GBPJPY: Short Signal with Entry/SL/TP

GBPJPY

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GBPJPY

Entry Level - 194.59

Sl - 195.64

Tp - 192.40

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY

GBP/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

GBP/JPY pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 191.791 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/JPY 4-Hour Chart of the Detailed Breakdown ,Detailed Breakdown of the GBP/JPY 4-Hour Chart

1. Price Action & Structure:

• The price is currently around 194.202 after a strong bullish move.

• It has been moving inside an ascending channel, forming higher highs and higher lows.

• The price is now approaching a key resistance zone (around 194.500 - 195.000), where rejection is likely.

2. Expected Market Movements:

• Scenario 1 (Consolidation & Rejection):

• The price could consolidate within the resistance zone before showing signs of rejection.

• If the price fails to break above the 195.000 zone, sellers may push it down.

• Scenario 2 (Bearish Breakdown):

• A break below the channel support line could trigger a bearish move.

• Price is expected to drop toward 193.500, where the first support level lies.

• Scenario 3 (Further Decline):

• If the price breaks below 193.500, the next targets are 191.500 and 189.000, which are marked as key support zones.

3. Key Technical Levels:

• Resistance Zone: 194.500 - 195.000

• First Support Zone: 193.500

• Second Support Zone: 191.500

• Final Target Support: 189.000

4. Trading Considerations:

• A bearish confirmation (such as a break of structure, engulfing candles, or rejection wicks) could signal a potential short trade.

• Stop-loss placement: Above 195.000, if expecting a reversal.

• Take-profit levels: 193.500, 191.500, and 189.000, depending on price action behavior.

5. Summary:

• The price has been bullish but is approaching a strong resistance zone.

• A potential rejection is expected, leading to a bearish move toward lower support levels.

• The chart suggests multiple shorting opportunities if a clear reversal pattern forms.

• Traders should monitor price action confirmation before taking any trades.

GBPJPYMy trade idea was simple:

If GBP/JPY breaks above a key level, I will look for a retest and enter a long position.

If it breaks below, I will wait for confirmation and enter a short position.

The key is to follow the market, not predict it. Always trade what you see, not what you think will happen. Let the price action guide your entries.

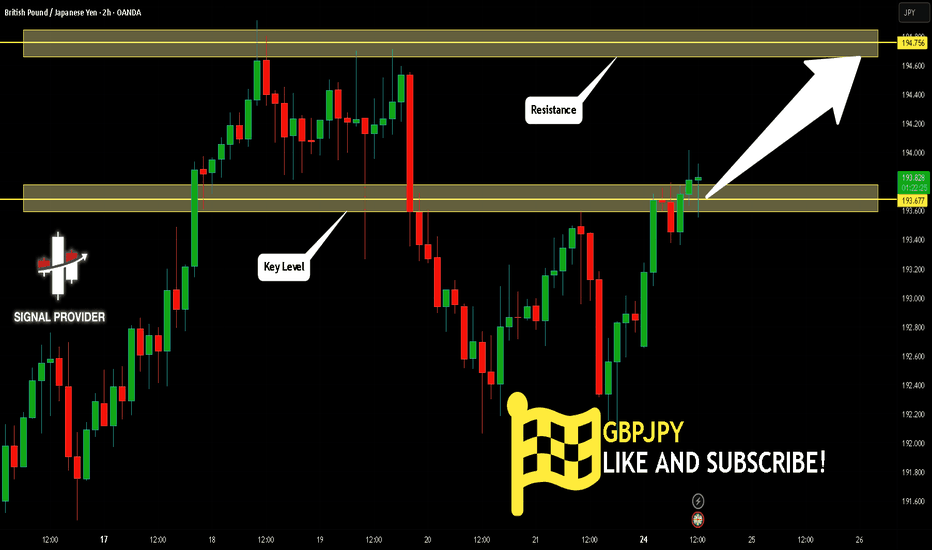

GBPJPY Will Go Higher! Buy!

