-term believers, this zone could be a solid place to accumulate more BTC.

- For those looking to enter Bitcoin for the first time, this is the area to watch.

What do you think? Are we heading lower, or...

🚀If you like the analysis, hit the boost as well🚀

Cheers,

Vaido

---------------------------

📢 Want more in-depth technical analysis?

I post similar insights on my Substack channel, where I break down technically strong stocks worldwide by saving you time and helping grow your portfolio. I do the technical analysis, so you don’t have to!

🔗 Find the link in my BIO (under the Website icon) , or if you're using mobile just scroll down to my signature to choose your preferred language.

See you there!

NEARUSDT on a bullish climb!

🚀 The price BINANCE:NEARUSDT.P is moving steadily inside an ascending channel, testing *3.080 USDT* resistance. If the breakout holds, we could see a push toward higher levels!

🔑 *Key Levels:*

**Support:**

*3.051 USDT* – main level keeping the trend intact.

*3.000 USDT* – deeper support if retracement kicks in.

**Resistance:**

*3.094 USDT* – key breakout point.

*3.150 USDT* – potential next stop for bulls.

🚀 *Trading Strategy:*

*Long Entry:* After confirming a breakout above *3.094 USDT*.

*Stop-Loss:* Below *3.051 USDT* – protecting against fakeouts.

*Profit Targets:*

*3.120 USDT* – quick scalp target.

*3.150 USDT* – solid take-profit zone.

*3.200 USDT* – full bullish extension if momentum builds.

📊 *Technical Outlook:*

Price respecting the channel = continuation likely.

Volume picking up – signals increasing bullish interest.

Failure to break resistance could lead to a pullback to support.

💡 *What to Watch?*

Watch for volume confirmation on breakout!

If resistance rejects, look for a retest at lower support before re-entering.

Bulls in control, but risk management is key.

Are we heading for a breakout or a pullback? Drop your thoughts! 🚀🔥

Ethereum’s Accumulation Phase Ends – What’s Next?Ethereum has successfully broken above the accumulation zone, indicating a potential bullish continuation. The price is now approaching a critical descending trendline resistance (blue line), where a breakout could trigger further upside momentum.

Key Observations:

Breakout from Accumulation: The price has cleared a consolidation phase, suggesting renewed buying interest.

Next Resistance (Green Box): The immediate hurdle is the descending trendline resistance within the green box. A breakout and successful retest of this level could push the price toward the next major resistance.

XRP Weekly Summary: February 15–21, 2025Welcome back to my weekly XRP roundup! As of February 21, 2025, the XRP market has been buzzing with activity, reflecting both its resilience and the broader crypto landscape’s volatility. Here’s what’s been happening with Ripple’s flagship cryptocurrency this week.

Price Action: A Rollercoaster Ride

XRP kicked off the week with a notable surge, climbing over 20% to hit $2.76 by midweek. This rally was a breath of fresh air for holders, fueled by whispers of regulatory clarity and renewed investor confidence. However, as Bitcoin and other major cryptocurrencies faced downward pressure, XRP cooled off slightly, trading around $2.50–$2.60 by Friday morning. Posts on X highlighted this pullback, noting resistance near all-time high volume-weighted average price (VWAP) levels, suggesting the market might be testing a critical ceiling. Despite the dip, XRP’s weekly gains remain impressive, hovering around 15–17% depending on the hour—a solid performance amid a shaky broader market. Or, if 15-17% doesn't impress you much in one week, you always have the alternative to put your money in a CD at your local bank for 4.7% per year.

Legal Winds Blow in Ripple’s Favor

The big story this week? Legal developments surrounding Ripple’s long-standing battle with the SEC. Sentiment on X and crypto news circles suggests growing optimism that the tides are turning. Speculation is rife that the SEC’s case could weaken further, especially with chatter about the agency acknowledging Grayscale’s XRP ETF filing. While no official resolution has dropped as of Friday morning, the narrative of “SEC overreach” is gaining traction, boosting XRP’s appeal as a “sleeping giant” ready to awaken. If these legal clouds clear, analysts see a path to $3 or higher in the near term—exciting times ahead!

