Dow Jones - Value Is The King Of 2025!Dow Jones ( TVC:DJI ) withstands all bearish struggles:

Click chart above to see the detailed analysis👆🏻

All major U.S. indices have been weakening lately but the Dow Jones is clearly the strongest of all. It seems like big institutions are shifting back to value stocks and therefore the Dow Jones remains very strong. Looking at technicals, this trend is rather likely to continue during 2025.

Levels to watch: $40.000, $50.000

Keep your long term vision,

Philip (BasicTrading)

D-DJI

BTC TARIFF TALKAs President Trump steps up on the stage to deliver his tariff plan BTC had a steady price rise going into the talk, a nice HH & HL LTF structure up into range high/ last weeks high, then as the speech began all of the progress made throughout the day wiped in less than 2 hours to reset BTC's price to Tuesdays low.

In the end the news event gave volatility as expected but ultimately the structure remains the same, rangebound. As the Tax year comes to an end it would be a hard ask for this choppy price action to shift bullish when institutions are going to be window dressing their portfolios for the next financial year.

In essence A continued LTF range with an overall HTF bearish trend looks to continue, this is compounded by yet another failed attempt at the 4H 200 EMA which had temporarily been broken but sent back below by the tariff announcements.

The SPX, DJI & NASDAQ Futures pre-market is looks dreadful so a revisit on the range low is probable on the cards at some stage today.

DOW JONES: 4 week bottom on the 1W MA50. Best time to buy.Dow Jones turned neutral again on its 1D technical outlook (RSI = 46.611, MACD = -297.980, ADX = 37.851) as it is recovering today and more importantly keeps its price action above the 1W MA50. This is the 4th straight week that it trades and holds the 1W MA50, which is shaping up to be the natural long term support. That is keeping the 1W RSI neutral (47.224), which technically suggets that it is the most low risk level to buy. The 1W RSI made a double bottom due to this consolidation and the 1W MACD printed the first light red bar, all of which are similar to the October 23rd 2023 bottom.

Both have been bottoms after bearish waves of the 1.5 year Channel Up and as a matter of fact similar in decline rate (-9.50%). The highest probability level for a rebound and start of the new bullish wave is this, and based on the previous, it should aim for the 2.0 Fibonacci extension (TP = 49,000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The Dow Jones Industrial Average (^DJI) Dips 1.69% The Dow Jones Industrial Average (^DJI), a price-weighted measure of 30 U.S. blue-chip companies across various industries except transportation and utilities, faced a notable downturn in Monday’s premarket session. Despite a positive movement in U.S. equity futures, the index saw a 1.69% decline, with its 1-month low serving as a critical support level. A break below this level could see the Dow finding support around the $42,000 region.

Technical Analysis

The Dow Jones (^DJI) is currently hovering near its 1-month low, which is acting as a key support zone. If the index fails to hold this level, it could face further downside pressure, potentially testing the $42,000 mark as the next major support. The overall sentiment in the stock market remains cautious, with investors monitoring upcoming economic reports and corporate earnings that could influence market direction.

Meanwhile, the broader market selloff has had a ripple effect, with the Nasdaq falling 2.5% on Friday, marking its worst weekly decline in three months. The S&P 500 also erased its February gains, while the Dow dropped nearly 750 points over the past week. The weakness in equities has largely been driven by concerns over slowing economic activity, disappointing PMI data, and rising inflation expectations.

Economic Uncertainty & Corporate Earnings

The broader stock market has been navigating economic uncertainty, with recent data signaling potential challenges. A disappointing services sector report from S&P Global’s PMI survey and a surge in inflation expectations from the University of Michigan’s consumer survey contributed to market jitters. Investors are now turning their attention to **this week’s key economic data releases, including:

- Thursday: Second estimate of U.S. Q4 GDP from the Commerce Department

- Friday: PCE price index data (the Fed’s preferred inflation gauge) from the Bureau of Economic Analysis

These reports will play a crucial role in shaping market sentiment, particularly with **inflation and economic growth concerns** taking center stage.

Market Reaction: A Positive Start to the Trading Day?

