Daytrading

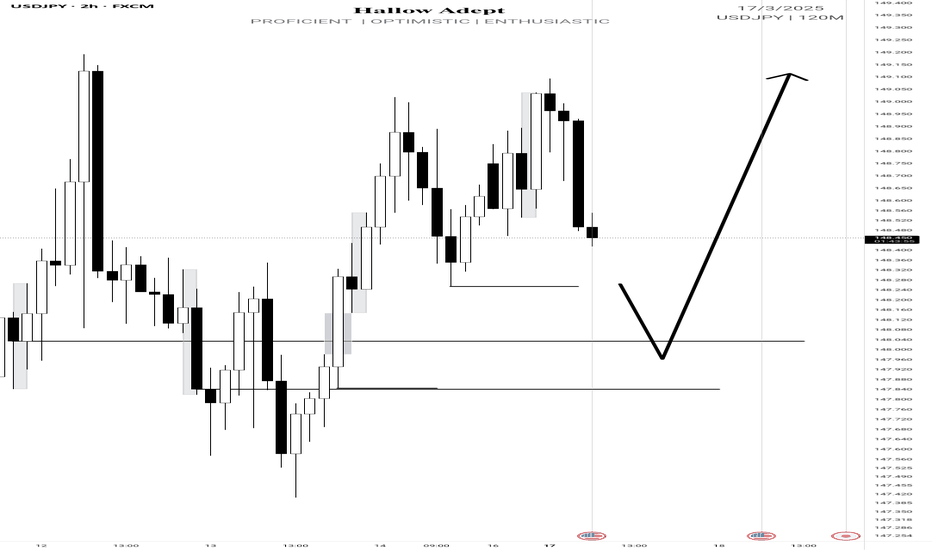

UsdJpy bullish continuation I was patiently waiting for price at 147.842 last week but it didn't come to my point of interest.

Nothing spoil, I'll watch how price reacts at 148.033, that's my assumed poi for the bullish continuation. If price didn't respect that zone then I'll be expecting price at 147.842

My draw on Liquidity 🧲 is the current higher high 149.193.

Kindly boost if you find this insightful 🫴

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading

Gold (XAU/USD) at a Critical Level – Key Zones to WatchCurrently, there is mixed bias in the market. On the higher timeframe (D1), the candle is rejecting with strong momentum, indicating selling pressure. However, there is also a possibility that it is forming a bottom wick, which could lead to a rejection from key levels like 2930.

Key Observations:

If 2930 acts as support, we may see a bounce, leading to a potential upside move.

If 4H sustains below 2930, it could indicate further downside continuation.

Trade Setup: 30m

🔹 Buy above 2045 if price shows bullish confirmation.

🔹 Sell below 2030 if price sustains under this level.

📊 Waiting for price action confirmation before entering a trade.

$REVG: REV Group – Riding the Specialty Vehicle Wave?(1/9)

Good morning, everyone! 😄

NYSE:REVG : REV Group – Riding the Specialty Vehicle Wave?

With NYSE:REVG at $31.00, is this stock revving up for growth or hitting a speed bump? Let’s dive into the details! 😎

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $32.00 as of 12-03-2025 😊

• Recent Moves: Up from last month, showing steady growth. 📈

• Sector Vibe: Specialty vehicles sector is stable, with consistent demand from public services and commercial clients. 🚒🚜

Short commentary: REVG’s price is on an upward trajectory, reflecting positive market sentiment. Let’s see what’s driving this! 🚀

(3/9) – MARKET POSITION 📈

• Market Cap: Approximately $1.75B (based on 52.13M shares * $32.00) 💰

• Operations: Designs, manufactures, and distributes specialty vehicles like fire trucks, ambulances, and recreational vehicles. 🚓🏎️

• Trend: Increasing focus on customization and technology integration in vehicles. ⚙️

Short commentary: REVG is a key player in the niche market of specialty vehicles, with a diverse portfolio that caters to various sectors. Their market position seems solid. 🌟

(4/9) – KEY DEVELOPMENTS 🔑

• Exited bus manufacturing business by selling ElDorado National, focusing on core segments. 🚐

