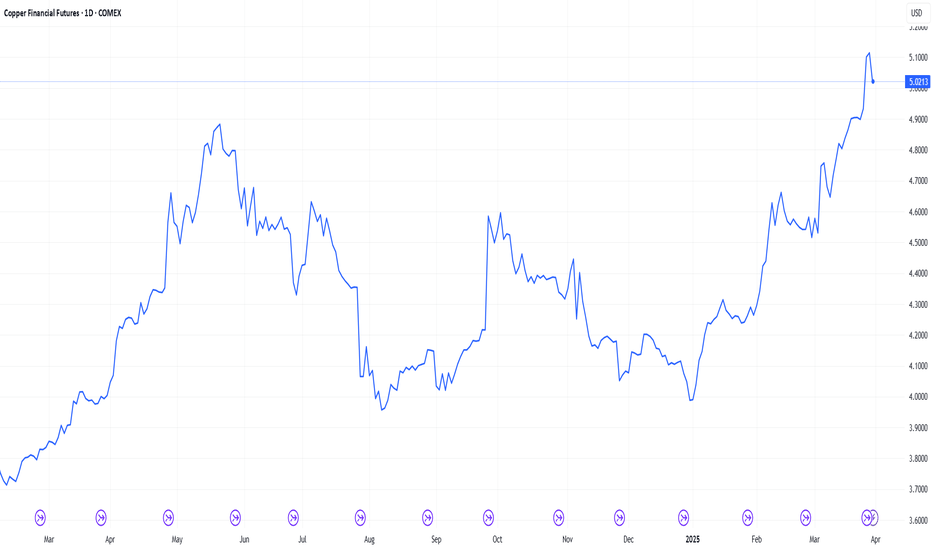

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Infrastructure

#MASK (SPOT) entry range( 2.86- 3.66)T.(12.00) SL( 2.727)BINANCE:MASKUSDT (Infrastructure)

Entry ( 2.86- 3.66)

SL 1D close below 2.727

T1 6.5

T2 7.8

T3 9.0

T4 12.0

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX

#PYTH (SPOT) entry range (0.3660- 0.4660)T.(0.9500) SL( 0.3573)BINANCE:PYTHUSDT ( Infrastructure )

Entry (0.366- 0.466)

SL 4H close below 0.3573

T1 .50

T2 .66

T3 .74

T4 .95

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #PYTH

KiNE: $0.077 | A Web 3.0 Decentralized Platformit's got the soul of OG BitMEX

the look and feel of Kucoin

the guidance of mentor OKX

the beauty of GMX

under rated valued for now

Cap: $1.5M

Float: 20% regulated managed

Handler: the usual 100x Bagger Suspects

DnA: BiNANCE

if you missed BnB at $0.10 cents

this could be it come 2024/25 in time for its roadmap

TradeCityPro | ANKR: Weekly Long-Term Box and Gradual Channel👋 Welcome to TradeCityPro!

In this analysis, I will examine the ANKR coin, which is part of the infrastructure for Web3 and other blockchain projects, with significant partners like Binance and Polygon.

📅 Weekly Timeframe: Long-Term Box with a Slight Incline Channel I will perform this analysis mainly using Fibonacci levels to identify crucial areas. In this timeframe, we can see the price movement from the previous alt season, which had significant growth followed by a decline after breaking the 0.236 Fibonacci level, correcting down to the 0.5 Fibonacci level.

🔍 The support at $0.01728, which coincides with this Fibonacci level, is currently the most crucial support on this chart. Since the price bottomed out in this area, we have seen a very gently sloping upward channel that has reacted three times and had one fake break above the ceiling before returning to the box.

📊 Given the greater ratio of buying to selling volume, I see a higher likelihood of the channel breaking upwards and the price increasing. The RSI has also risen from the 50 level, which could generate bullish momentum. The current main ceiling appears to be $0.06131, which coincides with the 0.236 Fibonacci level and represents a strong resistance.

📈 If the price rises and breaks through $0.06131, the next resistance will be at $0.19012, which is the all-time high (ATH) for the price. I will determine higher targets using Fibonacci extensions.

🔽 In a bearish scenario, the first support is the dynamic floor of the channel. If this support breaks, the primary supports at $0.02223 and $0.01728 are very important levels, and reaching any of these supports could introduce bullish momentum into the market and prevent further declines. If these supports break, the next support will be at the 0.618 Fibonacci level.

