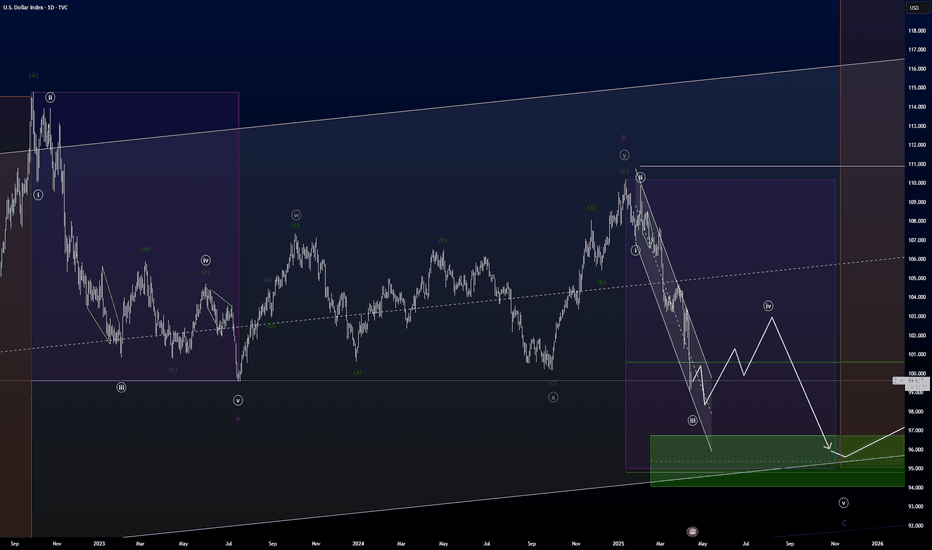

DXY Has More To The UpsideDXY is right now in what I believe to be a 4th wave correction, which has turned into a wxy, and probably also will turn into a WXYXZ.

It has plenty of room to develop.

Since 4th wave corrections has a tendency to enter the area of the 4th wave of previous impulse, it will most likely go up to the area of the green rectangle above.

This will be between 103.2 - 104,7.

If it will go further up before heading down is to early to say.

But my previous forecast about it will go down below 96 is still in play and intact.

Elliottwavecount

Gold Is Doing What Ever Gold Wants To DoPreviously I posted a reading where I said gold was to go a bit down before is went up. But Gold didn't go down, and went straight up.

But it did go up right :D

Right now I strongly believe gold is in a wxy correction.

And I think will finish the y-wave i the green box area somewhere between 3,147 and 3,077, which is the 100-123% fib-level of the w-wave.

The reason I believe this, is at that timewise the y-wave will here have taken as long as the w-wave, and I the price is heading for that cyan median line. And normally price will also go to the bottom and a bit below of the Kennedy line.

Multiple factors are pointing to that level.

When price hits that level, I believe we will see a 5th level to the upside where 4,000 definitely is in play.

I will include a link to a higher degree reading, where you can see I believe gold has finished a third wave, so we still need a 5th wave to the upside.

BTC is Still A Correction.BTC is in good rally these days, but my believe is that it is still in a correction.

I am not 100% confident in wavecount, but I am confident that BTC is not done correcting until it has gone down to somewhere between 62.500 - 52.500.

If the rally BTC is currently in, I believe we are seeing a flat, and I will correct my count accordingly.. But right now I'm seeing a W-X-Y-X-Z correction.

Be careful, and do not bet on BTC is rallying to a million just yet ;)

For now I believe there will be good odds for following the white line I've drawn on the chart.

COTI WAVE 3 is coming COTI has completed its initial phases, Wave 1, 2 of Elliot waves and is preparing for Wave 3📈.

Also COTI V2, released recently, aims to revolutionize web3 privacy.

COTI’s market capitalization is $96 million, suggesting substantial potential gains during the upcoming bull market🚀.

This information is not financial advice. Conduct thorough research before making investment decisions.

ULTRACEMCO: Wave ((iv)) Correction and Future ProjectionsTechnical Analysis on Exampled chart of Ultracemco Using Elliott Wave Theory

As always, this analysis is provided for educational purposes only and should not be taken as financial advice. Proper risk management and consultation with a financial advisor are recommended before making any trading decisions.

