Eurjpysignal

EURJPY - Expecting The Price To Bounce Higher FurtherH4 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two key Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

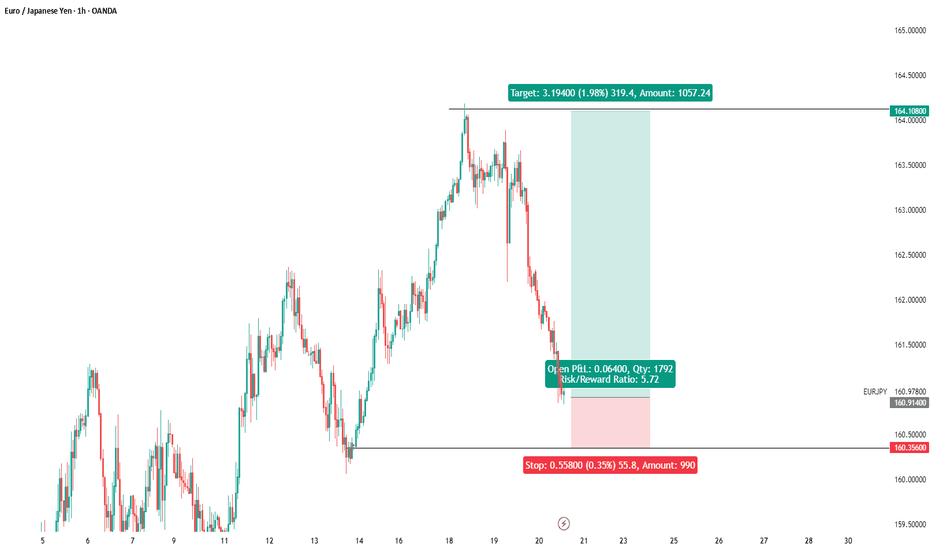

EURJPY Setup IdeaLooking for a long entry, limit order set....

Here is my logic from left to right: we have an short term "double top" forming inside a higher time frame up trend, I'm looking for a run on the stops of traders going short.

We found support at a bullish liquidity pocket (bottom red spot) = Bullish sign

Price completed a bullish harmonic (that grey double top structure is a harmonic) = Bullish sign

Price gave me entry signal with H1 break of structure (blue zone) = Bullish sign

We have equal lows sitting just above the blue line (X's) = Bullish sign

My target is the next red zone even though im projecting this pair to go much higher.

Earlier this week in my newsletter, I gave two zones to look for buy reactions in for EURJPY.

(the huge purple zone on the left, and the bottom red zone within it which currently has a +75 pip reaction.)

Feel free to check it out, the link is in my post signature, and profile bio.

Cheers 🍻

eurjpy analysis ellio. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/JPY "The Yuppy" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (161.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (158.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 165.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

EUR/JPY "The Yuppy" Forex market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

👉Fundamental Analysis

Fundamental analysis examines the economic and political factors driving currency value. For EUR/JPY, we focus on Eurozone vs. Japan.

👉Eurozone (EUR) Factors:

Interest Rates: Assume the European Central Bank (ECB) has maintained or raised rates by March 2025 to combat inflation or support growth. Higher rates attract capital inflows, strengthening EUR.

Inflation: If Eurozone inflation remains elevated (e.g., 2-3%), the ECB might tighten policy, supporting EUR.

GDP Growth: Strong growth (e.g., 2% annualized) signals economic health, boosting EUR.

Political Stability: Stable EU leadership and no major crises (e.g., elections or debt issues) favor EUR.

Trade Balance: A surplus in exports (e.g., German machinery) strengthens EUR.

👉Japan (JPY) Factors:

Interest Rates: The Bank of Japan (BoJ) historically keeps rates low or negative. If still near 0% or slightly positive by 2025, JPY remains weak.

Inflation: Japan’s chronic low inflation/deflation (e.g., 1%) limits JPY strength.