Here is our detailed technical review for GBPJPY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 193.677.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 194.756 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

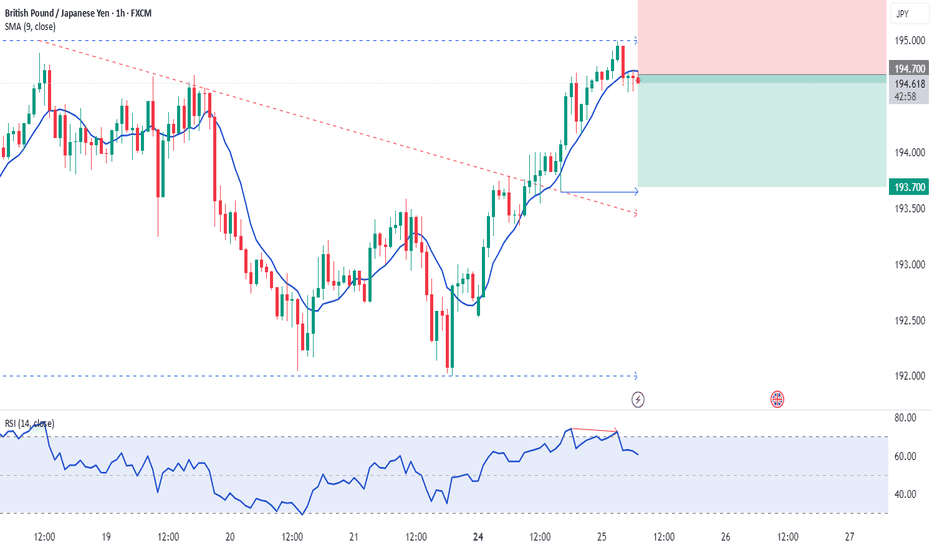

Bullish bounce?GBP/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 191.16

1st Support: 189.22

1st Resistance: 194.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Why GBPJPY is bullish ?? Detailed Technical and FundamentalsGBPJPY is currently trading around 193.000, with technical analysis indicating a potential bullish breakout that could yield gains exceeding 300 pips, targeting the 198.000 level. This anticipated movement is supported by the pair’s recent behavior, where it edged higher to 194.89 before a slight retreat, suggesting consolidation ahead of a possible upward surge. A strong breakout from the current resistance zone could trigger an aggressive bullish wave.

Fundamentally, the British pound has shown resilience, bolstered by stable economic indicators and a proactive monetary policy stance from the Bank of England. Meanwhile, the Japanese yen has experienced depreciation, influenced by the Bank of Japan’s commitment to maintaining ultra-loose monetary policies. The widening interest rate differential between the UK and Japan favors a stronger GBP, adding bullish momentum to the pair.

Technical indicators further reinforce the bullish outlook for GBP/JPY. The pair has been trading within a consolidation range, and a breakout above the current resistance level could signal the continuation of the prevailing uptrend. Moving averages and oscillators are aligning to support this bullish scenario, with the potential to reach the 198.000 target. Volume analysis also suggests growing buying pressure, which could accelerate the upward move once resistance is breached.

Traders should monitor key resistance levels closely, as a confirmed breakout could present a lucrative opportunity to capitalize on the anticipated 300-pip movement. Implementing robust risk management strategies, such as setting appropriate stop-loss orders, is essential to mitigate potential market volatility. Staying informed about upcoming economic data releases and central bank communications will also be crucial in navigating this trading opportunity effectively.

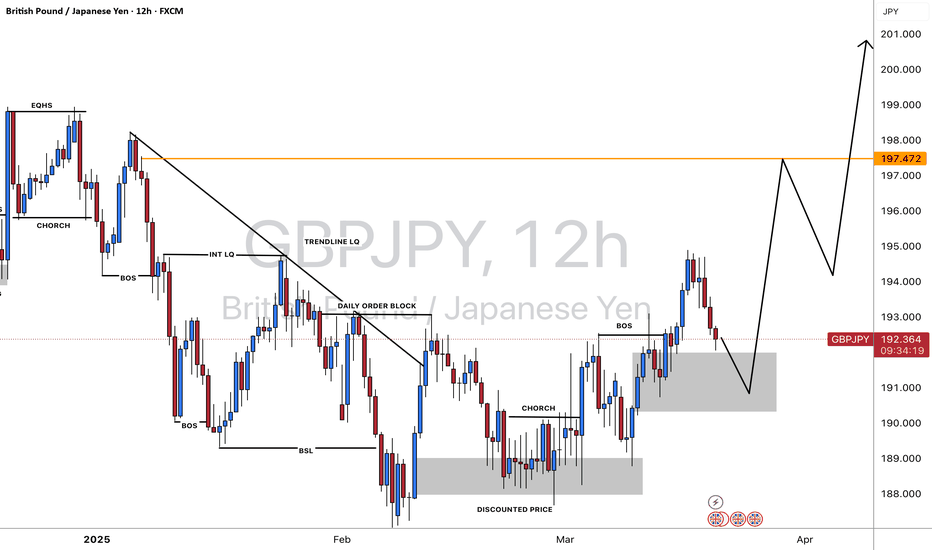

GBPJPY Will Move Lower! Sell!