Understanding Elliott Wave Principles

Elliott Wave Theory is a robust tool used by traders to analyze market cycles and forecast future price movements by identifying repetitive wave patterns. One of the core principles of Elliott Wave Theory is that markets move in five waves in the direction of the main trend (Impulse Waves) followed by three corrective waves (Corrective Waves). These waves are labeled numerically as 1, 2, 3, 4, 5 for impulse waves and alphabetically as A, B, C for corrective waves.

A few key rules and guidelines include:

Wave 2 cannot retrace more than 100% of Wave 1.

Wave 3 is usually the longest and never the shortest among waves 1, 3, and 5.

Wave 4 should not enter the price territory of Wave 1 (in a standard impulse wave).

Additionally, corrective waves come in various forms like Zigzags, Flats, and Triangles, and these patterns provide insight into the market’s corrective phases.

Current Wave Count and Analysis

On the daily time frame of Ultracemco, the price action has been unfolding within an Elliott Wave structure, and as of the latest data, the market appears to be in the process of completing wave ((iv)) in black.

The chart shows that the recent price action likely represents a corrective wave ((iv)), unfolding as an (a)-(b)-(c) structure, where wave (a) has been completed, wave (b) has bounced as a corrective upward swing, and wave (c) is currently progressing downward.

Key Observations for Wave ((iv)):

Depth of Correction: The retracement level of wave ((iv)) typically spans between 38.2% to 50% of wave ((iii)). The current retracement indicates that wave ((iv)) could find support around these levels, aligning with typical Elliott Wave corrective behavior.

Equality of Waves (a) & (c): One common characteristic within a Zigzag pattern is that wave (c) often equals wave (a) in terms of length. This potential equality provides a target zone for the completion of wave ((iv)).

Retracement of Wave ((iii)): The analysis of wave ((iv)) should also consider the Fibonacci retracement levels of wave ((iii)). A significant support area is found near the 50% retracement level of the prior wave ((iii)), which could act as a pivot point for the next upward move.

Potential Outlook for Wave ((v))

Once wave ((iv)) finds its completion, the next expected move is an upward swing as wave ((v)), which should unfold in an impulsive manner. Wave ((v)) often represents the final thrust in the direction of the trend and is typically characterized by strong momentum and breadth.

Characteristics of Wave ((v)):

Extension: Wave ((v)) may extend, particularly if wave ((iii)) was relatively short. In such cases, wave ((v)) could push the price higher than expected, sometimes exceeding the previous high established by wave ((iii)).

Fibonacci Projections: A common target for wave ((v)) can be projected using Fibonacci extension levels of waves ((i)) through ((iii)). The 61.8%, 100%, and 161.8% extension levels serve as potential price targets.

Volume and Momentum: Increased volume and momentum usually accompany wave ((v)) as it represents the final push in the direction of the prevailing trend. Traders should watch for any divergences in momentum indicators, as they often signal the end of the impulse wave and the start of a corrective phase.

Conclusion

In summary, the analysis suggests that Exampled chart of Ultracemco is likely completing wave ((iv)), with potential support zones emerging as the market corrects. Following the completion of wave ((iv)), the price is expected to rise in an impulsive wave ((v)), targeting new highs. However, it's crucial to remember that Elliott Wave analysis involves multiple possibilities, and traders should consider these insights as part of a broader trading strategy rather than standalone advice.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