GDP Growth: Slow growth (e.g., 1%) due to aging population and export reliance weakens JPY.

Yen as Safe Haven: JPY gains during global risk-off events (e.g., wars, recessions). If 2025 is calm, JPY weakens.

Trade Balance: Japan’s export-driven economy (e.g., cars, tech) supports JPY if global demand holds.

Conclusion: At 160.000, EUR likely benefits from higher yields and growth, while JPY is pressured by low rates and risk-on sentiment.

👉Macroeconomic Factors

Macro trends influence long-term currency movements:

Global Growth: Strong global growth in 2025 favors risk assets, weakening JPY (a safe haven).

Commodity Prices: Rising oil/energy prices hurt Japan (net importer) more than the Eurozone, weakening JPY.

Central Bank Policies: ECB tightening vs. BoJ easing widens yield differentials, pushing EUR/JPY higher.

Geopolitics: Assume no major conflicts by March 2025; stability favors EUR over JPY.

Demographics: Japan’s aging population caps growth, while Eurozone’s diverse economies adapt better.

Conclusion: Macro trends lean bullish for EUR/JPY.

👉Global Market Analysis

Equity Markets: Rising global stocks (e.g., S&P 500, DAX) signal risk-on, weakening JPY.

Bond Yields: Higher Eurozone yields (e.g., German 10-year at 2.5%) vs. Japan’s (e.g., 0.5%) drive EUR strength.

FX Volatility: Low volatility favors carry trades (borrowing JPY to buy EUR), supporting EUR/JPY.

USD Impact: If USD weakens (e.g., Fed cuts rates), EUR may outperform JPY due to Eurozone resilience.

Conclusion: Risk-on global markets support a bullish EUR/JPY.

👉Commitment of Traders (COT) Data

COT reports show positioning of large speculators, commercials, and asset managers:

Speculators: If net long EUR/JPY increases (e.g., +50,000 contracts), it signals bullish sentiment.

Commercials: Hedgers shorting EUR/JPY (e.g., -30,000 contracts) suggest exporters locking in rates, a neutral signal.

Open Interest: Rising open interest with price indicates trend continuation (bullish if above 160.000).

Historical Context: Extreme positioning often precedes reversals; moderate longs suggest room to run.

Hypothetical Conclusion: Moderate bullish positioning supports further upside.

👉Intermarket Analysis

Intermarket relationships link forex to other assets:

EUR/JPY vs. Stocks: Positive correlation with risk assets (e.g., Nikkei 225, Euro Stoxx 50) favors bulls.

EUR/JPY vs. Yields: Strong correlation with Eurozone bond yields; rising yields push EUR/JPY up.

EUR/JPY vs. Gold: Inverse correlation; if gold falls (risk-on), EUR/JPY rises.

USD/JPY Impact: If USD/JPY rises (JPY weakens broadly), EUR/JPY follows suit.

Conclusion: Bullish intermarket signals align with EUR/JPY strength.

👉Quantitative Analysis

Quantitative models use data-driven metrics:

Interest Rate Differential: Assume ECB rate at 3% vs. BoJ at 0.5%; 2.5% differential favors EUR.

Purchasing Power Parity (PPP): Long-term fair value might be 140; at 160, EUR/JPY is overvalued but momentum-driven.

Volatility (ATR): Low 14-day ATR (e.g., 1.5) suggests steady uptrend, not exhaustion.

Moving Averages: If 50-day MA (e.g., 158) < 200-day MA (e.g., 155) < price (160), trend is bullish.

Conclusion: Quant metrics support a bullish bias.

👉Market Sentiment Analysis

Sentiment reflects trader psychology:

Retail Positioning: If 70% of retail traders are short EUR/JPY (per broker data), contrarian logic favors bulls.

News Flow: Positive Eurozone headlines (e.g., growth data) vs. neutral Japan news boost EUR.

