NSE IONQ - Are we ready for a breakout?The corrective phase is complete and an impulse move appears likely. A strong buy above the A-B-C channel could target levels around 30 - 37 - 45 or higher. Good entry is possible above 26. However, if conditions worsen, further corrections may ensue.

I will update further information soon.

Elliottwaveprojection

XAG getting ready for another run down.I believe XAG has finished the blue ((c)) of green (iv) with an ending diagonal, and now doing the first 1-2 of the green (v) wave of gray ((c)).

The price might do a very small retrace to 31.12 before starting a 3rd wave down.

I believe the green (v) is going to the green box area at 28.15 - 27.40 area.

But I actually have a weekly trendline lower down, which the price might want to go won and test, which also fits with the idea that the (v) wave could go all the way to the 100% Fiblevel of (i)+(iii) level.

This would mean the price would probably test the 25.0 level.

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

My take on Gold. It's a difficult one..This is the read that makes most sense to me. And I have zoomed all the way into 15m, for you to be able to see my thoughts around it all.

For that wave down from April 2nd to April 7th to make any sense to me, I have labeled it as W-X-Y to complete (A). At first I had labeled it as a diagonal, but then price should not have retraced as much as it has since April 7th.

And I also believed Gold has finished a 5th of a 5th wave, so we need to see some more correction before price head to the upside again.

I simply can't read the retracement back up since the April 7th as a A-B-C, and this is why I believe price is just finishing up the A wave (and it might already have) before it goes into the B correction.

The initiated wave down (wave B of (B)) I believe will go down to 3,044 - 3,013 level and then finish of the flat with a wave C of (C).

This wave C should be able to go to the 3,130 - 3200 level.

But as I said, first we spend some days to the downside heading for that 3,044 - 3,013 level.

What is your current take on gold?

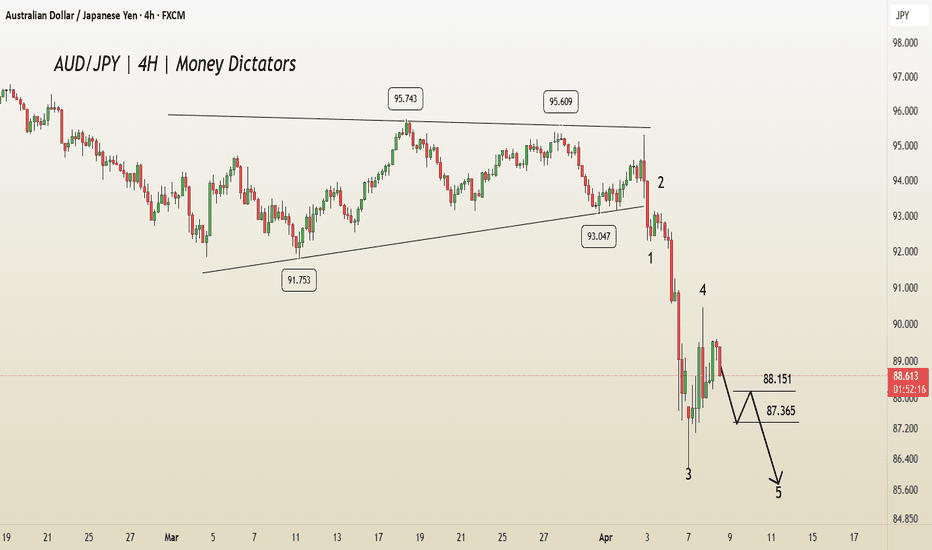

AUD/JPY Technical Outlook: Wave 5 Completion in SightIn AUD/JPY, the 4th wave has been completed, and the 5th wave is in progress. According to Elliott Wave theory, there is a high probability of the market continuing its downward movement.

Regarding potential targets, the price may reach 88.151 and 87.365 on the downside. However, a bullish move could also emerge if the market breaks above 89.645 .

Bearish Setup on NFLX: Correction Wave (C) UnfoldingTF: 4h

NFLX appears bearish at the moment. The corrective structure on the 4-hour timeframe suggests a potential decline. The current formation indicates that wave B likely completed at 998.61 , and the stock has now begun its descent into wave (C) of the correction.

The correction may extend to the 100% projection of wave A at 788.67 , or potentially deepen to 659.06 , aligning with the 1.618 Fibonacci extension of wave A. After the completion of wave (C), traders can buy for the target up to wave B at 998.61 .

I will continue to update the situation as it evolves.

NAKAUSDTAn analysis at the height of market fear..

A situation where all markets are experiencing sharp declines due to US tariffs and Middle East tensions..

It seems that around $0.25 is the ideal area for short-term buying for $0.75 targets and the ideal time to start this upward movement is early April..