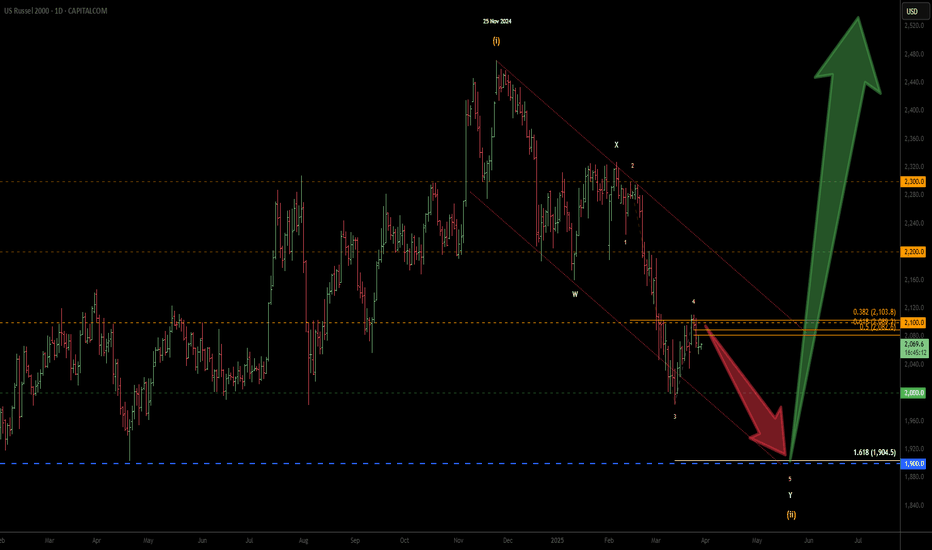

Russell 2000 - Sell till late May & Buy in Early June?

Wave (ii) is still in progress. Slight update to the primary wave count from the previous one below.

200 & 100 SMA's are sloping firmly to the downside therefore I will continue to keep selling at technical levels. Late May or early June would be a good time to go long...

Support levels are shown in green.

Binance Coin BNB is Likely to go down, until at least end of MayBNB has been in a correction since the start of December '24. And as time went by, it developed into an combo correction.

I believe we are at the end of the purple B-wave of the green (Y) wave.

We are right now finithing the white ((c)) wave of purple B wave, so we are going to see a small wave up until around the 630-640 level. And after this the purple C wave is going to take on downwards.

And since very rarely the c wave has a shorter timespan than the a wave, we are not going to see this correction end until the end of may/ start of june.

I believe the purple C wave are going to take us down to the 382 level in that yellow box.

The 383 level is the 61.8% retracement of the primary white ((1)) wave. And this level is also roughly around the 100% Fib level of the purple A wave.

If price comes to the green box I've drawn out. I belive that would be a good time to start looking for a confirmation to short.

A Zoom of the Weekly DXY into a Daily viewI kept the colored rectangels from my weekly analysis, to keep the focus and knowledge where we are on the chart.

DXY is doing a long A-B-C before it's is going into the last impulse og the C of Y of x of the larger degree.

It's quite a lot of corrections to manage, but if you swipe from the daily to the weekly timeframe, it makes good sense. For me at least :D.

The purple B wave took some time to figure out, but this was what made most sense to me. I was trying to look at it as a triangle, but that wouldn't have a good shape, so I ended out with this white ((w))-((x))-((y)) correction.

DXY is right now performing, what I see as, a extended 5th wave in the white ((iii) wave, before it goes into the white ((iv)) correction.

The white ((iv) wave correction could be become a long shallow drawn out correction for two reasons.

We had a steep and swift white (ii) followed by an extended white ((iii) wave. This usually means we are going to spend some time correcting that white (iii) wave and the rule of alternation tells us, if we have a quick 2nd wave, we are usually going to see a slow fourth wave.

I don't believe we have completed the white (iii) yet, so we have a long time to go still until that white (iv) wave is done.

When the white (iv) wave is done, the white (v) wave is probaly going to take us down to that green box.

So relax for the next 6 months and grab yourself a cup of coffee.

DXY In Difficult Circumstances Since the Start 80's I decided to give a go at the Dollar Index given the circumstances around the world. And to be honest, I tried to put on the positive glasses.

I believe the dollar has been in a complex correction since the mid 80's. Starting out with a large dump in '85 with the a-wave, the correction slowed down and only grew more and more complex.

Thought about current wave: What I believe we are going through now is, that we are finishing up the purple C-wave in a green (C)-wave. This wave can end at any time now, since it's now at the 61.8% fib level of the purple A-wave. But it might go down to the 95 level (The green box) to complete at the 100% fiblevel of the purple A-Wave.

But first we will have the fourth wave meaning the DXY is gonna struggle for some weeks. Because we had a swift two week wave 2, which means we are probably going have a slow fourth wave according to the rule of alternation. This mean the purple C-wave could drag out into the end of '25 into early '26.

This is also with that in mind that a C-wave most likely will take longer than an A-wave. These are the Purple boxes.

