Good recovery for USD but that is not enough🔔🔔🔔 EUR/USD news:

➡️ Ongoing rhetoric about easing trade tensions between the United States and China has had a positive impact on stock markets, helping to restore some calm. However, investors remain cautious about making significant bets on the U.S. dollar.

➡️ Meanwhile, the euro is trading slightly below the 1.1400 level early Wednesday, staying within a narrow range as traders have largely refrained from making bold moves in recent days.

Personal opinion:

➡️ EUR/USD is correcting lower after showing overbought conditions at a three-year high of 1.1575. However, a healthy correction for the USD has emerged but the US dollar cannot be considered back in the forefront. Let's take a look at the upcoming US trade deal.

➡️ Analysis based on important resistance - support and Fibonacci levels combined with EMA to come up with a suitable strategy

Personal Plan:

🔆Price Zone Setup:

👉Buy EUR/USD 1.1360 - 1.1350

❌SL: 1.1310 | ✅TP: 1.1410 - 1.1470

FM wishes you a successful trading day 💰💰💰

Longsetup

Stromm | S&P 500 & NASDAQ a RESISTANCE is NearThe S&P 500 and the Nasdaq are basically moving in lockstep right now — their structures look almost identical.

Starting with the S&P 500:

We’re currently trading into a 4-hour Fair Value Gap between $5,546 and $5,634, Sitting just under a 4-hour Order Block that could trigger a short-term reaction.

At the moment, though, it doesn’t really look like we’re going to flush all the way back down toward the $5,000 level (2-hour Order Block sitting much lower).

More likely?

This 4h Order Block just gives us a brief pullback, a minor reaction — and then price pushes higher again.

This would line up perfectly with my original scenario of Wave A completing around $4,805.

Personally, I’m already positioned around $4,800, so obviously, I'd love to see that level hold and price continue moving higher — ideally heading toward $6,000.

That would be the perfect extension — but nothing is guaranteed yet.

Still, structure right now leans bullish unless we see a sudden breakdown.

Now, for the Nasdaq CME_MINI:NQ1! :

Almost the same setup —

We have a 2-hour Order Block just above the current price, acting as short-term resistance,

And another 2-hour Order Block way lower, which now seems less likely to be tested unless something drastic happens.

So for the Nasdaq, the most realistic short-term scenario:

Hit resistance at the current 2h Order Block,

Maybe a small pullback toward 18,900–19,000,

Then continuation higher toward 20,000 or even 21,000 over the next few weeks.

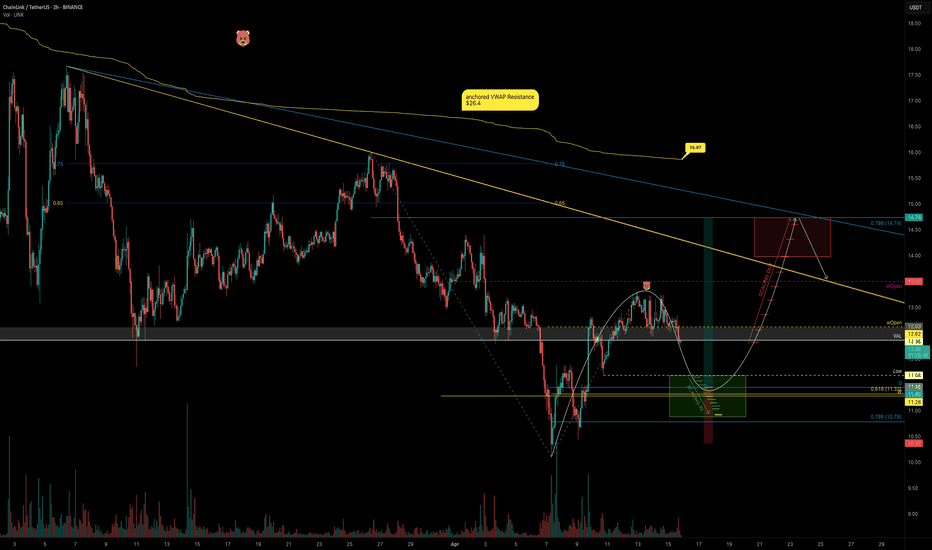

LINK’s Swing Setup Could Push Past $15LINK bounced right off the $10 mark, charging upward toward the monthly open before slamming into resistance around $13.25. But now what?

Let’s break it down — because the next high-probability setup is taking shape, and it’s one you don’t want to miss.