Despite the premarket dip in the Dow, U.S. equity futures suggest a potential recovery:

- S&P 500 futures indicate a 32-point gain at the opening bell

- Dow Jones futures suggest a 297-point advance

- Nasdaq futures are up 93 points, driven by premarket activity in Nvidia, Tesla (TSLA), and Intel (INTC)

Additionally, Berkshire Hathaway (BRK.B) shares are up 1.4% after Warren Buffett’s investment firm reported its third consecutive year of record profits, with a staggering $334.2 billion cash reserve.

Conclusion

The Dow Jones Industrial Average continues to face uncertainty amid economic headwinds and a volatile earnings season. While support at the 1-month low remains crucial, a break below could lead to a test of the $42,000 level. The upcoming economic data and Nvidia’s earnings report will be critical in determining whether the market can regain momentum or if further downside risks persist.

Combined US Indexes - Lower High checked; Lower Low next...As expected from previous analysis, there is a lower high likely as the TD Sell Setup is Perfected. This just missed the target but has the TD Bear Trend intact

Following, a Bearish Engulfing pattern plus a Gap Down occurred yesterday.

Breaking back into Extension Zone box... and likely to protrude out the other side.

MACD is turning down in the bearish zone too.

So, looking for a lower low now...

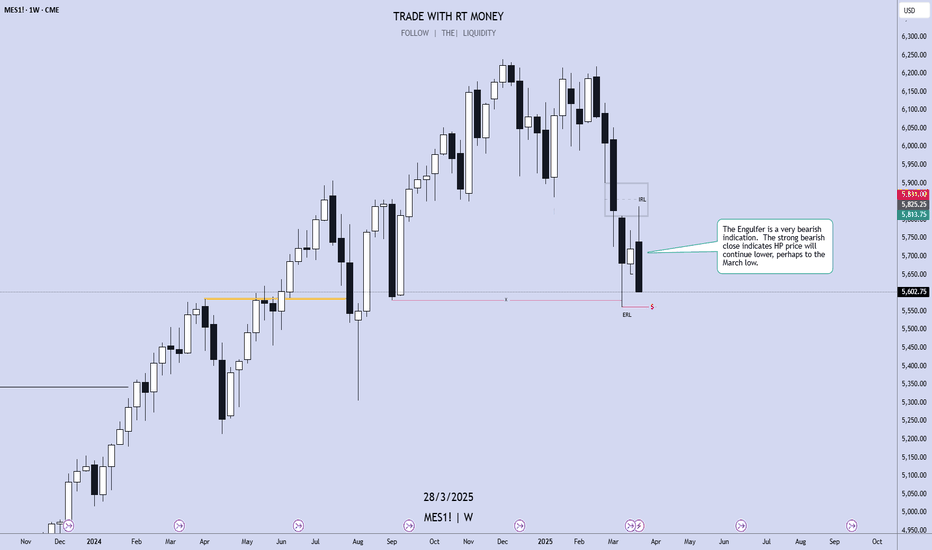

Weekly Market Forecast: SELL THE INDICES!In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of March 31st - April 4th.

The equity markets took a bearish turn last week. This is likely to continue for the upcoming week.

Monday is the end of March. Tuesday brings a new week and new opportunities. April 2nd brings... potentially market flipping volatility. The day the Trump tariffs are implemented.

Be careful. Let the market give you direction, and then get involved.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DJI US stock market forecast 2025-2026Assumption:

oct-22 — nov-24 (1-2-3-4-5) wave is over.

correction (a)-(b)-(c) is expected.

likely structure is a 3 wave regular flat.

Time:

the correction is expected to last until at least sep-25.

Price:

it's too early to predict final price for wave (c).

anticipated range is 35000-39000.

wave (a) shall reach 39600.

Long term waves:

Major uptrend lasts 25 years.

Major correcting downtrend lasts 9 years.

Next major downtrend is expected to start in 2033-2034.

BITCOIN - The Bearish Scenario - Sign's of a Possible Top...In this video, I explore the possibility that Bitcoin may have already hit a temporary peak.

My perspective comes from initially building a bullish case—only to uncover subtle flaws that I chose to set aside.

But as I meticulously documented my observations, those cracks in the bullish argument became impossible to ignore. When I switched to a bearish wave count, some thing began to align, shedding light on areas of the chart that previously seemed uncertain.

These market waves are intricate, requiring patience and a fresh perspective to decipher where we truly stand in the broader pattern.

Only after stepping back and allowing time for meaningful price action does the picture start to come into focus.

I also touch on Ethereum's pattern and the Dow Jones.