Social Media (X): Assume X posts show optimism on EUR, pessimism on JPY carry trade unwind.

Conclusion: Sentiment leans bullish.

👉Positioning

Carry Trade: Low JPY rates make it a funding currency; longs in EUR/JPY profit from yield and appreciation.

Hedge Funds: Assume funds are net long EUR/JPY, per COT or market rumors.

Central Banks: BoJ intervention unlikely unless EUR/JPY spikes (e.g., to 170).

Conclusion: Positioning favors bulls.

👉Next Trend Move

Technical Levels: Resistance at 162.000, support at 158.000. Break above 162 signals strong bulls.

Catalysts: ECB hawkish statement or BoJ dovishness could push EUR/JPY to 165.000.

Risks: Sudden risk-off (e.g., stock crash) could drop it to 155.000.

Prediction: Uptrend to 162-165, barring shocks.

👉Overall Summary Outlook

Bullish Factors: ECB tightening, BoJ easing, risk-on markets, yield differentials, bullish positioning.

Bearish Risks: Global risk-off, BoJ intervention, or EUR overvaluation correction.

Outlook: Bullish. EUR/JPY likely rises to 162-165 by Q2 2025, assuming stability. Watch for reversals if risk sentiment shifts.

Real-Time Market Feed (Simulated)

Since I can’t access live data, here’s a hypothetical snapshot as of March 10, 2025, 12:00 UTC:

Bid/Ask: 159.980 / 160.020

1-Hour Change: +0.150 (+0.09%)

Daily High/Low: 160.300 / 159.700

Volume: Moderate, carry trade-driven.

👉Future Prediction

Short-Term : Bullish to 162-166.

Long-Term : Depends on global risk and policy shifts; potential correction to 150 if JPY strengthens.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY: Potential downward move towards 161.00?OANDA:EURJPY is currently approaching a significant resistance zone, an area that has been a key point of interest where sellers have regained control, leading to notable reversals in the past. Given this, there is potential for a bearish reaction if price action confirms rejection, such as a bearish engulfing candle, long upper wicks or increased selling volume.

If the resistance level holds, I anticipate a downward move toward 161.00, a target that seems at least achievable. This would more likely be a call on a bearish outlook, as sellers may step in to push the price lower from this key level. However, if the price breaks this zone and sustains the up move, the bearish outlook may be invalidated, and we could potentially see a larger upside move.

Given the potential volatility around this zone, it’s crucial to monitor candlestick patterns and volume closely to identify strong selling opportunities. Proper risk management is essential to handle any potential volatility and protect your capital if the price breaks out.

eurjpy buy signal

Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

DeGRAM | EURJPY decline in the channelEURJPY is in a descending channel between the trend lines.

The price is moving from the upper boundary of the channel and dynamic resistance, which has previously acted as a point of decline.

The chart keeps the harmonic pattern relevant, as well as the descending structure.

We expect the decline to continue.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

DeGRAM | EURJPY retest of trend lineEURJPY is above the descending channel between the trend lines.

The price broke the upper boundary of the channel, formed a harmonic pattern and approached the dynamic resistance.

The chart maintains the descending structure.

We expect the decline to continue after consolidation under the nearest support level.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

EURJPY - Expecting Retraces Before Prior Continuation HigherHi Traders, on March 12th I shared this "EURJPY Short Term Buy Idea"

We expected to see correction prior to the bullish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bullish view still remains the same here.

We have bearish divergence in play based on the moving averages and histogram of the MACD and I expect to see retraces now before further continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.-

EURJPY sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

DeGRAM | EURJPY continues to grow in the channelEURJPY is in a descending channel between the trend lines.

The price is moving from the lower boundary of the channel, support level and lower trend line.

The chart has held above the 38.2% retracement level, the harmonic pattern persists.