The Current Situation:

LINK is:

Below the Point of Control (POC) of this trading range (~$11.35).

Below the monthly open at $13.5.

Still in a bearish trend on the 4H, showing lower highs.

Facing decent rejection from the monthly level.

We’re currently trading below the weekly open at $12.62, now sitting right on the Value Area Low (VAL) at $12.36. That puts us in a precarious spot and sets the stage for the next move.

Bearish, bearish, bearish. When bullish sir? Staying patient and waiting for a real shift in market structure is key.

The Bearish Play: Liquidity Grab Incoming?

There’s a liquidity pocket waiting below at $11.68, the most recent swing low. If LINK loses VAL and bearish pressure kicks in, this becomes the next logical target.

But here's where things get interesting...

The Bullish Setup: Confluence-Backed Long Opportunity

This isn’t just any random support zone — there’s a perfect confluence stack forming:

Swing low: $11.68

Daily support level: $11.45

Weekly support level: $11.28

POC of trading range: ~$11.35

0.618 Fibonacci retracement lands in this zone as well

That’s four layers of support in one tight cluster. This is where we want to scale into longs.

The Play: Scaling In

Entry: Ladder long positions from $11.68 down to the 0.786 fib (near $11.2)

Stop Loss: Below $10.35 for invalidation

Target: 0.786 fib retracement of the previous downward wave at ~$14.5

R:R: Approx. 3:1, with a potential +30% gain

The trend remains bearish but the chart is setting up a prime reversal zone. Patience is key here.

🔔 Set alerts. Watch for volume spikes. Look for SFPs or bullish engulfing candles etc.

The next move on LINK could offer one of the best swing setups especially since this trade could extend past the $15 mark, putting you ahead of the curve.

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

Ethereum: The biggest Opportunity in 2025!Ethereum is following Bitcoin—but with way worse performance. While BTC is still holding up relatively well, ETH has dropped all the way back to March 2023 levels, wiping out the entire rally. Since its top, Ethereum is down over 63%. 😮💨

Still—or maybe because of that—I’m beginning to slowly scale into spot positions here.

Yes, we could fall further. I’ve got limit orders set lower, specifically around $1,260, which aligns with the 88.2% Fibonacci retracement and the midpoint of the monthly order block. That’s a key zone I’ll be watching if price keeps dropping.

That said, this Wave (2) should be nearing its final stage. The sell-off has been steep, and if we lose $804, that would flip Ethereum’s entire monthly structure bearish—a scenario I’d consider extremely negative.

I don’t expect ETH to suddenly blast past $5,000 from here, but at these levels, I see a clear opportunity to build longer-term spot exposure—and that’s exactly what I’m starting to do now.

Stromm | ETHEREUM No Life Signal YETCompared to Bitcoin, Ethereum is honestly still moving at a snail’s pace — and the performance is almost embarrassing at this point.

There’s still barely any strength showing on the CRYPTOCAP:ETH chart.

Yes, ETH has finally reclaimed the Previous Monthly Low, and it’s holding it — which is a positive step.

But let’s be real:

We’re still 83% below the Yearly Open — a mind-blowing distance when you consider how BTC is behaving right now.

I'm currently risk-free on my trade here, which is a nice position to be in.

If we get another drop, I plan to add at the next Monthly Order Block.

But something serious needs to happen at the Ethereum Foundation level — real fundamental shifts — if ETH is going to deliver the kind of rally people keep hoping for.

Otherwise?

Everything else in the market is outperforming ETH by a mile — and that’s the worst-case scenario for Ethereum:

It doesn't die,

It just gets left behind.

For now, at least I’m sitting in profit, and that's a good start.

Everything beyond this will need careful watching — no blind assumptions, no blind faith.

ETH needs to prove itself — and fast.

XAUUSD Downtrend Continues- Is 3,175 the Next Stop?OANDA:XAUUSD is currently trading within a well-defined descending channel, with price action consistently forming lower highs and lower lows. This structure reflects sustained bearish momentum, and sellers continue to dominate the overall direction.

The recent upward move appears to be a technical rebound, with price approaching a potential resistance zone near the upper boundary of the channel. This area may now serve as a supply zone after acting as previous support, making it an important region for potential rejection.

If the resistance holds, a rejection here could lead to the continuation of the bearish trend, with a potential move targeting the support area around 3,175, aligning with the lower boundary of the descending channel.