Weekly Market Forecast SP500 NASDAQ DOW: Short Term BUYS!In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of March 24 - 28th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The equity markets have been choppy lately, but this week may be different. The economic calendar shows a smooth week ahead, as there are no NFP, FOMC, or similarly volatile news ahead to potentially reverse a market out of the blue. The indices show potential to break consolidation and move upwards. So we wait until there are definitive market structure shifts to occur, acting as confirmations.

Only then do we pounce!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Combined US Indexes - Time to make a Lower HighFrom the last time, the Combined US equity indexes did keep into the Extension Zone (EZ) as marked out. This Zone is defined from the lowest point of the TD Setup and the range is determined by the range of the candle that has the lowest point, this case being Candle 9 (4 March).

So after the expected two week in the EZ, we see an indication of the week ahead to continue the Sell Setup and break out of the EZ for the week, at least from mid-week where it would be candle 9.

According to TD rules, this Sell setup is NOT bullish, and can be expected to turn further down from resistance (Orange Line). This orange line is determined from the weekly chart where there is an ongoing TD Buy Setup (bearish) that needs to be kept intact for the trend to continue.

So, based on the techincals, the combined US equities may be seeing a last week of bullishness which goes through the yellow ellipse, then face strong resistance and continue the main Bearish trend (as depicted by the prevailing Buy Setup (20Feb to 4Mar). Noted that the main trend changed to Bear once the TDST was broken down on 3Mar.

Here are very good live examples for those keen on (Thomas) Demark indicators; watch and wait for it to develop...

DOW JONES targeting 50000 on this final Bull yearDow Jones / US30 posted the first green weekly candle after hitting last week the 1week MA50.

This is obviously a critical support level as it has been holding since the October 30th 2023 rebound.

As this chart shows, Dow has been repeating the same patterns, Cycle after Cycle.

Right now it has entered the Final Year of Bull, which is the part where it rises aggressively to form the Top before the new Bear begins in the form of a Megaphone pattern.

The previous Bull peaked on the 2.382 Fibonacci extension of the Megaphone.

This means that a 50000 Target for Dow is perfectly plausible by the end of 2025.

Follow us, like the idea and leave a comment below!!

DOW JONES: MA50-100 Bearish Cross says we've bottomed.Dow Jones is almost neutral on its 1D technical outlook (RSI = 43.171, MACD = -608.620, ADX = 62.568), rising aggressively since last week. Technically that was the bottom no just on the 8 month Channel Up but also on the LL trendline. We've seen the very same LL bottom on the October 2023 and March 2023 lows, all of which had oversold 1D RSIs. The 1D MA50-100 Bearish Cross marked those bottoms and today we've completed a new one. Technically the index can rise as high as the 2.0 Fibonacci extension (TP = 49,000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Dow Jones 3-daily OutlookLooks like a confirmed double-top, might turn into a Head/Shoulders even.

Head Shoulders:

A common scenario with these is, it looks like a double top, then has a strong reclaim of the neckline, which is around 41.9k, and then a 2nd loss of it shortly after w/ yet another re-test with failure to reclaim.

Double Top:

Another common scenario is just a re-test and failure to reclaim, and this is a textbook double-top.

50/200 3-daily EMAs and MAs:

After losing the 50 EMA and MA, we keep dropping below the 200 EMA and MA on the 3 daily chart during stronger dips, and then finally recovering back above both.

Recovery or Recession?

Recovery:

If we want to see a recovery, we need to do that again. So, a strong move back above the 200 and 50 EMAs/MAs after losing both, down to around 38.5k and then 37.5k, possibly as low as 36.3ish.

Or, for a more immediate flip to bullish, we need to reclaim ~41.9k during any re-tests, and then head to a new ATH above 45k.

Recession:

If we don't bounce from just below the 200 EMA and MA, we might see an extended move down or even a recession.

Dow 200 Points from Major SupportThe Dow Jones is just about 200 points from major support. I should caution there's often a move through support and slightly below, but this is where all the buyers are.

(I should have drawn the arrow to hit the next major resistance/support around 2031 lol, but you get the idea)

Good luck!