BUT, after this, DXY is gonna experience some happy years again, going back up to the yellow box somewhere between 110 and 120 to finish the WXY of x of the larger degree. This will take DXY into a couple of years bull-run as long as the green (C) wave runs and completes no earlier than late '27, depending when the purple C-wave prior to the green (C) wave ends. But I believe the green (C)-wave will take about two years to complete.

But after this, DXY could again go into some dark ages and considering the high degree purple w-wave took 23 years to complete (blue giant box), there is no reason to believe this high degree purple y-wave will be a swift matter and actually don't complete before the year 2050. And it will take the DXY all the down to start 60's or lower.

The reason I said I tried to put on the positive glasses, is that I tried seeing the white channel as a leading diagonal for a new bull run, but I just don't see it as such.

I also tried seeing it as a C-wave of a flat diagonal, but this would result in another C-wave afterwards, and also take us down to the 60's level. So that didn't do us any good.

For the sake of DXY, I hope I'm wrong, but this is how I see it.

Russell 2000 - one more drop to complete the correction?Looking for the double zig zag correction to complete (Y) leg in the blue zone. Will be looking for five waves to the downside for the target.

Updated the wave count from my previous chart below...

This drop from the 25th November 2024 to the expected target zone would be more or less similar to the Covid drop in terms of percentage.

Russell 2000 - 5th wave of Y leg may already be in progress... The rejection at 2100 price level also happens to be the 38.2% Fib of the decline from the 14th of February 2025. The decline from 6th of February 2025 counts beautifully as waves 1, 2, 3 & 4. If this wave count is correct, then the Russell is currently in wave 1 of 5 of Y of (ii).

This is my primary wave count as long as the 2100 resistance is not breached.

This changes my initial wave count from a complex WXYXZ to a simple WXY.

Click on the link to see the previous wave count which is still valid and is now an alternate wave count if the 2100 resistance is breached:

Only updating the wave count. My bias and direction remain the same.

Wave Y is possibly in progress. Looks like we are going to have a bearish April & possibly May as well. Selling corrective rally is still the way to trade for now. Take profit at 1905/1900, which is where technically, the Russell 2000 will possibly turn up for wave (iii).

Stop Loss can be placed above wave 4, well out of the way in case of any wild swing on this PCE Friday.

BITCOIN Final update !!! We're about to BOOM!!!According to bigger picture, we're still in bull market, 5th of macro and ending 4th of micro elliott wave.

Good news is, that we're about to get back into bullish mega green candles soon!!

BTC's major CME gap has been filled and this was also the region where FVG is also available and also corrective pattern (double three) Y ends in this region in combining with expanded flat's C. we may most probably by will of GOD almighty will see green days in coming weeks. Targets of wave 5 are up to 120-130K region.

BITCOIN TO 140K CONFIRMED !!! 🚀 On shorter time frame #BTC is forming ending diagonal in wave c of minor wave 2 correction, which indicates that correction may end up here and we may see shift from correction to minor wave 3 impulse move🚀

🚀 In that case major wave count of wave 3 and minor v ends up to 130k 🚀

🚀 If major wave 3 extends upto 130k, then we may see last 5th major to end up near 140k 🚀

How Far BNB Would Make In This BullRun??

As Per Harmonic crab Pattern, #BNB first target aligns at 975$, the 1.618 fib level, where crab's D leg is likely to end.

As for elliott wave macro count, we're currently running in 5th macro wave which ends near about 1100-1250$ region.

In going for micro wave count of macro wave 5, we've completed 4th corrective wave & now heading for 5th micro of 5th macro wave, that also aligns with macro wave 5.

Deeper Lows Ahead Before Reversal in SILVER ? Elliott WavesThe chart suggests a potential downward trend for Silver to complete wave (C) Blue of wave ((4)) Black and then wave Uptrend ((5)) Black.

Elliott Wave Structure:

The chart appears to be in a corrective wave structure, likely a Zigzag.

The current position seems to be within a corrective wave ((4)) Black in which wave (A) & (B) are completed and now we are unfolding wave (C) Blue of ((4)) Black.

