$SPY March 17. 2025AMEX:SPY March 17. 2025

15 Minutes.

AMEX:SPY near 200 averages in 15 minutes.

Big resistance point.

hence a pull back to 560.5 - 558.5 will be a good level to go long.

AMEX:SPY forming HH HL pattern.

A short I expect to be stopped around 556-558 levels.

Not a good R:R setup.

Sidelines today.

M-oscillator

Bears in Control, but Oversold Signals Hint at Squeeze RiskThe break of uptrend support dating back to the start of the artificial intelligence (AI) frenzy in early 2023 may embolden Nasdaq 100 bears to seek a far larger downside unwind than what’s already been seen. Coming on the back of last week’s disintegration of the 200DMA—and with valuations still stretched relative to historic averages while competition in the AI space from China seemingly grows by the day—the technical and fundamental ducks are lining up for such an outcome.

While recent price action has been entirely bearish, sustained directional moves rarely unfold without the occasional countertrend interruption. With RSI (14) now in oversold territory on the daily timeframe and Nasdaq 100 futures finding some buyers between minor support at 19300–19140, this may provide a platform for some form of countertrend squeeze.

If bids continue to repel bears on dips beneath 19,300, longs could be established above the level with a stop below 19140 for protection against a continuation of the prevailing bearish trend. Former uptrend support sits just below 19,900 and looms as a potential trade target. Alternatively, if the price breaks through 19,140 convincingly, bears may set their sights on support at 18,387.

Patience may be required for those considering the setup. Watching USD/JPY for signs of capital flight back into the yen may also be advisable given the skittish environment.

Good luck!

DS

TRUMP/USDTFundamental Overview of TRUMP/USDT:

Official Trump Coin (TRUMP) has gained attention due to its association with former President Donald Trump. With a current price of $11.86 and a market capitalization of approximately $2.37 billion, TRUMP ranks among the notable digital assets in the market. (coinmarketcap.com) Its popularity and volatility attract both investors and traders seeking new opportunities.

Technical Analysis:

We see that TRUMP coin is currently trading within a descending channel, respecting two trendlines that form a falling wedge pattern. If the downward momentum persists, we expect the price to drop into the $4.5-$5.0 range, where we anticipate strong buying pressure to emerge.

Key VWAP levels, highlighted with green circles, act as price magnets, making them crucial points of interest for a potential reversal. Additionally, Fibonacci retracement levels indicate significant resistance around $21.15 (0.618 Fib) and $24.22 (0.786 Fib), which could serve as key breakout targets if the price initiates an upward move.

If the price successfully reclaims these resistance levels, a bullish scenario could unfold, potentially targeting $30+ in the mid-term. However, failure to hold support around $4.5-$5.0 could lead to further downside exploration.

USDCAD Wave Analysis – 14 March 2025

- USDCAD reversed from key resistance level 1.4500

- Likely to fall to support level 1.4300

USDCAD currency pair recently reversed from the key resistance level 1.4500, which has been reversing the price since the middle of January.

The resistance level 1.4500 was further strengthened by the intersecting upper daily Bollinger Band.

Given the strength of the resistance level 1.4500 and the bearish US dollar sentiment seen today, USDCAD currency pair can be expected to fall to the next support level 1.4300.

SMPH Possible Trend ReversalAfter months of downtrend, SMPH seems to be somehow recovering from its bearish sentiment. From downtrend to sideways

Confluence

Macro: Shift from downtrend to sideways

Daily chart: higher lows

RSI: higher lows

Short term outlook: Looking like a 1 month short term uptrend.

Other Notes

Possibly looking to make a DB MB BO and hopefully a DB BT BO

Coming from a macro downtrend, sentiment shifting to defensive stocks. Property sector may not be the first mover post bearish sentiment since its not a defensive sector but perhaps the speculated rate cuts may help.

Earnings also released and looking good.