Take a look at our analysis for GBPJPY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 193.249.

Taking into consideration the structure & trend analysis, I believe that the market will reach 191.112 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY at Key Resistance Level: Will it Drop To 192.000?OANDA:GBPJPY is currently trading at a key resistance zone, where sellers may regain control. This level has been a strong area of interest in the past, suggesting the potential for another bearish reaction if sellers step in.

If the price confirms rejection from this zone, a move lower toward 192.000 is likely. However, a strong breakout above could invalidate this setup, shifting momentum back to the bulls.

Traders should monitor for bearish confirmation signals, such as bearish engulfing candles, long upper wicks rejecting the resistance, or increased selling volume before considering short positions.

Let me know your thoughts or any additional insights you might have!

GBPJPY uptrend supported at 191.40The GBP/JPY currency pair shows a bullish sentiment, reinforced by the prevailing uptrend. Recent intraday price action indicates a corrective pullback toward the previous consolidation zone and the rising trendline support area.

Bullish Scenario:

The key trading level to watch is 191.40, which represents the previous consolidation range. A successful bullish bounce from this level could target the 195.00 resistance, with potential continuation toward 195.66 and 198.30 over the longer timeframe.

Bearish Scenario:

However, a decisive break below 191.40 with a daily close below this level would invalidate the bullish outlook. This would signal a potential shift to a bearish trend, with downside targets at 189.65 and, subsequently, 187.00.

Conclusion:

The bullish sentiment remains intact as long as 191.40 holds as support. Traders should look for bullish confirmation at this level to sustain upward momentum. A break below 191.40 would indicate a deeper retracement and potential trend reversal.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPJPY 1D MA200 rejection. Channel Down sell signal.The GBPJPY pair has been trading within a Channel Down pattern and the recent Bullish Leg got rejected yesterday on the 1D MA200 (orange trend-line). If the 1D RSI closes below its MA trend-line, we will have the ideal sell confirmation signal.

Our Target is the top of the 4-month Support Zone at 188.550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURUSD DROPPING ?? OR THIS IS JUST RETESTING EUR/USD has recently experienced a bearish rising wedge breakout, a pattern that typically signals a potential downtrend reversal. Currently, the pair is undergoing a retest phase, a common occurrence where the price revisits the broken support level before resuming its downward trajectory. This phase is crucial for traders as it often determines whether the breakout was genuine or if price action will invalidate the move.

As of March 20, 2025, the EUR/USD is trading around 1.085, with a target price set at 1.070. The retest phase offers traders an opportunity to enter short positions, anticipating further declines toward the target. It's essential to monitor key support levels during this period, particularly around 1.0767, where buyers have previously stepped in. A strong rejection from this level could accelerate bearish momentum, pushing the pair lower in alignment with the breakout pattern.

Fundamental factors are also shaping the current market sentiment. The recent FOMC decision to maintain interest rates has kept the U.S. dollar in a relatively strong position, while the European Central Bank has taken a more cautious approach regarding rate cuts. This divergence in monetary policy between the Fed and ECB may add further pressure on the euro, making the bearish setup more compelling. Additionally, any unexpected macroeconomic data releases, such as U.S. inflation numbers or Eurozone GDP data, could further influence price action.

Traders should closely watch for confirmation signals during the retest phase, such as bearish rejection candles or increased selling volume. Implementing proper risk management strategies, such as stop-loss placement above the broken support level, is crucial to navigating potential reversals. If the bearish momentum continues as expected, EUR/USD could hit the 1.070 target in the coming sessions, providing a profitable short trade opportunity.

GBP_JPY LOCAL LONG FROM SUPPORT|LONG|

✅GBP_JPY is making a local

Bearish correction and will

Soon retest a horizontal

Support of 192.716 and as

We are bullish biased we

Will be expecting a local

Bullish rebound from the support

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY (British Pound / Japanese Yen) on a 4-hour timeframe.GBP/JPY (British Pound / Japanese Yen) on a 4-hour timeframe.

Chart Details:

• Current Price: 193.768

• Sell Price: 193.640

• Buy Price: 193.896

• Trend: The price is in an uptrend and has reached the marked “Entry Zone”, indicating a potential buy opportunity.

Possible Price Movement:

• The Entry Zone is highlighted as a potential buy area, meaning the price could bounce upward from this level.