• Provided fiscal 2025 guidance, showing confidence in future performance. 📈

• Increased quarterly dividend by 20%, signaling strong cash flow and shareholder value focus. 💸

Market Reaction: Positive, with stock price reflecting these developments. Investors are optimistic about the company’s strategic moves. 😃

Short commentary: These developments suggest that REVG is streamlining its operations and focusing on more profitable areas, which should benefit shareholders. 👏

(5/9) – RISKS IN FOCUS ⚠️

• Economic slowdown could reduce demand for new vehicles, especially in the commercial sector. 🌦️

• Supply chain disruptions might affect production schedules and costs. 🚚

• Increased competition in the recreational vehicles segment. 🏕️

Short commentary: While there are risks, REVG’s diversified portfolio and focus on essential services might mitigate some of these challenges. It’s important to monitor these factors closely. 🕵️

(6/9) – SWOT: STRENGTHS 💪

• Strong brand portfolio with recognized names in the industry. 🏆

• Diverse customer base across public services and commercial clients. 🌐

• Recent strategic decisions to exit less profitable segments. 🚫

Short commentary: REVG’s strengths lie in its well-established brands and broad customer reach, which provide stability and growth opportunities. 💪

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Dependence on economic conditions and potential regulatory changes. 📜

• Opportunities: Growth in the fire and emergency segment due to increased public safety spending. 🚒

Short commentary: While there are weaknesses tied to external factors, the opportunities in expanding sectors like fire and emergency services could drive future growth. It’s a balancing act! ⚖️

(8/9) – 📢REV Group at $32.00, with recent positive developments—your call?

• Bullish: $40+ soon, due to strategic focus and increased dividend. 🚀

• Neutral: Steady growth, maintaining current trends. 🛴

• Bearish: $25 drop, if economic conditions worsen. ⬇️

Drop your pick below! 😄

(9/9) – FINAL TAKEAWAY 🎯

REV Group’s $31.00 stance shows resilience and strategic planning, but economic risks linger. Volatility’s our ally—dips are DCA treasure. Snag low, soar high! Will it rev up or slow down?

SPY - support & resistant areas for today March 7, 2025The key support and resistance levels for SPY today are provided above.

Understanding these levels in trading can offer valuable insights into potential market movements. They often indicate where prices may reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

These levels are calculated using complex mathematical models and are specifically tailored for today’s trading session. They may change as market conditions evolve.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly appreciated! However, please note that if this post does not receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

SPY - support & resistant areas for today March 6, 2025The key support and resistance levels for QQQ today are above.

Understanding key levels in trading can provide valuable insights into potential market movements. These levels often indicate where prices might reverse or consolidate, serving as important signals for traders considering long (buy) or short (sell) positions.

Calculated using complex mathematical models, these levels are tailored for today's trading session and may evolve as market conditions change.

If you find this information beneficial and would like to receive these insights every morning at 9:30 AM, I invite you to support me by boosting this post and following me @OnePunchMan91. Your engagement is greatly valued! However, please note that if this post doesn’t receive more than 10 boosts, I will have to reconsider providing these daily updates. Thank you for your support!

QQQ - support & resistant areas for today March 6, 2025Above are the key support and resistance levels for QQQ today.

These levels can indicate where the price might reverse or consolidate and may signal potential long (buy) or short (sell) positions for traders.

These levels are calculated using mathematical models and are relevant for today’s trading session. Please note that they may change in the future.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, please support me by boosting this post and following me @OnePunchMan91.

Your engagement is greatly appreciated! If this post does not receive more than 10 boosts, I may reconsider providing these daily updates. Thank you!

Some Old charts we posted:

$2.80 to $4.50 in 30 minutes$2.80 to $4.50 in 30 minutes 💥 Been waiting for this NASDAQ:GV trade whole days since morning Buy Alert and reconfirmation in after $2.50 held support strongly before the move 🚀

Called out 3 trades today, all 3 of them reached my pre-planned max target areas 🎯 They were NASDAQ:GV NASDAQ:CDXC NASDAQ:MASS

Excited for new ones tomorrow

USD/JPY Buys | 15M TimeframeCurrent orderflow/price action is bullish. I will be looking for price to retrace into this zone which is a 50-61.8% Fibb golden zone pullback and also would fill a 15m FVG and tap into a 15 OB. I will then scale down to the 1-5m timeframe and look for an entry if it presents itself.