ETF Hype Heats Up

Speaking of ETFs, the XRP ecosystem is abuzz with ETF-related developments. Multiple firms have been pushing XRP exchange-traded fund applications, and this week, the buzz intensified. The idea of a BlackRock-backed XRP ETF even popped up in some enthusiastic X posts—though it’s still speculative at this stage. The potential for an approved ETF continues to drive bullish sentiment, with analysts suggesting it could unlock a “liquidity cascade” and propel XRP past its previous all-time highs. For now, it’s a waiting game, but the anticipation is palpable.

Another Financial Institution Connects to the XRP Ledger

On February 19, 2025, Braza Group, an international payment firm with over 15 years in the banking sector, announced the launch of its BBRL stablecoin on the XRP Ledger. Braza Group, while not a traditional bank itself, is a BACEN (Central Bank of Brazil) interbank player, meaning it operates within Brazil’s regulated financial ecosystem and facilitates interbank transactions. The BBRL stablecoin, pegged to the Brazilian Real, aims to provide a secure and efficient digital transaction option for individuals and businesses, leveraging XRPL’s capabilities.

Making Closer Ties Where Its Important

Brad Garlinghouse, the CEO of Ripple has been active in the public sphere recently, but the most notable events occurred earlier in February. On February 14, 2025, he shared on X about engaging with U.S. policymakers in Washington, D.C., including meetings with figures like Senator Tim Scott (Chairman of the Senate Banking Committee) and Representative Ritchie Torres. Photos from these meetings were posted, showing him alongside lawmakers such as Representatives William Timmons, Bill Huizenga, Bryan Steil, Zach Nunn, and French Hill. These discussions focused on advancing crypto regulatory clarity, but they fall just outside this week’s timeframe (February 15–21).

Market Sentiment and On-Chain Moves

On-chain data paints a picture of accumulation, with significant XRP outflows from exchanges reported earlier in the week—think tens of millions of dollars’ worth. This suggests big players might be stacking their bags, betting on a breakout. Meanwhile, X users are hyping up technical patterns like the “cup and handle,” hinting at a possible 18% jump to $3.30 if XRP clears key resistance around $2.82. The mood? Bullish, but cautious—everyone’s watching Bitcoin’s next move and the Fed’s hawkish stance for cues.

What’s Next?

As we wrap up this week, XRP stands at a crossroads. Will it smash through resistance and reclaim its glory above $3, or will market headwinds force a deeper correction? With legal clarity on the horizon, ETF speculation simmering, and strong community support, XRP is poised for a potentially historic moment. Stay tuned for next week’s update—we might just see fireworks!

XRPCRYPTOCAP:XRP is at a major turning point at the $2.65 level as we look to push through the 200 EMA. If we get news of the SEC case dropping, Federal Reserves or more positive ETF news we may be on our way towards $3 heading into the weekend.

If we fail this level we may retest the $2.45 support before we head back up.

We are looking more bullish everyday, the time is coming for the switch to be flipped.

Ethereum MELT UP is coming. There's been a lot of discussion lately on where ETH price might go and, mostly the news I saw, where super bearish on it.

I remember seeing a chart where Hedge Funds where MEGA bearish on it based on Trump news of some sort, however these data was not lying and indeed Hedge funds had the most COT bearish data ever recorded (2024 Xmas), thus the price suffered a great decline since.

Now the picture has change dramaticaly; technicals + recent COT are pointing to a MELT UP that can happen from March.

Ethereum present us a clear 1, 2, 3, 4 (we're here), 5 - Elliot Wave Count, where we are now in an extended corrective ABCDE pattern ready to blow up with Monthly Demand level, which we are currenly testing.

From COT readings, we can see Fund Managers going from -4.250 net positions, to 2095 net positions, meaning that they went from MEGA bearish to VERY bullish in a short period of time.

Conclusion, I see a MELT UP incoming in the next months of 2025.

Beyond BTC - Why Coinbase (COIN) is a Long-Term Buy?As a trader, I'm always watching the markets, but building long-term wealth is also key. That's why I'm digging into assets like Coinbase (COIN) . While my day job is trading, Coinbase has definitely caught my eye as something portfolio-worthy for the long haul. We might have missed the IPO buzz back in 2021, but looking at where Coinbase is headed, I think we're still early in a massive growth story.