However, failure to hold below this level could invalidate the bearish scenario and increase the likelihood of a retest toward the upper boundary of the channel.

Traders should monitor for clear rejection signals at resistance, such as bearish engulfing candles or strong rejection wicks, or alternatively, wait for breakout confirmation before considering a trend shift. As always, proper risk management remains essential.

Price Action + Fundamentals Point to Dollar StrengthThe current market environment presents compelling evidence for a bullish move in the US Dollar Index (DXY). While some patience is required, the setup is increasingly favorable for the dollar to appreciate in the coming weeks and months.

Key Factors Supporting a Bullish Move:

Monthly Close Above 100.160:

A critical technical level to monitor is the monthly close above 100.160. If achieved, it would signal a strong bullish breakout, setting the stage for a continuation higher. Given current price action and market dynamics, this scenario looks highly probable. However, if the price fails to close above 100.160 and instead breaks below it, we could potentially start looking for short opportunities.

Bond Market Strength (30Y, 10Y, 5Y):

This past week, we witnessed notable strength across the US bond market. Yields declined as prices rose, typically a positive signal for the dollar as it reflects capital inflows into US assets.

COT Report Insights:

The Commitment of Traders (COT) report reveals a critical shift: commercial traders, often considered the "smart money," are beginning to accumulate long positions in the dollar. This change in positioning historically precedes significant bullish moves.

Seasonal Patterns:

Seasonality also favors the dollar during this period. Historically, the dollar tends to strengthen in the mid-year months, aligning perfectly with the current technical and fundamental landscape.

Targets:

Initial Target: 106.120

Given the accumulation signs and supportive macro backdrop, a move towards 106.120 seems very realistic.

$EBAY $80 EOYA non factor amongst tariff rhetoric. I think the idea of US consumers (even internationally) buying and reselling has never been higher. I think a lot of consumers will start to look for used goods more than ever. I'm eyeing $70 calls for earnings this upcoming week (first week of May 2025) and if it has any pull back I will load the boat for $80 call leaps. I like the structure it's held at this $55-$65 range. I expect new highs on this name maybe earnings can give it a jolt. All the lines you see are 20, 50, 200 SMA and EMA. I could be wrong on earnings as this name tends to dip from earnings even posting beats but that's the gamble of earnings but LONG TERM this name is a good buy. Charts are Monthly and Daily.

WSL.

BAT ANALYSIS🚀#BAT Analysis :

🔮As we can see in the chart of #BAT that there is a formation of "Falling Wedge Pattern". In a daily timeframe #BAT broke out the pattern. Expecting a bullish move in few days if #BAT retest the levels

⚡️What to do ?

👀Keep an eye on #BAT price action. We can trade according to the chart and make some profits⚡️⚡️

#BAT #Cryptocurrency #TechnicalAnalysis #DYOR

TAO ANALYSIS📊 #TAOAnalysis

✅There is a formation of Descending Channel Pattern in daily time frame in #TAO .

Also there is a perfect breakout and retest. Now we can expect a bullish move. If the price sustains the major resistance zone then we will see more bullish move

👀Current Price: $349

🎯 Target Price : $460

⚡️What to do ?

👀Keep an eye on #TAO price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#TAO #Cryptocurrency #Breakout #TechnicalAnalysis #DYOR

ANGEL ONE - Potential Cup Pattern Breakout!Timeframe: Daily (1D)

Pattern: Cup Formation (shown with arc)

Setup:

Price is forming a classic cup pattern.

The neckline (arc resistance) is near 2538.40.

Price has recently approached but faced resistance around the neckline.

Once the price breaks above the arc line with strong volume, a bullish breakout could be confirmed!

Targets After Breakout:

🎯 Target 1: 2800

🎯 Target 2: 3000

Stop-loss suggestion: As per your risk management.

Notes:

Price is currently below the 200 EMA. For a strong confirmation, look for a close above the arc and the 200 EMA with volume spike.

Disclaimer

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a qualified financial advisor before making any investment decisions. Trading involves substantial risk.

Moonshot Ideas $CFLT > $40- We are entering era of Agentic AI which requires real time data and agent decides to take an action on that event in near real time.

- Confluent valuation is so cheap in a massive TAM and an exploding tailwind of AI Agents. I am seeing all the tech companies and startups are building AI Agents and apetite for real time data streaming capability, processing is required.

