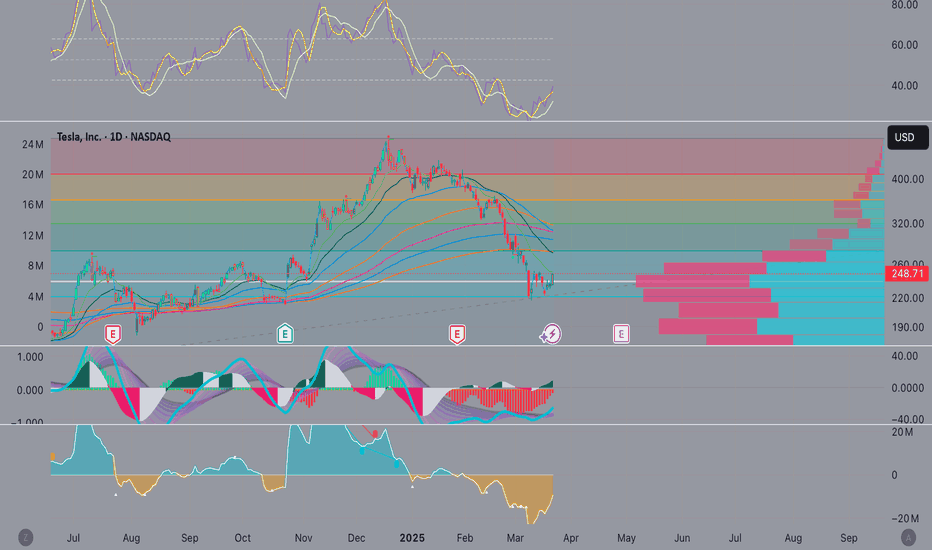

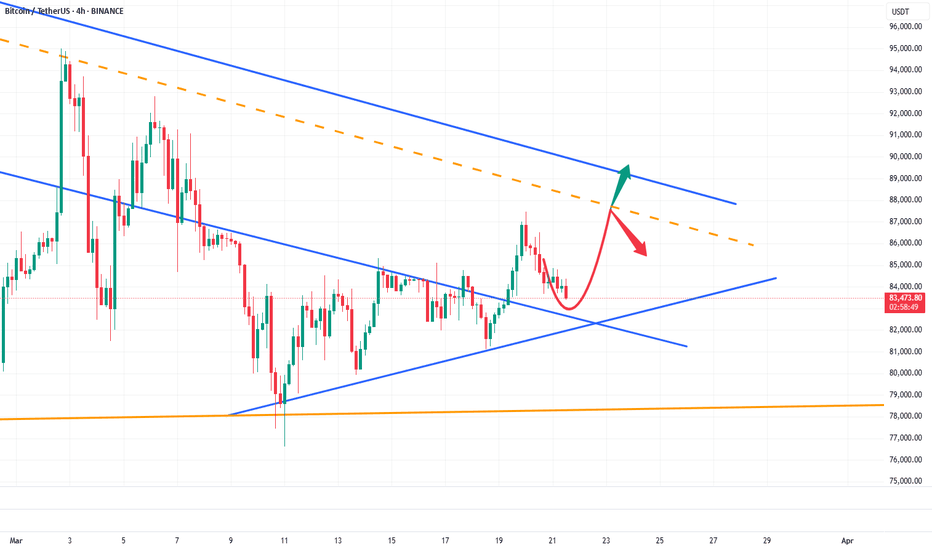

BITCOIN → Flag (consolidation) before falling to 78-73KBINANCE:BTCUSD is consolidating after a short-squeeze relative to 85-87K. A bearish set-up is being formed, the break of which may strengthen further decline to the key target of 73K

A symmetrical triangle is forming within the downtrend on D1, a breakdown of this structure may strengthen the decline. Locally, within the channel a flag - bearish figure is formed (on the local TF false uptrend, the crowd enters to buy from the support or at the break of local resistance, at accumulation of the necessary potential the big player removes the limit order and releases the price, which is dispersed by liquidation of traders), regarding 85K-86.6K the liquidity capture is formed and the price returns to the selling zone. Consolidation below 85K may trigger a breakdown of the figure support and further fall to 80K-78K

Fundamentally: the market sells off any positive news very quickly (negative background is created):

crypto summits, (Trump said nothing new at the second summit)

positive resolutions of problems (for example between SEC and XRP, or removal of restrictions from local exchanges)

crypto reserve

The only nuance, bitcoin's dominance index is still high despite the price drop...

Resistance levels: 85150, 866700, 89400

Support levels: 82K, 80K, 78200

There are no positive signs for growth. The zone where we can consider a trend reversal ( if something supernatural happens ) is 89-91K, but it is very far away.