✨ Moving on to finding targets based on Fibonacci, as you've seen, the price has corrected to the 0.5 Fibonacci retracement and has good momentum for continuing the upward move. According to Fibonacci rules, when a price corrects to 0.5, the likelihood of moving to the previous high with a break increases.

🧩 The previous price peak is at $0.19418, which coincides with the 0.5 Fibonacci extension. From a market cap perspective, this coin's price could move up to $0.34361. Therefore, we can consider logical targets between $0.19418 and $0.34361. Although the target box size is large and nearly 100% different, this is a weekly trend, and this target is approximate; we must wait for the price reaction to this range to find a more precise target.

🚀 I believe this range is a logical target for this coin, but if the market cap of the project increases and it becomes one of the more significant cryptocurrencies, the price could potentially move to the 1 or even 1.272 Fibonacci points.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | GRT : Short-Term Uptrend with Volume Convergence👋 Welcome to TradeCityPro!

In today’s analysis, I will review GRT for you. The Graph project is one of the key infrastructures of DeFi, with most projects like Uniswap and AAVE relying on this protocol for data extraction. This analysis is conducted in the daily timeframe.

📅 Daily Timeframe: Short-Term Uptrend with Volume Convergence

On the daily timeframe, the price was in an accumulation box and exited it after breaking above 0.2003. The strong buying volume has introduced upward momentum to the market.

🔍 Following the price increase and reaching the resistance at 0.3387, the coin corrected alongside Bitcoin and returned to the 0.2003 area.

✨ The price shadow touched the 0.618 Fibonacci level and, so far, has held well above 0.2003, forming a box between 0.618 and 0.382 Fibonacci levels. I believe if the price stabilizes above 0.382, it can resume its upward movement and potentially break the resistance at 0.3387.

📈 Breaking 0.3387 is considered a risky trigger for spot purchases but seems like an excellent trigger for futures trading. If the RSI stabilizes again above 57.36, the market momentum will remain bullish, increasing the likelihood of breaking this resistance.

🛒 The next resistance, representing the high wave cycle, is at 0.4574 and is a significant trigger. Breaking this level in both spot and futures trading could offer a great position. It is crucial for volume to increase and market momentum to turn bullish as the price approaches this area.

✅ The first target for the movement, upon breaking 0.4574, is the resistance at 0.7443, which is suitable for spot trading. For higher targets, I will update the analysis later as the price reaches this resistance to determine further targets based on market conditions.

🔽 If a deeper correction occurs and 0.2003 is broken, the bullish momentum will be completely lost. The price will need to form a new structure within the box between 0.1319 and 0.2003. Breaking below 0.1319 would signal bearish momentum in the market, presenting an opportunity for short positions.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#TWT (SPOT) entry range ( 1.200- 1.376)T.(2.520) SL( 1.160)BINANCE:TWTUSDT ( Infrastructure )

Entry ( 1.200- 1.376)

SL 4H close below 1.160

T1 1.800

T2 2.000

T3 2.520

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #PYTH #TWT

Analysis of NBCC (India) Limited ChartOverview:

The daily price chart of NBCC (India) Limited indicates a recovery phase after a significant correction from its 2024 highs. Key support and resistance levels are identified, along with a potential pattern that suggests consolidation followed by a breakout.

Key Observations:

1.Trend Analysis:

The stock was previously trading within an ascending channel, marked by higher highs and higher lows, indicating a bullish trend until August 2024.

Post-August, the stock broke below the channel, resulting in a sharp correction of approximately -30%.

2.Support Levels:

₹84.25: Strong support zone, as highlighted by multiple touches and a bounce from this level. It acted as a demand zone during the correction.

The stock formed a short-term base in the ₹84–₹90 range, leading to the current recovery.

3.Resistance Levels:

₹102.10: Immediate resistance, corresponding to the 100-day moving average (acting as a dynamic resistance).

₹111.44: The next major resistance from previous highs and the upper boundary of the consolidation zone.

4.Potential Pattern Formation:

A possible W-shaped reversal pattern is forming. If the stock sustains above ₹93.09 (mid-level support) and breaks ₹102.10, the next target could be ₹111.44.

The pattern suggests a consolidation phase before a potential breakout above ₹111.44.

5.Volume and RSI Analysis:

Volume: Increased buying interest near the ₹84 zone, indicating accumulation.

RSI: Currently recovering from oversold levels, indicating improving bullish momentum.