• Key resistance levels (targets for take profit):

• 195.500

• 196.103

• 196.124 - 196.500 (major resistance zone)

• The chart shows a zig-zag bullish pattern, suggesting that the price may experience minor pullbacks before continuing upward.

Analysis:

• If the price holds above the “Entry Zone,” it could be a buy opportunity.

• Take Profit (TP) levels: 195.500, 196.103, and 196.500

• If the price breaks below the zone, a bearish movement could occur.

This chart suggests a bullish setup for GBP/JPY, but confirmation through price action is necessary before entering a trade.

GBPJPY: Market Sentiment & Forecast

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPJPY pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

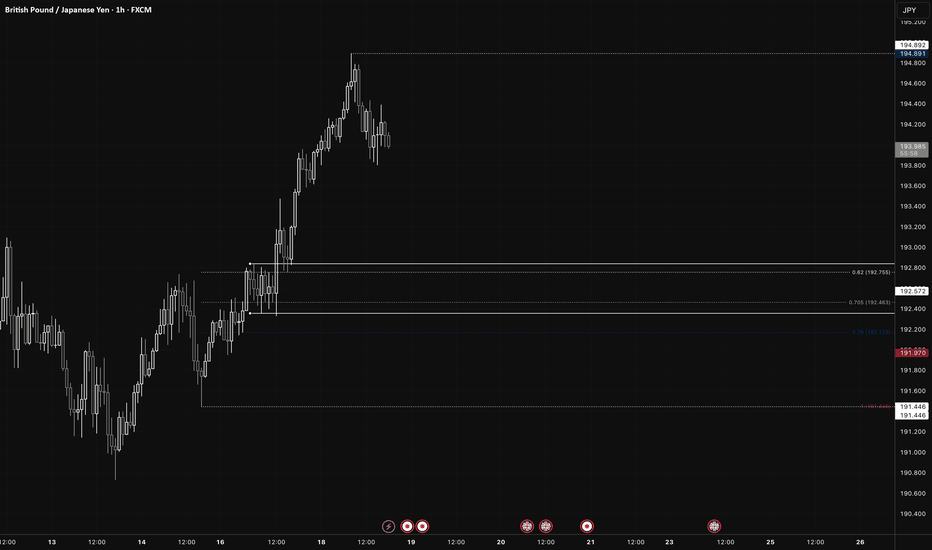

GBP/JPY (Long)Daily:

Price > 200EMA

Swing Period 10

Swing Low: 187.666

Swing Low: 194.892

Volume Imbalance: 2 Candles

Daily Order Block: 197.399 / 195.104

H4:

Price < 200EMA

Swing Period: 7

Swing High: 194.892

Swing Low: 190.728

Volume Imbalance: 2 Candles

H4 Order Block: 192.357 / 192.841

H1:

Swing Period: 5

Swing High: 194.892

Swing Low: 191.446

Volume Imbalance: 11 Candles

H1 Order Block: 192.357 / 192.841

Model 1:

Entry Price: 192.572

Stop Loss: 191.970

TP1: 191.970 @ 1:1 / 50%

TP2: 193.775 @ 1:2 / 25%

SL: Breakeven

TP3: 194.891 @ 1:3 / 25%

Model 2:

Entry Price: 192.750 - 192.159

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

Why GBPJPY is Bullish?? Detailed technical and fundamentalsThe GBP/JPY pair has recently confirmed a bullish reversal by breaking out of a falling wedge pattern, aligning with our earlier analysis. Currently trading at 194.000, the pair is on track toward our target of 199.000.

Technically, the breakout from the falling wedge—a pattern typically indicative of bullish reversals—suggests increased buying momentum. This is further supported by the pair's ability to maintain levels above key resistance points, now acting as support. The next significant resistance is anticipated around the 195.000 level, a psychological barrier that, if surpassed, could pave the way toward our 199.000 target.

Fundamentally, the British pound has been bolstered by positive economic indicators, including robust GDP growth and a resilient labor market, enhancing investor confidence. Conversely, the Japanese yen has experienced depreciation due to the Bank of Japan's commitment to ultra-loose monetary policies, aiming to stimulate inflation and economic growth. This monetary policy divergence has contributed to the upward trajectory of GBP/JPY.

In conclusion, the confluence of technical and fundamental factors supports a bullish outlook for GBP/JPY. Traders should monitor upcoming economic releases and central bank communications, as these could impact market sentiment and price action. Maintaining a disciplined approach with appropriate risk management strategies is essential as the pair approaches the 199.000 target.