EUR/USD 1-HOUR CHART BUYThis pair seems to be breaking out of a bullish continuation pattern. Keep risk small since later on today we will have the Non-farm Payroll report and also because of the US election. May the best man win!!!

Check out my latest report on the case for diversification and the US Eection here: wp.me

Heisenberg_trader

BHP GROUP (BHP) BUYIf prices break above the previous 34 156 resistance, this should be a good opportunity to buy into this market. The price is above the 100-day exponential moving average on the weekly chart and also seems to be bouncing off the 400-day EMA on the daily chart, as this seems to present a support zone. Our good old trendline shows the price making a series of higher highs and higher lows, however, the slope of the trendline is not that steep, meaning this stock will be a slow mover, if it moves to the upside at all.

Buy: When the price breaks above the 34 156 level. '

This trade will be invalidate if prices break well below the trendline or the 400-day exponential moving average on the daily chart. Proper risk management should be exercised.

ABSA BANK LIMITED (ABSP) SHORTABSA Bank Limited (ABSP)The walls are bloody for ABSA, which clearly shows momentum to the downside on the monthly timeframe (check out my full analysis on my instagram account @heisenberg_trader), as prices are trickling down, with momentary pauses in the form of bear flag patterns. The long term trend is clearly downwards, as prices have been forming a series of lower highs and lower lows.

Sell: When prices break below the 72 000 psychological level.

This trade will be nullified if prices drift closer to the 78 000 psychological level

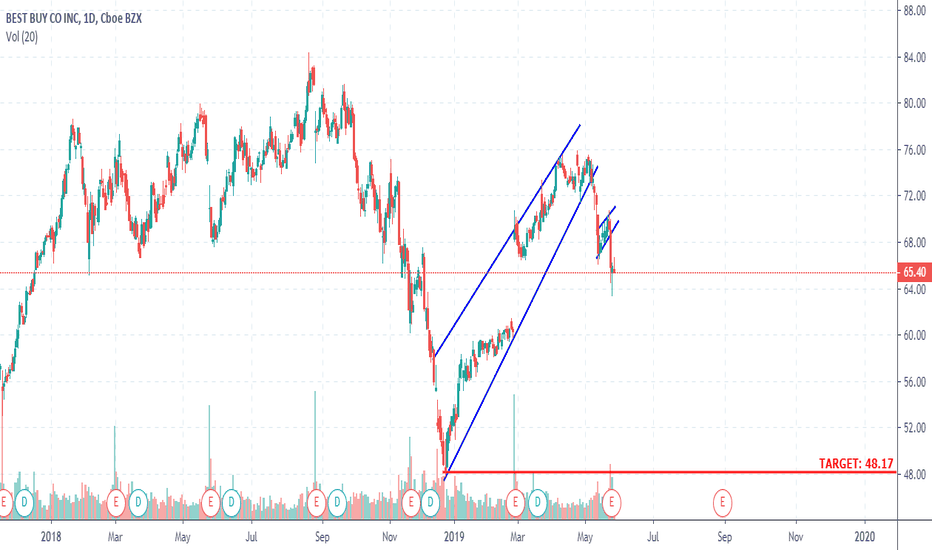

BEST BUY DAILY TIMEFRAME SHORTPrices dropped sharply before forming an ascending wedge, which topped out at the 76 price level. Now, price has already broken out of this corrective structure to the downside and is making a continuation move, with two opportunities to scale in already gone. But you can still jump in with proper risk management and target the bottom of the corrective structure, at the 48.17 price level. May the bears pounce on unsuspecting buyers lol!!

GBP/CAD SHORT 1-HOUR TIMEFRAME CONTINUATION (SCALING IN)Price formed another corrective structure in the form of a bear flag pattern after sellers struggled to hold ground. Now it has just broken to the downside and we are expecting further down movement. Things are a bit slow this week especially after the bank holidays yesterday. Risk management should be on point always. The technicals of this trade are;

Stop Loss: 1.70764

Target: 1.69140

BRITISH AMERICAN TOBACCO (BTI) 4-HOUR TIMEFRAME LONGThis stock has just broken out of a descending channel (bullish flag pattern), and is rallying towards the weekly descending trendline. Therefore, we should see much upside towards the 58 000-60 000 are. The technicals of this trade are as follows:

STOP LOSS: 52 000

TARGET: 60 000

WE CAUGHT 295 PIPS ON GBP/NZD!!! LET'S DO IT AGAINIf price should move below the 1.9350, i will be entering a short position again. Well this trade was obviously epic, as i entered it on a Thursday, on the daily timeframe, and Friday i spent half the morning in a gruesome Financial Reporting exam. Let it be known that i normally enter my trades using the 4-hour and the hourly timeframes. This was almost a first, if not a second. Can't say i wasn't pleased when i came back and the trade started moving in my favor. It was as if it was waiting for me to come back from the exam center. This trade has taught me a few things:

1. Don't focus on pips, focus on the strategy. If you want pips that bad, go on a higher timeframe. Otherwise focus on the process.