Flat correction in DOW JonesA flat correction differs from a zigzag in that the sub wave sequence is 3-3-5, as shown in chart. Since the first actionary wave, wave A, lacks sufficient downward force to unfold into a full five waves as it does in a zigzag, the B wave reaction, not surprisingly, seems to inherit this lack of countertrend pressure and terminates near the start of wave A. Wave C, in turn, generally terminates just slightly beyond the end of wave A rather than significantly beyond as in zigzags.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Its Been A Long Time Hasn't It?I see a possible horrible set up coming. But also an incredibly easy set up for the current US Administration to revert policy at a certain level.

I start to wonder if they are actually not looking at the market like they said. Its not like you need to look at the market for more than 5 minutes a day after doing a SINGLE in depth analysis on a longer time frame.

We will se what happens.

Combined US Indexes - Breakdown and JittersMarked out previously, the US indexes broke down a tad earlier and retested to fail only to drop further based on jitters and jitter-induced expectations.

While the candlestick is long and solid pretty much, there is an extension zone to expect more of the downside to overreach and be oversold before a bounce.

You should be able to see that the Buy Setup is pretty much done and can expect a bounce reversal soon... but only after momentum ebbs and a base support is found.

Watch for it...

DOW JONES Massive 1D MA200 reversal for Cup and Handle?Dow Jones (DJIA) has been trading within a Channel Up since the September 2022 market bottom. Throughout this long-term structure, Cup and Handle (C&H) patterns have emerged that were always contained above the 1D MA200 (orange trend-line) and subsequently initiated a rebound to at least the 1.382 Fibonacci extension before the next pull-back.

The 1D MA200 is right below us at the moment and the current C&H seems to be on the verge of completing its Handle. Moreover, the 1D RSI is on its usual Higher Lows trend-line that prompts to a the most optimal buy entry. We're bullish, targeting 46400 (the 1.382 Fibonacci extension).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOW JONES: 1D MA200 and Channel Up bottom. Bullish.Dow Jones is bearish on its 1D technical outlook (RSI = 36.722, MACD = -181.150, ADX = 58.438) as it is running the bearish wave of the 16 month Channel Up. Being so close to the 1D MA200 has been a buy signal since November 2nd 2023. Additionally, the price just hit the 0.382 Fibonacci level from the last consolidation phase. If that's confirmed, then the index is about to complete the new consolidation phase. The target on the previous one has been at least the 3.0 Fibonacci extension. The trade is long, TP = 50,500.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

DJI - Dow Jones Industrial Target 40000sChart analysis can be simple.

We take our tools, surround them with rules and follow them.

The rules and the framework of the Medianlines are simple, but not easy to follow every time.

The Shiff-Fork catches the resistance and support very nicely. Especially at the Center-Line.

Above the Upper-Medianline-Parallel, at the extreme where the stretch became clear, price had a job to to do, to trade up to the Warning Line. But it failed twice so far.

When price fails to trade to the next line, comes back into the Fork, Chances are >90% that we go to the Center-Line. The first time, it failed (10% fail). The second time, with these market sentiment, I'm even more convinced to follow the rules.

Target at the Center-Line around 40'000ish.

Combined US Indexes - Incoming Break or Bounce ?From the previously marked timeline on 18 Feb 2025, just days later, you see the combined US Indexes plummet to cut through the middle decision box (purple), and extrude out below. This formed the double top second peak in essence, and the days following just closed at a two month low.

While this might appear Bearish, it is worth noting the lower tails in previous candles which are followed by rallies to the upper resistance. Would this happen the third time?

I would beg to differ...

In fact, marked out is a critical support point which should be tested in early March. At that point (yellow ellipse), there is a confluence of a previous trend change support, the current TDST and just below that the larger consolidation range support.

While the RoVD is slightly bullish, the MACD is dipping with MACD in bearish lower half, and the signal line tapering down towards the boundary into bear territory.

In summary, it looks slightly bearish to the critical support point. From there, it would be good to see if it bounces or it breaks down.

DOW JONES Bull Flag completed. Massive rally ahead.Dow Jones / US30 has completed a Channel Down on the 0.5 Fibonacci retracement level.

This pattern is nothing more than a Bull Flag based on September's similar structure that also hit the 0.5 Fib and 1day MA50 and bottomed.

This time, the 1day RSI is also on a Rising Support.

Both corrections took place after a +8.15% rise and September's then went on to rebound to the 1.5 Fib extension.

Buy and target 46700.

Follow us, like the idea and leave a comment below!!