USD/CHF: Bearish Trend Pauses, but Breakdown Risks RemainThe strong bearish trend for USD/CHF stalled this week, with buying support emerging beneath .8774, continuing the pattern seen in December. The net result has been a grind higher before running into resistance at .8854, forming what resembles a bear flag on the charts. That should put traders on alert for a potential downside break and resumption of the bearish trend.

Indicators like RSI (14) and MACD are providing mixed signals on price momentum, with the former trending higher while the latter remains below the signal line. However, the modest RSI (14) uptrend looks vulnerable, mirroring the unconvincing price action.

If the price breaks down from the bear flag, immediate levels of note include .8774, .8711, and .8617, the latter being a more substantial support level. On the topside, a break of .8854 would put .8920 and .8966 on the radar for bulls.

The price is hanging around the 200-day moving average like a bad smell this week, but having traded through it on multiple occasions like it didn’t exist, it shouldn’t be a major consideration for traders.

Good luck!

DS

EURGBP Wave Analysis – 13 March 2025

- EURGBP reversed from key resistance level 0.8450

- Likely to fall to support level 0.8340

EURGBP currency pair recently reversed down with the daily Shooting Star from the resistance area between the key resistance level 0.8450 (which has been reversing the price from September) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the earlier short-term ABC correction ii from the end of February.

Given the strength of the resistance level 0.8450 and the overbought daily Stochastic, EURGBP currency pair can be expected to fall to the next support level 0.8340.

BTC 3 MONTHS LONG Starts, this week?Waiting for a last impulse 140 ds/3 months on INDEX:BTCUSD BITCOIN, this week could the 3 months BTC LONG START . Why? Let´s see:

- Channel with 4 elliot waves done. Looking for Wave 5.

- RSI 3D breaking out, like 1 year ago.

- RSI W Just about to Break out, like 1 year ago. Looking for confirmation.

- Rate Cuts this week, lets see.

www.tradingview.com INDEX:BTCUSD

XCN + 333%? X4 IS WAITING FOR IT IF THIS CONFIRMS.Last time Onyxcoin (XCN) had a Bullish divergence on RSI and make a Golden cross. it made a +383% in 5 waves making the 1st wave on the bigger cycle. (152 ds).

Wave 2 a correction ( 152 ds), corrects as Elliot says to the 4th of a minor degree.

And now that the Wave 3 seems to start, we break the descending channel and made a Golden Cross. We have the bull impulse until Feb/Mar 2025.

To confirm this we need the break out on the RSI.

And remember that Wave 3 usually is the strogest of all, we will find out on OCTOBER ;)

Cheers!

Hang Seng Tech Rocket Ship Running on FumesHang Seng Tech futures look like they’re running out of rocket fuel after the recent surge, hinting that a fresh catalyst may be needed to recalibrate the trajectory higher. That could mean a pullback before another move up.

Price, oscillators, and volumes have rolled over in unison, putting the uptrend established in January firmly on the radar. It’s found today around 5630, with minor support just above at 5710.

A break and close beneath the uptrend would strengthen the case for a trend reversal, pressuring weak longs and likely encouraging bears to target additional downside.

Levels to watch include 5484, 5300, and 5140 on the downside, while 5710 and 6209 remain in focus on the topside if the uptrend holds.

Good luck!

DS

Shorting Gold!Gold has been on a TEAR through 2025. Overextended in ATH territory and more expensive than ever before in history. Logically, we should expect a return to historically normal (still expensive) prices.

Daily chart is showing 3/3 sell signals

1. Price below 9 period MA

2. RSI bearish fanning beautifully from overbought levels

3. Average Daily Range expanding with volatility

I'm aggressively watching for shorts on Gold, Silver, and Copper in the weeks ahead. I've outlined 3 possible entries IF we're lucky enough to see some kind of relief from last weeks selloff. Should price proceed to fall, preparing smaller time frame short trades. I strongly believe we will see 2800. Strategy is invalidated if price breaches ATH's

Silver's Breakout—From Graveyard to Launchpad?Silver looks great on the charts, closing above $33 for the first time since late October. Previously, this was like a graveyard for bullish raids, putting increased emphasis on the price action over the next few days.