2. Set your stop loss and take profit levels and go meet some girls. I set my stops and had to go for an exam for three hours and i trusted that even if i was wrong, i would be taken out at a fairly reasonable level. There is more to life than trading.

3. The higher the timeframe, the more your patience is tested. I held this trade for close to a day before i could see some feasible profits. Don't just enter a trade on a higher timeframe (daily, weekly) and expect miracles immediately. An exception would be when there is a market crash (like the oil crash of 2018).

4. Trust the process. This is self explanatory. If you have a working trading system, why try and modify it? No system will give you 100% success. As long as it makes you profitable, it is a good system. So be content and scan for set-ups.

NZD/CHF DAILY TIMEFRAME SHORTNZD/CHF currency pair is moving in a gradual downtrend, making lower highs and lower lows. We can expect price to make a corrective structure and creep higher towards the 0.6700 area, before reversing and continuing with the current trend. We will wait for price to blow of some steam and slow down before we consider any shorting opportunities. Prices can also move closer towards the trendline, before resuming the downward trend. Always follow price and don't try to be a wizard. If wizards exist, then i am certainly not one of them.

CHF/SGD 4-HOUR TIMEFRAME LONGPrices on the CHF/SGD broke out of a interim downtrend on the daily chart, and we can anticipate further upwards movement. Price could find support on the 1.3650 if it forms a correctional structure in the form of a bear flag pattern, and then continue higher. Proper risk management is key especially when trading exotic currencies since there are huge margin requirements and they can be very volatile.

USD/JPY DAILY TIMEFRAME SHORTPrices formed an impulse to the downside and then moved up after a serious stop hunt, or rather rejection caused by the buyers, who came in and pushed prices higher. This was evidenced by the correctional structure (rising wedge pattern). Price is currently moving downwards after it retested the support turned resistance of the rising wedge pattern. On the 4-hour timeframe, price has already broken out of a second correction pattern (bear flag pattern in this instance) and is moving further downwards. This trade can be played both on higher timeframes as a swing, or on shorter timeframes. The choice will depend on your patience and account size. The technicals of the trade are as follows:

4-HOUR TIMEFRAME STOP LOSS: 113.043

4-HOUR TIMEFRAME TARGET: 109.090

DAILY TIMEFRAME STOP LOSS:

DAILY TIMEFRAME TARGET 2: 107.541

May the bears be with you!!!

EUR/NZD DAILY TIMEFRAME SHORTEUR/NZD currency pair might just form a double top pattern, if the right conditions are met. Price is showing little signs of exhaustion,but it is too early to count any birds from the eggs. Key levels are as below:

Resistance: 1.70713

Support: 1.63540

If price drops, we might catch some major pips though.

PLATINUM (XPT/USD) 4-HOUT TIMEFRAME LONGPlatinum prices are currently moving in an ascending channel on the 4-Hour timeframe, and they arfe currently almost completing a bear flag pattern. We can expect prices to move down and test the support zone at 874.30, and then push higher as they will be upper band of the ascending channel. Possible targets can be the length of the pole of the bear flag pattern.

Conservative traders can enter long positions one the price has broke out of the bull flag pattern, to the upside. This will be good on time but bad on price, as one will enter at a higher price. Risk seekers can enter at the support zone (874.30), and this will be good on price but bad on time. Either way, there is always risk in the financial markets. Safe trading, especially seeing that this is a commodity and the trades are costly.

RISK DISCLAIMER:

This information does not amount to investment advice. There is always risk inherent to trading, so make sure you consult a financial adviser before making any investment decisions. I will not be responsible for any or all of the losses incurred by anyone using this information. Information is provided solely for educational purposes. Do your own analysis and due diligence. Never invest money you are not willing to lose. Before investing any money, make sure your finances are in order and you have enough resources to cater for your daily needs. Trading is a risky business and you may lose part of or all of your capital. Losses may exceed deposits.

REMGRO (REM) 4-HOUR TIMEFRAME SHORTPrice is currently moving in a steady downtrend, whilst also making higher lows, characteristic of a symmetrical triangle pattern. Prices broke out of a bear flag pattern and we can expect further continuation to the downside. Traders can possibly scale in after a corrective move. The target will be the trendline posing as a support.

OLD MUTUAL LIMITED (OMU) DAILY TIMEFRAME SHORTPrice is moving in a range on the daily timeframe, with the support level at 2 120 and a resistance level at 2 370. Though it is possible that price may move further up to close the massive gap on this stock, it is my belief that prices are going to continue further down due to a cluster of orders that are sitting at or above the resistance level. The daily timeframe already shows two bearish candles that have formed indicating the presence (but not the dominance) of sellers. One of the two is actually engulfing previous bullish candles.

Here is my entry for this trade:

Entry: 2 300

Stop Loss: 2 400

Take-profit: 2 120

Risk-Reward: 1:1,80