Don't let short-term crypto ups and downs distract you. Coinbase is playing a long game, and here's why it's a smart long-term investment -

CEO Brian Armstrong's Big Vision (and Big Numbers):

Already a Financial Giant: Think of Coinbase as a bank or brokerage – it's already HUGE. It's as big as the 21st largest US bank by assets ($0.42 trillion!) or the 8th largest brokerage. This size matters.

Going Global: Coinbase isn't just focused on the US. They're expanding worldwide to grab new users and markets.

Becoming Your All-in-One Financial Hub: Forget old-school banks. Coinbase wants to be your single crypto-powered financial account for everything – payments, investing, and more. This is where finance is heading.

Token Powerhouse: Crypto is about more than just Bitcoin. Coinbase wants to list every token, becoming the go-to place for the entire crypto universe.

Blending Crypto Worlds: Coinbase is smart – they're linking up with new decentralized crypto systems (DeFi) to give you the best of both worlds, easy to use but with more options.

Working with Regulators: Coinbase is playing it smart, working with governments to make crypto safe and trusted for everyone long-term.

Massive Crypto Payments: People are using crypto to pay – big time. $30 TRILLION in stablecoin payments happened last year alone. Coinbase is ready to cash in on this payment revolution.

Why This Matters for Long-Term Investors:

Crypto is Exploding: Everyone knows crypto is going to get bigger. Coinbase is in the perfect spot to ride this massive wave.

Big Money is Coming: Big institutions like banks are starting to invest in crypto. Coinbase is built for them – safe, secure, and ready for big players.

Coinbase is the Brand You Trust: Coinbase is the big name in crypto. People know and trust them, which is gold in a new market.

Bottom Line: Coinbase isn't just a trend; it's building the future of finance. Yes, crypto is bumpy, but for the long haul, Coinbase is positioned to be a winner.

Now let's get technical and have a look at what the charts are saying -

Uptrend is Clear: Forget short-term noise – this chart shows Coinbase has been on a solid climb since late 2023. There's a strong bullish structural break which indicates the trend has shifted up after a short bearish run.

$350 is the Line in the Sand: Think of $350 as the ceiling right now. The price hit it, and we saw some selling. Gotta break above $350 to really see the bulls charging again.

$225-$250 is the Safety Net: On the flip side, $225-$250 is like solid ground. As long as we stay above that, the bull run is still in play.

Just Taking a Breather: Right now, the chart says "consolidation." Think of it as Coinbase catching its breath after a big run. This pause can be a good thing – building up energy for the next push up.

RSI is Neutral for Now: The RSI thing is the 50% level. Not screaming "buy" or "sell," just saying "wait and see." After showing us bearish divergence we are likely to see oversold conditions within the current range - if that does happen it would be a good time to strike.

What to Watch For (Trader Style):

Breakout Above $350 = Green Light: If COIN blasts through $350 with some volume, that's the signal to jump in long. Think higher targets.

Stuck Between $250 and $350 = Range Trade Time: If it stays in this range, you can play the range – buy low, sell high within the range. But be ready for a break either way.

Drop Below $250 = Caution Flag: If we crack below $250, that's a warning sign. Might be time to get a bit more defensive.

Final Notes:

Coinbase looks good long-term, but we're in a "show me" moment right now. Watch those key levels – $350 and $250. Patience is key, but the chart is set up for a potential bullish move if we get the right trigger. If you're looking to invest for the long-haul, now would be a good time to add some shares to your portfolio.

Important Disclaimer:

Please remember, I am not a financial advisor. My analysis here is based on my personal research and is intended for informational and educational purposes only. Before making any investment decisions, it is essential to consult with a qualified financial professional who can provide advice tailored to your individual circumstances.

Investing in financial markets, especially in assets like cryptocurrencies and related stocks, carries significant risk. There are no guaranteed returns, and it's crucial to understand that investing is not gambling. Strategic investing involves thorough research, careful timing, and a clear understanding of your own risk tolerance and investment amounts. Always conduct your own independent research and due diligence before investing in any asset.

NASDAQ:COIN COINBASE:CBETHUSD COINBASE:CBETHETH COINBASE:CBETHUSDC OANDA:NAS100USD

Crypto Crash: Is Forex and Gold Next?!The current market crash in crypto is likely due to a combination of factors, including:

1. Regulatory Pressure – Governments and financial regulators worldwide are tightening control over digital assets, leading to uncertainty and panic selling.