#ES_F Day Trading Prep Week 03.02 - 03.07.25Last Week :

Globex opened above VAH of 6054 - 5933 HTF Range and February RTH Cost basis which gave a hold to start the week to push us into the above Edge but more strength didn't come in, instead we ended up holding under 6074 - 60s and closer to Monday RTH open price failed in the Edge giving us a move into lower Value with a close inside it. Holding under Cost Basis meant weakness for longer term buyers and triggered moves lower all week as they needed to get out closer to month end we got. Lower Edge kept giving bounces back into Value which kept building more supply and when MM Month end came on Thursday we were able to take the stops under 5930 to give us continuation to test lower Value under 5870s. To finish the week we found buying inside lower Value and what I think was end of the Week short covering before the weekend which pushed us back into the Edge in the afternoon, all momentum traders had to do was buy it up under the Edge to push price back inside which triggered stops on the way up to give us end of day squeeze back into above VAL where all the supply was.

This Week :

We are starting a new Month and things can be tricky to start, we are at interesting locations on Weekly, Daily and Hourly charts with quite a few options going into this week so we really have to be open to different scenarios as things are not as clear as they were last 2 weeks going into Month End.

On Daily TF we have showed a failure over Daily Edge Top and at the same time have transitioned into a correction mode under it which gave us the move from Daily Edge into Daily VAH at 987 - 67 and flushed the buyers under it through Daily Mean towards Daily VAL at 846 - 28 without tagging it. End of week covering took us back into Daily VAH but left Daily TF in Correction mode under its MAs.

On Weekly TF we had a long consolidation in new Weekly balance over 5950s but we never transacted through the whole balance which means no acceptance in it, instead we built up a lot of Supply inside which at the end of the Month gave us this move back into lower Balance with a strong break and close under smaller MA with price closing right at the top/bottom ( depends which way we look at it ) of Weekly Balance. For now this tells us that we could see more weakness going into this new Month, as long as we hold under Weekly Smaller MA which is around 6010s and don't accept back above Daily VAH of 5987 - 67 then that could bring in continued weakness to rotate lower back towards Daily Mean and possibly test Daily VAL and maybe see a push under it.

Holding under the Daily Edge of 6073 - 43 implies continued weakness as well and will continue to target lower Daily areas all the way down into its bottom Daily Edge at 5754 - 24 which has Weak Stops and a Gap to fill under which was made during contract roll. Does not mean we will go there right away or go there at all of course BUT there are lots of things stacked up for more downside so far, of course we have to watch each area for continuation through but if there is still more sell volume to come out then we have to watch out looking for much higher prices from here and instead look for balances with weakness and rotations back down.

This week could play out as an inside week with weakness towards the bottom of previous week and IF there will be stronger volume then we could see last weeks lows get taken to give us pushes towards Previous Distribution Balance that we have made back in October which would be next big spot to visit.

On the Upside IF buying from Friday sticks and we start holding over 5930 - 40s then need to be careful forcing downside as we could build up enough and bring in more buying to push into above Value again, we do have trapped buyers inside it from last week so it would be a spot to be careful at as we could continue to see selling out of that Value on any pushes into it, for more strength inside that Value we would really need to push through VAL and start holding over 5970 - 90s which would signal stability and could have the price balance inside that Value and of course for anything higher we would need to take out February RTH cost basis above VAH because we have most of the buying from last few months trapped over it.

QQQ - support & resistant areas for today Feb 28, 2025The following key support and resistance levels for QQQ have been established for today. These levels are critical as they denote areas where price movements may experience reversal or consolidation. A rebound from these support or resistance zones can indicate potential long (buy) or short (sell) positions for traders.

The determination of these levels has been conducted through the application of mathematical models and forecasting techniques, ensuring their relevance for today's trading session. It is important to note that these levels are applicable solely for today and may be subject to change in subsequent trading sessions.