Just an analysis that may be wrong..

EUR/JPY – Bearish Setup with Elliott Wave AnalysisThis EUR/JPY daily chart shows an Elliott Wave analysis, suggesting a possible bearish continuation. The current wave structure indicates the pair is moving through the final phase of a five-wave impulsive sequence.

The market has completed three waves of a larger impulsive cycle, with Wave (4)

The price movement between Wave (2) and Wave (4) shows a pause or slowdown after going up. This means the buyers are losing strength, and the price may soon start to fall

If the price gets rejected near 162.900 , it could confirm further downside.

If it breaks below the 159.674 level, it may speed up the decline, with a possible target around 155.526 level.

NVDA’s Final Act: A Breakout Waiting to HappenNVDA appears to be nearing the completion of its corrective phase, setting the stage for a potential move to new highs. The current pattern resembles a falling wedge, indicative of an ending diagonal formation, which often signals a reversal and the start of an upward trend.

The structure of the corrective channel, along with the termination of the diagonal pattern, suggests a high likelihood of a running flat formation. Buyers are likely to intensify demand pressure as the price approaches the lower boundary of the trendline. A trend reversal may occur if there is a decisive breakout above the Wave 4 level of the ending diagonal.

Buying opportunity with minimal stop is possible after the reversal from lower side of the channel. Targets can be 112 - 120 - 132 - 140.

I'll be sharing more details shortly.

XAU/USD: 5th Wave Rally After CorrectionOn the 1-hour timeframe, XAU/USD has formed an Elliott Wave corrective structure. This is an expanded flat correction, typically seen in the 4th wave. The correction seems to have been completed at 3,054, suggesting that the 5th wave may be in progress.

For bullish traders, a potential long position can be considered around the 0.236 retracement level as a pullback entry point.

The 5th wave has the potential to reach the following upside targets: 3,110, 3,145, 3,165

However, this bullish outlook remains valid only if the low of Wave IV holds. A breakdown below this level would invalidate the bullish scenario.

Elliott Wave Forecast: EUR/USD Prepares for Next Bullish Leg!This EUR/USD 4H chart presents an Elliott Wave analysis, showing the market’s movement within a five-wave structure. The price has completed Wave 3 and is currently in a corrective Wave 4, finding support around Fibonacci retracement levels of 38.2%

• Wave 3: A sharp rally forming an extended third wave.

• Wave 4: An ABC correction is currently in progress and is expected to be completed around levels of 1.07456

If the market respects the proper Fibonacci levels, the target for wave 5 could be 1.09504 .

GBP/USD Technical Outlook: Elliott Wave Mapping the Next MoveThis GBP/USD 4H chart presents an Elliott Wave analysis.

Wave (1) and (2): The market had an impulsive bullish movement in Wave 1, followed by a corrective Wave 2.

Wave (3): A strong bullish move with momentum.

Wave (4): A corrective phase, forming a triangle pattern (a-b-c-d-e), which suggests the market is preparing for another impulsive leg.

Entry Confirmation: A breakout above the triangle pattern.

First Target: 1.31457 (Fibonacci 0.382)

Second Target: 1.32105 (Fibonacci 0.5)

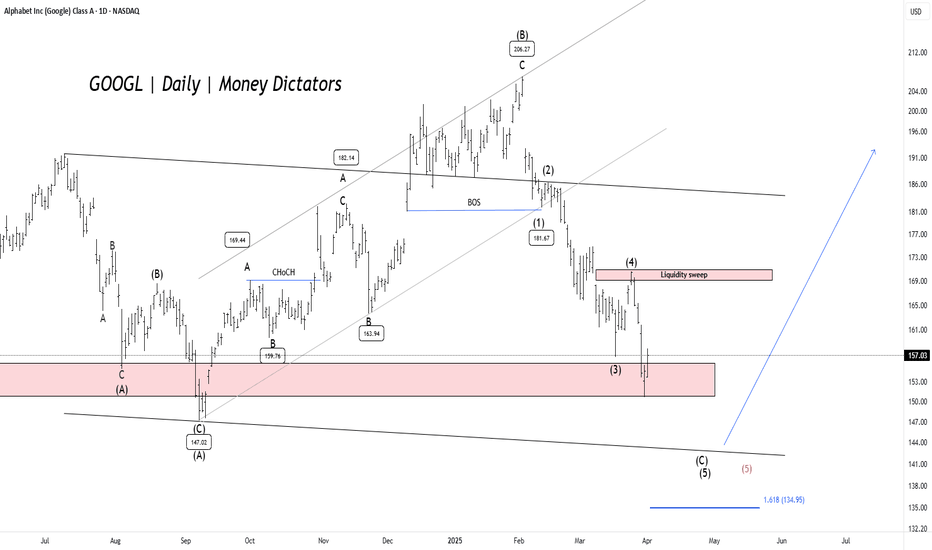

GOOGL - Elliott Wave Final ShowdownGOOGL has dropped over 27.28% , reaching a minor profit-booking zone. The $150 level serves as a key demand zone, where a potential price reversal could occur. The formation is either expanded flat or a running flat on the daily timeframe chart.