2. Macroeconomic Conditions – Rising interest rates, inflation concerns, and a stronger U.S. dollar often lead investors to pull out of risky assets like crypto.

3. Institutional Sell-Offs – Large holders (whales) and institutional investors may be liquidating positions, further driving prices down.

4. Market Sentiment & Liquidations – Fear-driven selling and cascading liquidations in leveraged positions exacerbate price drops.

Should We Worry About Forex and Gold?

Forex markets and gold are affected by macroeconomic conditions, but not always in the same way as crypto.

• Forex (XAU/USD & USD pairs): A strong dollar usually puts pressure on XAU/USD, but gold also benefits from risk aversion. If crypto weakness is tied to broader economic fears, gold might see increased demand as a safe haven.

• USD Strength: If the crypto crash is part of a broader risk-off sentiment, the U.S. dollar could strengthen, impacting major forex pairs.

Final Thoughts

Crypto’s crash doesn’t necessarily mean forex or gold will follow suit. However, if this is part of a bigger shift in risk appetite, we might see volatility across all markets. Watch economic data, Fed decisions, and global risk sentiment closely.

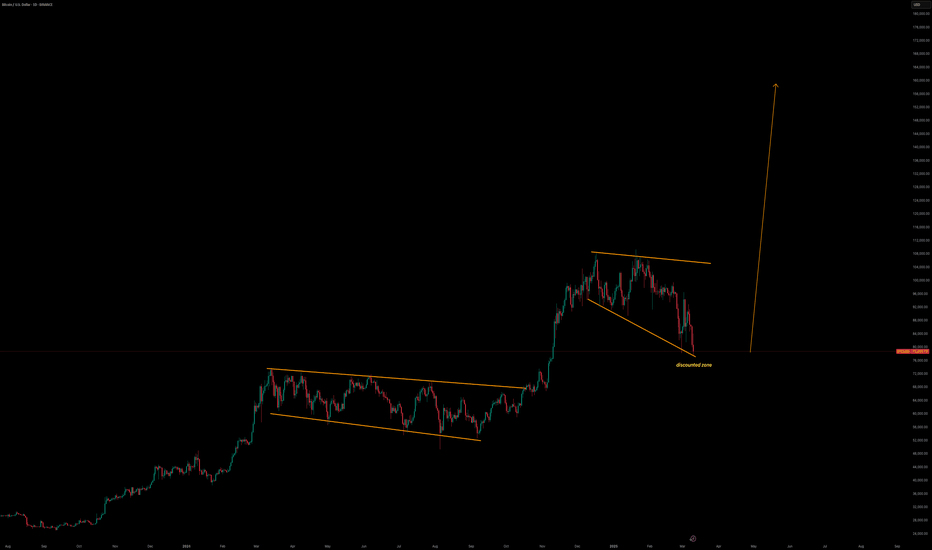

Bitcoin Game Plan - BTC PREDICTIONHello folks, it's time to update the BTC game plan.

My previous Bitcoin game plan worked precisely. The timing and price levels were 100% accurate, and as expected, we saw a new all-time high (ATH). I hope you managed to make some profits!

I’ve attached the previous BTC game plan below—feel free to give it a look.

New Game Plan:

Bitcoin has set a new ATH, but it seems we’ve encountered significant selling pressure at that level, and we couldn’t close above it. This indicates Bitcoin doesn’t yet have enough liquidity to expand higher.

From this perspective, I expect the price to retrace slightly, grab some liquidity from the buy side, and then continue its upward journey.

Scenario 1:

Price grabs the lows below and hits the purple line (Range High) before bouncing to a new high. (Less likely)

Scenario 2: (Marked on the chart)

Price grabs the lows completely and retraces to the blue bullish trendline, bouncing from there. We might even create a deviation below the blue line, trapping bears who aggressively short after a trendline break, and bounce from the green zone marked just below the blue line. (This is my preferred scenario.)

Scenario 3:

Price retraces further to grab all the way down to the lows and bounces from the black trendline we previously broke.

I’m sharing all three potential scenarios for clarity.

Also, with a pro-crypto president currently in office, any significant bullish news could send Bitcoin skyrocketing. Keep this in mind.

I remain overall bullish on Bitcoin. I firmly believe we haven’t seen the top yet. Despite the panic and sell-off from some gurus on X and TradingView who claim we’ve topped, I personally think we’re not even close to the peak.