But now I would consider a breakdown of the flag, or 83.5 - 82.5 and price consolidation below this zone with the purpose of further fall to the local important level 78173. Then another consolidation or correction is possible before a further fall to 73.5K

Regards R. Linda!

Fibonacci

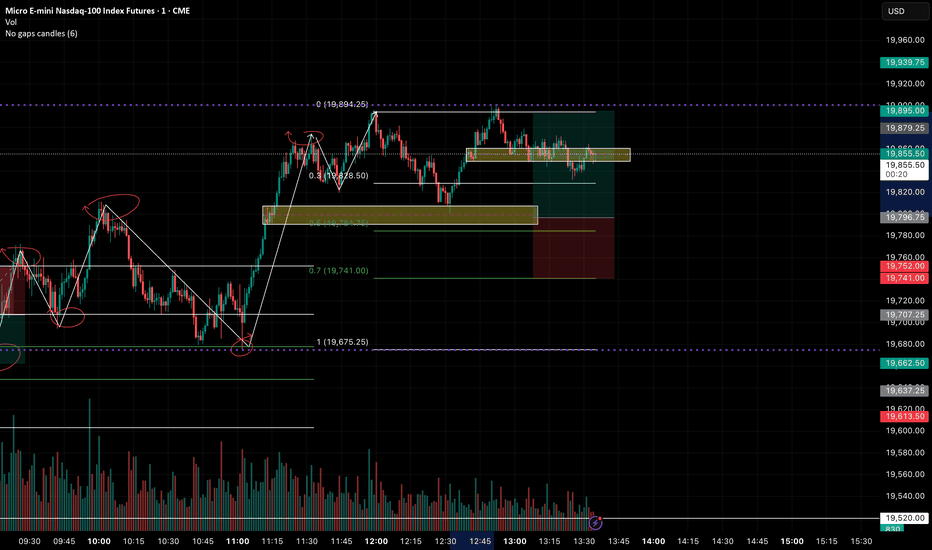

$SPY March 24, 2025AMEX:SPY March 24, 2025

15 Minutes.

Gap down open on 21st was not strong as gap was covered by close of day.

The fib move for downside was achieved by gap down hence no trade.

Now for the fall 570.57 to 558.03 566 is level to watch.

For the rise 558.72 to 564.89 561-562 is number to watch.

So, a short at 565-566 will have a target 562 -563 levels.

I will wait for Monday open before entering a trade.

GM Stock Chart Fibonacci Analysis 032125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 48/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

IREDA (Indian Renewable Energy) - Elliott Wave AnalysisCurrent Market Structure:

The chart suggests that IREDA is undergoing a Wave (2) correction after completing a strong impulsive Wave (1).

The corrective phase is labeled as an A-B-C structure, indicating a possible end to the pullback in the coming weeks or months.

Wave Count & Key Levels:

Wave A initiated the downward correction, followed by Wave B retracement, and now Wave C is in progress, subdividing into a five-wave pattern.

The projected completion zone for Wave (2) is highlighted in the ₹50–₹80 range, aligning with Fibonacci extensions and previous structural support.

An additional 1.618 Fibonacci extension target is placed near ₹23.78, though this would be an extreme case.

Outlook & Strategy:

If the price reaches the projected support zone and shows a strong reversal, it could indicate the beginning of a Wave (3) uptrend.

A confirmed break above key resistance levels and trendlines would strengthen the bullish case.

However, if selling pressure continues, a deeper correction toward the extreme target cannot be ruled out.

🚨 Disclaimer: The content shared is for educational and informational purposes only and should not be considered financial advice, investment recommendations, or trading signals. I am not a SEBI-registered analyst or advisor. Always conduct your own research and analysis before making any financial decisions. Trading and investing involve significant risk, and past performance is not indicative of future results. I may be completely wrong in my analysis. Please consult a professional financial advisor before making any investment decisions.

EUR/NZD at a Turning Point: Is the Rally Over?Why is the EUR/NZD pair in the spotlight as the week comes to an end?

At the beginning of this year, the euro rose by more than 6%, reaching its highest levels since November 2024. Meanwhile, the New Zealand dollar was experiencing a decline at the end of last year, touching its lowest levels since October 2022. But what has changed this week?

From the beginning of February until today's trading session on March 25, 2025, the New Zealand dollar has risen by approximately 4.37%, breaking through the 0.57729 level. This level represents the last significant lower high recorded in the market, and surpassing it indicates a shift in trend from bearish to bullish. From a technical perspective, this is considered a positive signal for the New Zealand dollar in the short to medium term.