Whether you’re talking price or momentum signals, they suggest this break may stick where others failed, putting a potential retest of the October 2024 swing high of $34.87 into play. We saw a key bullish reversal candle on Tuesday, followed up by further buying on Wednesday, contributing to the bullish break. That’s not surprising given price signals have often proved accurate in silver recently. RSI (14) is trending higher, with MACD confirming the bullish momentum signal.

The ducks are lining up. If silver can’t capitalise in this environment, it will be a telling sign as to where medium-term directional risks may lie.

Those considering bullish setups could buy above $33 with a stop beneath the level for protection. Some resistance may be encountered around $34 and $34.50, with a break above the latter putting $34.87 on the table. $35.36 and $37.46 are long-standing levels located just above.

If silver were to reverse and close through $33, the near-term bullish bias would be invalidated.

Good luck!

DS

Natural Gas Wave Analysis – 12 March 2025

- Natural gas reversed from round resistance level 5.0000

- Likely to fall to support level 3.815

Natural gas recently reversed from the resistance area between the round resistance level 5.0000, the upper weekly Bollinger Band and the 38.2% Fibonacci correction of the downward impulse from 2022.

The downward reversal from this resistance area stopped the earlier weekly upward impulse sequence (3) from the start of 2025.

Given the recent formation of the daily Shooting Star and the overbought weekly Stochastic, Natural gas can be expected to fall to the next support level 3.815.

Harley-Davidson Wave Analysis – 12 March 2025

- Harley-Davidson reversed from resistance level 27.35

- Likely to fall to support level 23.80

Harley-Davidson recently reversed from the resistance area between the key resistance level 27.35 (former double bottom from January), upper daily Bollinger Band and the 50% Fibonacci correction of the downward impulse from January.

The downward reversal from this resistance area stopped the earlier short-term ABC correction 4 from the start of February.

Given the overriding daily downtrend, Harley-Davidson can be expected to fall to the next support level 23.80.

Brent crude oil Wave Analysis – 12 March 2025

- Brent crude oil reversed from the pivotal support level 68.55

- Likely to rise to resistance level 71.30

Brent crude oil recently reversed from the support area between the pivotal support level 68.55 (former multi-month low from September) and the lower daily Bollinger Band.

The upward reversal from this support area stopped the earlier downward impulse waves 3 and (3).

Given the strength of the support level 68.55 and the oversold daily Stochastic, Brent crude oil can be expected to rise to the next resistance level 71.30.

EURCAD Wave Analysis – 12 March 2025

- EURCAD reversed from the resistance area

- Likely to fall to support level 14.20

EURCAD currency pair recently reversed from the resistance area between the long-term resistance level 1.5800 (which has been reversing the price since the start of 2020) and the upper daily Bollinger Band.

The downward reversal from this resistance area stopped the previous upward impulse wave (3).

Given the strength of the resistance level 1.5800, EURCAD currency pair can be expected to fall to the next support level 14.20.