We expect the growth to continue.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

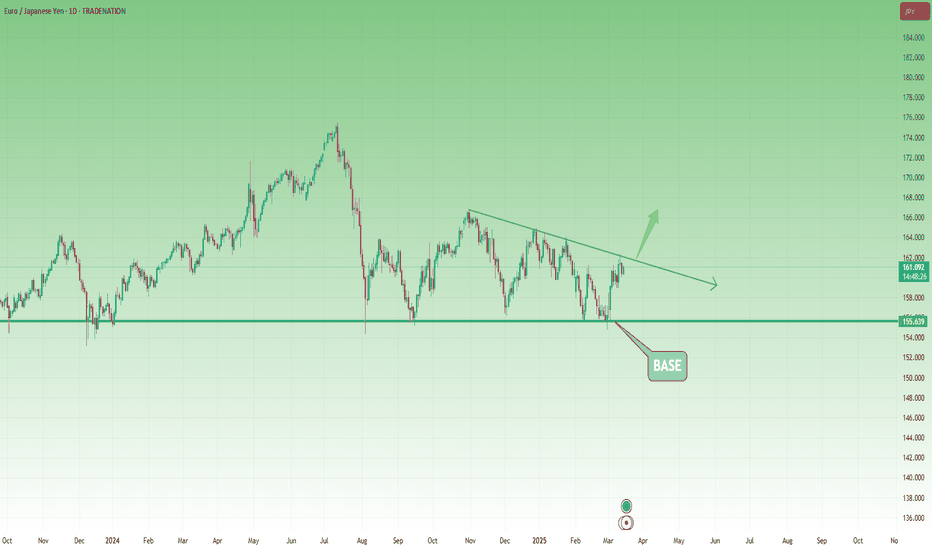

EUR/JPY Trade Setup: Buying the Dip Toward 160 for a 1:2.5 R/RSince reaching a low around 155 at the beginning of August, EUR/JPY has been trading within a defined range.

Earlier this March, the pair once again tested the lower boundary of this range and, as before, rebounded strongly. A higher low was established at the start of this week, suggesting that 159 may now serve as a new base of support.

In my view, EUR/JPY is likely to continue its upward trajectory, and a move toward 165 could materialize in the near future.

Conclusion:

Pullbacks toward the 160 area should be considered potential buying opportunities. With a stop-loss set around 158 and a target at 165, this setup offers an attractive risk-to-reward ratio of approximately 1:2.5.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EUR/JPY "YUPPY" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "YUPPY" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (157.700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA (or) placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 156.000 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 160.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

╰┈➤EUR/JPY "YUPPY" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

1. Interest Rates: The European Central Bank (ECB) has maintained a hawkish stance, with interest rates expected to remain around 3.25%. The Bank of Japan (BOJ) has also maintained a dovish stance, with interest rates expected to remain around -0.10%

2. Inflation: Eurozone inflation is expected to be around 2.2% in 2025, while Japan's inflation is expected to be around 1.5%

3. GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while Japan's GDP growth is expected to be around 1.1%

4. Trade Balance: The Eurozone has a significant trade surplus, while Japan has a trade deficit.

🟡Macroeconomic Factors

1. Monetary Policy: The ECB and BOJ's monetary policies have a significant impact on EUR/JPY.

2. Fiscal Policy: Government spending and taxation policies in the Eurozone and Japan can impact the economy and currency.