6.News Catalysts:

The Housing and Urban Development tie-up to develop a land parcel in Noida could provide a fundamental boost, aiding positive price action.

Projection and Strategy:

Bullish Scenario: Sustained breakout above ₹102.10 may lead to ₹111.44 and beyond. Traders could consider this level as a pivot point for long positions.

Bearish Scenario: Failure to hold ₹93.09 may lead to a retest of ₹84.25, where buyers could step in again.

Conclusion:

The stock is in a recovery phase, supported by strong fundamentals and technical patterns. Traders and investors should monitor key levels like ₹93.09 (support) and ₹102.10 (resistance) for confirmation of further trends.

#GTC (SPOT) entry ( 0.540- 0.840) T.(7.3 ) SL(0.528)BINANCE:GTCUSDT

entry range ( 0.540- 0.840)

Targets ( 1.59 - 2.09 - 4.26 - 7.3 )

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .4H close below (0.528)

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC

#T (SPOT) entry (0.026- 0.032) T.(0.13600) SL(0.02579)BINANCE:TUSDT

entry range (0.026- 0.032)

Targets ( .034 - .045 - .048 - .059 - 0.065 - 0.095 - 0.1149 - 0.136 )

SL .4H close below (0.02579)

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T

Update: Trade closed $138 $VRTOne of my best performing single name equities of 2024 - $NYSE:VRT. I've closed most of this trade because it has swollen to be a larger portion of my portfolio than was intended, i.e. portfolio rebalancing. I will keep VRT on my watchlist as a new leader in the AI infrastructure category and a YTD leader overall. I will shop for pullbacks to the 18, 21, and even 50 day moving averages, or a new pattern development -- the latter would take at least several weeks from now to form with enough duration for me to be interested.

My goal is to lock in this profit and to not give it back.

ACC Ltd (NSE: ACC) Weekly Chart Analysis🔹 Channel Support and Resistance

The stock has been moving within an ascending channel since early 2022, creating a structured uptrend. Currently, it’s trading near the channel’s lower boundary, around ₹2,357. This zone has historically acted as a key support level, making it an area to watch closely for potential buying interest.

🔹 Descending Wedge Breakout

Recently, ACC broke out of a descending wedge pattern, a generally bullish formation, which suggests the potential for an upward move. The breakout is still in its early stages, so continued momentum will be critical in confirming the trend reversal.

🔹 Price Targets

First Resistance: ₹2,592.75 – If momentum sustains, this level aligns with a prior high and could act as a short-term target.

Channel Resistance: If the stock gains further strength, the upper boundary of the channel could offer the next significant resistance level.

🔹 Cement Industry Tailwinds

According to brokerages, Indian cement firms, including ACC, have seen successful price hikes in September, and there are plans for further hikes in October. This is generally positive for margins, adding fundamental support to the current technical picture.

🔹 RSI

The Relative Strength Index (RSI) shows an oversold condition that’s starting to turn upwards, suggesting possible accumulation at these levels.

📈 Conclusion: Watch for sustained support around ₹2,357 and an upward move towards ₹2,592. A close above ₹2,592 could indicate renewed bullish strength, especially with ongoing industry tailwinds from price hikes.

SWING IDEA - IRB INFRA DEVIRB Infrastructure Developers Ltd ., one of India's leading infrastructure development companies, is displaying technical signals that suggest a swing trading opportunity.

Reasons are listed below :

58 Zone as Strong Support: The 58 level has proven to be a crucial support zone, offering a strong foundation for potential upward movement.

Bullish Engulfing Candle on Daily Timeframe: The formation of a bullish engulfing candle indicates a surge in buying pressure.

200 EMA Support on Daily Timeframe: The stock is receiving solid support from the 200-day EMA, which strengthens the bullish outlook.

Volume Spike: A noticeable increase in trading volumes suggests strong investor interest and potential for a breakout.

Target - 72 // 78

Stoploss - daily close below 57

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Emerging Real Estate, Infrastructure (nal jal yojna) & PM Aawas Apollo pipes ltd is having good dealership network in north India, once they spread across the rest of the country, they will undoubtedly at among top players in upvc and pvc pipes.

one can bet on their stock for coming 3 years, buy strategically at current level 538-542, accumulate more around at 494 finally buy more at 430 for the first target of 600 second target at of 750 finally book profit at 900 all above targets are likely to observe by the end of December24 to January 2025.

