GSL - Global Shipping Lease With Exceptional SignalsGlobal Ship Lease (GSL) stands out as a financially solid, deeply undervalued shipping play with improving earnings and favorable macro tailwinds.

If the stock breaks out above the Cup-& Handle pattern, it could be an attractive long opportunity.

For value-focused traders, the combination of low multiples, strong fundamentals, and technical setups makes GSL hard to ignore.

Global Ship Lease has nearly fully chartered its fleet—96% for 2025 and 80% for 2026—giving it strong cash flow visibility amid market turbulence.

On to the technical side:

From 2022 until now, the stock has traded within a large range of 14.62 – 29.90 and is now facing, for the third time, a breakout from the currently formed cup & handle pattern.

In anticipation of today’s breakout on news, I take this as my starting gun to begin building a position. I will be monitoring the stock closely intraday and trading accordingly.

Within the fork, we can see the price hitting the 1/4 line and getting slightly sold off. Ideally, we’d see a pullback to the CL or below. In the longer term, provided the fundamentals support the price, I would build larger positions at the LPL (Last Pivot Low).

The target for this stock is at least the U-MLH as PTG1 = 50% target at $36, and next the WL1 (PTG2) as the 100% target at around $48.

It goes without saying that this trade is not a quickie.

Good luck, and thanks for a like!

GSL

$GSL Buy the dip - global supply chain issues

- high rates in shipping locked

- 2022 estimates:

590M revenue

32% YoY revenue increase

65% YoY EBITDA increase

332M free cash flow

- either it should rebound from the support line of the channel or decline more towards the 200SMA where the entry point is even sweeter.

This is a nice BUY setup IMHO that satisfies both short term and long term factors

GSL Shippers Heating Up/Merger NewsGSL and Posiedon have agreed to a merger to take place sometime in November. GSL is being valued @ $1.78 a share by Posiedon and receiving over $200mln. With GSL trading at close today at $.95 the upside on the deal alone is great.

But also now take into account the shipper run that has taken place the past couple Novembers and I believe we have a perfect set of circumstance for a nice upside potential for GSL. Given that GSL ran to over $4 in Nov 2016 and $2 in Nov 2017 we could see $1.78 and more.

Check out the top trend line on the monthly chart below.

www.tradingview.com

seekingalpha.com

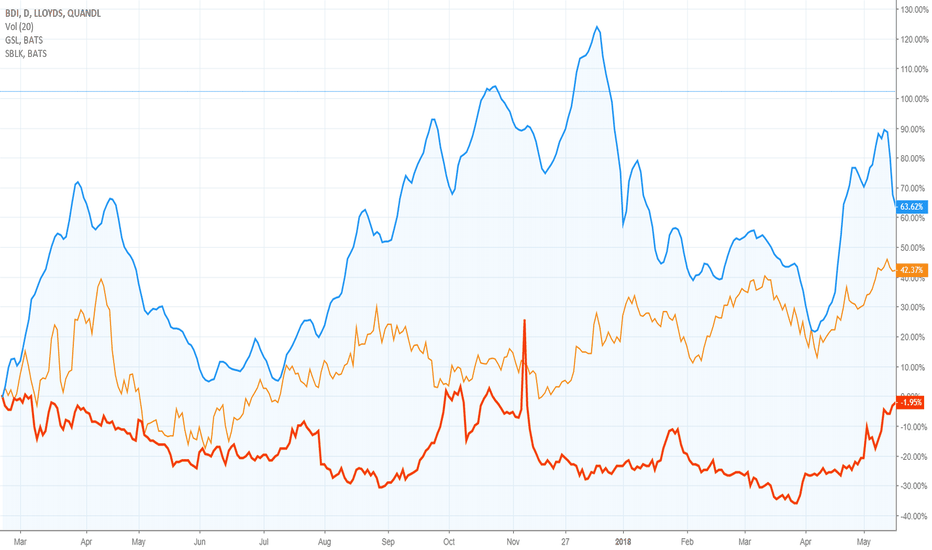

gsl up pattern formingsharp increase in GSL likely forming due to Baltic Dry Index & Star Bulk rising pattarn

$DRYS leading $GSLTextbook Rodrigue Bubble on $DRYS, too late to trade, but $GSL appears to be a day behind. Great short. Alerted by @stockwz on Stocktwits, thanks.