On the other hand, after reaching its highest levels since October 2022, the euro has shown some declines and weakening bullish momentum this week. If the U.S. dollar index experiences a corrective rise, further weakness in the euro is expected.

In this scenario, we have a positive outlook for the New Zealand dollar and a negative outlook for the euro, increasing the likelihood of a decline in the EUR/NZD pair, especially since it is currently trading at its highest levels since March 2020!

The recent rise in EUR/NZD gave a bearish signal during this week's trading after breaking below the 1.87675 level (which represents the last significant high low recorded) and forming a lower low. The recent rise to the 1.90668 level appears to be a corrective move before continuing the downward trend toward the 1.88120 level. However, the bearish scenario would be invalidated if the price rises above 1.91663 and closes daily above this level.

USDCHF Wave Analysis – 21 March 2025

- USDCHF reversed from support level 0,8750

- Likely to fall to support level 208.00

USDCHF currency pair recently reversed from the pivotal support level 0,8750 (former strong support from December and the start of March) standing close to the 50% Fibonacci correction of the upward impulse from September.

The upward reversal from the support level 0,8750 created the daily Japanese candlesticks reversal pattern Morning Star.

USDCHF can be expected to rise to the next resistance level 0.8850 (top of the previous minor correction ii).

BNB/USDT 1D chart, target and stop-lossHello everyone, let's look at the 1D BNB chart to USDT, in this situation we can see how the price came out of the top of the ongoing downward trend.

Going further, let's check the places of potential target for the price:

T1 = $ 646

T2 = $ 683

Т3 = $ 732

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 592

SL2 = $ 558

SL3 = $ 535

SL4 = $ 505

Looking at the RSI indicator, we see

As we entered the upper part of the range again, however, there is still a place for the price to go higher, giving more targets.

EURUSD | 4H | WAIT BREAKOUTHey there, Traders,

I’ve put together an analysis for EUR/USD. Right now, I’m watching it like a hunter, waiting for a breakout. As soon as it happens, I’ll drop updates right here under this analysis.

Big thanks to everyone who supports me with likes—you guys are awesome!

God bless you all

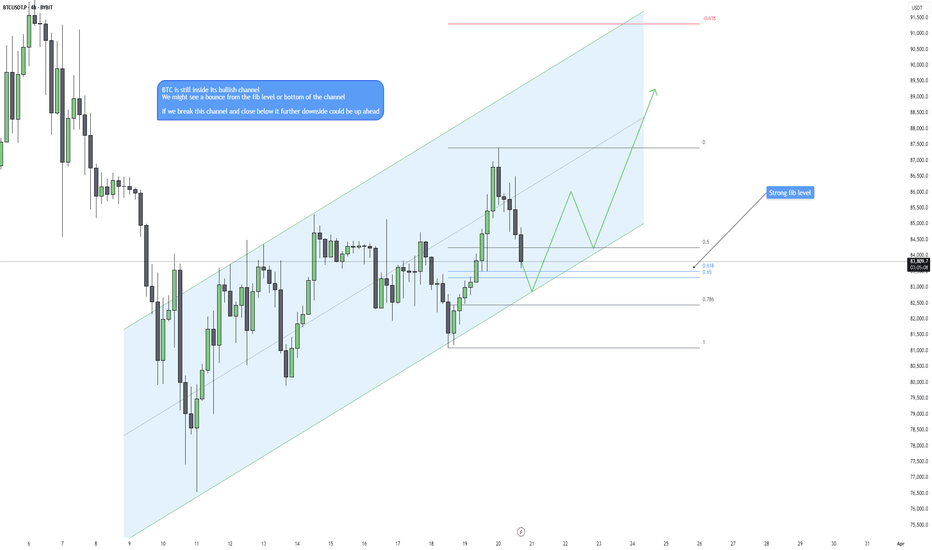

Bitcoin at a Turning Point: Rally or Reversal?Bitcoin (BTC) is currently trading within a upward channel, consistently making higher lows, a strong indication of bullish market structure. This suggests that buyers are still in control, and as long as BTC respects this pattern, the bias remains bullish, favoring a continuation to the upside.

At the moment, BTC is experiencing a pullback from recent highs and is now approaching a critical support zone. This level aligns with several important technical factors, making it a potential turning point in the current trend.

Key Factors Supporting a Potential Bounce:

Upward Channel Structure

BTC has remained inside a clearly defined ascending channel, where price action has respected both the lower and upper trendlines multiple times. As long as BTC stays within this structure and continues to form higher lows, the trend remains bullish.

Golden Pocket Fibonacci Retracement (0.618 - 0.65 Level)

The golden pocket is one of the most significant Fibonacci retracement levels, often acting as strong dynamic support. Historically, this zone has been a high-probability area for reversals in trending markets. With BTC now approaching this area, there is a strong possibility that buyers could step in, leading to a bounce back toward higher levels.