Inside wave (C) we had completed wave 1 & 2 and now we are unfolding wave 3 Red in wave (C), post wave 3, we have to unfold wave 4 & 5 Red to finish wave (C) Blue of wave ((4)) Black.

Potential Scenarios:

Downside: If the downward trend continues, the price may reach Fib extension level where wave (C) equals with wave (A) and some times may goes towards 1.236 Fibonacci extension level.

Post completion wave ((4)) Black, we may see Reversal towards new Highs to finish wave ((5)) which generally goes beyond wave ((3)) High.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

US10Y ELLIOTT WAVE ANALYSIS: 19 DEC, 2024©Master of Elliott Wave: Hua (Shane) Cuong, CEWA-M.

The entire ((2))-navy most recent completed as an (A)(B)(C)-orange Zigzag, and the ((3))-navy is now retracing to push higher.

It is subdividing into a (1)(2)-orange, and they have completed, since the high of 4.126%, the (3)-orange is unfolding to push lower, targeting the high of 5.163%

USDJPY Wave AnalysisIt seems that the downtrend has ended in this timeframe and we should wait for the start of an uptrend

Trade entry: 150.000 range

Stop loss: 145.700

Take profit: 158.376

This offer has a risk/reward ratio of around 2

Make sure to involve less than 2-3% of your total capital and adhere to the principles of money management

This is just a suggestion for consideration

NYSE:MU - ELLIOTT WAVE ANALYSIS: 22 NOV, 2024 - BULLISH©Master of Elliott Wave: Hua (Shane) Cuong, CEWA-M.

I see that an ABC-grey probably just completed recently at the 84.12 low, and the corrective waves are followed by motive waves, so I expect a much higher push in this stock.

Looking closer, I see that the 1-grey and 2-grey waves just completed at 95.53 and it looks like the 3-grey wave is unfolding. It is subdividing into ((i)),((ii))-navy. And after the ((ii))-navy wave is over, we can go long towards the ((iii))-navy wave.

While price must remain above 95.53 to maintain this view.

Key point: Wave B of wave ((ii))-navy.

Elliott Wave Outlook for RELIANCETechnical Analysis of Reliance Industries (RELIANCE) based on Elliott Waves

This analysis is based on Elliott Wave Theory and is for educational purposes only. It does not constitute financial advice. Investing involves risk, and past performance is not indicative of future results. Always consult with a financial advisor before making any investment decisions.

Elliott Wave Analysis

The provided chart of Reliance Industries (RELIANCE) outlines a potential Elliott Wave pattern within a 1-hour timeframe. Elliott Wave Theory suggests that financial markets move in predictable and repeatedly patterns based on investor psychology.

Key Observations:

1. Impulse Wave: The primary uptrend appears to be an impulse wave, a five-wave structure.

Wave 1: The initial uptrend from the low point.

Wave 2: A minor correction or pullback.

Wave 3: A strong extension of the uptrend.

Wave 4: A smaller correction.

Wave 5: The final wave of the impulse, often ending with a climactic price movement.

2. Corrective Wave: The current downward movement was a zigzag corrective pattern.

Wave A: The initial decline.

Wave B: A minor retracement.

Wave C: The expected continuation of the downward trend.

Potential Scenario:

If the current corrective pattern zigzag finishes here or near, then further wave ((3)) is to start post completion of wave (C) of ((2)), and it would not go sudden upside, because any impulse wave unfolds in five subdivisions, so wave (1) of wave ((3)) can start any time post completion of wave (C) of wave ((2)).

Note: This analysis is based on a specific interpretation of the Elliott Wave pattern. Other analysts might have different interpretations. It's crucial to use multiple tools and indicators to confirm your analysis.

Additional Considerations:

Fundamental Analysis: Consider factors like company earnings, industry trends, and economic indicators to support your technical analysis.

Risk Management: Always use stop-loss orders to limit your potential losses.

Diversification: Don't put all your eggs in one basket. Diversify your investments across different assets.

Remember: Elliott Wave analysis is a complex tool that requires practice and experience. It's essential to approach it with caution and always consider the potential risks involved in trading.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

MARA Bullish Outlook: Elliott WavesTechnical Analysis of MARA Based on Elliott Waves.