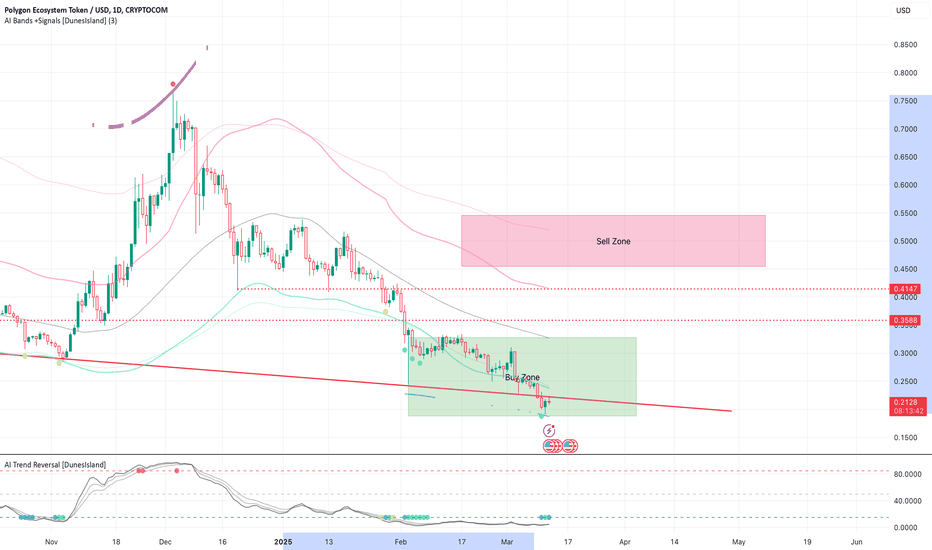

$POL still accumulatingPSX:POL dropped lower than I expected but its a better opportunity to continue to DCA, HODL for the long term, at this point we are in the lower side of the cycle. From the top it dropped ~75%. I think there will be a short term bounce as every indicator is oversold at this point. Lets see what the markets will do..

ASX 200: Oversold Signals Flash, But Bulls Need ConfirmationASX 200 SPI futures are so oversold on the daily timeframe that you can’t help but notice, especially when looking back over recent years. The only time an RSI reading this low didn’t spark some form of bounce was during the height of the pandemic panic in early 2020.

But being oversold alone isn’t enough to trade against the prevailing strong bearish trend, putting extra emphasis on Wednesday’s price action. To get bullish and position for a countertrend squeeze, we need a price signal for confirmation.

I’m watching 7796—the price dipped below this level in low-volume trade during the night session before reversing back above. It’s only a minor level, but beneath it there’s not much for bulls to hang their hat on until 7600, where buyers stepped in last year.

Depending on the price action around the open at 9:45 am AEDT, if bulls defend 7796 again, the risk of a squeeze increases, similar to what we saw on Tuesday.

Longs could be considered above the level with a stop beneath the session low for protection. 7900 is one potential target, with 7996 and former uptrend support around 30 points higher alternative options for those seeking greater risk-reward.

A clean break and close below 7796 would invalidate the squeeze setup. Unless accompanied by fundamentally bearish news, flipping short after recent declines would be risky.

Potentially working in bulls’ favour, iron ore futures in Singapore had a solid session overnight, lifting nearly 1% to $101.70 per tonne.

Good luck!

DS

KASPA: Soon to switch to being greedy again.Back into the green zone.

Stepping up DCA-accumulation into a more aggressive mode soon, expecting KAS to fall to as low as ~5.4 cents.

FG oscillator is still orange (bearish) on the weekly.

10 bps upgrade and activation incoming. 4 smart contract layers being developed. Tier1 exchange listings to look forward to. KII (Kaspa industrial initiative), and so on.

GOLD sell target in new week As of March 9, 2025, gold is trading at approximately $2,919.80 per troy ounce.

Forecasts for the upcoming week (March 10–14, 2025) suggest a potential decline in gold prices. Predictions indicate that gold may reach around $2,789 on March 12 and $2,784 on March 13, with a slight rebound to $2,825 by March 14.

Technical analysis indicates that gold prices have experienced a slight decline recently, with spot gold falling by 0.1% to $2,892.00 per ounce on March 4, 2025.

Given these projections and technical insights, setting sell targets at $2,860 and $2,850 for the upcoming week aligns with the anticipated market trend. However, it's essential to consider that gold's long-term outlook remains bullish, with forecasts predicting prices could reach $3,265 in 2025 and $3,805 in 2026.

Please note that market conditions can change rapidly, and it's advisable to stay updated with the latest analyses and forecasts before making any trading decisions.