Should you find this information valuable and wish to receive similar insights each morning at 9:30 AM, I kindly request your support by boosting this post and following my updates. Your engagement is instrumental in helping m

GJ | Still pushing downPrice is still trending down. I took a trade last night from the higher OB to the bottom of the range and it closed strong below the range. I will be looking for price to retrace back up into this 30M OB and will be watching lower time frame price action for confirmation to take it back down to the low. If price does not retrace back up that far and then continues to close below the current swing low, this trade will be invalidated.

TSLA - support & resistant areas for today Feb 27, 2025Here are the key support and resistance levels for TSLA for today. These levels are crucial as they indicate areas where the price may reverse or consolidate. A bounce off these support or resistance zones can signal potential long (buy) or short (sell) positions for traders.

These levels have been calculated using mathematical models and forecasting techniques, ensuring their relevance for today's trading session. Please note that these levels apply only for today and may change in the future.

If you find this information helpful and would like to receive these insights every morning at 9:30 AM, please support me by boosting this post and following me. Your engagement helps me understand the value of this content. If this post does not receive more than 10 boosts, I will reconsider continuing with these daily updates. Thank you for your support!

QQQ - support & resistant areas for today Feb 27, 2025So these are the support and resistant points for QQQ. Bounce off on these areas can initiate long or short positions.

This levels are mathematically calculated with future forecasting for the day. Only valid for the day.

If yall want me to post this every morning 9.30am please boost and follow me, so i know it is valuable for yall. If this post doesn't get more than 10 boosts, I will not continue this daily.

Thank you

QQQ - support & resistant areas for today Feb 26, 2025So these are the support and resistant points for $QQQ. Bounce off on these areas can initiate long or short positions.

I see IV is high today for QQQ in the opening. Maybe I will wait till the afternoon for options.

If yall want me to post this every morning 9.30am please boost and follow me, so i know it is valuable for yall. Thank you

Nightly $SPY / $SPX Scenarios for 2.26.2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸🤔 U.S. Consumer Confidence Dives 🤔: American consumer confidence fell to 98.3 in February (down from 105.3 in January), The steepest one-month drop since 2021.

🇩🇪📉 German GDP Contracts 📉: Germany’s economy shrank by 0.2% in Q4 2024 (quarter-on-quarter), confirming a downturn in Europe’s largest economy. Recession concerns in the Eurozone could influence global growth sentiment as exports and industry show signs of weakness.

🇺🇸💱 Fed Rate Cut Bets Trimmed 💱: Markets are now pricing in only one 25bps rate reduction in 2025 (versus two previously expected),

📊 Key Data Releases 📊:

📅 Wednesday, Feb 26:

🏠 MBA Mortgage Applications (7:00 ET) 🏠: Last week’s applications fell -6.6% amid rising interest rates. Traders will watch if lower demand continues, as higher borrowing costs cool the housing market.

🏠 New Home Sales (10:00 ET) 🏠: Consensus expects around 680K units (vs 698K in December). This Jan report will show if higher mortgage rates are slowing home sales or if housing demand remains resilient to start 2025.

🛢️ EIA Crude Oil Inventories (10:30 ET) 🛢️: Last week, inventories rose to about 432.5 million barrels. A larger-than-expected draw could boost oil prices, while a build might ease price pressures (and inflation concerns).

💬 Fed’s Bostic Speaks (12:00 ET) 💬: Markets will monitor his commentary for any hints on monetary policy or growth/inflation views.

📌 #trading #stockmarket #tomorrow #news #trendtao #charting #technicalanalysis

Master Your Emotions: The 3 Trading Psychology Hacks Most traders don’t struggle because they lack a strategy—they struggle because emotions get in the way. After coaching hundreds of traders, I’ve seen the same patterns over and over: hesitation, FOMO, revenge trading, and self-doubt.

I get it. I’ve been there too. You see the perfect setup but hesitate. Or worse, you jump in too late and watch the market turn against you. It’s frustrating, but there’s a fix.

In this video, I’m breaking down the biggest trading psychology mistake I see and the simple 3-step process that has helped my students trade with confidence, even in the most volatile markets.

If you’ve ever felt like your emotions are sabotaging your trades, this is for you. Let’s fix it.

Kris/Mindbloome Exchange

Trade Smarter Live Better