- NASDAQ:CFLT need to ride this wave and one way they could do is by making Apache Flink to natively support Python instead of just relying on Java. If they build sdk, python library which could do the heavy lifting when it comes to stream processing, transformation then NASDAQ:CFLT would be number one choice and popular among growing Python community and ML community.

- I wouldn't be surprised to see NASDAQ:CFLT well above 60 dollars in next 2-3 years.

Positive trade talks fuel USD recovery.🔔🔔🔔 USD/CAD news:

➡️ The USD/CAD pair rebounded from its recent losses seen in the previous session, trading around 1.3870 during Friday’s Asian session. The pair is stronger as the U.S. dollar gained traction, supported by optimism over potential U.S. trade deals. The greenback attracted some dip-buying interest after Thursday’s mild decline and found additional support from upbeat U.S. macroeconomic data.

Personal opinion:

➡️ USD is on the rebound and performing better than CAD. Therefore, the main trend for this pair is still bullish in the short term

➡️ Analysis based on resistance - support levels and trend lines combined with SMA to come up with a suitable strategy

Personal plan:

🔆Price Zone Setup:

👉Buy USD/CAD 1.3866 - 1.3850

❌SL: 1.3830 | ✅TP: 1.3920 - 1.3970

FM wishes you a successful trading day 💰💰💰

Trade news gradually improves - Supporting USD to rise again🔔🔔🔔 USD/JPY news:

➡️ The USD/JPY pair extended its gains to approach the 144.00 level early Friday, driven by renewed demand for the U.S. dollar following a Bloomberg report suggesting that China is considering suspending the 125% tariff on certain U.S. imports. The pair largely ignored Tokyo’s hotter-than-expected CPI inflation data.

Personal opinion:

➡️ USD/JPY continues to rise thanks to positive news from the Trump administration’s negotiations with Asian countries. Although good Japanese economic data supports the JPY, the focus is still on the active trade war and it supports the USD

➡️ Analysis based on important resistance - support and Fibonacci levels combined with EMA to come up with a suitable strategy

Personal plan:

🔆Price Zone Setup:

👉Buy USD/JPY 143.00 - 144.40

❌SL: 142.50 | ✅TP: 143.80 - 144.40

FM wishes you a successful trading day 💰💰💰

THETA at Rock Bottom? The Bounce Could Be LegendaryFor the past 136 days, THETA has been in a strong downtrend, shedding an incredible -82% from its high at $3.351. Recently, it tapped into a major support level at $0.617, interesting that it's like the golden ratio 0.618. And it bounced off it beautifully. Over the last few days, we’ve seen a notable surge in volume, hinting at potential accumulation. Could this be one of the best times to scale in? It might just be. An 82% discount is no joke.

🔑 Key Levels to Watch

The $1 level is the key psychological and technical resistance everyone’s eyeing. Longing from current levels to $1 offers a solid +40% gain, not bad at all. But let’s zoom out and get the bigger picture with some Fibonacci levels.

Using Fib retracement on the full 136-day move down:

0.236 Fib = $1.252 → Approx. +75% from current price

0.382 Fib = $1.653 → Roughly +135% gain

These are solid mid- to long-term upside targets if bullish momentum builds.

📈 Trade Setup & R:R

Invalidation: Current low at $0.600

Monthly Open: $0.804. Reclaiming and flipping this level into support would be a bullish sign.

Current Resistance: Around $0.71, where the anchored VWAP (yellow line) aligns with a yearly level. This needs to be broken and ideally retested as support.

We might also be seeing the early formation of an inverse head and shoulders pattern. While the “head” is still developing, if this setup plays out, the target sits at $1.5.

And here’s the kicker:

That $1.5 region lines up with multiple higher timeframe moving averages, adding significant weight to the level:

Monthly 21 EMA: $1.52

Monthly 21 SMA: $1.47

Weekly 21 SMA: $1.514

This confluence makes $1.47–$1.52 a major magnet for price and a likely take-profit or reaction zone if momentum continues.

👉 Feel free to use this indicator—just head over to my profile and under the Scripts section, add it to your favorites. Enjoy.

🎯 Risk to Reward Potential

These setups have excellent R:R potentials, ranging from 3:1 to over 60:1, depending on entry, stop-loss placement, and target selection. These are the kinds of high-probability setups that traders dream of. Clean structure, strong support, major upside, and clear invalidation.

If we see a breakout above $1 with strong volume, it could act as a catalyst for an even faster move toward higher Fib levels and MA targets.