This is not a buy recommendation, this is my personal idea and view for upcoming 6 months to 3-year time frame, one should take advise from his financial advisor before investing.

Refer Chart for Logic and Analysis methodology.

SWING IDEA - KNR CONSTRUCTIONSKNR Constructions , a leading infrastructure development company, is showing technical signals that suggest a potential swing trading opportunity.

Reasons are listed below :

325 Zone Tested Multiple Times : The 325 level has been a significant resistance zone. The price is now attempting to break through this level, indicating strong bullish momentum.

Bullish Marubozu Candle on Weekly Timeframe : The recent formation of a bullish marubozu candle on the weekly chart indicates strong buying pressure and suggests potential for further upward movement.

50 EMA Support on Weekly Timeframe : The stock is finding support at the 50-week exponential moving average, reinforcing the overall bullish sentiment and providing a strong support level.

Breaking Out of a 3-Year Consolidation Zone : KNR Constructions is breaking out of a long consolidation phase that lasted for 3 years, signaling a potential new bullish trend.

Sudden Surge in Volumes : A noticeable increase in trading volumes confirms the strength of the price move, indicating strong investor interest and participation in the current trend.

Trading at All-Time High : The stock is trading at its all-time high, suggesting strong market confidence and potential for further gains. However, traders should watch for potential overbought conditions or profit-taking at these levels.

Target - 400 // 450

Stoploss - weekly close below 265

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

JSWINFRALooks Supergood on Charts.

Near All Time High.

Above all Key EMA.

Good for Shortterm.

Do Like ,Comment , Follow for regular Updates...

Keep Learning ,Keep Earning...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

GMRINFRAMultiple Breakouts.

52 Week High and Rounding Bottom.

Good Volume Buildup.

Good for Short Term.

Do Like ,Comment , Follow for regular Updates...

Keep Learning ,Keep Earning...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

8000 MARKET CAP IS BOUND TO 11 THOUSAND MARKET CAP IN 100 DAYSArchean Chemical Industries Ltd, incorporated in the year , has its registered office in No 2 North Crescent Road, T Nagar, Chennai, Tamil Nadu, 600017, 91-44-61099999. The main industry in which Archean Chemical Industries Ltd operates is Chemicals.

Auditor/Auditors for Archean Chemical Industries Ltd is/are PKF Sridhar & Santhanam LLP. In the main management, is chairman and G Arunmozhi is the company secretary for Archean Chemical Industries Ltd.

SPOT 653

DATE 12 APRIL 24

777 EXPECTED TO GO

ADD UPTO 636

MAIL US FOR MORE VIJAY at Vijaymarketingg . com

HAPPY INVESTING

EDGE - #DePin Infrastructure long term playThis is NOT a short term indicator play. It's a cyclic infrastructure investment #DePin, with a real product and revenue, token burning mechanism. Great entry on a 365 ema retrace touch which gives the best possible RR given the nature of this investment. I will also be participating in providing a node and staking. Little birdie told me good alpha about the roadmap. DYOR

PSN Engineering Consultants /Design LONGParsons reports in 2 days. This multinational engineering firm thrives on infrastructure projects

like highways and bridges, airport runways and other engineering issues such as cybersecurity

walware attacks, election interference, DOS wars, dams, irrigation projects, 100-year storm

assessments and FEMA related work. I am very familiar with this multinational firm that

someday will be consulting on the rebuilt of Ukraine and the Gaza Strip. It is a stable

company with a bright and prosperous future.

The chart shows investors reacting to the impending earnings report and taking positions.

Volatility was extreme last Thursday one week before earnings. I will be adding to my long

position in PSN. This is a slow and steady wins the race type of stock best suited to long term

investors or traders with options strategies.

GTL INTRASTRUCTURE - BEST PERFORMER PENNY STOCKCan enter at CMP 1.75 or Enter at 1.60 level

Targets - 2.35,3.75+

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

IRB INFRASTRUCTURE STRONG BREAKOUT ON OCT 2023STRONG SUPPLY ZONE BREAKOUT

- Strong BO Candidate

- Big Range Accumulation

- Strong Bullish Momentum

- Trading All Time High

- Strong HH-HL Trend

- Massive Volume Buildup

- Looks Ready For 40,45,50+

- Hold 4 to 5 Months

Entered at 35

Targets - 40,50,60,80+

1st Target Completed with in 2 months 23% returns & going

CMP - 41.55

Re-entry possible at 40 level

if falls again from 40 level then average at 35 level

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.