The following analysis is based on the provided chart and is for educational purposes only. It does not constitute financial advice. Investing in stocks involves risk, and past performance does not guarantee future results. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Key Observations from the Chart

- Elliott Wave Theory: The chart appears to be using Elliott Wave Theory to identify potential future trends. Elliott Wave Theory suggests that markets move in predictable patterns, often referred to as "waves."

- Uptrend: The overall trend of the chart seems to be bullish, indicating a potential uptrend.

- Invalidation Level: A horizontal line is drawn at the bottom, labeled "Invalidation Level." This level could serve as a support level, and if the price breaks below it, the bullish outlook might be invalidated.

- Pattern Recognition: The chart seems to be suggesting a potential "5-wave impulse" pattern, which is often associated with an uptrend.

- Price Action: The price has recently shown a pullback, which could be a healthy correction within the larger uptrend.

Potential Outlook

Based on these observations, the chart suggests a bullish outlook for MARA. If the price can hold above the "Invalidation Level" and continue to follow the Elliott Wave pattern, there is a potential for further upward movement.

However, it's important to note that technical analysis is not foolproof.

Market conditions can change rapidly, and unexpected events can affect the price. Always stay informed about the company's fundamentals, industry trends, and broader market conditions.

Next Steps

1. Monitor Price Action: Keep an eye on the price in relation to the "Invalidation Level" and the Elliott Wave pattern.

2. Consider Other Indicators: Combine technical analysis with fundamental analysis to get a more complete picture of the company.

3. Risk Management: Implement risk management strategies, such as stop-loss orders, to protect your investments.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

COIN Technical Analysis: Wave (4) Correction Nearing CompletionTechnical analysis chart of the cryptocurrency "COIN" using Elliott Wave Theory. Elliott Wave Theory is a technical analysis method that suggests that financial markets move in predictable patterns based on a series of five waves.

The information provided in this post is for educational purposes only and should not be considered as financial advice. There is a risk of being completely wrong, and users are warned not to trade or invest solely based on this study. The content is not an advisory and does not guarantee profits. We are not responsible for any kind of profits and losses; individuals should consult a financial advisor before making any trading or investment decisions.

Based on the chart, we had identified a potential impulse wave pattern from January 2023 to the present. An impulse wave pattern consists of five waves, with each wave labeled (1), (2), (3), (4), and (5).

Wave (1): This is the first wave in the impulse pattern and is typically a strong upward trend. In this case, wave (1) appears to have run from the low near 31-32 to a high near 114.

Wave (2): This is a corrective wave that moves in the opposite direction of wave (1). It is typically a retracement of wave (1), but it can also extend beyond the starting point of wave (1). Wave (2) appears to have run from the high near 114 to a low near 69.

Wave (3): This is the second wave in the impulse pattern and is typically a strongest upward trend that extends most of times. Wave (3) given move from 69 to 283

Wave (4): This is a corrective wave that moves in the opposite direction of wave (3). It is typically a retracement of wave (3). Wave (4) is currently in progress, but at verge of completion now any time.

Wave (5): This is the final wave in the impulse pattern and is typically a strong upward trend that completes the pattern. Wave (5) is expected to start soon and could potentially reach the levels of 300 plus.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

XLE: Rising Wave PatternTechnical analysis chart of the Energy Select Sector SPDR Fund (XLE), with Elliott wave analysis overlaid. Let's break down the analysis based on the chart and labels:

Overall Analysis:

The chart suggests a bullish trend for XLE, based on the Elliott wave structure. It indicates that we have completed wave ((4)) of wave V and are now in the unfolding wave ((5)). Within wave ((5)), we have started wave (1), and are currently in wave (3) of (1).

Wave Counts and Labels:

V Red: This represents the fifth and final wave of a larger Elliott wave pattern.

((4)) Black: The fourth corrective wave within V.

((5)) Black: The fifth and final impulsive wave within V.

(1) Blue: The first impulsive wave within ((5)).

1 Red: The first wave within (1).

2 Red: The second corrective wave within (1).

3 Red: The third impulsive wave within (1) (currently unfolding).

Price Projection and Invalidation as per Waves:

Bullish Projection: The chart suggests a potential target of 105 for wave ((5)).