Didn’t want to go too deep, but this lays out a clear roadmap with levels to monitor and possibilities to consider. The rest depends on how new data unfolds in the coming weeks. As always... plan your trade, manage your risk, and let the market come to you. Keep monitoring volume, structure, and key levels. The opportunities are here, now it's about execution.

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Novo Nordisk's The recent drop in Novo Nordisk's stock price is attributed to several factors. A key issue is the company’s struggle to meet the surging demand for its weight-loss drugs, such as Wegovy. Although demand remains strong, investors are concerned about Novo Nordisk's ability to scale up production and deliveries, which is creating downward pressure on the stock.

Additionally, some recent financial results failed to meet Wall Street expectations. Despite revenue growth in key product categories, overall revenues in some reports came in below forecasts. This underperformance has contributed to a negative investor sentiment.

However, analysts emphasize that Novo Nordisk's core products remain in high demand, and the company has significant long-term growth potential if it addresses its supply chain and production challenges

BTC on the verge of another accumulation range breakoutMorning all! So its time for a proper set of markups having spent the last few months breaking down the charts in video format for you all.

The last BTC update I gave was on 24/03, in the 4 year cycle analysis breakdown. In that video i was expecting lower pricing into SSL and the range lows once more, forming a bottoming structure before seeing a HTF bullish reversal come through, aligning with the 4 year cycle where we have time to continue higher based on past cycle data and where we are in the current cycle.

A month later and we have seen that come through wonderfully after the sweep of the range lows and its time to reanalyse now the direction is changing....

BTC has formed another accumulation range down in these discounted levels over the last couple months and there was nothing really interesting taking shape until the last couple of days thats give us some real confirmation of a trend change in this accumulation range that we can now work with. Unlike the August 2024 bottom, there isnt a massive influx of volume on the sweep event. I was able to call the bottom after such a sweep and high volume event back then just days after but in this most recent range we havent seen volume like back in August 2024, so ive had to be more cautious of further downside until we get some market shift confirmations to confirm intent and be on the safer side here whilst still holding my HTF bias of new ATHs before cycle end.

As shown on the charts, ive marked up the range and stages. We have carried out the sellers climax event, forming the range low, into the automatic rally (AR) forming the range high, moving into the secondary test (ST) with a failure swing back to the lows which forms the secondary test in phase B. From there we continued to range before putting in another range low deviation in the Spring event, with tests of the range low before seeing this explosive move come through from the spring event back to the range highs.

Volume also supports price action with a high influx of volume on the sellers climax low, stopping the prior trend, decreasing volume in the range into supply with a further increase in buyer volume as we deviate the lows in the spring event.

We have also broke structure bullish in the range and formed a HH, with a HL yet to be formed....

**So whats next? **

It seems a lot more clear now after the last couple days, and also confirms intent behind the range and i think its safe to say we have formed a bottom here and my focus is now on the upside on BTC from here. After this range high deviation into supply, in this new HH, i wouldn't be surprised to see BTC pull back to the midpoint of the range between $84,000 - $76,500, back into demand and form a last point of support/demand in the accumulation range forming a HL, before another leg higher as shown.

With how price has set up, with the demand left behind in the range and the bullish intent, my focus is on BTC forming a HL from demand before a continuation higher in line with my HTF bias that we will see new ATHs again before the cycle end. This is also supported in what im seeing on USDT.D and USDC.D where they are distributing in their ranges in supply with breakdowns in both and moving to a bearish trend.

Therefore, when price corrects into these levels i will be looking to allocate risk into the market during the discount of the HL and I will be looking for my buys on DOGE and any other opportunities, where im expecting higher lows in the market before continuations higher across the board. This doesnt mean everything though as many alts are yet to catch up and flip bullish, so my focus will be on the higher quality, stronger coins such as DOGE, but i expect the rest of the market to catch up eventually as BTC runs higher from these lows.

1D:

3D:

1W:

1M:

Panic Selling LINK? Here’s Your Master PlanBuckle up! LINK has been riding a relentless bearish trend for 113 days, ever since it kissed its peak of $30.94 back in December 2024. With economic uncertainty casting a shadow over the markets and fear gripping investors, the big questions loom: Is this the dip to buy while others panic-sell? Or is it wiser to sit on the sidelines? Let’s slice through the noise, dissect LINK’s chart like a seasoned pro, and uncover the setups that could turn this chaos into opportunity. Let’s dive in!