Confirmation is best observed near the lower trendline of the parallel channel. If bearish momentum persists, prices may decline further to the $142-$140 range before a strong rebound. Once the correction ends, the upside targets are $168, $180, and $195.

A new low will form if the previous low is breached. Further research will be uploaded soon.

Is Bitcoin on the Verge of a Massive Breakout?Bitcoin's wave ((4)) has successfully completed a W-X-Y corrective formation. If Bitcoin manages to decisively break above the key resistance level of 88,826, it could trigger a powerful impulsive rally, potentially driving prices toward the next major targets at 95,250 - 99,508 - 109,176.

Additionally, the parallel channel's lower trendline is offering substantial support, preventing further downside movement. A strong breakout above this channel could significantly enhance bullish momentum, increasing the probability of Bitcoin reaching new all-time highs.

We will update you with further information.

Oversold RSI vs. bearish wave count The market shows strong bearish dominance with price (22,207.79) below all key moving averages (EMA200: 22,743.51).

3 Bearish Confirmations:

ADX 35.85 + -DI (36.59) > +DI (11.27) = strong downtrend

RSI 28.53 shows oversold but no reversal momentum

MACD (-139.49) remains below signal line (-116.26)

Price struggles below Camarilla pivot (22,680.36) with immediate resistance at 22,534.35 (R1)

Multiple POTENTIAL downward patterns identified (Flat/Downward Candidates & Diagonal Structures)

Recent wave structures suggest Wave 3 extension in progress below 22,207

Contradiction: Oversold RSI vs. bearish wave count suggests possible relief rally before continuation

Action: SELL LIMIT

Entry Zone: 22,680-22,800 (61.8% Fib of recent swing high)

TP1: 22,156 (S1) | TP2: 21,853 (S2 Classic)

Stop-Loss: 22,900 (above EMA200)

Risk/Reward: 1:3.5 to TP2

Position Size: Risk 1% capital (220 pips risk)

Investor Summary

High-risk buying opportunity only if:

Daily close > EMA200 (22,743)

MACD bullish crossover

RSI sustains > 45

Accumulation zone: 21,800-22,200 with tight stops

FLSR - Bulls Will control an Impending Advance---Elliott wave analysis---

As you can see on the daily chart, There is an impulsive cycle from the low of 5960 that validates all the required rules of the Elliott wave principle given below:

Wave (2) can never exceed the starting point of wave (1).

Wave (3) can never be the shortest wave among (1), (3) & (5).

Wave (4) can never enter the price territory of wave (1).

So, we have a valid reason to validate the wave count. In addition, FSLR's wave cycle has the following formation in the wave with Fibonacci levels:

Wave (1) is an impulse wave.

Wave (2) retraced 100% of wave (1). It has formed A-B-C zigzag.

Wave (3) is an extended wave.

Wabe (4) is a complex correction W-X-Y, that retraced to 0.382 level.

Wave (5) is an ending diagonal.

Wave A retraced 0.382 of wave (5), which extended to 1.618 level.

Wave (B) retraced 100% of wave A.

FLSR had accomplished impulsive structure at 232 and started corrective formation. It looks like the correction phase occurred at 132.19 . We can expect a new motive cycle from 132.19 . Traders should carefully watch the breakout of wave 4 of wave (c).

Target projection:

Using Reverse Fibonacci of wave (B)

Reverse Fibonacci Of correction

resistance and pivot levels

From the above projections, we can find a cluster of levels to measure our targets. Traders can follow cluster targets: 168 - 188 - 192 or higher. It can extend up to 100% at 232.

Alternatively, Failure can continue correction to the final support level of 115.58, which is less likely to happen.

---Indicator Study:---

Average true range:

ATR of the FLSR rose to 7.79 when the price was rising. It suggests that we can get a rapid upward move after the breakout of wave (4).

RSI:

The RSI of the FLSR surged from 31.09 to 49.5 . RSI surge along with price suggests that bulls have a strong grip on the stock. We can also see a divergence from the previous move.

Exponential Moving averages:

Major EMAs, such as the 200-day and 100-day , are trading above the price, but the 20-day Exponential Moving Average is being broken by FSLR. Its possible for security to reach quickly to 50 EMA soon.