Invalidation Level: A break below 83.02 would invalidate the current bullish analysis.

Educational Notes:

Elliott wave theory is a technical analysis tool that identifies patterns in price movements based on a series of five waves.

Impulsive waves (1, 3, 5) move in the direction of the overall trend, while corrective waves (2, 4) move in the opposite direction.

Wave labels use brackets to indicate different levels of analysis. For example, ((5)) is a larger wave than (1).

Colors are often used to visually differentiate between different waves and patterns.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

From Correction to Impulse: Elliott Waves in Jindal Steel power Technical Analysis of JINDAL STEEL & POWER LTD. based on Elliott Wave Principles

This analysis uses Elliott Wave Theory and structures, offering one potential market scenario among multiple possibilities. The information is for Educational purposes only and should not be taken as trading advice . There is always a risk of being incorrect, and users should not make trading or investment decisions based solely on this analysis. The content does not guarantee profits, and we are not responsible for any financial outcomes. It is recommended to consult a financial advisor before making any trading or investment decisions.

Introduction to Elliott Wave Theory:

Elliott Wave Theory, developed by Ralph Nelson Elliott, identifies repetitive price patterns in financial markets, driven by investor psychology and crowd behavior. Here are some key Elliott Wave rules:

1. Wave 2 cannot retrace more than 100% of Wave 1.

2. Wave 3 is often the most powerful and cannot be the shortest of the impulse waves.

3. Wave 4 should not overlap with the price territory of Wave 1 (except in diagonal patterns).

4. Impulse waves move in five smaller waves (1-2-3-4-5), while corrective waves move in three waves (A-B-C).

Wave Counts and Analysis:

On the 2-hour chart of JINDAL STEEL & POWER LTD., the completion of Wave (4) in blue is likely at the 896 low. This corrective phase may have concluded, signaling the start of a new bullish impulse wave.

Current Structure: Wave (5) in Blue Unfolding

We may now be at the start of Wave (5) in blue, which suggests further upward momentum. Within this wave, the internal structure shows:

- Wave 1 in red of Wave (5) has been completed.

- Wave 2 in red of Wave (5) also seems to have finished, a typical pullback phase.

- Wave 3 in red of Wave (5) appears to be starting, signaling a potential strong upward move.

Characteristics of Wave 3:

Wave 3 is typically the most extended and powerful part of an impulse wave. It often accelerates rapidly, fueled by market sentiment, and can deliver outsized price gains. This wave is expected to push the stock price higher with more conviction.

Based on Fibonacci levels, potential targets for Wave 3 are:

- The first target could be 1020 (100% Fibonacci extension).

- A further target lies at 1076, the 1.618 Fibonacci extension, a common level for extended third waves.

- An extended target is 1111 at the 2.0 Fibonacci extension.

Moving Averages Confirmation:

Adding to the bullish outlook, JINDAL STEEL & POWER LTD. is currently trading above both the 200-period EMA and the 50-period EMA on the 2-hour, daily, and weekly timeframes, which signals strong strength to show upward momentum across multiple timeframes. The alignment of these exponential moving averages (EMAs) indicates that the stock is maintaining long-term support, which provides additional strength to the current bullish wave count.

Critical Level to Watch: 988

Once the price closes above the 988 level, we can expect further confirmation of strength. This price level is crucial as it would signal a breakout, paving the way for additional bullish momentum and targeting higher Fibonacci levels, such as 1020, 1076, and 1111.

Invalidation Level:

The wave count remains valid as long as the price stays above 896, the low of Wave (4) in blue. A break below this level would invalidate the current wave structure, implying that the bullish trend may be in jeopardy.

Summary:

In conclusion, JINDAL STEEL & POWER LTD. appears to have completed its corrective Wave (4) in blue, with the price now starting to unfold into Wave (5) in blue. With Wave 1 and Wave 2 in red complete, the stock is likely entering Wave 3 in red, which typically exhibits strong price advances. The stock’s upward trajectory is supported by its position above the 200-period EMA and 50-period EMA across multiple timeframes (2-hour, daily, weekly), further strengthening the bullish case. Key levels to watch include 1020, 1076, and 1111, while 988 acts as a near-term breakout level. The invalidation point for this wave count remains at 896.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.