The Big Picture: LINK’s Bearish Blueprint

LINK is currently trading at $13, a far cry from its yearly open of $20. April has kicked off, and LINK has already surrendered the monthly open at $13.5, a critical level now acting as a brick wall overhead. Zooming out, the trend is unmistakably bearish: lower highs and lower lows dominate the chart. Adding fuel to the fire, LINK is languishing below the Point of Control (POC) at $14.32, derived from a 1.5-year trading range. This is a market screaming caution for bulls and whispering opportunity for bears, at least for now.

But charts don’t lie, and they’re packed with clues. Let’s map out the key levels, pinpoint trade setups, and arm ourselves with a plan that’d make even the most seasoned traders nod in approval.

Resistance Zones: Where Bears Sharpen Their Claws

1.) Resistance - The Golden Pocket ($13.6 - $13.7)

Using the Fibonacci retracement tool on the latest downward wave, the golden pocket (0.618 - 0.65 Fib) aligns beautifully with the monthly open at $13.5. Oh wait there’s more, this zone overlaps with a Fair Value Gap (FVG), making it a magnet for price action.

Trade Setup (Short):

Entry: ~$13.5 (if price tests and rejects this zone).

Stop Loss (SL): Above the recent swing high at $14.4.

Take Profit (TP): First target at $11.85 (swing low), with a stretch goal at $11.

Risk-to-Reward (R:R): A solid 2:1.

The Play: If LINK crawls up to this resistance and gets smacked down, bears can pounce. Watch for rejection candles (e.g., shooting star, bearish engulfing) to confirm the move.

2. Key Resistance - Cloud Edge & VWAP ($15.74 - $16.5)

The Cloud edge of my indicator sits at $15.74, while the anchored VWAP (from the $26.4 high) hovers at $16.5. A break above $16.5 would flip the script, snapping the bearish structure and signaling a potential trend reversal.

Bullish Scenario: If bulls reclaim $16.5 as support, it’s a green light for a long trade. Until then, this is a fortress for bears to defend.

The Play: No bullish setups here yet.

Support Zones: Where Bulls Build Their Base

1.) Support - Swing Low ($11.85)

This is the first line in the sand for bulls. A potential Swing Failure Pattern (SFP), where price dips below $11.85, sweeps liquidity, and reverses—could spark a long trade.

The Play: Watch for a bullish reversal candle or volume spike here.

2.) Major Support Cluster - The Golden Zone ($10 - $11.85)

This is where the chart sings a symphony of confluence:

Swing Low: $11.85.

POC: $11.33 (1.5-year trading range).

Monthly Level: $11.02.

Fib Retracement: 0.886 at $10.69 and 0.786 (log scale) at $10.77.

Psychological Level: $10.

Trade Setup (Long):

Entry: Dollar-Cost Average (DCA) between $11.85 and $10.

Stop Loss (SL): Below $10

Take Profit (TP): First target: $13.5 (monthly open), stretch goal: $20 (yearly open).

Risk-to-Reward (R:R): A monstrous 6:1 or better, depending on your average entry. This is the kind of trade we are looking for!

The Play: Patience is key. Wait for confirmation—think bullish engulfing candles, a surge in volume, or positive order-flow momentum. This isn’t a “hope and pray” trade; it’s a calculated ambush on the bears.

Market Structure: Bears Rule, But Bulls Lurk

Right now, LINK’s chart is a bear’s playground—lower highs, lower lows, and no bullish momentum to speak of. The $16.5 VWAP is the line in the sand for a trend shift, but until then, short trades take priority. That said, the $10 - $11.85 support zone is a coiled spring for bulls. If fear drives LINK into this range, it’s time to load the boat with longs—provided confirmation aligns.

Your Trading Edge

LINK’s 113-day bearish descent is a wild ride, but it’s not random chaos—it’s a roadmap. Bears can feast on rejections at $13.5 - $13.7 with a tidy 2:1 R:R short. Bulls, meanwhile, should stalk the $10 - $11.85 zone for a high-probability long with a 6:1+ R:R payoff. Whether you’re scalping the dips or swinging for the fences, these levels give you the edge to trade with confidence.

So, what’s it gonna be? Short the resistance and ride the wave down? Or stack bids at support and catch the reversal of a lifetime? The chart’s laid bare—now it’s your move. Drop your thoughts below, and let’s conquer this market together!

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know, I’m here to break down the charts you want to see.

Happy trading =)