3. Global Events: Events like the COVID-19 pandemic, Brexit, and trade wars can impact EUR/JPY.

🔴COT Data

1. Non-Commercial Traders: These traders hold a net long position in EUR/JPY futures, with 55.1% of open interest.

2. Commercial Traders: Commercial traders hold a net short position in EUR/JPY futures, with 44.9% of open interest.

3. Open Interest: The total number of outstanding contracts is 233,111.

🟤Market Sentimental Analysis

1. Bullish Sentiment: 53.5% of investors are bullish on EUR/JPY.

2. Bearish Sentiment: 46.5% of investors are bearish on EUR/JPY.

3. Sentiment Index: The sentiment index is at 54.2, indicating a neutral market sentiment.

🟣Positioning Analysis

1. Long Positions: 56.3% of investors are holding long positions in EUR/JPY.

2. Short Positions: 43.7% of investors are holding short positions in EUR/JPY.

3. Retail Trader Sentiment: Retail traders are net long EUR/JPY, with a sentiment index of 57.1%.

4. Institutional Trader Sentiment: Institutional traders are net short EUR/JPY, with a sentiment index of 45.6%.

🔵Quantitative Analysis

1. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

2. Relative Strength Index (RSI): The RSI is at 55.9, indicating a neutral market sentiment.

3. Bollinger Bands: The price is trading near the upper band, indicating a potential overbought condition.

🟢Intermarket Analysis

1. Correlation with Other Markets: EUR/JPY has a positive correlation with EUR/USD and a negative correlation with USD/JPY.

2. Commodity Prices: EUR/JPY has a positive correlation with gold prices and a negative correlation with oil prices.

⚫News and Events Analysis

1. ECB Meetings: The ECB's monetary policy decisions can significantly impact EUR/JPY.

2. BOJ Meetings: The BOJ's monetary policy decisions can also impact EUR/JPY.

3. Economic Data Releases: Releases of economic data, such as GDP growth and inflation, can influence EUR/JPY.

⚪Next Trend Move

Based on the analysis, the next trend move for EUR/JPY is likely to be bullish, with a potential target of 160.000.

🟡Future Prediction

Based on the analysis, the future prediction for EUR/JPY is bullish, with a potential target of 165.000 in the next 6-12 months.

🔴Overall Summary Outlook

EUR/JPY is expected to remain in a bullish trend, driven by the ECB's hawkish stance and the BOJ's dovish stance. However, investors should remain cautious of potential market volatility and economic uncertainties.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DeGRAM | EURJPY growth in the channelEURJPY is in a descending channel between trend lines.

The price is moving from the lower boundary of the channel and support level, and the 38.2% retracement level is the nearest obstacle to growth.

The chart retains a descending structure, but it has already formed a harmonic pattern.

On the 4H Timeframe, the indicators are pointing to a bullish convergence.

We expect growth in the channel after consolidation above the 38.2% retracement level.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

EURJPY: Gap is Going to Close 🇪🇺🇯🇵

There is a nice gap up opening on EURJPY.

The formation of a bearish engulfing candle

after a test of the underlined resistance indicates

that the gap is going to be filled soon.

Goal - 156.3

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/JPY Weekly Forecast – Liquidity Grab Before Bullish Move 🔍 Market Overview:

EUR/JPY is currently approaching a key weekly sell-side liquidity zone. We anticipate that institutions will sweep this liquidity before driving price higher for a long-term bullish trend.

🎯 Trade Plan:

✅ Wait for Liquidity Grab: Look for price to take out the weekly sell-side liquidity (SSL) before considering long positions.

✅ Confirmation Zone: Watch for a strong reversal signal near demand zones after the liquidity sweep.

✅ Bullish Targets:

Target 1: First supply zone after BOS (Break of Structure).

Target 2: Higher timeframe order block for extended bullish move.

📊 Key Market Confluences:

🔹 Liquidity Sweep: Institutions may clear weak buy-side traders before reversing.

🔹 Smart Money Concept (SMC): We need a clear Change of Character (ChoCH) for bullish confirmation.

🔹 Institutional Order Flow: Watch for high-volume rejections & price absorption signs.

🚀 Best Trading Sessions to Monitor:

📌 London & New York Overlap – High volatility expected for entry confirmation.

⚠️ Risk Management:

Patience is key! Wait for the liquidity grab and a strong bullish reaction before entering long positions. No FOMO!

💬 Do you see EUR/JPY flipping bullish after liquidity sweep? Comment below! 👇🔥