NSE-INDIA

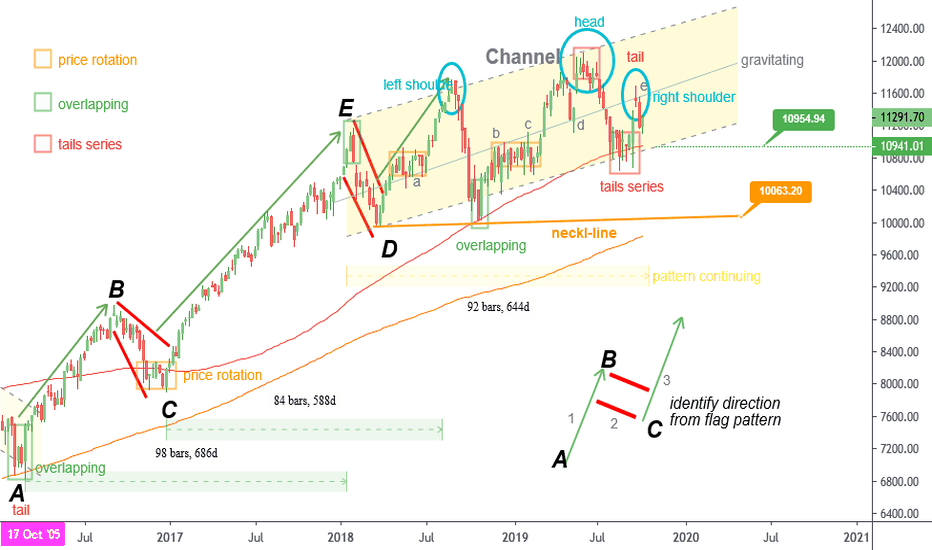

Nifty long-term chart analysis give a story from 2000 to 2020.Following patterns are found for data of 2015 to 2019 (5 years data) on weekly candle chart.

Channel pattern

Flag Patterns

Currently running Head and Shoulders pattern

Remarkable zone 1, 2 and 3

Head & Shoulders pattern is still uncompleted with right shoulder. The neckline target is 10063

At the remarkable zone, its has highly price rotatio n detected with tails

As per channel pattern , the range is 12600 to 10900. The gravitating target 12000 for nifty.

Conclusion, break 10900 below nifty can draw more downward.

History may not repeat itself, but Chart pattern gives you data points and insights to understand how the market can behave in the future.

Weekly candle chart for the spot NIFTY from 2000 to 2020 until the present. Patterns, uptrend, downtrend, or sideways trend, etc are drawn. We have divided this data in 5 years data chart. Comparing the four charts that We have generated, conclusions was written. There're many similarities and difference was found. We can get clear picture of NIFTY for next price move.

Case 1 (2000-2005)

Lot of time and brainpower attempting for technical analysis.

Case 2 (2005-2010)

Technical Chart patterns on nifty.

Case 3 (2010-2015)

Chart the weekly data for the NIFTY.

YESBANK:NSE Possible buy from 125-30 range.Yesbank has been struggling with the bears from poor results. Seems like a good gains from range of 125-30. (Aiming for 300-310 if hold on technicals).

current rend - Downtrend/bearish

RSI oversold on till daily charts.

Consider fundamentals and enter with confirmations.

TATA Power adds more power to their Kitty!NSE:TATAPOWER Tata Power's 50:50 joint venture with Exxaro Resources in South Africa, Cennergi (Pty) announced commencement of commercial operations for its 95 MW Tsitsikamma Community wind farm project on Thursday.

Technically on weekly chart, price is moving up from a significant base formation and consolidation. I expect price to hit 90 levels over next few months. Keep 70 levels as stop-loss and trade cautiously. Volume spike over last two spikes indicate that smart money is investing in the script.

NMDC ...breakout after consolidationNSE:NMDC .NMDC India's largest Iron ore producer is going to benefit from firming of Global prices. With the revision of Chinese GDP growth rate by Moody's, I expect commodity prices to hold its reins over next few months.

NMDC has formed firm base around 90-100 levels and It has consolidated over six months. It is on the verge of breakout from cloud and Momentum is visible both on weekly and daily charts. One can expect 130 levels over next few month. Keep your stop loss around 90 and trade cautiously.

Tech Mahindra can see lower levelsNSE:TECHM ...Tech Mahindra Is under pressure due to BREXIT and Relative weakness in IT sector. Though the Quarterly results were fairly in line with analysts expectations, Sector weakness and BREXIT could lead TechM to lower levels.

Technically TEchM is in Multitimeframe bearish trend. I expect levels of 450 over next few months before any significant support can come in. 510 levels can acts as a stoploss as well as resistance.

Monsoon fuels Jain irrigation NSE:JISLJALEQS

Excellent Monsoon rains can help Jain irrigation to increase their revenue in coming quarters. After few years of drought several government initiatives to support Micro irrigation systems is also in its favor.

Results are due on August 12th , so some care is required while trading but the target is 80 for the coming month and one can see easily 92 levels in next few quarters

Technically stock has been in sideways to bullish trend for over six months. MACD has just turned Bullish on daily charts and price is above Ichimoku cloud. I expect a breakout this month.

TataElxsi Ready for an UpMove!!TataElxsi is giving a Buy Setup and is ready for a substantial upmove upon breakout. I would be buy stock around current levels with stoploss just below 1590 for a Target of 1800 / 2000. Details are on the chart.

Happy Trading!!

Siraj Hudda, CFTe

Web: www.prowaveanalysis.com

Skype: sirajhudda

Email: contactus@prowaveanalysis.com

Facebook: www.facebook.com

Twitter: twitter.com

LinkedIn: in.linkedin.com