Confluence of Key Support Levels

The Fibonacci golden pocket aligns closely with the lower boundary of the ascending channel, reinforcing this zone as an area of potential support.

There are also previous horizontal support levels in this region, adding further confluence to the idea that BTC could hold this level and bounce.

Potential for Bullish Continuation

If BTC finds support at the golden pocket and reacts positively, we could see another leg to the upside within the channel. In this scenario:

Price could bounce off the lower trendline and move toward the midline of the channel.

If momentum continues, BTC could ultimately target the upper boundary of the channel, potentially leading to new highs.

Bearish Breakdown Scenario – When to Be Cautious

While the bullish structure is still intact, it is essential to consider the potential risks if BTC fails to hold the support zone.

If BTC breaks below the lower boundary of the channel and closes a bearish candle below support, this could be an early signal of a trend reversal. A breakdown of this structure would indicate that bullish momentum is weakening, and further downside could follow.

In this scenario:

BTC could start making lower lows, shifting the trend from bullish to bearish.

The next logical downside targets would be deeper Fibonacci retracement levels or previous swing lows, where buyers may attempt to step in again.

A confirmed breakdown would invalidate the current bullish thesis and could lead to increased selling pressure.

How to Approach This Trade Idea

Bullish Case: If BTC finds support at the golden pocket and forms a strong bullish reaction (such as a clear rejection wick, bullish engulfing candle, or higher low), this would signal a potential bounce. This could present a good long opportunity, targeting the midline or upper boundary of the channel.

Bearish Case: If BTC closes a strong bearish candle below the channel, it would indicate a potential trend shift. In this case, traders should exercise caution, as further downside could be expected.

Final Thoughts

This is a critical area for BTC, as it decides whether the bullish trend continues or a reversal is imminent. The market’s reaction at the golden pocket level will be key. Traders should wait for confirmation before making any moves watching for strong rejection signals for a bullish bounce or a clear breakdown below the channel for a bearish shift.

For now, BTC is still respecting its bullish structure, but this key level will determine whether that trend holds or breaks.

GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

BTC: Accumulate energy for the rise and soar into the sky!📍BTC's volatility has narrowed, with selling pressure showing signs of weakening. Throughout the choppy price action, the 84000-83500 zone has established itself as a critical support area in the short-term structure. This level now serves as a key defensive line.

📍Following this consolidation phase, BTC may stage a rebound from this support region. If the price manages to break through the resistance around 84800 with strength, further upside momentum could drive it towards the 90000 level.

🔎Trade Idea:

BTCUSD:Buy at 83500-83000

TP:84500-85000

SL:Adjust according to risk tolerance.

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

LayerZero ZRP price analysisThe price of CSE:ZRO has entered the $3,00-3.40 “distribution” zone, where buyers and sellers of OKX:ZROUSDT have been historically particularly intense in measuring their strength and deciding on the future direction of the trend.

Therefore, it's not a good idea to make trading decisions in this zone on your own and guess where to go next.

It is better to wait for #LayerZero :

1️⃣ or a confident consolidation of the price above $3,40

2️⃣ or try to bribe much lower, around $2.20

But in general, in the medium term, why not see CSE:ZRO at $7. again?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Three Possible Scenarios for EURUSDEURUSD has flattened out after its strong upward move from around 1.0350 to 1.0950. The bullish momentum has eased, with Europe’s new spending plans priced in, most of the tariff impact accounted for, and markets digesting the FOMC forecasts. Now, the focus shifts to the next major decision point.

There are three possible scenarios:

1-This is a double top formation around 1.0950. If 1.08 breaks, the formation target is at 1.0650, which is also the midpoint of the rally from 1.0350 to 1.0950. It’s a classic technical setup, and fundamentals such as a potential escalation in trade tensions when the April 2 tariffs come into effect could support this move.

2- The second scenario is that this is a consolidation phase before the next leg higher. In this case, the current movement forms a flag pattern, and a breakout would aim for 17 years long downtrend line just above 1.11. For this to materialize, a clear breakout above 1.0950 with strong fundamental support is required.

3- The market may stay indecisive due to the high level of risks and unknowns. In this case, EURUSD would likely continue moving sideways, possibly with minor corrections or false breakouts on both ends, before a clearer direction emerges.

Our view favors the first scenario as the most probable outcome, though all three have valid technical and fundamental reasoning behind them. We lean toward the first scenario because sharp upward moves like this typically require a healthy correction, the risk of trade war escalation increases with each new statement from Trump, and the technical setup aligns well with this narrative.

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!