Thank you!

By @moneydictators on @TradingView Platform

Looking for a minimum of ES 5850In the days to come our initial pattern off the recent has the high probability to get into the 5850 area.

Here I will be looking for a pullback.

If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for follow through for either Minor B having completed early, or the alternate wave (iv). If that sort of price action were to materialize, it's Friday's low of 5651.25 that must support any drop if we're to continue to subdivide higher and have this minor B take more time.

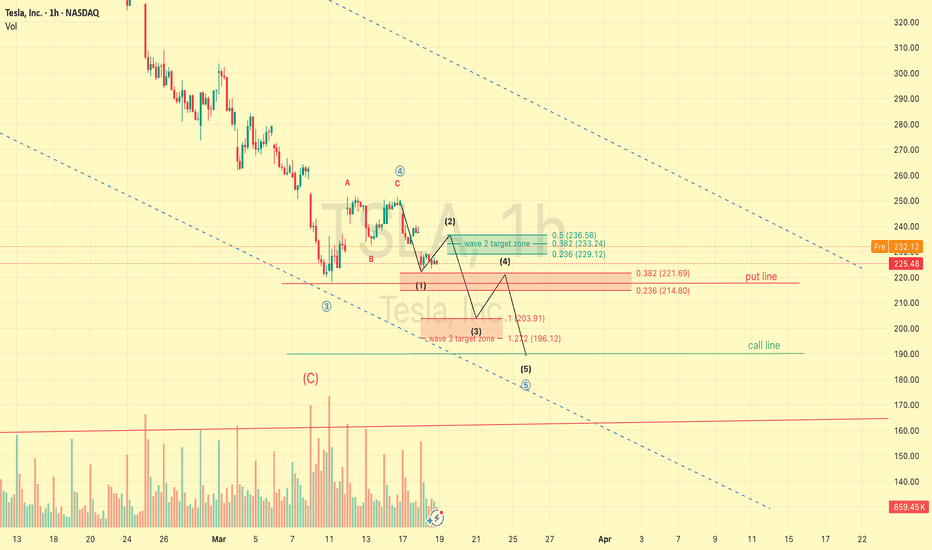

TSLA near-term Elliott wave projections(looks promising)If this is incorrect, i may have to restart learning from the beginning.

And if it does happen, it will happen in a matter of 2-3days time, at the same time get the stop loss ready.

Even if this wave analysis turns out to be completely wrong, we will still manage to find an entry on the uptrend.

Let's go!!

Gold Forming Triangle Pattern in Wave IV - Potential BreakoutXAU/USD is currently displaying a textbook triangle consolidation pattern as part of what appears to be wave IV in its Elliott Wave sequence. This corrective structure is developing after a strong upward move and shows clear converging trendlines with alternating A-B-C swings.

Technical Analysis:

Price consolidating near $3,044 level with minor bearish bias labelled wave ((D))

A-B-C internal wave structure visible inside consolidation

Potential wave ((iii)) price target at $3082.37

Triangle patterns typically represent consolidation before continuation of the primary trend. If this pattern completes as expected, we could see a final wave V impulse in the coming sessions.

Watch for a breakout from this triangle formation - volume should increase to confirm the validity of the move. Target exit or adjust stops based on the direction of the breakout.

XAUUSD - 4H Update: Potential End of Impulse Wave StructureGold continues its impulsive rally, currently completing what appears to be the final leg of wave ⑤ within an ascending channel. This aligns with the larger Elliott Wave count we've been tracking.

Key points to consider:

Wave Structure : We can observe the completion of five internal waves within wave ⑤, with price now at critical resistance levels near the 2.618 Fibonacci extension ($3,065.338).

Bearish RSI Divergence : While price has continued to climb, RSI has started to show signs of bearish divergence, signalling weakening momentum and a potential reversal.

Support Levels : Should a correction materialize, the next key areas to watch are the 0.236 ($3,025.340) and 0.382 ($2,997.608) Fibonacci retracement levels, which align with the lower trendline of the ascending channels.

Wave ⑤ may be nearing exhaustion, with both the Fibonacci extension and bearish divergence suggesting caution for longs. We could see a retracement to support zones if price reverses.

Will the spring & summer of 2025 conclude our retrace in minor BIn the interest of full disclosure we have not even confirmed our minor A has in fact bottomed...but assuming we have struck a short term bottom, we are now embarking on a minor B wave retrace that I anticipate taking us into the start of summer.

In any respect, I am viewing this as only a counter trend rally with a scary (c) of C of (A) to come into the low SPX 5,000 region eventually. There everything gets decided for the long-term.

Be careful out there.

Chris